Page added on September 18, 2016

THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S.

The Death of the Great Bakken Oil Field has begun and very few Americans understand the significance. Just a few years ago, the U.S. Energy Industry and Mainstream media were gloating that the United States was on its way to “Energy Independence.”

Unfortunately for most Americans, they believed the hype and are now back to driving BIG SUV’s and trucks that get lousy fuel mileage. And why not? Americans now think the price of gasoline will continue to decline because the U.S. oil industry is able to produce its “supposed” massive shale oil reserves for a fraction of the cost, due to the new wonders of technological improvement.

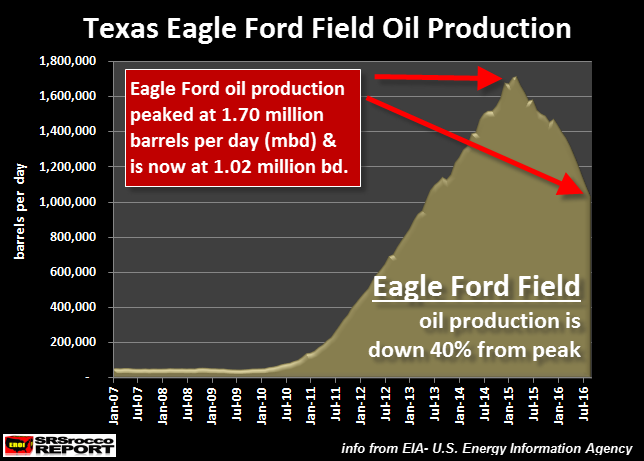

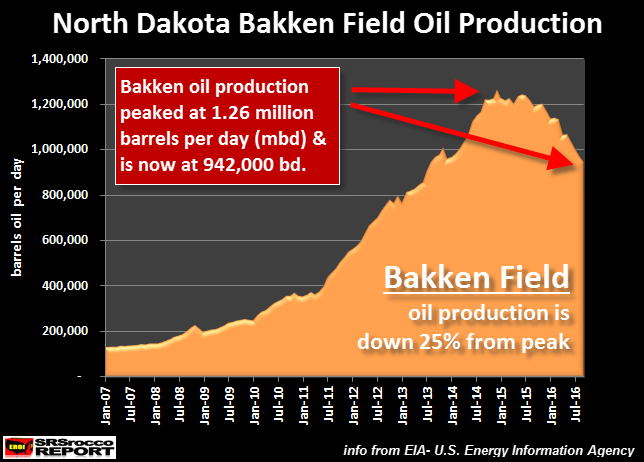

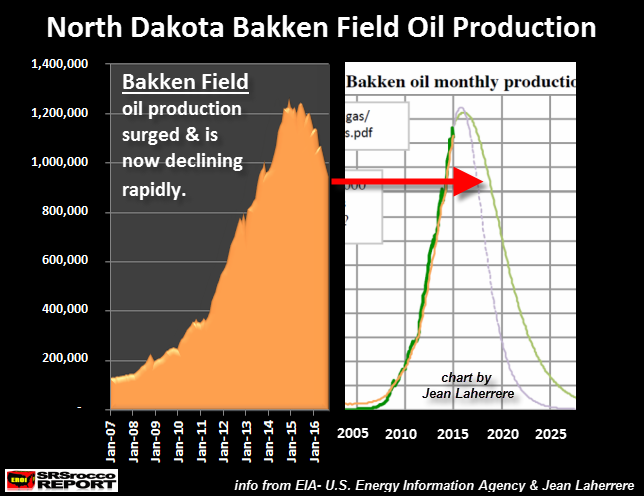

I actually hear this all the time when I travel and talk to family, friends and strangers. I gather they have no clue that the Great Bakken Oil Field is now down a stunning 25% from its peak in just a little more than a year and half ago:

The mighty Bakken oil field located in North Dakota reached peak production in December 2014 at 1.26 million barrels per day (mbd) and is now down to 942,000 bd. This decline is no surprise to me or to my readers who have been following my work for the past several years.

I wrote about the upcoming crash of the Bakken oil field in my article (click here to read article)– Published, NOV. 2013:

I ended the article with these sobering words:

There are only so many drilling locations available and once they run out, the Great Bakken Field will become a BUST as the high decline rates will push overall oil production down the very same way it came up.

