Page added on September 18, 2016

THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S.

The Death of the Great Bakken Oil Field has begun and very few Americans understand the significance. Just a few years ago, the U.S. Energy Industry and Mainstream media were gloating that the United States was on its way to “Energy Independence.”

Unfortunately for most Americans, they believed the hype and are now back to driving BIG SUV’s and trucks that get lousy fuel mileage. And why not? Americans now think the price of gasoline will continue to decline because the U.S. oil industry is able to produce its “supposed” massive shale oil reserves for a fraction of the cost, due to the new wonders of technological improvement.

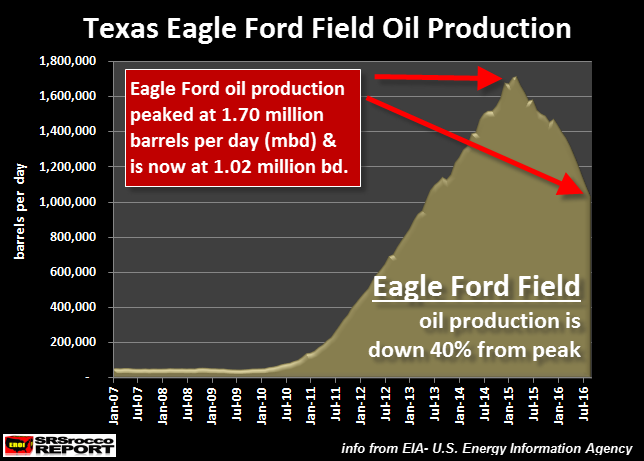

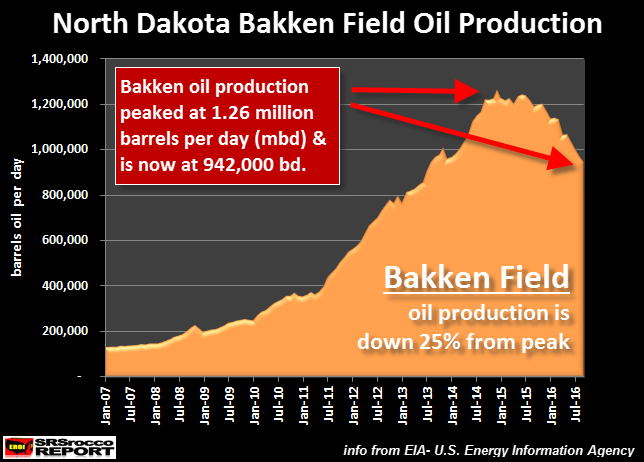

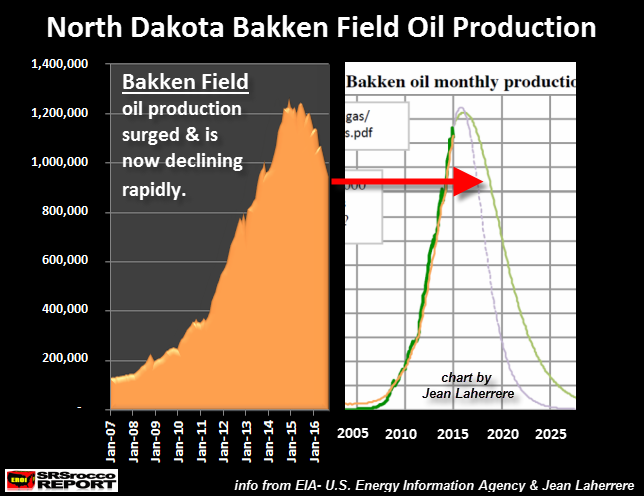

I actually hear this all the time when I travel and talk to family, friends and strangers. I gather they have no clue that the Great Bakken Oil Field is now down a stunning 25% from its peak in just a little more than a year and half ago:

The mighty Bakken oil field located in North Dakota reached peak production in December 2014 at 1.26 million barrels per day (mbd) and is now down to 942,000 bd. This decline is no surprise to me or to my readers who have been following my work for the past several years.

