Page added on September 18, 2016

THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S.

The Death of the Great Bakken Oil Field has begun and very few Americans understand the significance. Just a few years ago, the U.S. Energy Industry and Mainstream media were gloating that the United States was on its way to “Energy Independence.”

Unfortunately for most Americans, they believed the hype and are now back to driving BIG SUV’s and trucks that get lousy fuel mileage. And why not? Americans now think the price of gasoline will continue to decline because the U.S. oil industry is able to produce its “supposed” massive shale oil reserves for a fraction of the cost, due to the new wonders of technological improvement.

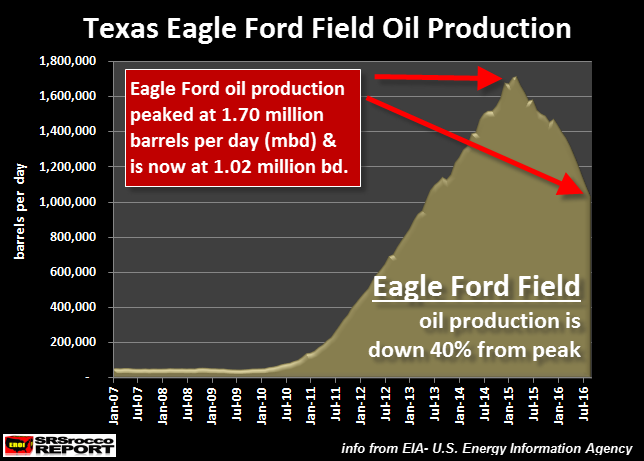

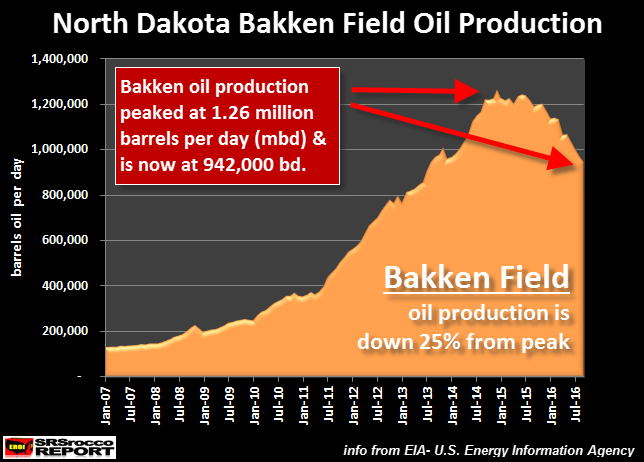

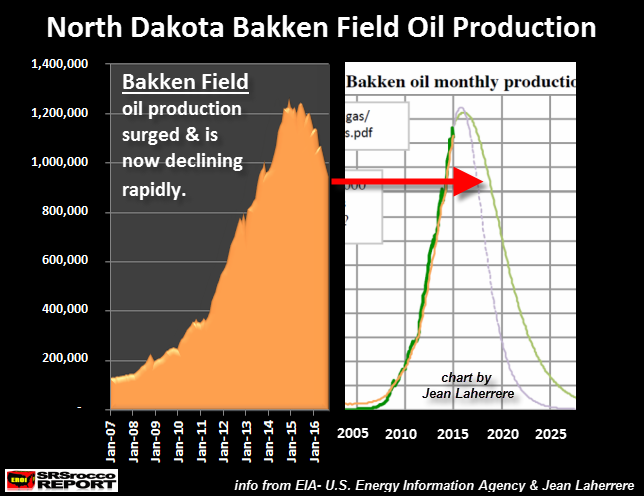

I actually hear this all the time when I travel and talk to family, friends and strangers. I gather they have no clue that the Great Bakken Oil Field is now down a stunning 25% from its peak in just a little more than a year and half ago:

The mighty Bakken oil field located in North Dakota reached peak production in December 2014 at 1.26 million barrels per day (mbd) and is now down to 942,000 bd. This decline is no surprise to me or to my readers who have been following my work for the past several years.

I wrote about the upcoming crash of the Bakken oil field in my article (click here to read article)– Published, NOV. 2013:

I ended the article with these sobering words:

There are only so many drilling locations available and once they run out, the Great Bakken Field will become a BUST as the high decline rates will push overall oil production down the very same way it came up.

Those who moved to the frigid state of North Dakota with Dollar signs in their eyes and images of sugar-plums dancing in their heads will realize firsthand the negative ramifications of all BOOM & BUST cycles.

Well, the Bust of North Dakota economy has arrived and according to the article, “The North Dakota Great Recession“:

Unfortunately by April 2015 it was clear that the oil markets were in a secular decline brought on by oversupply in the global energy markets fueled by a deep recession in China. As a result, companies started to lay off workers, and over the following months caused a massive exodus of people as jobs were eliminated. Nobody is exactly sure how many people have left the state, but some put estimates as high as 25,000.

