Page added on September 18, 2016

THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S.

The Death of the Great Bakken Oil Field has begun and very few Americans understand the significance. Just a few years ago, the U.S. Energy Industry and Mainstream media were gloating that the United States was on its way to “Energy Independence.”

Unfortunately for most Americans, they believed the hype and are now back to driving BIG SUV’s and trucks that get lousy fuel mileage. And why not? Americans now think the price of gasoline will continue to decline because the U.S. oil industry is able to produce its “supposed” massive shale oil reserves for a fraction of the cost, due to the new wonders of technological improvement.

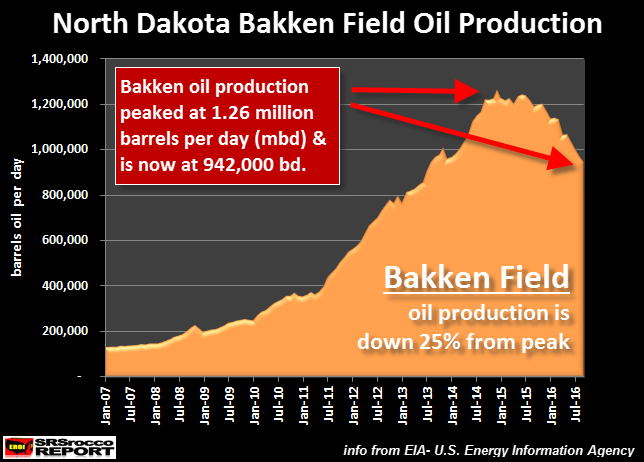

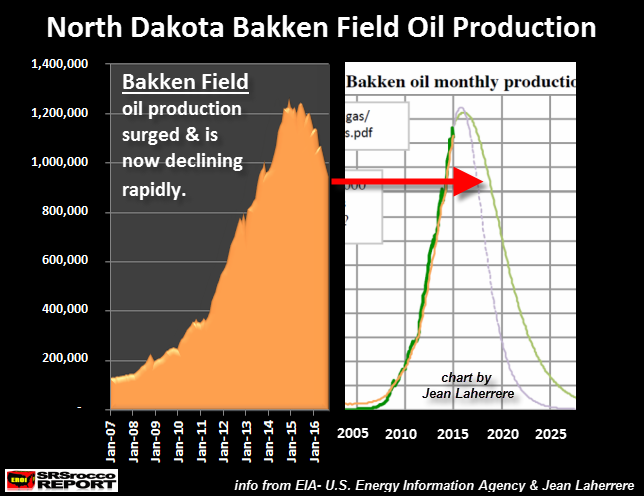

I actually hear this all the time when I travel and talk to family, friends and strangers. I gather they have no clue that the Great Bakken Oil Field is now down a stunning 25% from its peak in just a little more than a year and half ago:

The mighty Bakken oil field located in North Dakota reached peak production in December 2014 at 1.26 million barrels per day (mbd) and is now down to 942,000 bd. This decline is no surprise to me or to my readers who have been following my work for the past several years.

I wrote about the upcoming crash of the Bakken oil field in my article (click here to read article)– Published, NOV. 2013:

I ended the article with these sobering words:

There are only so many drilling locations available and once they run out, the Great Bakken Field will become a BUST as the high decline rates will push overall oil production down the very same way it came up.

Those who moved to the frigid state of North Dakota with Dollar signs in their eyes and images of sugar-plums dancing in their heads will realize firsthand the negative ramifications of all BOOM & BUST cycles.

Well, the Bust of North Dakota economy has arrived and according to the article, “The North Dakota Great Recession“:

Unfortunately by April 2015 it was clear that the oil markets were in a secular decline brought on by oversupply in the global energy markets fueled by a deep recession in China. As a result, companies started to lay off workers, and over the following months caused a massive exodus of people as jobs were eliminated. Nobody is exactly sure how many people have left the state, but some put estimates as high as 25,000.

The strongest real estate market continues to be Watford City with the weakest in Minot. However, even in Watford City the price of a three-bedroom rental home has come down from $2,500 in 2015 to a current price of $1,400. This represents a 44 percent decline of the rental price in the market.