I wrote about the upcoming crash of the Bakken oil field in my article (click here to read article)– Published, NOV. 2013:

I ended the article with these sobering words:

There are only so many drilling locations available and once they run out, the Great Bakken Field will become a BUST as the high decline rates will push overall oil production down the very same way it came up.

Those who moved to the frigid state of North Dakota with Dollar signs in their eyes and images of sugar-plums dancing in their heads will realize firsthand the negative ramifications of all BOOM & BUST cycles.

Well, the Bust of North Dakota economy has arrived and according to the article, “The North Dakota Great Recession“:

Unfortunately by April 2015 it was clear that the oil markets were in a secular decline brought on by oversupply in the global energy markets fueled by a deep recession in China. As a result, companies started to lay off workers, and over the following months caused a massive exodus of people as jobs were eliminated. Nobody is exactly sure how many people have left the state, but some put estimates as high as 25,000.

The strongest real estate market continues to be Watford City with the weakest in Minot. However, even in Watford City the price of a three-bedroom rental home has come down from $2,500 in 2015 to a current price of $1,400. This represents a 44 percent decline of the rental price in the market.

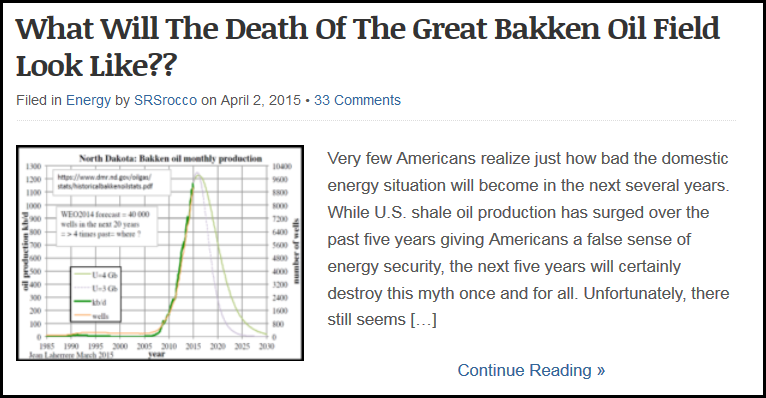

Some folks believe the reason for the decline in oil production at the Bakken was due to low oil prices. While this was part of the reason, the Bakken was going to peak and decline in 2016-2017 regardless of the price. This was forecasted by peak oil analyst Jean Laherrere. I wrote about this in my article below (click here to read article)– Published, APRIL 2015:

I took Jean Laherrere’s chart and placed it next to the current actual Bakken oil field production:

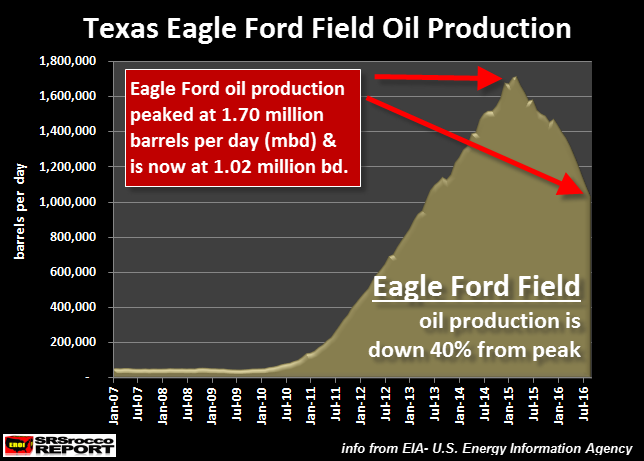

As we can see in the chart above, the rise and fall of Bakken oil production is very close to what Jean Laherrere forecasted several years ago (shown by the red arrow). According to Laherrere’s chart, the Bakken will be producing a lot less oil by 2020 and very little by 2025. This would also be true for the Eagle Ford Field in Texas.

According to the most recent EIA Drilling Productivity Report, the Eagle Ford Shale Oil Field in Texas will be producing an estimated 1,026,000 barrels of oil per day in September, down from a peak of 1,708,000 barrels per day in May 2015. Thus, Eagle Ford oil production is slated to be down a stunning 40% since its peak last year.

