Page added on September 18, 2016

THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S.

The Death of the Great Bakken Oil Field has begun and very few Americans understand the significance. Just a few years ago, the U.S. Energy Industry and Mainstream media were gloating that the United States was on its way to “Energy Independence.”

Unfortunately for most Americans, they believed the hype and are now back to driving BIG SUV’s and trucks that get lousy fuel mileage. And why not? Americans now think the price of gasoline will continue to decline because the U.S. oil industry is able to produce its “supposed” massive shale oil reserves for a fraction of the cost, due to the new wonders of technological improvement.

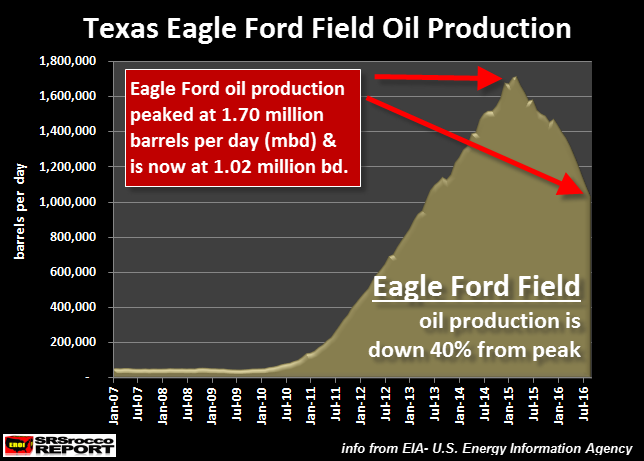

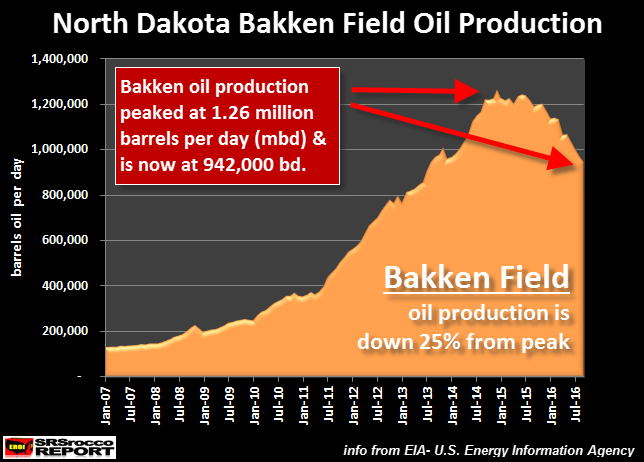

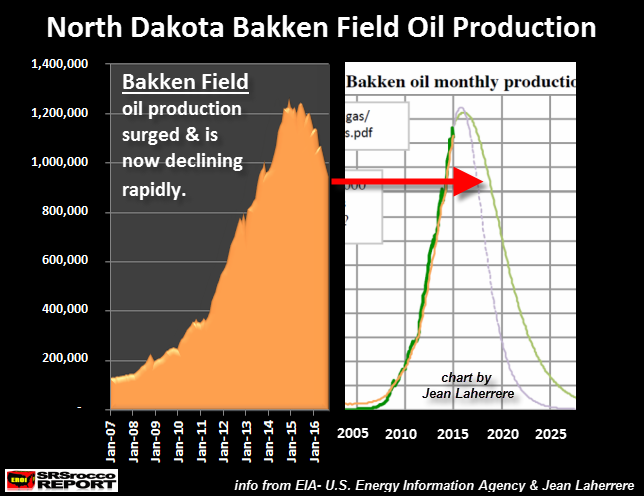

I actually hear this all the time when I travel and talk to family, friends and strangers. I gather they have no clue that the Great Bakken Oil Field is now down a stunning 25% from its peak in just a little more than a year and half ago:

The mighty Bakken oil field located in North Dakota reached peak production in December 2014 at 1.26 million barrels per day (mbd) and is now down to 942,000 bd. This decline is no surprise to me or to my readers who have been following my work for the past several years.