Some folks believe the reason for the decline in oil production at the Bakken was due to low oil prices. While this was part of the reason, the Bakken was going to peak and decline in 2016-2017 regardless of the price. This was forecasted by peak oil analyst Jean Laherrere. I wrote about this in my article below (click here to read article)– Published, APRIL 2015:

I took Jean Laherrere’s chart and placed it next to the current actual Bakken oil field production:

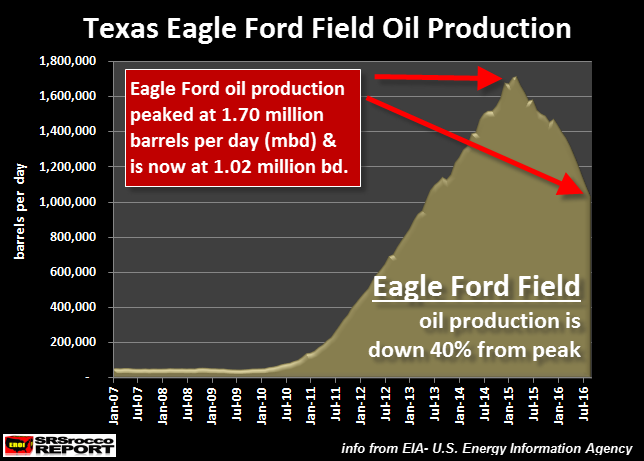

As we can see in the chart above, the rise and fall of Bakken oil production is very close to what Jean Laherrere forecasted several years ago (shown by the red arrow). According to Laherrere’s chart, the Bakken will be producing a lot less oil by 2020 and very little by 2025. This would also be true for the Eagle Ford Field in Texas.

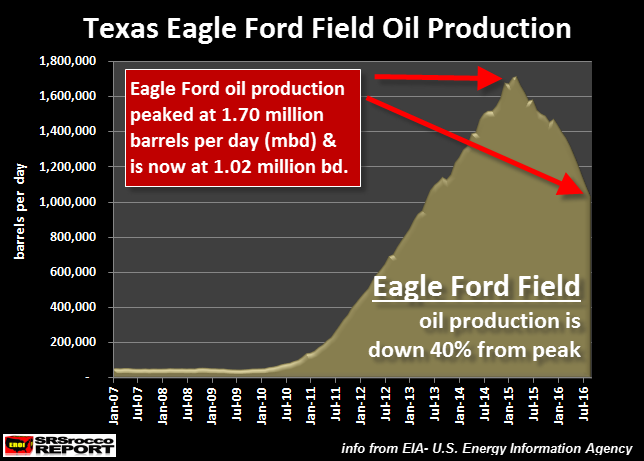

According to the most recent EIA Drilling Productivity Report, the Eagle Ford Shale Oil Field in Texas will be producing an estimated 1,026,000 barrels of oil per day in September, down from a peak of 1,708,000 barrels per day in May 2015. Thus, Eagle Ford oil production is slated to be down a stunning 40% since its peak last year.

Do you folks see the writing on the wall here? The Bakken down 25% and the Eagle Ford down 40%. These are not subtle declines. This is much quicker than the U.S. Oil Industry or the Mainstream Media realize.

And… it’s much worse than that.

The U.S. Oil Industry Hasn’t Made a RED CENT Producing Shale

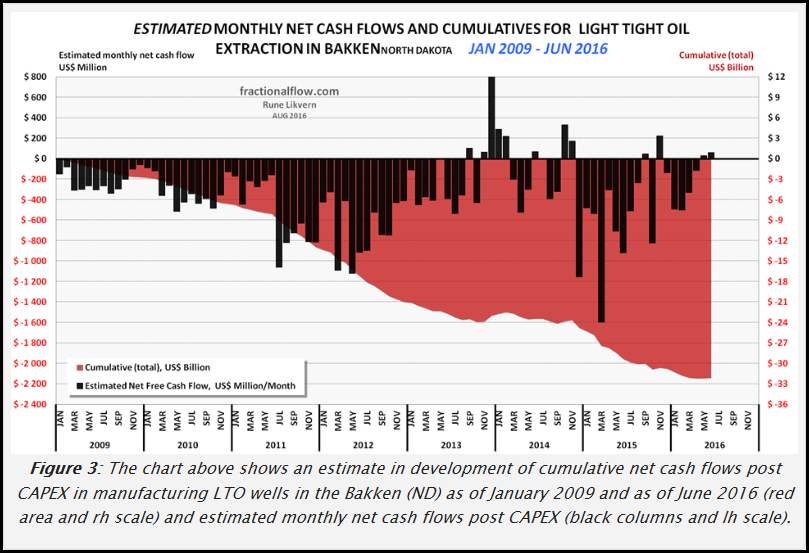

Rune Likvern of Fractional Flow has done a wonderful job providing data on the Bakken Shale Oil Field. Here is his excellent chart showing the cumulative FREE CASH FLOW from producing oil in the Bakken:

I will simply this chart by explaining that the BLACK BARS are estimates of the monthly Free Cash flow from producing oil in the Bakken since 2009, while the RED AREA is the cumulative negative free cash flow. As we can see there are very few black bars that are positive. Most are negative, heading lower.