Do you folks see the writing on the wall here? The Bakken down 25% and the Eagle Ford down 40%. These are not subtle declines. This is much quicker than the U.S. Oil Industry or the Mainstream Media realize.

And… it’s much worse than that.

The U.S. Oil Industry Hasn’t Made a RED CENT Producing Shale

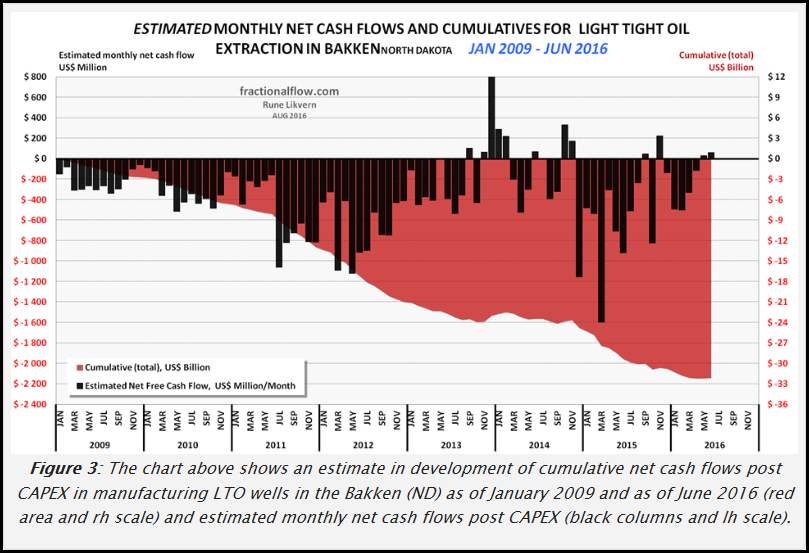

Rune Likvern of Fractional Flow has done a wonderful job providing data on the Bakken Shale Oil Field. Here is his excellent chart showing the cumulative FREE CASH FLOW from producing oil in the Bakken:

I will simply this chart by explaining that the BLACK BARS are estimates of the monthly Free Cash flow from producing oil in the Bakken since 2009, while the RED AREA is the cumulative negative free cash flow. As we can see there are very few black bars that are positive. Most are negative, heading lower.

Furthermore, the red area shows that the approximate negative free cash flow (deducting CAPEX- capital expenditures) is $32 billion. So, with all the effort and high oil prices from 2011-2014 (first half of 2014), the energy companies producing shale oil in the Bakken are in the hole for $32 billion. Well done…. hat’s off to the new wonderful fracking technology.

According to Rune Likvern in his article on the Bakken, he stated the following:

Just to retire estimated total debts (about $36 Billion, including costs for DUCs, SDWs, excluding hedges and income/loss of natural gas and NGLs) would require about 7 years with extraction and prices at Jun-16 levels.

Nominally to retire all debts (reach payout) would take an (average) future oil price close to $65/bo (WTI) for all the wells in operation as of end June – 16. This is without making any profit.

For the wells in production as per Jun-16, the total extraction of these will decline about 40% by Jun-17, and depletes their remaining reserves with about 20%. By assuming the operations remain cash flow neutral, total debt remains at $36 B in Jun-17.

As from Jul-17 this would now require an average oil price of about $73/bo (WTI) for these wells to nominally retire all debts (reach payout). Additional wells will add to what price is required to retire the total debt.

What Rune is stating here is that the $36 billion in total cumulative debt will occur by June 2017. Thus, it would take an average $65 a barrel to just pay back the debt in seven years. With the way things are going in the U.S. and world economies, I doubt we are going to see much higher oil prices.

Furthermore, the work by Louis Arnoux and the Hills Group suggest the price of oil will fall, not rise due to a Thermodynamic Collapse. More about this in an upcoming interview.

The United States Is In Big Trouble & Most Americans Have No Clue

As I have been documenting in previous articles (going back until 2013) the U.S. Shale Oil Industry was a house-of-cards. Readers who have been following my work, based on intelligent work of others, understood that Shale Oil is just another Ponzi Scheme in a long list of Ponzi Schemes.