Those who moved to the frigid state of North Dakota with Dollar signs in their eyes and images of sugar-plums dancing in their heads will realize firsthand the negative ramifications of all BOOM & BUST cycles.

Well, the Bust of North Dakota economy has arrived and according to the article, “The North Dakota Great Recession“:

Unfortunately by April 2015 it was clear that the oil markets were in a secular decline brought on by oversupply in the global energy markets fueled by a deep recession in China. As a result, companies started to lay off workers, and over the following months caused a massive exodus of people as jobs were eliminated. Nobody is exactly sure how many people have left the state, but some put estimates as high as 25,000.

The strongest real estate market continues to be Watford City with the weakest in Minot. However, even in Watford City the price of a three-bedroom rental home has come down from $2,500 in 2015 to a current price of $1,400. This represents a 44 percent decline of the rental price in the market.

Some folks believe the reason for the decline in oil production at the Bakken was due to low oil prices. While this was part of the reason, the Bakken was going to peak and decline in 2016-2017 regardless of the price. This was forecasted by peak oil analyst Jean Laherrere. I wrote about this in my article below (click here to read article)– Published, APRIL 2015:

I took Jean Laherrere’s chart and placed it next to the current actual Bakken oil field production:

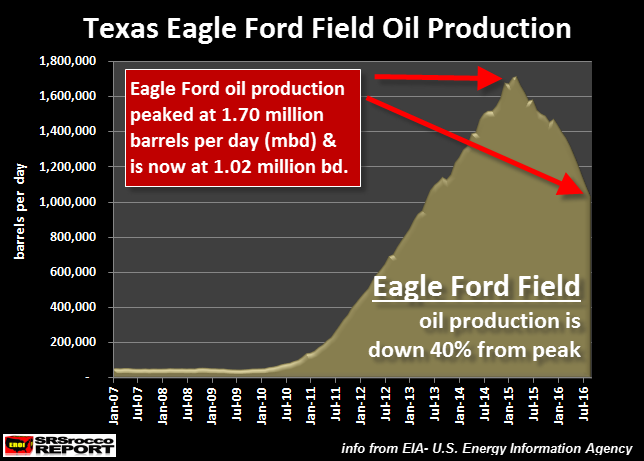

As we can see in the chart above, the rise and fall of Bakken oil production is very close to what Jean Laherrere forecasted several years ago (shown by the red arrow). According to Laherrere’s chart, the Bakken will be producing a lot less oil by 2020 and very little by 2025. This would also be true for the Eagle Ford Field in Texas.

According to the most recent EIA Drilling Productivity Report, the Eagle Ford Shale Oil Field in Texas will be producing an estimated 1,026,000 barrels of oil per day in September, down from a peak of 1,708,000 barrels per day in May 2015. Thus, Eagle Ford oil production is slated to be down a stunning 40% since its peak last year.

Do you folks see the writing on the wall here? The Bakken down 25% and the Eagle Ford down 40%. These are not subtle declines. This is much quicker than the U.S. Oil Industry or the Mainstream Media realize.

And… it’s much worse than that.

The U.S. Oil Industry Hasn’t Made a RED CENT Producing Shale

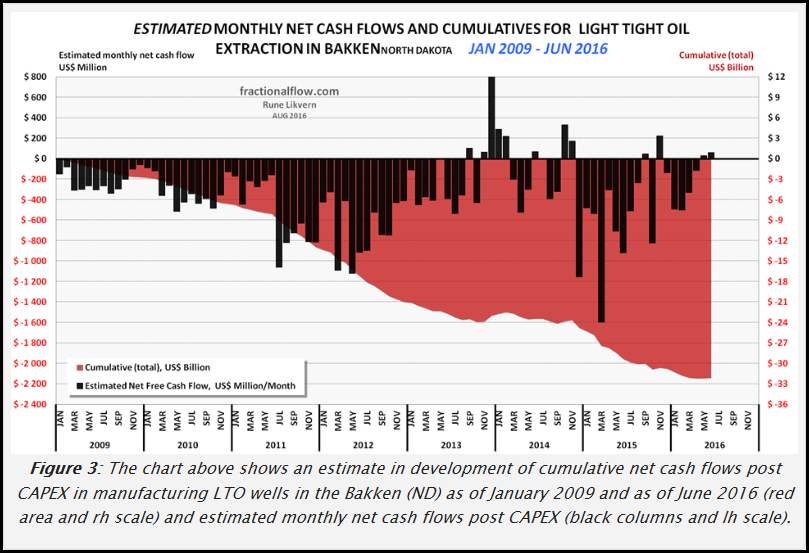

Rune Likvern of Fractional Flow has done a wonderful job providing data on the Bakken Shale Oil Field. Here is his excellent chart showing the cumulative FREE CASH FLOW from producing oil in the Bakken:

I will simply this chart by explaining that the BLACK BARS are estimates of the monthly Free Cash flow from producing oil in the Bakken since 2009, while the RED AREA is the cumulative negative free cash flow. As we can see there are very few black bars that are positive. Most are negative, heading lower.