The strongest real estate market continues to be Watford City with the weakest in Minot. However, even in Watford City the price of a three-bedroom rental home has come down from $2,500 in 2015 to a current price of $1,400. This represents a 44 percent decline of the rental price in the market.

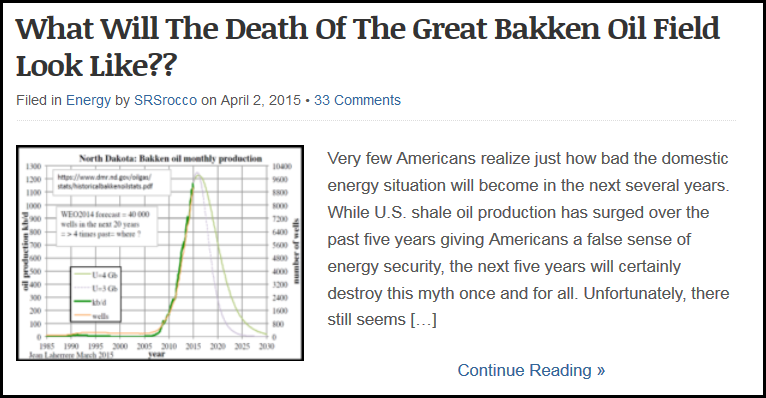

Some folks believe the reason for the decline in oil production at the Bakken was due to low oil prices. While this was part of the reason, the Bakken was going to peak and decline in 2016-2017 regardless of the price. This was forecasted by peak oil analyst Jean Laherrere. I wrote about this in my article below (click here to read article)– Published, APRIL 2015:

I took Jean Laherrere’s chart and placed it next to the current actual Bakken oil field production:

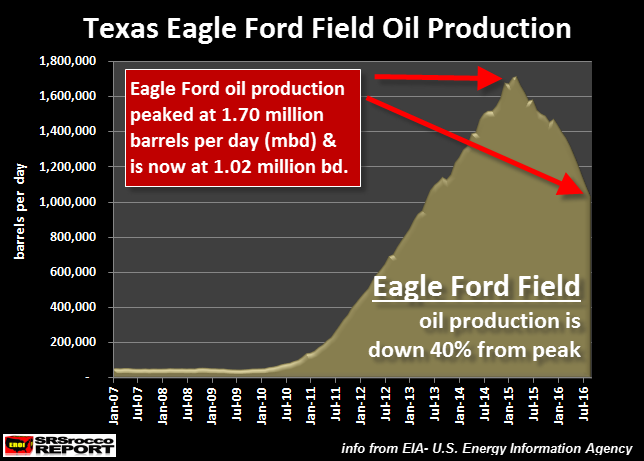

As we can see in the chart above, the rise and fall of Bakken oil production is very close to what Jean Laherrere forecasted several years ago (shown by the red arrow). According to Laherrere’s chart, the Bakken will be producing a lot less oil by 2020 and very little by 2025. This would also be true for the Eagle Ford Field in Texas.

According to the most recent EIA Drilling Productivity Report, the Eagle Ford Shale Oil Field in Texas will be producing an estimated 1,026,000 barrels of oil per day in September, down from a peak of 1,708,000 barrels per day in May 2015. Thus, Eagle Ford oil production is slated to be down a stunning 40% since its peak last year.

Do you folks see the writing on the wall here? The Bakken down 25% and the Eagle Ford down 40%. These are not subtle declines. This is much quicker than the U.S. Oil Industry or the Mainstream Media realize.

And… it’s much worse than that.

The U.S. Oil Industry Hasn’t Made a RED CENT Producing Shale

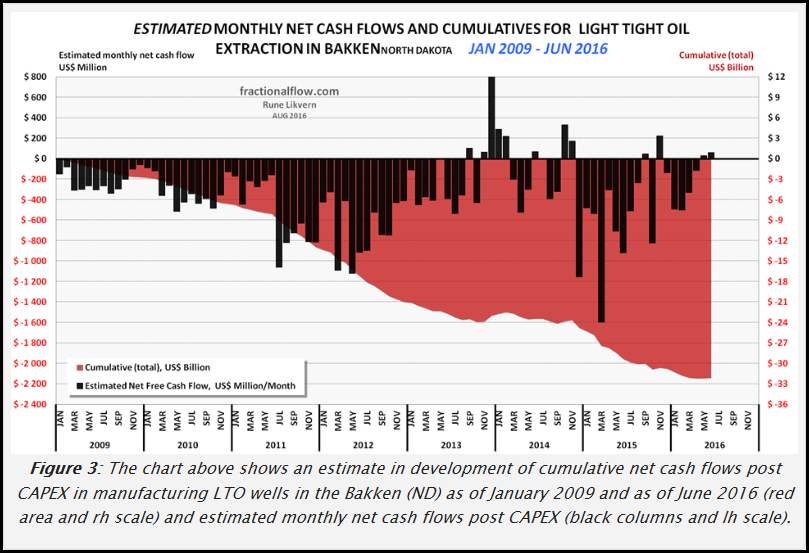

Rune Likvern of Fractional Flow has done a wonderful job providing data on the Bakken Shale Oil Field. Here is his excellent chart showing the cumulative FREE CASH FLOW from producing oil in the Bakken:

I will simply this chart by explaining that the BLACK BARS are estimates of the monthly Free Cash flow from producing oil in the Bakken since 2009, while the RED AREA is the cumulative negative free cash flow. As we can see there are very few black bars that are positive. Most are negative, heading lower.

