Trader's Corner 2007

Re: Trader's Corner 2007

If the global economy is so strong that it can easily decouple from US growth then what is up with metals?

$this->bbcode_second_pass_quote('', '

')Base Metals

Quantifying the risk to base metals prices

The risks to the downside in base metals are mounting as US demand continues to fall while worries emerge over Chinese demand in coming months

Prices have been moving mostly sideways for the past two years

Metals prices have been largely rangebound, as a strong China has been offset by a weak US, allowing consumers to opportunistically enter and exit the market.

Demand and inventories - the key drivers in our models - may be at an inflection point

Backward looking data on metals demand is still firm, but forward looking indicators suggest the potential for an inflection point in demand and inventories.

Updating our metals price elasticities

To help in responding to the unfolding macro outlook for base metals demand over the next weeks and months, we quantify the sensitivity in prices to the shifts in the key fundamentals.

$this->bbcode_second_pass_quote('', '

')Base Metals

Quantifying the risk to base metals prices

The risks to the downside in base metals are mounting as US demand continues to fall while worries emerge over Chinese demand in coming months

Prices have been moving mostly sideways for the past two years

Metals prices have been largely rangebound, as a strong China has been offset by a weak US, allowing consumers to opportunistically enter and exit the market.

Demand and inventories - the key drivers in our models - may be at an inflection point

Backward looking data on metals demand is still firm, but forward looking indicators suggest the potential for an inflection point in demand and inventories.

Updating our metals price elasticities

To help in responding to the unfolding macro outlook for base metals demand over the next weeks and months, we quantify the sensitivity in prices to the shifts in the key fundamentals.

Source: Goldman Sachs Commodities Research

November 21, 2007

I am not quite sure how we quantify the sensitivity in prices to the shifts in the key fundamentals? But are not metals also quoted in those depreciating US dollars? Hmm?

Looking at crude prices that retreated from $99.29 yesterday, but look set to test the $100 mark, one has to ask themselves how much of that is demand and how much is the US dollar effect?

In a basket of currencies WTI looks like this from yearly lows to year to date highs...

USD +99%

CAD +67.5%

CHF +79%

EUR +75%

JPY +84%

SEK +78%

GBP +90%

We see 79% real rise in the price of oil, and about 20% due to the depreciation of the US dollar against this basket of currencies.

Just for the fun of it I wanted to see how some major stock markets have also performed YTD. All gains or losses are reported in EUR as opposed to local currency for comparison purposes.

USD (S&P500) -11%

CAD (TSX) +8%

CHF (SMI) -9%

EUR (DAX) +14%*

JPY (Nikkei) -16%

SEK (OMX) -11%

GBP (FTSE) -8.5%

So there seems to be no ready correlation between either developments in the price of oil, or currency appreciation or depreciation, and the performance of local stock markets YTD. No matter what links commentators may draw to those tenuous links at best.

What about China?

Oil in CNY +90%

and the Shenzhen Composite in EUR (SZCOMP) +129%

Wow! How high might it have been if oil prices had not gone up on average 75% in EUR?

But we also see almost no real appreciation of the CNY (or JPY) against the EUR or that basket of six major currencies excluding the USD either.

So once again I have to ask what's up with metals? Are they not supposed to be proxies for worldwide growth? Take copper, although up 9% YTD as measured in euros, it is well off its highs (-28% in EUR). It seems to be signalling slower global growth despite a weak US dollar.

I am not sure that a single data point weakens the case for decoupling from a possible recession in the USA, but it certainly does not strenthen the argument either.

Happy Thanksgiving Day to our American friends! ; - )

*DAX +14% but for other major EU bourses

CAC -3%

IBEX +8.5%

MIB -10%

AEI -2%

so clearly the DAX outperformed its peers

UPDATE: lotsa useful statistics, some of which I have not seen before, but beware of the slant and the conclusions....

$this->bbcode_second_pass_quote('', 'L')ast of all, China is providing a bonanza of cheap manufactured goods to developing nations - fueling an unprecedented consumer frenzy. The Chinese behemoth is rapidly displacing the US as the world's main source of capital, manufacturing and commodity demand, leading to a decoupling of the waning North American giant from the rest of the marketplace.

Source: Make way for the Chinese giant

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

Re: Trader's Corner 2007

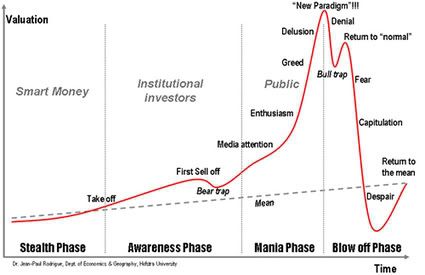

$this->bbcode_second_pass_quote('MrBill', 'I') told a Chinese girlfriend of mine who has made money in both real-esate and the stock market to please be very careful. But the Chinese love to gamble in any case, so up it goes, until it doesn't! ; - )

It seems I got really lucky with the timing of the sale of my PetroChina shares.

Bought them at $125, sold them at $250 and now they are back down at $180.

Peak oil is not an energy crisis. It is a liquid fuel crisis.

-

Starvid - Intermediate Crude

- Posts: 3021

- Joined: Sun 20 Feb 2005, 04:00:00

- Location: Uppsala, Sweden

Re: Trader's Corner 2007

$this->bbcode_second_pass_quote('MrBill', 'T')he S&P 500 is up a measely 1% year to date (YTD). That means it is down almost 10% YTD in euro terms. Not very impressive I am afraid.

At least it is up. The Stockholm stock exchange (OMX) is down about 10 %. Hehe, not in dollars though.

My Swedish holdings, two big investment/holding companies and a tiny local iron mining startup have been slaughtered, down 20-30 % since I bought them this spring.

One reason for that is the cursed Ericsson, another is that the other holdings have generally fallen more than they really should have. That's good as it means a further weakening of the global economy will hopefully not result in further radical falls.

And hey, with lower share prices the dividends will look bigger.

Peak oil is not an energy crisis. It is a liquid fuel crisis.

-

Starvid - Intermediate Crude

- Posts: 3021

- Joined: Sun 20 Feb 2005, 04:00:00

- Location: Uppsala, Sweden