Furthermore, the red area shows that the approximate negative free cash flow (deducting CAPEX- capital expenditures) is $32 billion. So, with all the effort and high oil prices from 2011-2014 (first half of 2014), the energy companies producing shale oil in the Bakken are in the hole for $32 billion. Well done…. hat’s off to the new wonderful fracking technology.

According to Rune Likvern in his article on the Bakken, he stated the following:

Just to retire estimated total debts (about $36 Billion, including costs for DUCs, SDWs, excluding hedges and income/loss of natural gas and NGLs) would require about 7 years with extraction and prices at Jun-16 levels.

Nominally to retire all debts (reach payout) would take an (average) future oil price close to $65/bo (WTI) for all the wells in operation as of end June – 16. This is without making any profit.

For the wells in production as per Jun-16, the total extraction of these will decline about 40% by Jun-17, and depletes their remaining reserves with about 20%. By assuming the operations remain cash flow neutral, total debt remains at $36 B in Jun-17.

As from Jul-17 this would now require an average oil price of about $73/bo (WTI) for these wells to nominally retire all debts (reach payout). Additional wells will add to what price is required to retire the total debt.

What Rune is stating here is that the $36 billion in total cumulative debt will occur by June 2017. Thus, it would take an average $65 a barrel to just pay back the debt in seven years. With the way things are going in the U.S. and world economies, I doubt we are going to see much higher oil prices.

Furthermore, the work by Louis Arnoux and the Hills Group suggest the price of oil will fall, not rise due to a Thermodynamic Collapse. More about this in an upcoming interview.

The United States Is In Big Trouble & Most Americans Have No Clue

As I have been documenting in previous articles (going back until 2013) the U.S. Shale Oil Industry was a house-of-cards. Readers who have been following my work, based on intelligent work of others, understood that Shale Oil is just another Ponzi Scheme in a long list of Ponzi Schemes.

From time to time, I look around different websites that publish my work and read some of the comments. I am surprised how many individuals still don’t believe in Peak Oil even though I explained the Falling EROI – Energy Returned On Investment quite clearly.

For some strange reason, some individuals cannot use deductive reasoning to destroy lousy conspiracy theories. Moreover, if they do believe in Peak Oil, then they think there is a wonderful “Silver-Bullet Energy Technology” that will save us all. I gather they believe this because the REALITY and IMPLICATIONS of Peak Oil are just too horrible, to say the least. So, holding onto HOPE that something will save us, just in the nick of time, is better than accepting the awful reality heading our way.

And the awful reality of Peak Oil will be felt more by Americans as their lifestyles have been highly elevated by the ability to extract wealth and resources from other countries through the issuing of massive amounts of paper Dollars and debt. Basically, they work, and we eat.

Unfortunately, the propping up of the U.S. market by the Fed and the domestic shale energy Ponzi scheme is running out of time. This is why it is imperative for investors to start moving out of Bonds, Stocks and Real Estate and into physical gold and silver to protect wealth.

For the wealthy investor or institution that believe a 5-10% allocation in physical gold is good insurance, you are sadly mistaken. While Donald Trump is receiving more support from Americans in his Presidential race, his campaign motto that he will “Make American Strong Again”, will never happen. The America we once knew is over. There just isn’t the available High EROI – Energy Returned On Investment energy supplies to allow us to continue the same lifestyle we enjoyed in the past.

So, now we have to transition to a different more local or regional way of living. This new living arrangement will be based on capital that is “STORED ECONOMIC ENERGY or WEALTH.” This can only come via the best sources such as physical gold and silver.

If individuals and countries have been acquiring physical gold and silver, they will be in better shape and will be able to enjoy more options than those who have been selling their gold and accumulating lots of debt and derivatives.