I wrote about the upcoming crash of the Bakken oil field in my article (click here to read article)– Published, NOV. 2013:

I ended the article with these sobering words:

There are only so many drilling locations available and once they run out, the Great Bakken Field will become a BUST as the high decline rates will push overall oil production down the very same way it came up.

Those who moved to the frigid state of North Dakota with Dollar signs in their eyes and images of sugar-plums dancing in their heads will realize firsthand the negative ramifications of all BOOM & BUST cycles.

Well, the Bust of North Dakota economy has arrived and according to the article, “The North Dakota Great Recession“:

Unfortunately by April 2015 it was clear that the oil markets were in a secular decline brought on by oversupply in the global energy markets fueled by a deep recession in China. As a result, companies started to lay off workers, and over the following months caused a massive exodus of people as jobs were eliminated. Nobody is exactly sure how many people have left the state, but some put estimates as high as 25,000.

The strongest real estate market continues to be Watford City with the weakest in Minot. However, even in Watford City the price of a three-bedroom rental home has come down from $2,500 in 2015 to a current price of $1,400. This represents a 44 percent decline of the rental price in the market.

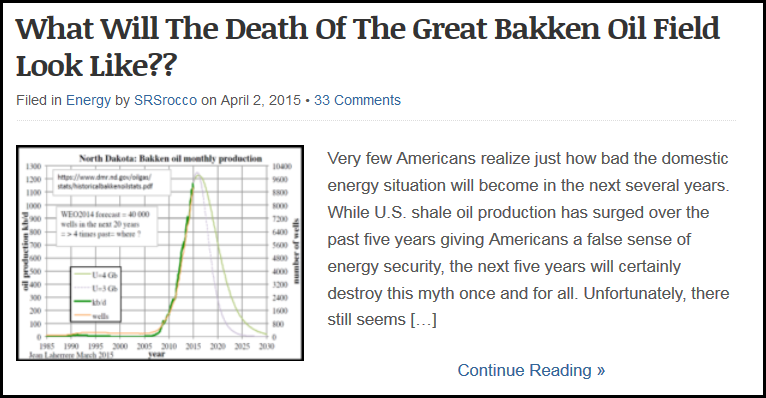

Some folks believe the reason for the decline in oil production at the Bakken was due to low oil prices. While this was part of the reason, the Bakken was going to peak and decline in 2016-2017 regardless of the price. This was forecasted by peak oil analyst Jean Laherrere. I wrote about this in my article below (click here to read article)– Published, APRIL 2015:

I took Jean Laherrere’s chart and placed it next to the current actual Bakken oil field production:

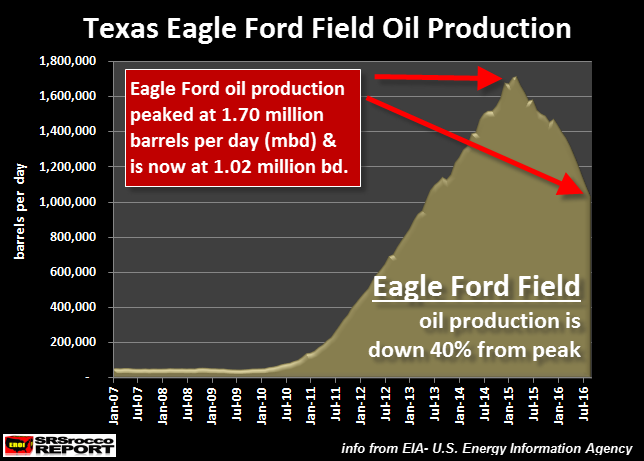

As we can see in the chart above, the rise and fall of Bakken oil production is very close to what Jean Laherrere forecasted several years ago (shown by the red arrow). According to Laherrere’s chart, the Bakken will be producing a lot less oil by 2020 and very little by 2025. This would also be true for the Eagle Ford Field in Texas.