Furthermore, the red area shows that the approximate negative free cash flow (deducting CAPEX- capital expenditures) is $32 billion. So, with all the effort and high oil prices from 2011-2014 (first half of 2014), the energy companies producing shale oil in the Bakken are in the hole for $32 billion. Well done…. hat’s off to the new wonderful fracking technology.

According to Rune Likvern in his article on the Bakken, he stated the following:

Just to retire estimated total debts (about $36 Billion, including costs for DUCs, SDWs, excluding hedges and income/loss of natural gas and NGLs) would require about 7 years with extraction and prices at Jun-16 levels.

Nominally to retire all debts (reach payout) would take an (average) future oil price close to $65/bo (WTI) for all the wells in operation as of end June – 16. This is without making any profit.

For the wells in production as per Jun-16, the total extraction of these will decline about 40% by Jun-17, and depletes their remaining reserves with about 20%. By assuming the operations remain cash flow neutral, total debt remains at $36 B in Jun-17.

As from Jul-17 this would now require an average oil price of about $73/bo (WTI) for these wells to nominally retire all debts (reach payout). Additional wells will add to what price is required to retire the total debt.

What Rune is stating here is that the $36 billion in total cumulative debt will occur by June 2017. Thus, it would take an average $65 a barrel to just pay back the debt in seven years. With the way things are going in the U.S. and world economies, I doubt we are going to see much higher oil prices.

Furthermore, the work by Louis Arnoux and the Hills Group suggest the price of oil will fall, not rise due to a Thermodynamic Collapse. More about this in an upcoming interview.

The United States Is In Big Trouble & Most Americans Have No Clue

As I have been documenting in previous articles (going back until 2013) the U.S. Shale Oil Industry was a house-of-cards. Readers who have been following my work, based on intelligent work of others, understood that Shale Oil is just another Ponzi Scheme in a long list of Ponzi Schemes.

From time to time, I look around different websites that publish my work and read some of the comments. I am surprised how many individuals still don’t believe in Peak Oil even though I explained the Falling EROI – Energy Returned On Investment quite clearly.

For some strange reason, some individuals cannot use deductive reasoning to destroy lousy conspiracy theories. Moreover, if they do believe in Peak Oil, then they think there is a wonderful “Silver-Bullet Energy Technology” that will save us all. I gather they believe this because the REALITY and IMPLICATIONS of Peak Oil are just too horrible, to say the least. So, holding onto HOPE that something will save us, just in the nick of time, is better than accepting the awful reality heading our way.

And the awful reality of Peak Oil will be felt more by Americans as their lifestyles have been highly elevated by the ability to extract wealth and resources from other countries through the issuing of massive amounts of paper Dollars and debt. Basically, they work, and we eat.

Unfortunately, the propping up of the U.S. market by the Fed and the domestic shale energy Ponzi scheme is running out of time. This is why it is imperative for investors to start moving out of Bonds, Stocks and Real Estate and into physical gold and silver to protect wealth.

For the wealthy investor or institution that believe a 5-10% allocation in physical gold is good insurance, you are sadly mistaken. While Donald Trump is receiving more support from Americans in his Presidential race, his campaign motto that he will “Make American Strong Again”, will never happen. The America we once knew is over. There just isn’t the available High EROI – Energy Returned On Investment energy supplies to allow us to continue the same lifestyle we enjoyed in the past.

So, now we have to transition to a different more local or regional way of living. This new living arrangement will be based on capital that is “STORED ECONOMIC ENERGY or WEALTH.” This can only come via the best sources such as physical gold and silver.

If individuals and countries have been acquiring physical gold and silver, they will be in better shape and will be able to enjoy more options than those who have been selling their gold and accumulating lots of debt and derivatives.

Lastly, if you haven’t checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

341 Comments on "THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S."

Kenz300 on Sun, 18th Sep 2016 11:39 am

Wind, solar and geothermal continue to grow in use every year while fossil fuel use declines………..