Lastly, if you haven’t checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

341 Comments on "THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S."

Rev. Stephen M. King on Sun, 18th Sep 2016 2:33 pm

The Long Emergency, as outlined by James Howard Kunstler in his book by the same title, has begun.

Michael Rosenglick on Sun, 18th Sep 2016 2:33 pm

Geez Jammer, I could have waited a couple of minutes and you brought up the same thing I was thinking, which until we said it, nobody else did. Either we forgot or most of the readers are too young to remember. The fear back then was panic for no reason. So why do you want to start another panic attack.. If you agree and oil is doomed, then take a Xanax and all will be fine tomorrow.

The world has a lot bigger problems then oil, guaranteed. At least for now

sam on Sun, 18th Sep 2016 2:35 pm

what does the donald think

rick on Sun, 18th Sep 2016 2:42 pm

Surprised? people are stupid thinking this is going to last for ever.

david on Sun, 18th Sep 2016 2:43 pm

this is completely bogus

So the shale oil fields aren’t as rich as thought ?

where the hell is the surprise in that ?

it was a stupid idea and cost alot of fools alot of money !

the idea you can bring American Industry by pulling as truly Garbage product out of the ground is quite moronic !

When Americans stop pretending they can CON their way back to the TOP and stop listening to the Cheap Skates Our Economy will truly return !

Until that happens we will continue to see this ” Bubble and Burst” economy, thats all cheap skatery can accomplish

C on Sun, 18th Sep 2016 2:44 pm

BS BS propaganda what is this guy selling oh yeah Snake oil.

Jude on Sun, 18th Sep 2016 2:48 pm

What people fail to understand is it is NOT our oil that brought prices down, It was Obama and a deal he made with Saudi Arabia…people need to do research before publishing stories like this, that have no matter in the how and whys gas prices are down/.///..the deal Obama struck with Saudi Arabia is also what is making the Russian economy fall..and that is the REAL reason tensions are high between the 2 countries…and why they are trying hard to make it so oil can be purchased without the American Dollar…

Larry Gagnon on Sun, 18th Sep 2016 2:50 pm

somebody tell the writer Tesla has

about a half million cars–on order!

The death of an oil field from shale

has nothing to do with the graphs,

it about return on investment.

Shale oil is in trouble for one very

simple reason, cost vs free market

(the Saudi’s/OPEC kick to balls, see

big drop in global price of oil)

I should say “free market” is half

truth considering OPEC’s price fixing.

I also think/believe the Arabs have

the insight to see the higher the

cost of driving a gas engine vs

electric, the faster the death of

(it is coming this century, zero doubt) of gasoline powered cars.

Sorry that does not work for American

oil Corp’s–hence, they would like

another middle east war–that should

make shale workable again.

John on Sun, 18th Sep 2016 2:50 pm

Am I the only one who’s noticed that the author has something to sell here?? On Precious Metals Investing!

Jay on Sun, 18th Sep 2016 2:52 pm

I remember an older form of writing that used statements written in bold and all caps every other paragraph or so as this “article” does. That old form of writing was called “junk mail.” It was kind of a spatter sales pitch technique. This author is selling something, or promoting some personal agenda, or both.

bobm on Sun, 18th Sep 2016 2:52 pm

Let me see, oil is at approx. $43.00 a bbl and production is down. These ppl must think that the readers are a bunch of democrats.

Joe Scott on Sun, 18th Sep 2016 2:53 pm

I’ve been hearing about “peak oil” for decades. The truth is that there is just the right amount of oil. The market will continue to supply oil which will continue to be the main power source for automobiles for at least 20 more years.

Dick Smith on Sun, 18th Sep 2016 2:54 pm

What a bunch of BS. The decline is do to not drilling. Not that there is nothing left to drill. The same can be said almost anywhere in the US. The production has dropped off as they aren’t drilling or only drilling minimal. There is still a lot of oil in the ground.

J on Sun, 18th Sep 2016 2:55 pm

Perhaps they stopped pumping oil because the price is too low to make any money so they are saving it for when the price rebounds?

You know, supply and demand…

Tom on Sun, 18th Sep 2016 2:56 pm

As a 16 year old, I waited in lines at gas stations in the mid 70’s as we were told that there would be no oil left in the world by the year 2000.

Currently, there is more oil sitting in ships at sea than they know what to do with. Now that Iran has had some sanctions relief, they are pumping wildly to get the money. Russia is broke and they are pumping wildly.

