$this->bbcode_second_pass_quote('sparky', '.')

Then , what could account for a worst energy ratio ?

Maybe " hard " manufacturing doesn't generate as much GDP as a fully developed financial sector ?

.

Trader's Corner 2007

Re: Trader's Corner 2007

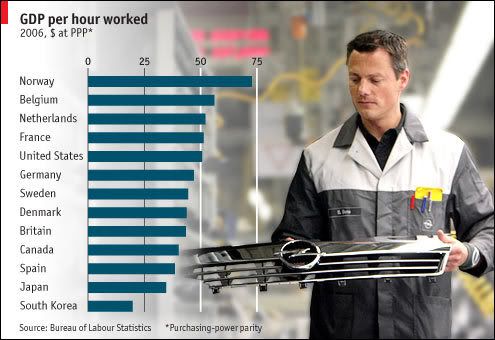

Well, again refering to this chart you see S. Korean labor productivity is not very high. Plus their energy mix includes heavy industry such as ship building. It takes a lot of energy to produce steel. And S. Korea has to import all of that energy.

But you're right, manufacturing does not generate the same GDP as the financial sector. Half of a bank's carbon footprint, for example, is bankers flying or traveling to meet customers. Aside from the energy needed for their servers, airconditioning and lighting - less than smelting steel - banking uses less energy per output than manufacturing.

Developed countries have already invested a lot in their infrastructure, so new investment is in improvements and maintaining existing infrastructure. Perhaps a smaller portion of current GDP while reaping rewards or payback on past investments compared to developing countries that are still in the phase of building and developing that basic infrastructure.

Which by the way is not a bad thing. They get the benefit of hindsight as to what works well and what does not, and they can use leap-frog technologies to reach the same end result faster and less expensivey. Like mobile versus fixed line and fibre optic versus copper wire telephony for examples.

However, I would also suggest that S. Korea's state sponsored capitalism is not quite as efficient when it comes to energy use either. Sometimes the Asian Tigers have been guilty about sheltering local businesses from competition and are quick to subsidize export industries that are growing faster and generate jobs. Usually anything that is subsidized is not as efficient. I would suggest that goes for energy use as well.

Whereas America, for example, wastes energy like no one's business, but that is recreational driving and personal consumption. Business is more energy efficient than the individual consumer's choices would indicate. The guy that spends $100K on a motorhome is not too concerned about the price of gasoline, except to bitch about it, but the company sees this as just another cost to be optimized.

And the commuter may choose the convenience of the car over public transport for any number of personal reasons, while his or her employer may see economies of size for reducing their A/C or lighting bill. You might not notice an extra $50 a month, but a company might take note of $100.000 per month and adjust accordingly.

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

Re: Trader's Corner 2007

.

There got to be something wrong with equating the making of steel or chemicals as being of lesser value that a well developed real estate re-possession sector

the GDP seems , to me , not to make much difference between making wealth and merely churning numbers

it make more sense to look at a country share of international trade

one million hair dressers working the streets in India is not quite the same muscle as a mid size manufacturing ,

on the light side , the IEA seems to admit that the U.S. geological survey numbers for oil reserves is a lot of very professional wishful thinking .

It was becoming painful to watch the squirming about the demand numbers , pie in the sky confront decreasing stocks but there is no problems

http://www.ft.com/cms/s/0/55563030-b407 ... fd2ac.html

.

.

There got to be something wrong with equating the making of steel or chemicals as being of lesser value that a well developed real estate re-possession sector

the GDP seems , to me , not to make much difference between making wealth and merely churning numbers

it make more sense to look at a country share of international trade

one million hair dressers working the streets in India is not quite the same muscle as a mid size manufacturing ,

on the light side , the IEA seems to admit that the U.S. geological survey numbers for oil reserves is a lot of very professional wishful thinking .

It was becoming painful to watch the squirming about the demand numbers , pie in the sky confront decreasing stocks but there is no problems

http://www.ft.com/cms/s/0/55563030-b407 ... fd2ac.html

.

.

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: Trader's Corner 2007

$this->bbcode_second_pass_quote('sparky', '.')

There got to be something wrong with equating the making of steel or chemicals as being of lesser value that a well developed real estate re-possession sector

the GDP seems , to me , not to make much difference between making wealth and merely churning numbers

it make more sense to look at a country share of international trade

one million hair dressers working the streets in India is not quite the same muscle as a mid size manufacturing ,

on the light side , the IEA seems to admit that the U.S. geological survey numbers for oil reserves is a lot of very professional wishful thinking .

It was becoming painful to watch the squirming about the demand numbers , pie in the sky confront decreasing stocks but there is no problems

http://www.ft.com/cms/s/0/55563030-b407 ... fd2ac.html

.

There got to be something wrong with equating the making of steel or chemicals as being of lesser value that a well developed real estate re-possession sector

the GDP seems , to me , not to make much difference between making wealth and merely churning numbers

it make more sense to look at a country share of international trade

one million hair dressers working the streets in India is not quite the same muscle as a mid size manufacturing ,

on the light side , the IEA seems to admit that the U.S. geological survey numbers for oil reserves is a lot of very professional wishful thinking .