Furthermore, the red area shows that the approximate negative free cash flow (deducting CAPEX- capital expenditures) is $32 billion. So, with all the effort and high oil prices from 2011-2014 (first half of 2014), the energy companies producing shale oil in the Bakken are in the hole for $32 billion. Well done…. hat’s off to the new wonderful fracking technology.

According to Rune Likvern in his article on the Bakken, he stated the following:

Just to retire estimated total debts (about $36 Billion, including costs for DUCs, SDWs, excluding hedges and income/loss of natural gas and NGLs) would require about 7 years with extraction and prices at Jun-16 levels.

Nominally to retire all debts (reach payout) would take an (average) future oil price close to $65/bo (WTI) for all the wells in operation as of end June – 16. This is without making any profit.

For the wells in production as per Jun-16, the total extraction of these will decline about 40% by Jun-17, and depletes their remaining reserves with about 20%. By assuming the operations remain cash flow neutral, total debt remains at $36 B in Jun-17.

As from Jul-17 this would now require an average oil price of about $73/bo (WTI) for these wells to nominally retire all debts (reach payout). Additional wells will add to what price is required to retire the total debt.

What Rune is stating here is that the $36 billion in total cumulative debt will occur by June 2017. Thus, it would take an average $65 a barrel to just pay back the debt in seven years. With the way things are going in the U.S. and world economies, I doubt we are going to see much higher oil prices.

Furthermore, the work by Louis Arnoux and the Hills Group suggest the price of oil will fall, not rise due to a Thermodynamic Collapse. More about this in an upcoming interview.

The United States Is In Big Trouble & Most Americans Have No Clue

As I have been documenting in previous articles (going back until 2013) the U.S. Shale Oil Industry was a house-of-cards. Readers who have been following my work, based on intelligent work of others, understood that Shale Oil is just another Ponzi Scheme in a long list of Ponzi Schemes.

From time to time, I look around different websites that publish my work and read some of the comments. I am surprised how many individuals still don’t believe in Peak Oil even though I explained the Falling EROI – Energy Returned On Investment quite clearly.

For some strange reason, some individuals cannot use deductive reasoning to destroy lousy conspiracy theories. Moreover, if they do believe in Peak Oil, then they think there is a wonderful “Silver-Bullet Energy Technology” that will save us all. I gather they believe this because the REALITY and IMPLICATIONS of Peak Oil are just too horrible, to say the least. So, holding onto HOPE that something will save us, just in the nick of time, is better than accepting the awful reality heading our way.

And the awful reality of Peak Oil will be felt more by Americans as their lifestyles have been highly elevated by the ability to extract wealth and resources from other countries through the issuing of massive amounts of paper Dollars and debt. Basically, they work, and we eat.

Unfortunately, the propping up of the U.S. market by the Fed and the domestic shale energy Ponzi scheme is running out of time. This is why it is imperative for investors to start moving out of Bonds, Stocks and Real Estate and into physical gold and silver to protect wealth.

For the wealthy investor or institution that believe a 5-10% allocation in physical gold is good insurance, you are sadly mistaken. While Donald Trump is receiving more support from Americans in his Presidential race, his campaign motto that he will “Make American Strong Again”, will never happen. The America we once knew is over. There just isn’t the available High EROI – Energy Returned On Investment energy supplies to allow us to continue the same lifestyle we enjoyed in the past.

So, now we have to transition to a different more local or regional way of living. This new living arrangement will be based on capital that is “STORED ECONOMIC ENERGY or WEALTH.” This can only come via the best sources such as physical gold and silver.

If individuals and countries have been acquiring physical gold and silver, they will be in better shape and will be able to enjoy more options than those who have been selling their gold and accumulating lots of debt and derivatives.

Lastly, if you haven’t checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

341 Comments on "THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S."

killJOY on Sun, 18th Sep 2016 8:40 am

The tone of this article is so 2005.

OK, fine. I was a firm believer in the upcoming peak oil catastrophic failure back in 2005, but it turns out each and every prediction was falsified by subsequent events. They missed the future by a long shot.

Remember Simmons: “All we can do now is pray”?

And Hirsch: “Oil could reach 500 dollars a barrel”?

And Tverberg: “Crash in 2014”?

Etc.