OPEC and others are pumping so much oil that prices will remain low and supplies high for as long as it take to prefect the hydrogen car.

No need to worry, America.

Jared Palick on Sun, 18th Sep 2016 2:58 pm

One more way to fool the American people by telling us how much we are going to be affected and of course paying at the pump. It’s all a bunch of lies to get us to pay more when our government has “free” energy thru cold fusion that they supposedly told us that it doesn’t work, but in all actuality, the government has refined this process into their weapon they’ve been using against our own people. Fool us again, right?

Apneaman on Sun, 18th Sep 2016 3:00 pm

The remedial debating club is now in session.

maverick on Sun, 18th Sep 2016 3:01 pm

I didn;t bother reading i just wnt to the end and yup there it was his agenda. all i have to say is, no never mind.

Jethro Bodine on Sun, 18th Sep 2016 3:02 pm

I suppose the recession in China has nothing to do with this? It is not that the field is dying, it is that until the price stabilizes with supply that the jobs will come back, and with it, the increase in production. I suppose, however, that any oil field is dying after the first barrel is removed from the ground.

Dean Winter on Sun, 18th Sep 2016 3:17 pm

Shrinking energy use seems to never be posted here as a significant factor. In 2007 my 7000 sq ft machine shop/attached residence had a total monthly retail energy cost of $2000. My monthly energy cost is now $500 with the differential $1500 mo. going into my retirement.

Heat pump water heater, mini-split cold climate heat pump solves heat, AC and dehumidifying. The 2″ styrofoam wrap around the 10″ cinder block building, LED and T8 lighting with walk-into-room sensor switching and white paint on the walls dropped it the rest of the way.

With continuing low interest rates for new home, rehab and repair loans, a guy can make a huge difference in the monthly bills and force the oil to stay in the wells.

If you watch House Hunters International on the HG channel, you’ll notice that almost every rehabbed home in almost every country has a mini-split heat pump/AC on the wall, and cfl’s for lighting.

LED lighting and walk-into-room switching can reduce home energy cost by 10% ALL BY ITSELF, yet I never see it mentioned here.

Lithuania, for example has a policy about heat pumps to lower energy use. They don’t say it, but you know it’s a strategic move to reduce dependence on Russian fuel. Poland is small potatoes on heat pumps, but sales tripled in one year. 2015.

The massive amount of inventing information available to anybody is causing currently invisible, yet exponential advances in new inventions and improvements in existing technologies. Frederick Bastiat would suggest it unwise to ignore this most important area when attempting to forecast in economics.

James... on Sun, 18th Sep 2016 3:20 pm

Such propaganda is coming out now in hopes the Republicans take the White House for excuse to raise prices and make the markets unstable for BIG OIL aka BIG BROTHER…

planefreek on Sun, 18th Sep 2016 3:23 pm

Who cares? The world will always need oil for lubricants, plastics. With LENR(cold fusion)about to wash across the world their will be no need for oil to power automobiles (electric cars),heat homes(cold fusion runs at about 1700c) and the grid will be mostly for backup except for some industrial applications. In the next 20yrs the swing to cold fusion will be truly astonishing. The world will be unrecognizable.

Teri Franz on Sun, 18th Sep 2016 3:24 pm

So why are they trying to build a pipeline across four state, then?

Richard Zuendt on Sun, 18th Sep 2016 3:34 pm

This is the same nonsense that was written back in the 70’s. Oh my, we are running out of oil. This is nothing but a bunch of crap!

chuck on Sun, 18th Sep 2016 3:41 pm

A lot of folks are not being told that this country has enough oil reserves to last for the next 700 years. That is not a typo. Do some research and you can find out. And incidentally,this was way before the bakkan discovery.just sayin

Mineral Buyer on Sun, 18th Sep 2016 3:44 pm

I have been buying minerals for a living since 1984 and would gladly buy some more in the core of this great field. There are so many untapped drilling locations in here in both the Bakken and Three Forks formations. Of course they would stop drilling HBP (held by production) leases when the price falls and let that oil lay until prices rise. Why pick on the Bakken…I see this same thing nationwide.

Phil on Sun, 18th Sep 2016 3:50 pm

I’ve had people try to convince me that oil renews itself underground every few years. How do they know? Some religious based person or text told them so, so they believe it.