According to the most recent EIA Drilling Productivity Report, the Eagle Ford Shale Oil Field in Texas will be producing an estimated 1,026,000 barrels of oil per day in September, down from a peak of 1,708,000 barrels per day in May 2015. Thus, Eagle Ford oil production is slated to be down a stunning 40% since its peak last year.

Do you folks see the writing on the wall here? The Bakken down 25% and the Eagle Ford down 40%. These are not subtle declines. This is much quicker than the U.S. Oil Industry or the Mainstream Media realize.

And… it’s much worse than that.

The U.S. Oil Industry Hasn’t Made a RED CENT Producing Shale

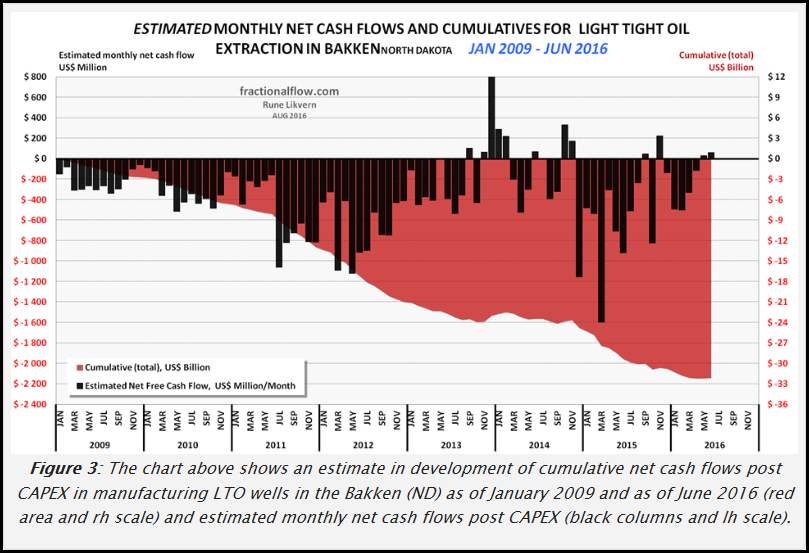

Rune Likvern of Fractional Flow has done a wonderful job providing data on the Bakken Shale Oil Field. Here is his excellent chart showing the cumulative FREE CASH FLOW from producing oil in the Bakken:

I will simply this chart by explaining that the BLACK BARS are estimates of the monthly Free Cash flow from producing oil in the Bakken since 2009, while the RED AREA is the cumulative negative free cash flow. As we can see there are very few black bars that are positive. Most are negative, heading lower.

Furthermore, the red area shows that the approximate negative free cash flow (deducting CAPEX- capital expenditures) is $32 billion. So, with all the effort and high oil prices from 2011-2014 (first half of 2014), the energy companies producing shale oil in the Bakken are in the hole for $32 billion. Well done…. hat’s off to the new wonderful fracking technology.

According to Rune Likvern in his article on the Bakken, he stated the following:

Just to retire estimated total debts (about $36 Billion, including costs for DUCs, SDWs, excluding hedges and income/loss of natural gas and NGLs) would require about 7 years with extraction and prices at Jun-16 levels.

Nominally to retire all debts (reach payout) would take an (average) future oil price close to $65/bo (WTI) for all the wells in operation as of end June – 16. This is without making any profit.

For the wells in production as per Jun-16, the total extraction of these will decline about 40% by Jun-17, and depletes their remaining reserves with about 20%. By assuming the operations remain cash flow neutral, total debt remains at $36 B in Jun-17.

As from Jul-17 this would now require an average oil price of about $73/bo (WTI) for these wells to nominally retire all debts (reach payout). Additional wells will add to what price is required to retire the total debt.