So why believe it now? If the “experts” could be so wrong back then– not even acknowledging the existence of tight oil– what are they missing now?

The is the fallacy of overconfidence described by Kahneman in his book “Thinking, Fast and Slow.”

“What you see is all there is.”

Or perhaps not.

ghung on Sun, 18th Sep 2016 8:58 am

““What you see is all there is.””

What I see is $trillions in debt born of robbing Peter’s kids to pay Paul’s current fuel bill. That’s what I see. When dangerously loose monetary policy begets a glut of tight oil, not sure how naysayers can gloat about the peak oil idea being so wrong; when so much energy capital being sucked from the future will never be paid back. Even simple minds can understand this.

Cloggie on Sun, 18th Sep 2016 9:09 am

not sure how naysayers can gloat about the peak oil idea being so wrong

The assumed “gloating” is merely related to the insight that the earth’s crust is overloaded with fossil fuel, probably more so than there is oxygen in the earth’s atmosphere to burn it all. The dynamic factor is technology, making the ASPO-2000 assessment that industrial society was about to collapse, completely irrelevant.

I refer again to the fairly recent discovery (or rather “remembrance” of the results of thousands of drillings) of enormous coal deposits under Britain and the North-sea (and no doubt on many other locations on the planet) and the issuing by the British authorities of dozens of permits to explore the economic feasibility of UCG:

https://en.wikipedia.org/wiki/Underground_coal_gasification

There is enough to fry us all, hence the “gloating”.

killJOY on Sun, 18th Sep 2016 9:14 am

If “simple” minds “understand” it, then it’s probably wrong. For example, “everyone knew” back in 2005 that the United States was in permanent decline, and history proved them wrong. So what else are they wrong about?

And by citing “what you see,” you are not acknowledging what you don’t see. You are making Kahneman’s point for him.

It’s easy to make predictions and then to rationalize failures and to put off predictions to a further future time. That’s Kahneman’s definition of Overconfidence.

killJOY on Sun, 18th Sep 2016 9:15 am

>>The assumed “gloating” is merely related to the insight that the earth’s crust is overloaded with fossil fuel.<<

Well, no. This is just as false that civilization would collapse by 2010. I'm not a cornucopian, either.

I'm an agnostic.

ghung on Sun, 18th Sep 2016 9:20 am

“There is enough to fry us all…”

Even if we can’t afford to burn it. Meanwhile, I’ll be forced, one way or another, to pay for a lot of oil and coal I didn’t burn. Since I pay for things in real time, my peak oil year was, indeed, about 2005. I’m burning less every year. But if simpletons want to make it narrowly about total production of hydrocarbons, go for it. Changes little. Folks like you will continue to smugly blunder into a future of unpayable debt, environmental destruction, and economic contraction.

Cloggie on Sun, 18th Sep 2016 9:20 am

“I’m an agnostic.”

Apparently so.

https://en.wikipedia.org/wiki/Agnosticism

Agnosticism, a nice word for a state of mind also known as laziness.

http://www.dailymail.co.uk/news/article-2593032/Coal-fuel-UK-centuries-Vast-deposits-totalling-23trillion-tonnes-North-Sea.html

ghung on Sun, 18th Sep 2016 9:30 am

killJOY; “… “everyone knew” back in 2005 that the United States was in permanent decline…”

All things considered, it is.

“…you are not acknowledging what you don’t see.”

What would that be? The debt? Declining infrastructure? A country that nominates two utterly corrupt clowns for President? Oil-related companies declaring bankruptcy left and right? Political impotence on the increase? Declining arable land? Rising sea levels? An electorate which becomes more idiotic every day? Bought-and-paid-for corporate media? I could go on. Absolutely inept and dangerous foreign policies?

What do you think I’m missing?

Outcast_Searcher on Sun, 18th Sep 2016 9:30 am

Consider the source. Zerohedge repeating a doom and gloomer who is constantly pushing gold and silver hard due to coming (real soon now) economic collapse.

Sound familiar?

LTO has finite supplies, but globally, they are very large. They will buy the globe time (decades) to transition toward green energy.

The big challenge will be dealing with the effects of AGW in the coming decades — not economic collapse because of peak oil being in our face.

But of course, let’s pretend that’s not true since selling perma-insta-doom is what doomers gotta do, whatever their motivation.

Disclosure: I’m a long term doomer. I think humanity is far exceeding the carrying capacity of the planet, and will pay the price. I also think that humanity is unwilling to pay the steep price in relative income/lifestyle willing to meaningfully address that issue in an acceptable timeframe.

However, that will take decades, and more likely centuries to play out. And meanwhile, as Cloggie says, there are enough FF’s to burn to make AGW catastrophic.

Cloggie on Sun, 18th Sep 2016 9:31 am

“Folks like you will continue to smugly blunder into a future of unpayable debt, environmental destruction, and economic contraction.”

As usual you are putting words in my mouth.

