Trader's Corner 2007

Re: Trader's Corner 2007

MrBill,

Thank you. Didn't know you had a bloomberg terminal. I know the bandwidth is limited, but do you have the current charts of 1m + 3m LIBOR for the past 6mths or 1year?

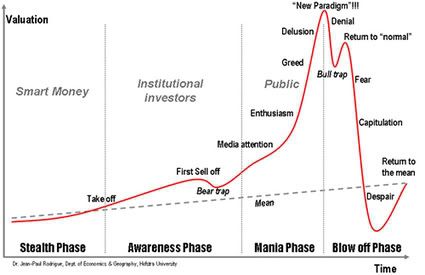

Looking at the posts in this thread, it would seem to imply that since around the July/August period, the cost of money has increased due to lending (thus credit) being stopped, and banks attached a high cost (LIBOR rate ramps/spikes) as a result. To keep the banking system going, the Fed needed to pull this rate down back then, but because lending trust is still not restored, we today are still faced with distrust in the banks and therefore the banks still attach a high cost to each other, and thus the Fed's pre Dec-11 moves.

Looking forward (and seeking your historical experiences way back since 1945s till now), what then, when interest rates are forced DOWN due to lending dry-up?

BTW, thanks for your very own experience securing lending at terrible times. Why did you succeed when the rest didn't? Collateral quality differences?

Thank you. Didn't know you had a bloomberg terminal. I know the bandwidth is limited, but do you have the current charts of 1m + 3m LIBOR for the past 6mths or 1year?

Looking at the posts in this thread, it would seem to imply that since around the July/August period, the cost of money has increased due to lending (thus credit) being stopped, and banks attached a high cost (LIBOR rate ramps/spikes) as a result. To keep the banking system going, the Fed needed to pull this rate down back then, but because lending trust is still not restored, we today are still faced with distrust in the banks and therefore the banks still attach a high cost to each other, and thus the Fed's pre Dec-11 moves.

Looking forward (and seeking your historical experiences way back since 1945s till now), what then, when interest rates are forced DOWN due to lending dry-up?

BTW, thanks for your very own experience securing lending at terrible times. Why did you succeed when the rest didn't? Collateral quality differences?

regards,

Rostov

"Some {} are more equal than others"

Rostov

"Some {} are more equal than others"

-

rostov - Lignite

- Posts: 346

- Joined: Sat 29 Jan 2005, 04:00:00

- Location: New Zealand

Re: Trader's Corner 2007

Daryl wrote:

$this->bbcode_second_pass_quote('', 'B')y the way, nice looking charts, Mr. Bill. And a question. How does today's Euro rate translate back into the old $/DM rate? I can't remember how to do that. Are we past the old 1979 lows for the dollar yet? I believe that was around 1.76 DM or something.

$this->bbcode_second_pass_quote('', 'B')y the way, nice looking charts, Mr. Bill. And a question. How does today's Euro rate translate back into the old $/DM rate? I can't remember how to do that. Are we past the old 1979 lows for the dollar yet? I believe that was around 1.76 DM or something.

MrBill writes:$this->bbcode_second_pass_quote('', '

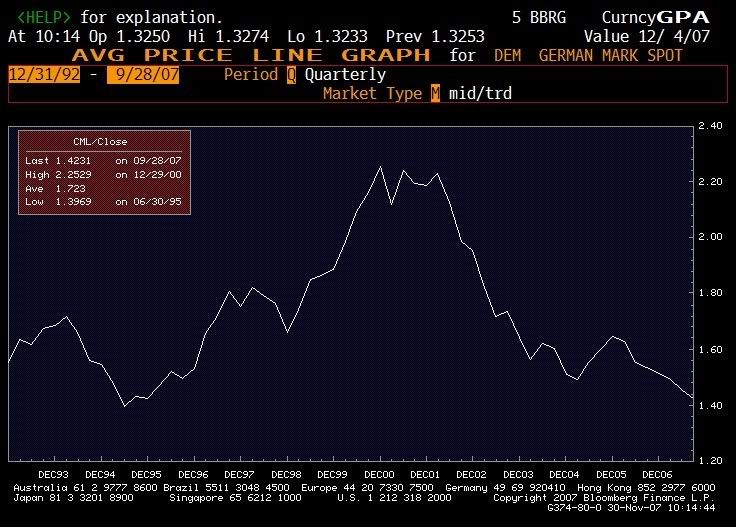

')The fix of the DEM to EUR was at 1.95583

Bloomberg still does a continuous chart in DEM, so comparisons are quite straight forward. However, for historical charts that old I can only pull-up weekly, monthly and quarterly charts that hide the absolute highs and lows as they take the mid-point.

It seems to me that the low in USD/DEM was $1.3450 in 1995. Just after the ERM crisis. My American military friends in the National Ski Patrol could hardly afford to train in Switzerland that winter, but it was great to be paid in deutschmarks! ; - )

But according to weekly Bloomberg data the respective highs and lows were

Low $1.3679 04/21/95 - $1.4298/EUR @ 1.95583 DEM/EUR

High $2.3455 10/27/00 - $0.8339/EUR

Low $1.4377 12/31/04 - $1.3604/EUR

High $1.6709 11/18/05 - $1.1705/EUR

Low $1.3222 11/23/07 - $1.4792/EUR

Again that is using weekly averages that may hide the actual highs and lows. So for all the huff and puff we are $1.4725 today versus a US dollar low in 1995 of $1.4300 or about 3% weaker! Pretty darned stable compared to commodity or oil prices! ; - )

Here is the quarterly chart...