From time to time, I look around different websites that publish my work and read some of the comments. I am surprised how many individuals still don’t believe in Peak Oil even though I explained the Falling EROI – Energy Returned On Investment quite clearly.

For some strange reason, some individuals cannot use deductive reasoning to destroy lousy conspiracy theories. Moreover, if they do believe in Peak Oil, then they think there is a wonderful “Silver-Bullet Energy Technology” that will save us all. I gather they believe this because the REALITY and IMPLICATIONS of Peak Oil are just too horrible, to say the least. So, holding onto HOPE that something will save us, just in the nick of time, is better than accepting the awful reality heading our way.

And the awful reality of Peak Oil will be felt more by Americans as their lifestyles have been highly elevated by the ability to extract wealth and resources from other countries through the issuing of massive amounts of paper Dollars and debt. Basically, they work, and we eat.

Unfortunately, the propping up of the U.S. market by the Fed and the domestic shale energy Ponzi scheme is running out of time. This is why it is imperative for investors to start moving out of Bonds, Stocks and Real Estate and into physical gold and silver to protect wealth.

For the wealthy investor or institution that believe a 5-10% allocation in physical gold is good insurance, you are sadly mistaken. While Donald Trump is receiving more support from Americans in his Presidential race, his campaign motto that he will “Make American Strong Again”, will never happen. The America we once knew is over. There just isn’t the available High EROI – Energy Returned On Investment energy supplies to allow us to continue the same lifestyle we enjoyed in the past.

So, now we have to transition to a different more local or regional way of living. This new living arrangement will be based on capital that is “STORED ECONOMIC ENERGY or WEALTH.” This can only come via the best sources such as physical gold and silver.

If individuals and countries have been acquiring physical gold and silver, they will be in better shape and will be able to enjoy more options than those who have been selling their gold and accumulating lots of debt and derivatives.

Lastly, if you haven’t checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

341 Comments on "THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S."

Carl W on Sun, 18th Sep 2016 4:53 pm

I have watched the same people make the same prediction for the past 10 years. They have ended up spectacularly wrong and they just double down. The peak in these fields is economical, the result of prices causing people to cap wells. Just means it will come out slower, not that there is any less. Another recent find in the Permian basin has added to our known domestic reserves.

joe wrenn on Sun, 18th Sep 2016 4:53 pm

Oil never runs out, it is constantly produced deep inside the Earth. Oil has been running out since that great scam they pulled on us back in the late 70s. Dont believe folks like the author of this b.s. Enjoy oil, its neverending.

joe wrenn on Sun, 18th Sep 2016 4:54 pm

Oil never runs out, it is constantly produced deep inside the Earth. Oil has been running out since that great scam they pulled on us back in the late 70s. Dont believe folks like the author of this b.s. Enjoy oil, its neverending. Oil running out is like saying we are going to breath up all the air. fools.

shortonoil on Sun, 18th Sep 2016 4:54 pm

“The remedial debating club is now in session. “

Once they realize that it is going to cost $39 trillion, out of their pockets, to keep the oil flowing for another decade the substance of the debate may improve a little bit. About a month of an exclusive diet of bean sandwiches is likely to improve their objectivity. Driving into a brick wall is not something that is readily noticed by the myopic. They don’t see what’s coming until their face is stuck into the windshield. It is a variation on ignorance is bliss.

Where have we heard this story before?

Mark on Sun, 18th Sep 2016 4:55 pm

The only Reason it’s slowing down. Is because the Company Men who manage the wells there are 1,000’s of them. They can slow the output of the well even to bring it to 0 Barrels a day. to a much as 20 Barrels or more an hour. A long as you have the truck or Pipelines there to move the oil. So I worked in the North Dakota Bakken Oilfields for 2 1/2 year’s I was working Salt water from the wells and fresh water to the Frack sites. Different Companies. But I talked with alot of company men. And they new sooner or later the well would have to be slowed down. Don’t Let these Moron’s tell you the oil is running Dry. Because there is 100’s of year’s of oil in the ground there. just with the light crude. And then another few thousand feet or more below that there is Heavy Dark Crude even more of than the light Crude. Wake up people

Mel on Sun, 18th Sep 2016 4:57 pm

The Saudis are laughing their camel asses off.

fred smith on Sun, 18th Sep 2016 4:59 pm

Do your own research. DO NOT believe what you read in the “sky is falling” rags. There are trillions of barrels of oil under the US but the “environmentalists” and the “progressives” are hiding it from you. Again, do your own research.