David Lusly on Sun, 18th Sep 2016 3:54 pm

Shale Oil has been the mythical magic bullet since the mid 70’s, after OPEC cut off our water and demonstrated how vulnerable we were. Rather pursuing the logical solution, develop and mature alternate renewable energy sources and wean ourselves off of a dependence on oil we chose denial and chase the myths. This result should surprise no one. Unfortunately it will still not likely to stimulate further development of renewable, not toxic lithium batteries that will simply be another massive toxic waste problem that will need to be expensively dealt with later. What is the parity point now? At what price/cost point does oil need to reach for renewable to become competitive?

mike on Sun, 18th Sep 2016 3:56 pm

HAHA I am to believe an article from a website called peakoil.com … really?

penury on Sun, 18th Sep 2016 3:57 pm

I read the article but, what really caught my attention was the comments.Are there really people who continue to believe in infinite “oil” on a finite planet? Is economic understanding in such short supply that people no longer understand that companies must turn a profit to stay in business. And the truth, leave the oil in the ground until the prices rise. The only catch to that is: can anyone afford to re-open production from the stagnant field?

John on Sun, 18th Sep 2016 4:00 pm

The hand writing has been there for a while. The Problem is Natural Gas is going the same as Oil. You can Squeeze that old Turnip for so long before it dry.

Expect the same for ALL non-renewable energy.

and Expect more Mid West Earth Quakes once that Turnip is dry.

Board Jim on Sun, 18th Sep 2016 4:00 pm

They are drilling less because it hasn’t been worth it. It’s only economical if oil is above $3 a gallon. When oil goes up again, they’ll take more.

biffula on Sun, 18th Sep 2016 4:01 pm

This article makes many errors. One is that it doesn’t seem to take into account that many wells get shut in or throttled back when prices drop. They can be ramped up again when prices rise. Second, it doesn’t take into account more fracking into the same wells. And lastly, it doesn’t take future technology developments into account. 20 years ago you couldn’t have had a Bakken oil field. Technology developments in fracking allowed for it to be developed.

Board Jim on Sun, 18th Sep 2016 4:02 pm

They are drilling less because it hasn’t been worth it. It’s only economical if oil is above $3 a gallon. When oil goes up again, they’ll take more. This is doom porn.

John on Sun, 18th Sep 2016 4:02 pm

The hand writing has been there for a while. The Problem is Natural Gas is going the same as Oil. You can Squeeze that old Turnip for so long before it dry.

Expect the same for ALL non-renewable energy.

and Expect more Mid West Earth Quakes once that Turnip is dry. And don’t forget Hydrogen fuel.

morete on Sun, 18th Sep 2016 4:11 pm

Who cares what happens to oil or the price of oil? We’ll all still have our dual income household, flat screen TV’s and new cars. If the price of oil is high, then the U.S. oil companies make out as well as oil workers and those that own mineral rights in the U.S.. If the price of oil is low then the average consumer makes out at the pump. Either way, it’s a win-lose for someone, somewhere.

Now, all of you go back and do what you’re best at doing — watching a bunch of racists in uniforms take a knee during the national anthem and say to yourselves that it’s alright because they have the freedom to do it.

Bob on Sun, 18th Sep 2016 4:19 pm

I get the feeling that the author has written this article before, and it was different times and different circumstances. Typical of single issue ideologues, he presents his case as an inevitable catastrophe, and has been prove wrong by the passing of time. What he doesn’t realize is that if peak oil has been reached, it is one of those “so what” moments. The nation will not collapse, neither will the world economy. Things may change, but who cares in the long run. In the long run we are all dead, and our children and grandchildren will figure out a way to fire their economies. The peak oil movement is pretty much flat-earth stuff. Nobody cares because in the long run, it makes no difference.

Mike Wagner on Sun, 18th Sep 2016 4:21 pm

Hmmmm…so it made money when prices were high and now prices are low it is losing money and prodiction is going down as they cant sell at a profit…hmmm… So what you are saying is if I buy high and sell low I will lose money… How come no one ever thought of that before…. explains GM, KMART, ENRON… you are a genius sir

Bob on Sun, 18th Sep 2016 4:22 pm

I get the feeling that the author has written this article before, and it was different times and different circumstances. Typical of single issue ideologues, he presents his case as an inevitable catastrophe, and has been repeatedly proven wrong by the passing of time. What he doesn’t realize is that if peak oil has been reached, it is one of those “so what” moments. The nation will not collapse, neither will the world economy. Things may change, but who cares in the long run. In the long run we are all dead, and our children and grandchildren will figure out a way to fire their economies. The peak oil movement is pretty much flat-earth stuff. Nobody cares because in the long run, it makes no difference.