Climate Change will be the defining issue of our lives…

23 States to Rely on Geothermal, Solar, or Wind Power as a Primary Source of Electric Generation in 2016

http://www.renewableenergyworld.com/articles/2016/09/23-states-to-rely-on-geothermal-solar-or-wind-power-as-a-primary-source-of-electric-generation-in-2016.html

J on Sun, 18th Sep 2016 11:40 am

I think oil should only be used for lubrication etc not for fuels and gasoline. There are plenty other choices for that. Try to explain that to the Koch brothers and a few others.

Rafael fuentes on Sun, 18th Sep 2016 11:46 am

this is mostly Scare tactics bs, while it is significant, there are many other oil fields, some have not been drilled.\ tapped yet. so there is still a lot of oil in the us, however, areas containing much of it, is off limits for now, so do not be fooled, brainwashed, etc by this writer/article.

Josef Mueller on Sun, 18th Sep 2016 11:50 am

I know people working out there and they tell me that the ND government will not be granting extensions on the DUCs left, about 750-1000. They must frack them. They are ordering water and hiring drivers out there right now. SO, I guess you think they will abandon the DUCs? I think not, drilling costs are already sunk, so, any cash flow they can get out of them is good.

Randall on Sun, 18th Sep 2016 11:54 am

It’s simple supply and demand economics at work…the price of oil is down resulting in no new drilling or exploration. Once oil prices return to a level to justify new drilling, you’ll see another uptick.

kHIEM on Sun, 18th Sep 2016 11:58 am

in the meantime, in West Texas and Southern New Mexico they are drilling new wells and building refineries as fast as they can!

Daniel Duncan on Sun, 18th Sep 2016 11:59 am

Look at this site! They would have you believe there is an imminent oil crisis. That could not be further from the truth. The fact of the matter is, our oil industry is and was already scared for its life. The whole point of us starting to use fracking en masse was to compete with the rest of the world and in response, the world decided to boost its production of oil far far far beyond what we could ever pull out of the ground using fracking techniques.

Don’t you ever wonder why fuel prices at the pump are more than a dollar cheaper than it was this time last year? Did you ever question it? Its because the rest of the world boosted their production. In reality, prices of gasoline at the pump should be closer to ONE dollar right now, with as much as the rest of the world is producing to put us out of business.

This is a war we lost already. Right now, the only thing saving us is the “petrodollar”, which is the U.S. dollar that someone has to trade their currency for in order to purchase oil. That is the only thing standing between us and total economic collapse. Yeah, we are walking a tight rope right now.

They talk like there is an imminent crises. The crisis is already well under way and has been for quite a while.

In fact, we have been in recession since the very late 1990’s, you know, back when gasoline at the pump was under a dollar and when a gallon of milk only cost about a dollar. You remember those days? Those were the days BEFORE we entered recession. A recession we never recovered from, even to this very day.

Oil is nothing compared to the problems we face VERY soon down the road. If they want to scare us, me specifically, they are going to have to find something else to use to scare with.

Compared to how our coastlines are going to be under water in under 70 years, which most of us are going to live to see, oil running out is nothing, I don’t even care about oil.

sam Donald on Sun, 18th Sep 2016 12:02 pm

Like the Motley Fool, peakoil.com is a “sky is falling” marketing business to make money from uneducated and insecure fools. Parasites like “peakoil.com” and religious evangelists have been around for centuries. Its no secret that oil, gas, certain minerals, water are finite precious natural resources. Truth is that there remains PLENTY of oil and gas reserves worldwide to service the world economies. New technology are being enabled now and new energy alternatives will be affordable and ubiquitous long before we run out of oil and gas.

Don on Sun, 18th Sep 2016 12:10 pm

Seriously!? The fields production went down when the cost of a barrel of oil dropped like a rock and it was no longer profitable to extract oil from the field. This is just hype as far as I’m concerned and should the price of oil surge again then the output will follow right along.

I can’t help but laugh at the drones commenting on climate change but they have been proven wrong over and over again about the impacts of “global warming” or “climate change” like NYC being underwater a few years back. They can’t predict the weather a week out reliably and consistently but they will try to tell us what the weather will be 5 or more years out! Yeah, right! And they will also say that the weather is different than the climate yet what makes up the climate but the weather!

Dave Emerson on Sun, 18th Sep 2016 12:11 pm

The reason for the decline is the price. There are many wells that have been drilled and casing run but not completed. When the price comes back the bakken production will also. The bakken has been less than half drilled.

ghung on Sun, 18th Sep 2016 12:12 pm

Did someone mention “religious evangelists”?