Joey on Sun, 18th Sep 2016 5:01 pm

Baloney.

The production decrease is due to one thing: The price of oil is less than what it costs to extract it in many places using shale technologies.

$60 to $80 per barrel is required. We are at about $47.

Today I paid $1.81 per gallon of gasoline. That includes 38c of tax, for a net pre-tax price of $1.43.

I saw an Abbott & Costello movie a few months ago that showed gas prices in 1941. Adjusted for inflation, that price is $1.85. Comparing net cost before excise tax, that is $1.83.

That makes gasoline 22% cheaper today than in 1941! It is no surprise that more expensive wells are going into mothballs. But is has nothing to do with not enough oil, it has everything to do with too much oil.

Mineral Buyer on Sun, 18th Sep 2016 5:08 pm

I put my three kids in big trucks when they were young so that they would win! Teenagers out driving after dark is a dangerous thing. If it cost a little more, then it was worth it.

Boom & bust cycles are indeed a staple of the oil & gas business…this is my 5th, and by the grace of all things fair and just, perhaps my last. I hope to see solar powering my home within 1-2 years.

Chris on Sun, 18th Sep 2016 5:10 pm

Its amazing to me that anyone would read this nonsense that is so clearly a stupid sales pitch and see it for anything else. The entire premise is wrong. Declines in production are because of low prices… if it was because it was running it, it wouldn’t be low. Scumbag lowlife con artist website folks! Trump would be so proud…

shortonoil on Sun, 18th Sep 2016 5:11 pm

“Because there is 100’s of year’s of oil in the ground there. just with the light crude. “

It takes 8 to 10 years to bring a new field online. The problem is there are no new fields in sight.

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/icbkDFACM4iA/v2/-1x-1.png

The average Bakken well is producing 46 barrels a day after 5 years. Don’t let these morons tell you that there is 100s of years of oil remaining. The world will be in big trouble in less than 10.

DonM on Sun, 18th Sep 2016 5:14 pm

Bakken is expensive oil. Saudi oil is cheap, perhaps 5$ per barrel to get out.

When the price goes down, it only makes sense to pump Saudi oil. Taking the Bakken field off line now means that it can be put back on line the next time prices go above 65$ a barrel.

So the terrorist national oil companies of the world (Russia, Iran Saudi Arabia, Venezuela) won’t be able to devote the money gained from 65$ to 200$ a barrel oil to terrorism. This is a good thing.

It would be a nice idea if we could trim their revenues to 35$ a barrel, but that would take more advanced technology. Smart people are working on it.

adornoe on Sun, 18th Sep 2016 5:16 pm

What a maroon!

There is nothing more phony than peak-oil, and there is absolutely nothing to back up the stupid assertions in the article above.

What has brought down production from Bakken and fracking in general, is that, the oil producing countries had to bring down prices in order not to lose their shirts with the lowered oil prices that fracking brought.

If the author believes that Bakken or fracking are done, then, he’s got a big surprise waiting for him, and that surprise would come by way of the oil producing countries raising their prices, which would be followed by a lot of the closed fracking facilities being opened up again.

Cause and effect…

Cause and effect #1: Fracking increased oil production, and brought oil prices down

Cause and effect #2: The oil producing countries had to cut prices and raise production.

Cause and effect #3: With oil production rising, and oil prices going down as a result, fracking took some hits.

Cause and effect #4: If oil prices rise again, and oil production gets cuts, fracking will be revived to all-time highs.