Karl on Sun, 18th Sep 2016 4:25 pm

We are not anywhere near in trouble as far as oil goes they just found a oil field 3 years ago in Green Canyon off the coast of Louisiana and Texas that will sustain this country for 130 year are more and they think there is more oil then we can use off the east coast

Tom on Sun, 18th Sep 2016 4:25 pm

The author of this piece must be a liberal loon, because none of them undersand anything about economics. No company is going to maintain the same production @ $45/bl as $80-100/bl! Of course productions down.

Joe Jitsu on Sun, 18th Sep 2016 4:26 pm

If you run a website called peakoil.com, at what point do you decide your positions are untenable, and it’s time to shut down?

Tom on Sun, 18th Sep 2016 4:26 pm

Do you folks see the writing on the wall here? ****** No, I see a moron that doesn’t understand economics.

Mineral Buyer on Sun, 18th Sep 2016 4:31 pm

Renewables should overtake fossil fuels in a lot of our lifetimes, and the planet will be better off as a result. It will just take time as there are just so many things that are made from petroleum products today. The one good thing that the current administration has done in my humble opinion is to force the conversion of so many coal burning power plants to methane (natural gas). Depending on who you listen to this amounts to a forty percent cleaner (CO2) burn. If the price of oil gets too high and Venezuela is economically allowed to develop the Orinoco Oil Belt, the oil sands project in Canada will look like a deck chair on the Queen Mary.

Marc Rauch on Sun, 18th Sep 2016 4:35 pm

Americans drive large vehicles because they want and/or need them. There is nothing wrong with people having what they want and/or need.

For some years, large vehicle owners were shamed by the claim that they are responsible for the world running out of oil. That claim proved to be nonsense.

Then owners of large vehicles were shamed because they were causing more pollution. Better emissions technology, and the replacement of poisonous tetraethyl lead and MTBE with ethanol, calmed at least some of the pollution complaints.

Now, this story reignites the large vehicle issue with the Bakken Field issue. One thing has nothing to do with the other. As I wrote at the beginning, some people want and/or need a large vehicle. As long as they can afford it there’s no reason for them not to have them. If we need to clean the environment more, which we do; and we need to end dependence on foreign fuels, which we do, the answer is not to force more poison and environmental disasters on us with more petroleum oil solutions, the answer is to produce and use more ethanol. When and if electric vehicles ever become the economical answer, then we can switch to that.

ARCADIUS on Sun, 18th Sep 2016 4:40 pm

New shale oil fields are discovered every year.

Puker on Sun, 18th Sep 2016 4:44 pm

Oil and coal are moving to nat.gas and alternatives. Cars will move toward electric, and things are going green. That means America, like many countries in Europe that are energy neutral or energy positive (Germany), is the future, not oil. The future is green, not black.

zika on Sun, 18th Sep 2016 4:45 pm

Volume is down becuase of prices. The whole thread regarding debt may be accurate, but this isn’t because the feilds have any less oil in them than they did 18 months ago (other than what was pumped), it’s purely supply and demand and world price driven. I’m a huge fan of J Kuntsler like many of you, for a lot of reasons, including the hydrocarbon problem, and am for electric cars, trains, wind, and solar as well. But this is the same boom bust that has been going on in OK, TX, and the gulf for 4 decades. It should be a warning though, especiallly to communities who welcome these drillers into town with zero taxes and such only to be turned into a strip mall waste land.

Kurt on Sun, 18th Sep 2016 4:47 pm

This is just another example of reporting without asking any questions about the facts and then making up whatever story you want. You might try actually taking a trip to North Dakota and asking almost anyone in the oil producing area why oil production is down. I can save you the trip because I was just there two week ago. It is real simple – basic economics 101. Oil production is down because the price of oil is down. New wells are not being drilled because financially it does not have a return. Almost all new wells that have come on line in the last 8 years are on timers and are only running on REDUCED SHEDULES. The individuals that I spoke with, which have oil wells on their land (a real source for information) told me that the wells are running 50% to 75% of the day / week.

feas ant on Sun, 18th Sep 2016 4:51 pm

we should have used up foreign oil reserves first and saved our oil for later