Plantagenet on Sun, 18th Sep 2016 12:15 pm

We’re in an oil glut. Of course less drilling and production is occurring in the Bakken. There is less drilling and exploration going on just about everywhere in the world because of the oil glut.

When the oil glut ends and the price of oil recovers, there will be more drilling in the Bakken and elsewhere.

Its not very complicated folks.

Cheers!

Wm.Mosley on Sun, 18th Sep 2016 12:20 pm

Like the guy says it’s all scare tactics.F.Y.I…The oil companys export United states oil to other countries for a high price,,and Buy other countries oil at a lower price and inport it here in the USA.making a big return in Money!!!SSOOO they make hugh amounts of Money Both ways!! Don’t be scared of their Bu-l sh-t,,it’s all about Profit!!!

Mark Coffman on Sun, 18th Sep 2016 12:21 pm

They are mistaking Bakken for Fracking

which produces Natural Gas. Perhaps the

hydrocarbon folks need to study Catalytic Synthesis of Natural Gas to Gasoline/Alcohol. The Peek oil people said this much; “the oil fields they are finding these days may produce only one or two years of the oil based on a

country’s needs”. My tendency is go

with a winner; safe clean green energy.

Michael on Sun, 18th Sep 2016 12:25 pm

Totally agreed Sam !!!!! preying on fools that are suseptable to anything!! these bunch of f,n wolves that are only concerned about the dollar. !!!!

Cloggie on Sun, 18th Sep 2016 12:27 pm

paulo1 says: Obviously, this is delusional. Ask any petroleum geologist or engineer who works for a Major the state of recoverable reserves? I would imagine most insiders are now holding on to any job they have in hopes a retirement soft landing.

You can’t read. I wasn’t talking about petroleum, but carbon reserves in general. ASP0-2000 may have been largely correct as far as conventional oil is concerned (your soft retirees wannabees), but there is more to fossil fuel than petroleum. Far more.

https://en.wikipedia.org/wiki/Coal_gasification

https://simple.wikipedia.org/wiki/Methane_hydrate

And again to protect myself against bad readers or those who willfully put words in my mouth: I am not advocating a future of centuries of massive fossil fuel exploitation, but just enough fossil fuel harvesting to create a renewable energy base and next to send any employee in the fossil fuel branch packing.

(Sorry rockman)

Arloine Bollinger on Sun, 18th Sep 2016 12:28 pm

This entire situation is a microcosm of what is wrong with America. Instead of letting the markets play out our politicians should have protected American jobs and the economy by increasing tariffs on imported oil and giving the money to support the oil recovery in the Bakken fields. Middle Eastern, Asia, and African countries are always putting themselves first. Western countries are slowly dying by not caring about its people. Let’s do everything to put America first.

DuluthMN on Sun, 18th Sep 2016 12:31 pm

Amazing, simply amazing how facts can be abused. The decline of Bakken oil production corresponded with a decline in oil prices. What article will you write when oil returns to $100/barrel and pumping levels increase. Why do you confuse volume of recoverable oil with levels of production? Before writing off the Bakken oil field, consider that there are additional oil fields located beneath the Bakken and the enormous extent oil recoverable oil hasn’t been fully measured. Otherwise great article except for the complete failure to correctly assess the situation, flawed conclusions, and the bold attempt to scare readers.

GypsyR on Sun, 18th Sep 2016 12:41 pm

Probably would be a better article if the author didn’t deem it necessary to remind the reader of how smart he is every other paragraph or so.

Geogeezer on Sun, 18th Sep 2016 12:43 pm

Any accumulation of Oil, or any other resource for that matter, has value dependent on current price. Examples of this abound – a spike in the price of Gold results in reopening of formerly abandoned mines, a run-up in the price of wheat results in planting on otherwise sub-marginal land.

How much oil do we – or more specifically the Bakken have? It depends on two primary factors, (1) the price of oil, and (2) the cost of extraction. Convenience, technology advances, competing resources/technologies etc. enter the picture through one or both of these primary factors.

Rapid decline of production is the norm from both naturally fractured reservoirs and “shale reservoirs” so the 25% and 40% declines mentioned are neither surprising nor unanticipated. Nor do they foretell the end of either Bakken or Eagle Ford production. What they do clearly show is that operators in these areas are not starting new production when it would be at a loss. Similar to your local retailer who stops stocking widgets when his profit margin on them turns negative, or a farmer letting his land lay fallow when commodity prices mean he would have a loss even with a record crop.