The very fact that you point at the presence of enormous fossil fuel reserves, doesn’t mean that we should exploit them.

What we should do is to use them to swiftly move into renewables and leave the rest of the dirty asphalt where it is: in the ground.

1 kwh is the equivalent of 1 man day of very hard physical labor. In Europe 1 kwh costs between 6-30 cents:

https://upload.wikimedia.org/wikipedia/commons/a/a9/Electricity-prices-europe.jpg

In other words: a kwh price of a few dollars would still be paid if the alternative is that you sit on a home-trainer all day to generate the kwh yourself. Money doesn’t matter, only EROEI does.

We already know that UCG works (discussed here recently), hence by prudent optimism that after 2050-2060, most of the energy, at least in Europe, will be generated renewable.

Outcast_Searcher on Sun, 18th Sep 2016 9:35 am

GHUNG said: “Folks like you will continue to smugly blunder into a future of unpayable debt, environmental destruction, and economic contraction.”

As long as folks like you continue to insist a growing global economy is a “recession” or even a “depression”, don’t expect to have any credibility outside the hard core short term doomer echo-chamber.

(Hint: economic expansion isn’t economic contraction — even if it has undesirable side effects like evironmental destruction. Words have precise meanings.)

killJOY on Sun, 18th Sep 2016 9:40 am

ghung: “What do you think I’m missing?”

You’re asking me to be omniscient, when I just told you I’m agnostic.

Lay people have no business making vast predictions. Kahneman’s point is that even the experts are wrong when it comes to making economics predictions!

ghung on Sun, 18th Sep 2016 9:40 am

Clog said; “What we should do is to use them to swiftly move into renewables and leave the rest of the dirty asphalt where it is: in the ground.”

Well, shit, Cloggo, I figured that out over 20 years ago, and acted on it. Not sure what the rest of you are doing. Seems the less burning of hydrocarbons I do, the more humanity burns. So-called ‘renewables’ have largely been in-addition-to other energy sources; not displacing them.

rockman on Sun, 18th Sep 2016 9:50 am

Wow! Shocked that the average American, who lacks even a basic understanding of science, couldn’t comprehend the complexity of petroleum geology? Reminds of comments I heard long ago from “average” citizens during a momentary fuel crisis: “The damn companies talk about needing to drill more oil wells. That’s wrong…what we need are more gasoline wells”. Or a truly smart guy (a PH.D in his field): “It’s foolish to store 100’s of millions of bbls of oil underground in the SPR. Eventually those bbls will rust and leak”

And, of course, there’s the inept output of the MSM combined with the hidden agendas of politicians and activists on both sides of the issue. Given the net effect of minimal science education, poor media coverage and demagogic efforts it’s a wonder the average American can even spell “petroleum”. Which, to be honest, I suspect many tens of millions can’t. LOL.

Killjoy – “I was a firm believer in the upcoming peak oil catastrophic failure back in 2005,” I’m not trying to be rude but whose fault is it when one takes the words of a false profit with blind faith? And while everyone can’t get a degree in petroleum geology there’s a world of data available on the net. Data that could take the average person months to absorb and develop their own conclusion. When has anyone be born with the knowledge sufficient to truly understand anything? Thus folks have to decide which profits to follow so the responsibility still falls on them. Unfortunately such choices are often made to support one’s prejudices.

Cloggie on Sun, 18th Sep 2016 9:56 am

“Well, shit, Cloggo, I figured that out over 20 years ago, and acted on it. Not sure what the rest of you are doing.”

Well, I figured that out in 1973 (bomb shell report of Club of Rome) and in 1975 (41 years ago) decided to act upon it and choose an engineering study to help solve the problem.

Cloggie on Sun, 18th Sep 2016 9:59 am

“So-called ‘renewables’ have largely been in-addition-to other energy sources; not displacing them.”

The usual uninformed bs.

https://upload.wikimedia.org/wikipedia/commons/a/a9/Electricity-prices-europe.jpg

There is a reason why in Denmark a kwh costs 30 cent, the usual “early adopter” fate. That’s a country that to a substantial degree did displace fossil.

ghung on Sun, 18th Sep 2016 9:59 am

O_S said; “As long as folks like you continue to insist a growing global economy is a “recession” or even a “depression”, don’t expect to have any credibility outside the hard core short term doomer echo-chamber.”

As long as folks like you continue to use metrics that don’t really matter much; aren’t all-encompassing, the illusion of “growth” will continue, until it can’t.

BTW: I really don’t give a shit about my “credibility”. Goes back to what metrics one uses. It’s all just constructs designed to support one’s world view and for keeping BAU going for another day, so I just do my own thing and try to pay attention to what’s really happening; all of it.