What Rune is stating here is that the $36 billion in total cumulative debt will occur by June 2017. Thus, it would take an average $65 a barrel to just pay back the debt in seven years. With the way things are going in the U.S. and world economies, I doubt we are going to see much higher oil prices.

Furthermore, the work by Louis Arnoux and the Hills Group suggest the price of oil will fall, not rise due to a Thermodynamic Collapse. More about this in an upcoming interview.

The United States Is In Big Trouble & Most Americans Have No Clue

As I have been documenting in previous articles (going back until 2013) the U.S. Shale Oil Industry was a house-of-cards. Readers who have been following my work, based on intelligent work of others, understood that Shale Oil is just another Ponzi Scheme in a long list of Ponzi Schemes.

From time to time, I look around different websites that publish my work and read some of the comments. I am surprised how many individuals still don’t believe in Peak Oil even though I explained the Falling EROI – Energy Returned On Investment quite clearly.

For some strange reason, some individuals cannot use deductive reasoning to destroy lousy conspiracy theories. Moreover, if they do believe in Peak Oil, then they think there is a wonderful “Silver-Bullet Energy Technology” that will save us all. I gather they believe this because the REALITY and IMPLICATIONS of Peak Oil are just too horrible, to say the least. So, holding onto HOPE that something will save us, just in the nick of time, is better than accepting the awful reality heading our way.

And the awful reality of Peak Oil will be felt more by Americans as their lifestyles have been highly elevated by the ability to extract wealth and resources from other countries through the issuing of massive amounts of paper Dollars and debt. Basically, they work, and we eat.

Unfortunately, the propping up of the U.S. market by the Fed and the domestic shale energy Ponzi scheme is running out of time. This is why it is imperative for investors to start moving out of Bonds, Stocks and Real Estate and into physical gold and silver to protect wealth.

For the wealthy investor or institution that believe a 5-10% allocation in physical gold is good insurance, you are sadly mistaken. While Donald Trump is receiving more support from Americans in his Presidential race, his campaign motto that he will “Make American Strong Again”, will never happen. The America we once knew is over. There just isn’t the available High EROI – Energy Returned On Investment energy supplies to allow us to continue the same lifestyle we enjoyed in the past.

So, now we have to transition to a different more local or regional way of living. This new living arrangement will be based on capital that is “STORED ECONOMIC ENERGY or WEALTH.” This can only come via the best sources such as physical gold and silver.

If individuals and countries have been acquiring physical gold and silver, they will be in better shape and will be able to enjoy more options than those who have been selling their gold and accumulating lots of debt and derivatives.

Lastly, if you haven’t checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

341 Comments on "THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S."

ghung on Sun, 18th Sep 2016 10:37 pm

Fungus maybe? Among us?

Peter on Sun, 18th Sep 2016 10:38 pm

These are just lies propagated to try to pump up the price of oil, which is way down and suffering from a glut on the market

jojo on Sun, 18th Sep 2016 10:43 pm

This guy seems like an idiot. Production slowed down not because the Bakken is dried up, it slowed down because the oil supply is overstocked. Why produce more if you can’t even store it.

Neil on Sun, 18th Sep 2016 10:45 pm

Dont care

I live in Dallas

I have natural gas under my house untapped. and all along the Trinity River which the city council forbids drilling along

Get hysterical somewhere else

SRSrocco on Sun, 18th Sep 2016 10:48 pm

Heads up to the REGULARS here. I had nothing to do with the massive amount of insane comments… LOL.

However, my article did go somewhat viral on many sites. Last count on Zerohedge was 75,000… and that was just on their Contributor section, not their main page.

While some of the comments may be bots, I can tell you there is indeed a lot of ignorance out there when it comesto PEAK OIL.