Both Bakken and Eagle Ford will boom again when the price is right. And they will produce varying volumes depending on price for a long time to come.

RockinTheBakken on Sun, 18th Sep 2016 12:55 pm

Whoever wrote this is a dumbass. 1) there are about 700-900 wells in the Bakken that have not yet been fracked due to the low market prices. 2) there are other wells that have been in production for 10 years that are now marginal and are shut in until the prices recover. 3) There is always a decline in production over time. As far as America’s energy independence, it is not singularly dependent on the Bakken. We also have the Eagle Ford, the Barnetts, the Niobrara, the Marcellus, the Permian and so many other undeveloped fields. Doubt they would build the DAPL or develop the infrastructure to the extent it has been if this was a 10 year flash in the pan. I drove down hwy 40 north of Tioga ND a few weeks ago. There is a well (several actually)that I completed in 1981 that is still pumping if that tells you anything.

oildriller on Sun, 18th Sep 2016 12:58 pm

I don’t believe this garbage about running out of places to drill. There are thousands of places for new oil wells. This is all about politics and after Trump is voted in, the boom will be on again. If hitlary gets in, we are doomed for sure.

Borgano Coyote on Sun, 18th Sep 2016 12:59 pm

All of you are crocked! Better take a look at two points! The first point is oil/gas leases, because the more leases purchased the more money that gets made. Leases have declined EVERYWHERE, not just in ND. TX oil/gas leases are down as much as 10% from just Jan. 1 of this year. Second, fracking technology was stuck in it’s first generation from its’ beginning. Based only on the fact there’s still oil or gas in those wells the current fracking technology isn’t enough to extract it. A whole new generation of technology is needed and so far, no one wants to create it or even admit that it’s needed. Maybe some of you entrepreneurs might want to think about that one!In any case the author was correct and until there is a new generation of fracking technology I can expect oil prices to be “volatile” for a long time to come!

SFCGator on Sun, 18th Sep 2016 1:01 pm

This article is a massive load of propaganda and misdirection. The general message behind this was made apparent in the beginning with the first sentence of the second paragraph “…BIG SUVs and trucks which get lousy gas milage.” This ignores the fact that they get great milage compared to their counterparts of 20 years ago. Do they compare to a Prius, VOLT or Tesla? No, but that’s comparing two different classes of vehicles used for different purposes. Production in this case has nothing to with capacity and reserves and everything to do with the current market price of oil. When the market goes back up there will be a corresponding increase in production from both Eagle Ford and Bakken

Cloggie on Sun, 18th Sep 2016 1:01 pm

Message to admin: forum worked perfectly for some weeks.

Today the forum is very slow and error messages like these:

Fatal error: SQL ERROR [ mysql4 ]

[0]

An sql error occurred while fetching this page. Please contact an administrator if this problem persists. in /home/peakoil/public_html/forums/includes/db/dbal.php on line 707

Jeff Tischler on Sun, 18th Sep 2016 1:06 pm

What is silver and gold worth, other than peoples willingness to speculate on it? When people move from investing in productive means or things of intrinsic value (such as farmland) they are merely fueling more destructive mining and the ecological damage that ensues. I would rather eat the caviar than the gold.

There is nothing real or immutable about putting ones savings in Gold. It is also a Ponzi scheme which only accomplishes environmental destruction, waste of energy and removal of precious metal from uses for which it has utility.

ghung on Sun, 18th Sep 2016 1:19 pm

Considering all of the new account names showing up, and the “too many connections” message I’m getting, looks like a troll/DOS attack.

pkrock on Sun, 18th Sep 2016 1:20 pm

I only got about half way through when I stopped. Anyone who has to result in quoting their own articles, means they have a lack of credible resources to support their position. I don’t see any quotes from geologists or petroleum engineers that would be knowledgeable about these wells. And the companies drilling these wells are well aware that fracked low permeable formations do not produce commercial amounts of oil for very long. To assert that this field is spent without any information to support it is ridiculous.

G Warren on Sun, 18th Sep 2016 1:23 pm

Scare tactics. The author talks about production being down 25%. So what. This has nothing to do with the actual reserves still available. Production could stop tomorrow, making a 100% drop, but again this would not reflect actual reserves. Production rates are driven by economics. If it is not profitable to produce then production will drop or cease. It’s the same in every field in the US. If the price of oil were to return to $70+ per barrel, we would see an increase in production almost immediately. The Bakken Field is still very healthy and is in no immediate danger of “dying”.