But,heck, I understand where the author is coming from, since, peak oil has been proven to be a phony theorem, and its proponents had to lay dormant for a few years, so now, they would like to revive their stupid theory, while claiming that they were right all along. Nothing could be further from the truth. Cause and effect: something that the peak oil nuts would like to disregard completely.

dirk pitt on Sun, 18th Sep 2016 5:18 pm

this article is utter propaganda

Flash9t on Sun, 18th Sep 2016 5:27 pm

Anybody that has been reading your work could be losing a lot of money. If peak oil ever happens it will not matter any more.

Black Helicopters on Sun, 18th Sep 2016 5:35 pm

When I got to you have to buy silver and gold I stopped. Freaking commercial!

Larry on Sun, 18th Sep 2016 5:42 pm

Peak oil may exist, but the significance and fear the term once held is swiftly eroding. Alternative energy sources like solar and battery-electric are beginning to take over the sector. Some markets that are producing solar power are now even paying local consumers from profits earned by exports, and more solar farms are being added without the former need of government subsidies to make money. Then, and if I recall correctly, there are estimates that half of all cars on the road within the next 10 years will be battery powered. Moreover, we have bulging surpluses of natural gas.

Yeah, so I agree, we have too much oil, and prices ain’t like to rise a lot from here.

antaris on Sun, 18th Sep 2016 5:42 pm

So many new names today. This article must have some truth to attract so many anti peak oil types.

Uncle Artie on Sun, 18th Sep 2016 5:45 pm

Read the punchline — this author is selling gold and silver. He just disguised it in a ‘sky-is-falling’ wrapper.

Charles on Sun, 18th Sep 2016 5:48 pm

For all of you that don’t understand the economics oil companies will not spend the money to drill/produce until the Return on Investment is met within the proper time frame.

OPEC (Saudi Arabia) has been pumping oil and flooding the market in an effort to kill production in the U.S. It has hurt all producers not only in the U.S. but world wide; including the Saudi’s. At some point they will pull back and the prices will go back up. Then the Bakken and other fields will pick up again.

GB on Sun, 18th Sep 2016 5:48 pm

This seems to be an advertorial. Production is down because prices went down. If prices go up production will go back up. This is pretty much Economics 101 supply and demand influenced by market prices.

JGav on Sun, 18th Sep 2016 5:54 pm

Short- Thanks for injecting some reality into the largely superficial comments above.

antaris on Sun, 18th Sep 2016 5:56 pm

Or maybe one nut bar with multiple personalities

ghung on Sun, 18th Sep 2016 5:56 pm

Almost all of the “superficial comments”, above, are an obvious troll attack. Many accounts being created by the same jerk, it appears.

CEDALY1968 on Sun, 18th Sep 2016 5:56 pm

Didn’t a company in Texas just claim this yea they found 5 trillion gallons of oil in Texas?

ghung on Sun, 18th Sep 2016 6:00 pm

Weren’t you supposed to stay on your meds?

Go Speed Racer on Sun, 18th Sep 2016 6:01 pm

Joe Wrenn for President

Lawrence Lal on Sun, 18th Sep 2016 6:03 pm

It is so firkin sad that capitalistic America after the discovery of oil in Saudi made a mandate with OPEC that all trade should go through American currency exchange first. What a capitalistic cronyism of Jewish style theory of living as middleman without a sweat. When Iraq bypass this oil deal with OPEC and start selling oil on its own, it was annihilated by US in name of WMD presence which took the lives of over million Muslims. All this is cause as cut in dividends as middle man, war threats and finally starting oil production in ND and shale b but world over production has hit US oil markets on decaling prices

Recently India, Iran, China, Pakistan and Russia traded OPEC oil for Gold Bars and America dumbfounded was pissed off it started threatening the blame game of China’s inhumanity and territorial grounds, picked on Russia on Ukraine conflict and on Iran for mobilizing radicals, and started to drone tribal’s in Pakistan but scared to mess with India..American domination of world oil hypocrisy is catching up on them

making easy money but now plumting after Russia, hina, India and Pakistan start echabing Gold Bars for oil This is the reason why started its own oil weel in Shale.