It’s telling that, besides climate change perhaps, I never see you address the negative side of the human equation. But that equation will balance out in the end, and the illusion of growth will die along with the civilization that relied on that delusion so much. Such has it always been, and the louder folks like you denounce folks like me, the closer we are to the inevitable. Words like “depression” and “recession” won’t matter much, because we’re running out of planet to exploit.

killJOY on Sun, 18th Sep 2016 10:00 am

rockman, I don’t recall saying it was anyone else’s fault, although I did say the others’ predictions were flat wrong.

And the “false prophets” I listened to included several EXPERTS, some with your esteemed “degree in petroleum geology,” including Deffeyes, Campbell, and even my own geology professor, now retired, whose name I withhold out of respect for him.

Davy on Sun, 18th Sep 2016 10:04 am

Killjoy, missing a collapse date by a few years is not a big deal. Dates are irrelevant in such a short time frame. Seeing a collapse process in process and understanding we are in a “regime of collapse” is nailing it.

Davy on Sun, 18th Sep 2016 10:07 am

/to͞oˈSHā/

“As long as folks like you continue to use metrics that don’t really matter much; aren’t all-encompassing, the illusion of “growth” will continue, until it can’t.”

killJOY on Sun, 18th Sep 2016 10:11 am

Davy, you should read Kahneman’s book. Your statement is a classic example of the rationalizations used by “experts” when their predictions fail. Here’s a quotation:

“Tetlock [a research psychologist] also found that experts resisted admitting that they had been wrong, and when they were compelled to admit error, they had a large collection of excuses: they had been wrong only in their timing, an unforeseen event had intervened, or they had been wrong but for the right reasons.”

Sissyfuss on Sun, 18th Sep 2016 10:19 am

According to this article, I’m going to die if I don’t hurriedly check out their new Precious Metals Investing section. Who said capitalists are uncaring sociopaths. These people care enough to try to save me from the catastrophes they created. Wait,,,,what?

ghung on Sun, 18th Sep 2016 10:22 am

“…resisted admitting that they had been wrong…”

“Wrong”, and “right” are typical binary concepts that too many of you depend on because you are either too lazy, or too simple, to understand that just about everything is far more complex. Very few things are “right” or “wrong”. They just are. If you bother to look, most, if not all, of these folks were right about some things. We ignore those things at our peril.

denial on Sun, 18th Sep 2016 10:28 am

I think this is a good article; I have been arguing this point for some time. Yes the wells are in decline we know this is common for shale deposit to decline 80 percent in the first few years and the best spots are fracked first. All that being said for each person on the planet you could put associate several barrels of oil for each and we need more and more oil….I don’t see how the price for oil does not go up…I do know that the U.S has done well to destabilize the mid east pitting Iran against SA to keep prices down but I don’t know how long that will last when they see that they can raise prices and get a lot more for their oil.

PoorPeter on Sun, 18th Sep 2016 10:33 am

What people fail to understand is that no one is going to drill to lose money. It takes higher priced oil to make investors want to sink money into a drilling project. On top of that, if shale wells are shut-in for extended periods of time those wells can lose their ability to flow oil and natural gas due to a number of effects that are occurring in the reservoir and on the wellbore. Companies shut-in wells if the price is not sufficient to warrant paying for their operations. Since the shale boom, our PODUS and many Americans do not regard oil and gas with the view that it is a strategic national commodity that keeps our country strong. So we are squandering this resource. We also did not take advantage of our position of technical strength when it could have built wealth for our nation. This will be the true legacy left to us by Mr. Obama.

dissident on Sun, 18th Sep 2016 10:36 am

Until the discussion goal posts stop moving there can be no useful outcome. Conventional oil did peak already and invoking bottom of the barrel extraction driven by high oil prices as some “proof” that the original conventional oil peak analysis was wrong is insanely retarded.

The non-conventional production is deliberately misconstrued as having the capacity to replace all the conventional production via MSM drivel that lumps Green River kerogens with Bakken tight oil. We are seeing that now that the bottom of the barrel does not have all that much oil that can be dredged up. There will be no replacement of conventional supply by this “miracle produced by wondrous technology”.

I find it peculiar how the 7% drop in US oil production (from all sources) over the last year is ignored. This is an epic decline rate and the US will quickly lose the the production increase that we have seen over the last few years.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfpus2&f=m

Sissyfuss on Sun, 18th Sep 2016 10:39 am

Oncrack Searcher, the only growth in the Ponzi economy is money printing and financial manipulation. Growth is as dead as the Monarch butterfly population.

paulo1 on Sun, 18th Sep 2016 10:45 am

The Cloggie statement of: “The assumed “gloating” is merely related to the insight that the earth’s crust is overloaded with fossil fuel, probably more so than there is oxygen in the earth’s atmosphere to burn it all. The dynamic factor is technology, making the ASPO-2000 assessment that industrial society was about to collapse, completely irrelevant.”

Why bother pursuing discussion any further? Obviously, this is delusional. Ask any petroleum geologist or engineer who works for a Major the state of recoverable reserves? I would imagine most insiders are now holding on to any job they have in hopes a retirement soft landing.