Rich on Sun, 18th Sep 2016 1:23 pm

I don’t believe any of this..

I remember years back the talk about the millions of barrels of oil we will see..Almost endless..

ghung on Sun, 18th Sep 2016 1:25 pm

Looks like multiple accounts from the same person. They all sound like the same asshole.

Conservative Texan on Sun, 18th Sep 2016 1:28 pm

The author is an economic imbecile. All he is is another snake oil salesman trying to get people to invest in metals that HE probably backs. The Permian Basin has plenty of oil. So does the Bakken Fields in ND. Yes, there IS a glut on the market because the middle east market is trying to put those fields out of business. I have to sadly shake my head at the BS global warming/attack the big SUVs and trucks tactic as well. It’s already been debunked, not once, but several times, but people still try to bring it up as a defense for their stupidity. That’s sad. So is this article. The author of the article? He’s just another hyped on himself used car salesman trying to get folks to embrace something that will make him more money. Don’t donate bit coins to this guy. You’d do better to invest it in something that will really help you, not some moron who only wants your money for him putting out imbecilic nonsense.

Andrew Kohlhofer on Sun, 18th Sep 2016 1:32 pm

Get over it. Oil production is down because demand and prices are down. Production is not down because of dwindling reserves.

MB on Sun, 18th Sep 2016 1:33 pm

There is truth on both sides of the argument. The Williston Basin in particular has been largely drilled. Oil companies have been very efficient about creating economies of scale drilling the Bakken formation. Operators almost all drilled long lateral, closely offset wells and although there is more oil to extract in the Bakken, almost all of the high margin stuff is gone and production was set to decline over the coming years anyway. The Eagle Ford has been less heavily developed and roughly half the drilling locations remain. The most gross production upside exists in the Permian Basin. That said, they will continue to find new pockets of production or extensions of older fields. There are a number of very profitable areas that are currently untouched because of the focus on larger projects. The oil industry will continue to find and extract new fields, but prices will need to rise to make that happen. That said, there is no question that the race to acquire the best acreage and extract the most oil to maximize growth at any cost resulted in a mountain of debt that companies will continue to buckle under. The race to acquire reserves will, in the end, have a few champions and many losers.

Alejandro on Sun, 18th Sep 2016 1:47 pm

The Shale oil is an ilusion to justify the looting of Libya and Iraq.. Now that Gaddafi’s loyals are taking back the fields from ISIS in Lybia, U.S reserves are in trouble again.. coincidence?

es5150 on Sun, 18th Sep 2016 1:49 pm

Is this a cause, or an effect. I find it more interesting that the decline coincides with the severe drop in oil prices. perhaps it is not that the Bakken oil field is drying up, but rather it is simply not as profitable. Shale will not be profitable until oil prices go far higher than they are currently. That having been said, I do agree that American driving public (as well as the newly rich Chinese) are indeed spoiled by the low prices, purchasing gas-guzlers by the boatloads for no particularly good reason.

PastPeakoil on Sun, 18th Sep 2016 1:53 pm

For what its worth I am a Petroleum Engineer with 32 years experience, US, Canada, MiddleEast, and North Sea. This article is for the most part correct. The frac’d shale (source) reservoirs always were a scheme to extract money from investors with very little chance of significant return. 10,15,20 stage frac jobs in a mile long horizontal section makes the cost of these wells upwards 0 $10mm, whereas a vertical well with a single frac (we’ve been doing these for 40+years) costs in many cases less than $1mm. The vertical well with minimal Ultimate Recovery, is around the same economic return as the horizontal well with the relatively small Ultimate Recovery…. basically sub-economic.

Essentially every Basin I’ve worked in is in terminal decline. The great Ghawar field (largest in the world) in Saudi is now producing from the crest of the reservoir.

The end of the Oil-Era began in 2005.

….all of you deniers, go ahead have a fit – we are now trying to produce from the source rocks….that should tell you something/alot

ghung on Sun, 18th Sep 2016 1:58 pm

es5150, Alejandro, Andrew Kohlhofer, Conservative Texan, G Warren, Rich, Jeff Tischler, pkrock, SFCGator, Borgano Coyote, etc. thinks we don’t know he’s all the same asshole troll. Time for the moderators to take care of it?

George on Sun, 18th Sep 2016 2:00 pm

What a pathetic attempt to direct thought. There has been no analysis of the activties of supply and demand on the market place, no reference to the clear part played by price fluctuations largely driven by the derivatives markets. All in all this piece was written as an attack on American petroleum energy production and nothing more.