It was becoming painful to watch the squirming about the demand numbers , pie in the sky confront decreasing stocks but there is no problems

http://www.ft.com/cms/s/0/55563030-b407 ... fd2ac.html

.

I think it is very dangerous to make 'value' judgements about what is and what is not GDP? The so-called 'old economy' versus the 'new economy'.

What we are talking about is value-added. And if we are to live sustainably within our environmental boundaries then we have to out of necessity switch from 'dirty, low-value, polluting industry' to 'more higher value work' that generates the same or more economic activity, but with less of an environmental footprint.

Higher living standards are not just about having more, but also having better and more efficient. Better diets, better schools, more efficient homes and autos, or doing the same and more with less.

It also means plowing accumulated wealth back into sustainability programmes instead of using it for conspicuous consumption. Building and maintaining nature preserves as well as buffer zones in environmentally fragile areas instead of over-exploiting our natural resources.

Being an investment banker is not a higher calling, but I can lift more millions out of poverty using the capital markets and development than I can by dedicating my life to charity. Actually we need all kinds.

I do my important charity work through the Rotary Club by raising money for emergency aid programmes, supporting schools in Africa, a hospice for merchant sailors, planting trees here in Cyprus and our programme this year for greening schools and other environmental projects. I also support Ducks Unlimited because they are a group that buys land and preserves wildlife habitats and watersheds.

I always prefer groups that actually do something constructive! The point being that raising living standards is not the same as unlimited growth or just producing more stuff. But I think it is a subject for another day. Take care.

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

Re: Trader's Corner 2007

.

I have no issues with trading , arbitrating or insurances

those activities have existed shortly after the first market opened in the first city ,

some of the greatest explorers or conquerors were traders

My deepest suspicion is when trading is in fact computers programs dealing with each other at increasing speed on ever thinner margins

bubbles happen ,

.

I have no issues with trading , arbitrating or insurances

those activities have existed shortly after the first market opened in the first city ,

some of the greatest explorers or conquerors were traders

My deepest suspicion is when trading is in fact computers programs dealing with each other at increasing speed on ever thinner margins

bubbles happen ,

.

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: Trader's Corner 2007

$this->bbcode_second_pass_quote('', 'T')here got to be something wrong with equating the making of steel or chemicals as being of lesser value that a well developed real estate re-possession sector

It is very complex, but in the grand scheme of things one more or less steel or chemical plant is not going to make much of a difference in anyones life. However, being able to shift property to its highest valued uses can make all the difference to the local inhabitants; perhaps being the difference between poverty and prosperity.

To put it another way, if bond investors cannot re-possess a steel or chemical plant then they will not invest and it will not be constructed in the first place, no matter how valuable its existance would be to the rest of society.

As such, how can you suggest that real-estate re-possession is less important than steel plants? It sounds to me like they are at least equally valuable.

-

LoneSnark - Tar Sands

- Posts: 514

- Joined: Thu 15 Nov 2007, 04:00:00

Re: Trader's Corner 2007

[align=center]A recap of energy, metals and commodity prices in 2007[/align]

[align=center]Happy New Year and all the best for 2008![/align]

I am back in mid-January.

[align=center]Happy New Year and all the best for 2008![/align]

I am back in mid-January.

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

Re: Trader's Corner 2007

.

All true , no doubt

It just seems to me that the GDP numbers are a gross measure of a country activity and could mislead as to its real strength or weakness

I would suggest it undervalue non financial activities and overvalue tennis trading .

If this would be the case , a decrease in trading " pressure "would see the bubble pop ( worst case ) or the souffle deflate ( probably the case now )

P.S.

For the end of the year ,the barrel is going to miss 100$ by a bit ,

I was amazed at the underlying strength of the price ,

It would be nice to bet on the price of oil for 2008

I repeat my estimate of a 90$ ~110$ range for the first six months ,

.

All true , no doubt

It just seems to me that the GDP numbers are a gross measure of a country activity and could mislead as to its real strength or weakness

I would suggest it undervalue non financial activities and overvalue tennis trading .

If this would be the case , a decrease in trading " pressure "would see the bubble pop ( worst case ) or the souffle deflate ( probably the case now )

P.S.

For the end of the year ,the barrel is going to miss 100$ by a bit ,

I was amazed at the underlying strength of the price ,

It would be nice to bet on the price of oil for 2008

I repeat my estimate of a 90$ ~110$ range for the first six months ,

.

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: Trader's Corner 2007

$this->bbcode_second_pass_quote('', 'I')t just seems to me that the GDP numbers are a gross measure of a country activity and could mislead as to its real strength or weakness

Of course, this is why very few economists look at raw GDP numbers when deciding an economy's strength and weaknesses.

$this->bbcode_second_pass_quote('', 'I') would suggest it undervalue non financial activities and overvalue tennis trading .

This may be true. But mass delusions rarely last for centuries, as you appear to be describing economic valuations, which remain predominantly unchanged for centuries.

-

LoneSnark - Tar Sands

- Posts: 514

- Joined: Thu 15 Nov 2007, 04:00:00