I live in a rural area full of some very independent people. Townies think we are a little violent and out of ‘Deliverance’. Anyway, one fellow I know, (who was raised in a cult, no less), believes the centre of the Earth is filled with petroleum, and that when we need more God will simply allow more discoveries to be made.

Let me know if any of you want his email or phone #. I am sure you will feel better and more confident.

ghung on Sun, 18th Sep 2016 10:46 am

PoorPeter; “Since the shale boom, our PODUS and many Americans do not regard oil and gas with the view that it is a strategic national commodity that keeps our country strong.”

A bird in the hand is worth two in the bus, eh? At least that’s what they think. Our way of doing things has become more reactionary and less pro-active, and will continue to do so as we bump our way into limits to growth.

All of the compartmentalisations and rationalisations we see here don’t mean much in that light; systemic decline born of ongoing resource depletion. All of our conjuring and equating faux capital with real “stuff” is only stealing from a future that won’t have the means to address most of their problems in any meaningful way.

We may as well take our grandkids out back and just beat the crap out of them. At least they’ll know what to expect.

Plantagenet on Sun, 18th Sep 2016 10:51 am

Why do you expect people to shift to renewables when oil and gas are cheap and president Obama is running around boasting about how great it is to have cheap oil and gas and then patting himself on the back and taking credit for it?

Its hard for science and reason to tell people to use less FF, when the president is sending the opposite message….there is no way to compete with the President and his bully pulpit when the president is out there pumping up the FF industry.

Cheers!

shortonoil on Sun, 18th Sep 2016 10:55 am

It now requires 78,400 BTU to produce a gallon of crude and its finished products. That gallon has an energy content of 140,000 BTU. The waste heat produced when it is burned is at least 40,600 BTU per gallon. The economy is now getting, at most, 15% of the useable energy in a gallon of oil. High energy cost fields like the Bakken probably supply zero.

The fact that they are going broke is hardly a surprise.

http://www.thehillsgroup.org/

Davy on Sun, 18th Sep 2016 11:02 am

Kill joy, I am not a self-described expert and I don’t do predictions. I am a doomer and prepper that lives what he preaches. I see a civilization regime change in process and I am getting ahead of the curve. I have never chosen a date and always refer to a period with unknowns. Choosing a date is too defining for me. People who choose collapse dates are sloppy and lack subtlety. I am open to mystery and surprise. I am not sure I will be better off than those who are unconcerned with collapse. I do feel energized with what I am doing because it is grounded in reality. I am making concrete rational steps to risk management. I am having the best time in my life now living real and honest.

killJOY on Sun, 18th Sep 2016 11:03 am

dissident: “Conventional oil did peak already …”

Even if we grant your point, the question becomes–and I never thought I’d ever hear myself saying this–“So what?”

The “peak” of “conventional” oil was supposed to usher in a suite of distressing outcomes, but as these outcomes never materialized–indeed, just the opposite: it ushered in unprecedented increases in production–one has to question the original assumptions which drove the peak oil movement.

killJOY on Sun, 18th Sep 2016 11:04 am

Davy, I was once in the same boat as you, until I realized that one cannot possibly prepare for an outcome one can’t possibly predict.

Dan on Sun, 18th Sep 2016 11:06 am

Every time we hear about “peak oil” and how we’ve used up ‘the mother lode field’ someone somehow seems to manage to find ANOTHER huge oil field somewhere else. While ALL things are finite, including the amount of oil on/in planet earth I suspect there is still quite a bit left we haven’t found. So while we really do need to find alternatives to fossil fuel we almost certainly have more time than all the naysayers claim. Much of the Sturm un Drang is spouted for the purpose of manipulating the market….not for edification.

shortonoil on Sun, 18th Sep 2016 11:07 am

“What people fail to understand is that no one is going to drill to lose money. “

The shale industry has now spent over $1 trillion to create an industry with $362 billion in gross sales. If they returned a 10% profit margin on their gross sales, and paid zero interest on the money it would require 27 years to return the capital invested.

Oil CEOs making $20 million per year is a pretty good reason to keep drilling wells, and keep borrowing money. That is why it is called a Ponzi scheme.

http://www.thehillsgroup.org/

ghung on Sun, 18th Sep 2016 11:09 am

killJOY; The “peak” of “conventional” oil was supposed to usher in a suite of distressing outcomes, but as these outcomes never materialized–indeed, just the opposite: it ushered in unprecedented increases in

productionglobal debt and failing states.There; fixed that for you, killJOY.

JGav on Sun, 18th Sep 2016 11:11 am

Ghung – Yep. Stealing from the future has become one of our civilizational mainstays. We didn’t invent it of course (see the history of the Roman Empire) but we may have refined it to an extent never before seen.