$this->bbcode_second_pass_quote('', 'W')hich is once again going to mess up spacing on this page, so to compress the comments I will just make them look like quotes. Any JPG sizing tips most welcome. Thanks.

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

Re: Trader's Corner 2007

$this->bbcode_second_pass_quote('rostov', 'M')rBill,

Thank you. Didn't know you had a bloomberg terminal. I know the bandwidth is limited, but do you have the current charts of 1m + 3m LIBOR for the past 6mths or 1year?

Looking at the posts in this thread, it would seem to imply that since around the July/August period, the cost of money has increased due to lending (thus credit) being stopped, and banks attached a high cost (LIBOR rate ramps/spikes) as a result. To keep the banking system going, the Fed needed to pull this rate down back then, but because lending trust is still not restored, we today are still faced with distrust in the banks and therefore the banks still attach a high cost to each other, and thus the Fed's pre Dec-11 moves.

Looking forward (and seeking your historical experiences way back since 1945s till now), what then, when interest rates are forced DOWN due to lending dry-up?

BTW, thanks for your very own experience securing lending at terrible times. Why did you succeed when the rest didn't? Collateral quality differences?

Thank you. Didn't know you had a bloomberg terminal. I know the bandwidth is limited, but do you have the current charts of 1m + 3m LIBOR for the past 6mths or 1year?

Looking at the posts in this thread, it would seem to imply that since around the July/August period, the cost of money has increased due to lending (thus credit) being stopped, and banks attached a high cost (LIBOR rate ramps/spikes) as a result. To keep the banking system going, the Fed needed to pull this rate down back then, but because lending trust is still not restored, we today are still faced with distrust in the banks and therefore the banks still attach a high cost to each other, and thus the Fed's pre Dec-11 moves.

Looking forward (and seeking your historical experiences way back since 1945s till now), what then, when interest rates are forced DOWN due to lending dry-up?

BTW, thanks for your very own experience securing lending at terrible times. Why did you succeed when the rest didn't? Collateral quality differences?

MrBill writes:

$this->bbcode_second_pass_quote('', 'C')areful, LIBOR rates have declined as the Fed has cut their Fed funds target rate from 5.25% to 4.50%, but 3-mos LIBOR is still above that target rate at 5.12% as banks are reluctant to lend to one another. Actually, one-month LIBOR that goes over year-end is as high as 5.22% according to Bloomberg.

(continued)

$this->bbcode_second_pass_quote('', 'J')ust a caveat the screen prices may not be the Broker's price in money market. If you are lending Interbank and have a choice between IKB and KFZ , two German banks embroiled in the sub-prime mess, for example, you may not lend to IKB at all, while pumping-up the spread even for KFW who actually own IKB.

What has increased is not LIBOR rates (see chart), but the spread over LIBOR. Say L + 1.00% to L + 1.50% or L + 1.50% to L + 2.00%. So the Fed cuts by 0.75%, but in many cases the 'spread' has increased, so it has neutralized the easing. While if you are a single-A (or lower) rated bank you might find your access to capital either restricted or at least more expensive in terms of spreads. Ironically, if you are a highly rated bank, say AA+, then if there is excess liquidity in the money markets then you might benefit from a lower spread. Although this does not seem to be the case headed into year-end where liquidity is tight and banks are hoarding it for their own needs.

Overnight rates between December 28th and January 2nd might go up as high as 100% annualized if there is a severe short-squeeze. Therefore, banks are in emergency meetings between repos desks, money market traders and their Treasury department to make contingency plans for liquidity overnight. If they find themselves short, then they certainly are not going to lend to external hedge funds or other non-core customers.

Why have I survived? Pretty simple really. One, as you say, good collateral and a long-term track record. Secondly, as the sub-prime crisis has taken its toll on lending in these banks linked to mortgages and the US domestic market, for example, they have to be mindful of making 'some' of that money back elsewhere in the bank. Trading, and other areas like emerging markets, are picking-up the earning's slack.

What's worse than a $10-billion write-down? A $10-billion write-down AND no new business coming in the frontdoor. Banks are forced to earn their way out of this crisis and that is to be expected. Hopefully not by blowing-up another bubble somewhere else, but in improved credit and lending practices and by actively chasing opportunities elsewhere.

I am reminded of all the investment banks that left Moscow 'for good' in 1999 after the Russian debt crisis and vowed 'never to return'. Unfortunately for them, those that stayed took a beating, but earned those losses back and then some. Then those banks who left were forced to return to Russia, but only after the low-hanging fruit and wide spreads had disappeared. Plus they had no customer goodwill and had to pay more for experienced staff.

Which is an interesting thing about risk. Risk is risk. It is very hard to get rid of. So does it make sense to get in early when the fees are high to take those risks, and then scale back as spreads come down? Or does it make sense to wait until spreads have already come down, indicating less risk, and then increase your activities, or your risk, to make up for lower spreads? ; - )

The organized state is a wonderful invention whereby everyone can live at someone else's expense.