Steve

Roy on Sun, 18th Sep 2016 10:51 pm

Then why are pensions and sovereign wealth funds flooding the US tight oil market with cash? Hint: they’re making money, and so am I. There are enormous amounts of locations left to drill in the Bakken, you idget without a clue.

trumpsahead on Sun, 18th Sep 2016 11:03 pm

This may be simplistic, but seems like Economics 101. We know there is plenty of oil in the ground in America. Prices are low because Demand for Oil is low. Demand is low because Economy is collapsing in America and all over the world. If America’s Dollar collapses prices will rise at the gas pump but low in relation to the devalued Dollar, and prices will never be high enough to begin pumping Oil in ND again.

Gold and Silver will reign and it does have intrinsic value – they are non perishable, industrial, beautiful, and known for thousands of years as the perfect medium of exchange, especially during times of crisis when fiat currency becomes unstable.

G&S will not save anyone, but guns and ammo and stored food raises the possibility. In any case, America is in for a Hell ride.

Tim on Sun, 18th Sep 2016 11:13 pm

This Guy is just trying to get people to invest in Gold and Silver on his website.

Apneaman on Sun, 18th Sep 2016 11:13 pm

The Bakken’s life span, like the humans, barely register in the big picture. Both will be gone before ya know it and no one will know or care.

Scientists expect to calculate amount of fuel inside Earth by 2025

With three new detectors coming online in the next several years, scientists are confident they will collect enough geoneutrino data to measure Earth’s fuel level

“…a team of geologists and neutrino physicists boldly claims it will be able to determine by 2025 how much nuclear fuel and radioactive power remain in the Earth’s tank.”

https://www.sciencedaily.com/releases/2016/09/160909094848.htm

ND Ranch Cook on Sun, 18th Sep 2016 11:19 pm

I have a very hard time believing much in this article. I live in western ND know more than the author does about what has and is going on in the Bakken. I can tell you without gloom and doom and the charts and graphs. There is less oil being pumped than a year ago because of the low prices. There has been an overabundance of oil in the world market. OPEC has the ability to drive oil prices all around.

The oil reserves in the Bakken are still enormous, with much,much left untapped. When prices go back up and it becomes profitable for the companies to lease and drill those reserves, production will go back up and jobs in the oil patch will too. However,hopefully, this time it will be at such a frantic place. The Bakken and other oil producer locations have seen boom and bust and boom again in the past!

joe on Sun, 18th Sep 2016 11:32 pm

Many people are missing the peak oil blinkers flashing warning. Debt in the bakken and the other tight oil feilds tells you allot. It explains why other countries arent doing it much, and should show the consequences of ending this loss making enterprise.

If tight oil extraction ends, easy oil nations like Russia are back on top. Peak oil gives control to Americas enemies as long as it is depending on oil to function. However, the FED is working very hard looking for ways to justify hiking interest rates and give an effective boost to global inflation and the world will pay America more to buy the dollars it needs to buy oil themselves. I doubt very much the Bakken or any other tight oil source will cease to function in the age of peak oil, that is unless American energy policies change.

Bill Fold on Sun, 18th Sep 2016 11:40 pm

I too am thinking the death of “big oil” is greatly exaggerated. Who are you trying to convince?

Someone has already made the point that production has tapered due to the increased supplies globally thus lower prices.

To look at the authors blog page:

http://www.zerohedge.com/blogs/srsrocco

It seems we are headed for every conceivable financial disaster that exists. .

THE BREAKDOWN OF THE U.S. & GLOBAL MARKETS EXPLAINED: What Most Analysts Miss

The Coming Global Silver Production Collapse & Skyrocketing Price

THE SUBPRIME U.S. ECONOMY: Disintegrating Due To Subprime Auto, Housing, Bond & Energy Debt

Why The Collapse Of The U.S. Economic & FInancial System Has Accelerated

This Will Push The Gold Market Over The Edge

This guy writes for more bogus blogs than paranormal investigators . .

https://srsroccoreport.com/about/

What an idiot. . .