Declining net energy availability per capita. We’re already there. Whatever causal relationship or combinations of same is invoked to explain it (geological, financial, political …), that fact will have real consequences for real people.

obv data misinterpreted LOLOLz on Sun, 18th Sep 2016 11:15 am

Ummmm, production is down because the market price has fallen to uneconomical levels. Hard Stop.

What a jack ass of an article! LOLOLz

killJOY on Sun, 18th Sep 2016 11:18 am

ghung, what you’ve done is not present an argument. You’ve simply moved the goal posts. It deflects a discussion away from a failure:

http://rationalwiki.org/wiki/Moving_the_goalposts

dennis on Sun, 18th Sep 2016 11:20 am

Oil certainly is on it’s death bed. It will be a long tortuous death. With the new discoveries in solar panel technology and the upsurge that is coming from wind generated electricity fossil fuels will see a massive decline in the next decade. EV’s are in their beginning stages. All the naysayers concerning EV’s will soon see the folly in their disregard. I have been driving an EV for 3 years and all the negativity towards them in my eyes has proven to be foolish. With the production of longer ranged cars will come an acceptance by many of their savings. It will be a snowball effect but it will consume all but the diehard morons.

ghung on Sun, 18th Sep 2016 11:23 am

killJOY said; “…one cannot possibly prepare for an outcome one can’t possibly predict.”

Once again, I disagree. Have a 401K? Saving for retirement? Preparing for an outcome one can’t possibly predict? Can you reasonably predict that that funny money will be worth much in ten years? Twenty?

One CAN reasonably predict that utter reliance upon declining top-down complex systems will cause difficulty for just about everyone. One can reasonably predict that healthcare costs will continue to become more unaffordable. One can reasonably predict that finite resources will continue to be depleted as demand (at least tries to) increase. One can predict that our debt levels will eventually cause a big economic reset……

One can get out of debt (generally a win/win, that). One can reduce one’s consumption, and get used to living on less. One can become more self-reliant and resilient in their lifestyle. All of these are reasonable goals, whatever the future holds.

Expecting things to continue as they are is ‘reasonable’?

Robert on Sun, 18th Sep 2016 11:27 am

What we need is an #EmissionsTax – oil is too valuable to just burn and is damaging to our environment.

The Plan: http://www.emissionstax.org/the-plan/

Ron Smith on Sun, 18th Sep 2016 11:28 am

The low price of oil just might have a little to do with lower production in shale oil fields. Their costs are higher than conventional fields and they are waiting for prices to go up rather than pump at lower margins.

Plus we still haven’t really begun to explore the ocean reserves. We will still be using oil for the next 50 years. That doesn’t mean we should’ be exploring renewable energy alternatives, however.

rockman on Sun, 18th Sep 2016 11:29 am

Killjoy – No problem: I often some some posts more as an excuse to promote my hidden agendas. LOL.

And I didn’t say “false prophets”…I said “falsely profits”. Many here enjoy pointing out what poor spellers geologists are so I intentionally toss them a bone. And sometimes not so intentional. LOL.

Truthhurts on Sun, 18th Sep 2016 11:32 am

So, are they past peak production, or past peak availability of oil? Big difference.

What I’m seeing, is oil and gas prices went down, so they reduced production voluntarily. That is not the same as reducing production due to lack or resources.

ghung on Sun, 18th Sep 2016 11:32 am

killJOY; “ghung, what you’ve done is not present an argument. You’ve simply moved the goal posts.”

…and you call THAT an argument? WTF are the “goal posts” anyway? This isn’t a freaking football game, killJOY. It’s an ongoing open-ended process; clearly a process of resource depletion. If you can’t grok that, you’re out of your league. But I’ll give you a chance to explain how humanity will overcome it’s out-of-control behavior of planetary exploitation and environmental destruction. Go for it.

Truthhurts on Sun, 18th Sep 2016 11:38 am

Worrying about peak oil is kind of pointless, what you should worry about is peak population and how we are going to provide enough food/water for everyone. Or employment for that matter.

Larry Gnarly on Sun, 18th Sep 2016 11:39 am

Just one more asshole who knows nothing but is trying to make a killing on the emotions of Big Oil.

Stabilizer on Sun, 18th Sep 2016 11:39 am

Brilliant article.

I heard an analyst from the US energy department lay out the same facts a bit differently, but he was talking to people who know oil.

His observation was the Bakken can supply more oil than we need, but not at $50. The value of the Bakken was its ability to cap world oil prices at about $75 more or less permanently.

In other words, gasoline will not stay above $3.50 for more than a few months (while the Bakken ramps up) during the life of your SUV.

If you can afford $3.50 the Bakken is a real asset.

I’d add that Bakken oil profits stay in the USA and aren’t used to fund terrorism like Saudi and UAE oil profits, so I’d like to see a tariff to increase imported oil to $75, not for economic reasons, for security reasons. We’d pay a lot less taxes if we weren’t spending 75% of our tax dollars on endless war.

Great article.