Be aware John Q. Public, this writer and those of his mindset will be looked upon as the cognoscenti to whom the power to direct our economic policy will be handed over in the event we become a command economy.

There in lies why socialism will always fail. It is not a science nor a government, just a childish knee jerk reaction by those who do not understand simple conomics but think they can be the ones to bring utopia to the masses.

ghung on Sun, 18th Sep 2016 2:00 pm

Go suck a Koch, Alejandro.

Jeanine Taylor on Sun, 18th Sep 2016 2:01 pm

Where’s the ethanol?

George on Sun, 18th Sep 2016 2:03 pm

What a pathetic attempt to direct thought. There has been no analysis of the activties of supply and demand on the market place, no reference to the clear part played by price fluctuations largely driven by the derivatives markets. All in all this piece was written as an attack on American petroleum energy production and nothing more.

Be aware John Q. Public, this writer and those of his mindset will be looked upon as the cognoscenti to whom the power to direct our economic policy will be handed over in the event we become a command economy.

There in lies why socialism will always fail. It is not a science nor a government, just a childish knee jerk reaction by those who do not understand simple conomics but think they can be the ones to bring utopia to the masses.

Should these sort succeed in implementing their schemes the good old USA will go the way of Venezuela.

Hillary doesn’t care, she just wants to be remembered as our last president.

Common Cents on Sun, 18th Sep 2016 2:06 pm

So if The Bakkan is running out of oil then why is the $3.8 billion North Dakota Access Pipeline being built? A pipeline of the magnitude is built for a minimum of 75 years of service. This article is B.S.

donhuan on Sun, 18th Sep 2016 2:08 pm

The US government used to prohibit the export of oil to the global market because they deemed it as a strategic asset which will come in handy in times of a global crisis, e.g., world wars. But with the advent of the Shale oil/gas, such precaution is thrown to the winds; not only is the Shale oil / gas extracted in unnecessary huge volumes, it was also used as a political weapon against Russia / Iran to suppress the price of oil /gas to its historic low price. However, such a strategy has a double edge effect; the first being to hurt the economic earning powers of oil /gas producing Russia / Iran, but at the same time hastened the depletion of the US’s the long term strategic assets, as well as impacted negatively on the US economy in the medium and long run.

Realist on Sun, 18th Sep 2016 2:11 pm

BS story to sell precious metals.

Boomerang on Sun, 18th Sep 2016 2:11 pm

Naturally there has been a big decline in Bakken Oil production. It is called a crash in world oil prices. Oil wells that were drilled were not finished as it takes a lot of capital to bring them into production. Where ever possible many other producing wells have had their production cut way down or even totally shut in. This is done and production will pick up when prices go higher. Another big factor is getting the oil to market, it cost much more as The Bakken is so far from the refineries and infrastructure necessary to get to the consumers. Pipelines are the cheapest and safest ways to get it to that market.

Dew deded on Sun, 18th Sep 2016 2:17 pm

This author sounds very happy about this development

Michael Rosenglick on Sun, 18th Sep 2016 2:20 pm

There’s not much to add to everyone’s response to this, but it does remind me of the big gas lines in the 70’s, when we were running out of oil???? Over 40 years ago. Oil isn’t one of my expertise areas, I’m not that up to date on all the details, but obviously we didn’t run out back then, whether due to not being able to produce it as fast as demand was rising or whatever, we made it and big oil companies made billions and billions “$$$” of barrels since we were running out??? And if we do have shortages, we’re humans, with brains and will come up with a solution, like always!!! I’ll believe it when I see it. Till then, not worried one bit!!! I’m already retired, but still can see the world of technology changing the way and how much oil we really need, less and less. Just ask a Tesla or Prius owner if they are using more or less then 10 yrs. ago. I’m sure we know the answer…

Jammer on Sun, 18th Sep 2016 2:20 pm

This is the same line of BS that has been pushed since the early 1970’s.

For those who can remember those days, recall the many articles that predicted the end of oil and natural gas within 20 or 30 years. They were even ripping natural gas lines out of industrial plants to save the natural gas for residential users because we were ALMOST COMPLETELY OUT OF NATURAL GAS RESERVES IN THE US.

Not true then, not true today.

Jmariani on Sun, 18th Sep 2016 2:23 pm

People are driving huge vehicles because they like huge vehicles and advertisers keep pushing them. Gas prices are generally irrelevant. The great unwashed could care less about their behavior and the future of the planet.