Lawrence Lal on Sun, 18th Sep 2016 6:04 pm

It is so firkin sad that capitalistic America after the discovery of oil in Saudi made a mandate with OPEC that all trade should go through American currency exchange first. What a capitalistic cronyism of Jewish style theory of living as middleman without a sweat. When Iraq bypass this oil deal with OPEC and start selling oil on its own, it was annihilated by US in name of WMD presence which took the lives of over million Muslims. All this is cause as cut in dividends as middle man, war threats and finally starting oil production in ND and shale b but world over production has hit US oil markets on decaling prices

Recently India, Iran, China, Pakistan and Russia traded OPEC oil for Gold Bars and America dumbfounded was pissed off it started threatening the blame game of China’s inhumanity and territorial grounds, picked on Russia on Ukraine conflict and on Iran for mobilizing radicals, and started to drone tribal’s in Pakistan but scared to mess with India..American domination of world oil hypocrisy is catching up on them

The reaper on Sun, 18th Sep 2016 6:12 pm

It is sad that there are so many conspiracy theorists online making up their wild conclusions. Isn’t it plain as the face on a dollar that when the price is down that they conserve these reserves until the price goes up. That some of these tapped reserves will have to be pumped is a given. Everyone needs cash flow.

Don Bolin on Sun, 18th Sep 2016 6:14 pm

This is a sales pitch for gold and silver! Sometime ago I read a story about oil wells actually filling up again. It said there are some kind of micro organisms that grow oil!

Larry on Sun, 18th Sep 2016 6:19 pm

Lawrence, your commentary could be taken more seriously without your compulsion to reveal a bias stemming from bigotry. Geesh!

willys36 on Sun, 18th Sep 2016 6:19 pm

Let’s put this article in perspective shall we? Note the title of this web site, “Peak Oil”. The whole purpose of tis site is to predict the death of the oil business. Now let’s add some logic. I know that is tough for Progressives but try to follow me. I think we can all agree the current regime ruling the USSA has pretty much stopped the Capitalist economy. As America goes, so goes the world so the whole world has not grown for 8 years. Thus I think you might have noticed oil price has crashed by about 60%. Add to that the irrational fear of ‘fracing’ and the requisite punitive regulatory environment. the fact that shale projects like Bakken have gone on hiatus is totally understandable. Rest assure, once we get a conservative, business friendly environment, the Bakken will resume the nice performance. We don’t have an energy problem, we have a government problem. But you could make that statement for any subject concerning government regulation.

shortonoil on Sun, 18th Sep 2016 6:25 pm

“Short- Thanks for injecting some reality into the largely superficial comments above. “

I have been writing software for 35 years. Some was even some pretty sophisticated AI apps.

They are bots! What you are seeing is the future of the internet. Control of everything thru artificial intelligence.

Where is that guy with all the blue and red piles?

Have noticed, they are all “XXXX on Sun”? A dead give away.

Jeffrey Booth on Sun, 18th Sep 2016 6:26 pm

The minute I looked down this article and saw how many charts were being highlighted in what I already could see was a bogus editorial with all kinds of misleading info then I really started laughing. I truly hope we have enough intelligent folks out there to see this is total b.s.

shortonoil on Sun, 18th Sep 2016 6:28 pm

I can also tell you, these were not generated on some home PC. These are super computers (big, big mainframes).

Dredd on Sun, 18th Sep 2016 6:36 pm

Like the children of Oil-Qaeda who love their parents, they will suffer when their murderous parents die (Smoke & Fumes).

Mass death is a statistic, one death is a tragedy (Stalin).

According to Voltaire, the solution has been to do mass killings to the sound of trumpets, and all will be well.

“It is forbidden to kill, therefore all murderers are punished unless they kill in large numbers and to the sound of trumpets.” -Voltaire

(Will This Float Your Boat – 13).

James Silvester on Sun, 18th Sep 2016 6:44 pm

I come from an energy family (coal)in West Virginia….Even though we stopped mining in the early 60’s we have many friends still in the business including one who is the largest independent oil & gas producer in the State with 3000 wells and 400,000 acres either owned or leased…I spent a day with him last week inspecting one of his fields and I can tell you from my knowledge of West Virginia reserves, and the reserves of other energy states, we have plenty of BTU capacity left for at least three centuries….But we need to be eyeballing alternatives sources and not risk the notion that fossil fuel will be with us forever or we are forced to abandon there use due to global warming…..A mixed approach utilizing both fossil fuels and alternative sources is the key with the phasing out of fossil fuels over the next 50 to 100 years…

shortonoil on Sun, 18th Sep 2016 6:46 pm

“Almost all of the “superficial comments”, above, are an obvious troll attack. Many accounts being created by the same jerk, it appears.

I really hope that you are right. But as Has Solo said, “I have a bad feeling about this”

fredjohnson on Sun, 18th Sep 2016 6:52 pm

This story is HOGWASH. Bakken production is down because they stopped drilling in many areas when oil prices dropped below $40. As the price rises, drilling will start again. Who writes this garbage anyway?

shortonoil on Sun, 18th Sep 2016 6:54 pm

It’s back————————–

Shane Carothers on Sun, 18th Sep 2016 6:57 pm

This Joe Wrenn guy isn’t too bright! Granted there is a crap load of Oil there still, he fails to understand how Oil is actually made. It can run out, hundreds of years from now maybe, but it can run out.

Over millions of years, layer after layer of sediment and other plants and bacteria were formed. Stage 2 – As they became buried ever deeper, heat and pressure began to rise. The amount of pressure and the degree of heat, along with the type of biomass, determined if the material became oil or natural gas.

There must be Biomass there first! The Earth does not just magically creat Oil.

Bigdg on Sun, 18th Sep 2016 7:02 pm

Last paragraph sums I all up.

He’s selling “GOLD”

All b.s. !

Bigdg on Sun, 18th Sep 2016 7:03 pm

Last paragraph sums It all kup.

He’s selling “GOLD”

All b.s. !

ChipsterNGA on Sun, 18th Sep 2016 7:03 pm

Bakken has been replaced by the old Permian Basin solely for economic reasons. Not to worry. Fuels will be steadily priced for a long time.

shortonoil on Sun, 18th Sep 2016 7:04 pm

If their are any humans still out there please report.

Jeff Mahan on Sun, 18th Sep 2016 7:05 pm

OMG, it seems like I’ve been hearing this same song and dance for 40 years. Give it a rest.

Apneaman on Sun, 18th Sep 2016 7:06 pm

I just “endured” a two hour power outage on a beautiful sunny late summer westcoast day. I went for a walk in the neighbourhood and I have not seen that many suburbanites outside since 1979. Many looked a little edgy – electronic withdrawal.

I too suspected a bot given the number and nature of the comments. Overkill much? Does it even work? Is it worth the effort? I think it’s just one more make work project, since the majority of the sheeple are so utterly dumbed down at this point. It’s like the NSA and their counterparts in every country. They don’t know what else to do. Too much info and like airport security or the war on drugs is ineffective and a huge waste of money. If one could prove peak oil was going to happen in 23 years from now would anything change? Oh yeah everyone would sell the Mcmansion and take up permaculture. Get fucking real. This is just more paranoid ideology at work. A bunch of stupid fucking humans who think they are in control and that their every action, or in this case counter action, has all important implications. This article changes nothing. If Yahweh magically piped it into every human’s head (he’s an awesome translator) on the planet, not one damn thing would change. 99.999 would either forget about it or deny it or creatively explain it away and continue on with their plans for a future that ain’t gonna happen.

Much ado about nothing

Martin Fano on Sun, 18th Sep 2016 7:12 pm

OIL is a finite commodity…the guy who claims more and more is being made in the depths of the earth is misinformed…we will run out of oil one day…when that is who knows…that is why we need to continue to invest in Green Energy that will never run out!..ie…wind, solar, tidal

Paul David on Sun, 18th Sep 2016 7:12 pm

The early history of the Iron Range of Minnesota was very similar. The Merrits owned the vast resources of the Mesabi Iron Range but lost their holdings in the crash of 1893. Many historians will tell you the crash was precipitated by the robber barons of the East who rescued the Merrits from bankruptcy gaining the fast wealth of the Mesabi. The result was United States Steel, the empire of Andrew Carnegie et.al. Watch who acquires the vast wealth of the Bakken.