Jon on Sun, 18th Sep 2016 11:50 pm

Yes this is all bologna. Russia and the Saudi’s want to collapse the American oil ecoonomy and ultimately the American economy, a different kind of warfare. The only problem is America still can manipulate oil number and prices. The world has way too much oil in it right now. We have over 500 million barrells stored, and opec is not slowing down.

Northwest Resident on Mon, 19th Sep 2016 12:03 am

“It seems we are headed for every conceivable financial disaster that exists.”

Yes, a logical analysis of the facts indicates exactly that. Global economic meltdown is well under way. Only a fool or an ignoramus could assert otherwise. Or a liar on a mission to obfuscate and deny.

Bots? Or not? Check out these headlines:

“Russian internet trolls were being hired to pose as pro-Trump …”

“Hillary Clinton’s Million Dollar Professional Internet Troll Army”

“One Professional Russian Troll Tells All”

It is well known fact that groups of trolls are hired and hard at work trying to sway public opinion. These groups of trolls work for private individuals, for industries and for other “causes”. They gang up on commenters that are advancing a message that they wish to deny. They flock to articles that get top listing spots in search engines and they do what they have done here, all in the name of twisting and denying truth, and in an effort to quash reasonable discussion.

SRSrocco has obviously hit a VERY SENSITIVE NERVE with this article. And if anybody needs to deny the truth these days, it is the oil industry and their financial backers. They are sinking fast, dragging the whole damn global economy down with them.

Apneaman on Mon, 19th Sep 2016 12:21 am

“Russian internet trolls were being hired to pose as pro-Trump …”

ESL, Russian’s make the best pro-Trump posers with their primitive understanding of english sentence structure and grammar. Top CIA analysts can’t even tell them apart from the real pro-Trump supporters.

“HillOree dum dum Trump moar bester”

wingcmdr on Mon, 19th Sep 2016 1:04 am

…..Texas investors with big money are BUYING properties with oil and gas reserves….and those guys in Texas didnt get rich making the wrong call in the energy markets….this article is BS.

ALXNDR on Mon, 19th Sep 2016 2:03 am

Oil and gas industry is boom and bust no matter where it is in the U.S. I don’t understand what you are trying to get across. Oil is drying up? Oil companies will fail?? America is doomed???

Oil production has slowed because…I don’t know…maybe it has to do with the decrease in drilling activity…you think!

Oil companies and service companies have been failing and filing from bankruptcy…do you think these failure would stop the same people from starting over when the price/barrel rises again??

The only Americans that are doomed are the ones who continue to play with fire and work in that industry, and those who went out and bought car with crappy gas mileage. The price of oil will rise, its just a matter of time.

Shale plays are a house of cards??? Shale plays (and new fracking technology) allowed America to produce as much oil as Saudi.

I have no idea how this nonsense made it to Yahoo!’s front page.

CA May on Mon, 19th Sep 2016 2:08 am

Well… if you can keep writing about every bad thing…then next week write about something good… when the s*%t hits the fan you can always say you were right… Cover all the bases…good and bad… that way it wont matter what really happens… you can always say you were right.

It would be nice if the price of oil stays low…drop a dollar or a dollar and a half a gallon at the pumps right now and keep it that way.

When people drive, they tend to spend cash… if your putting $50-$100 into a one tank fill up at the pumps, you dang sure aint gonna spend Christmas at the Kronks you know?

WHen the cost to transport goods goes up… everything goes up… food, household goods, building materials… the cost to produce steel goes up. Any one saying anything different is foolish… the cost to travel goes up, the goods transported goes up… its simple logistics… if the transporter don’t raise his or her prices to cover increased transportation costs… profits fall.

Waiting for the day when a different source of fuel can be produced that has unlimited reproduction limits. That can set a standard price that wont waiver and stabilize transportation costs at a set standard.

When you know how much your transportation costs are, heating and cooling costs and very little fluxuation with them…For the little guy and gal…it helps.

Id support a flat rate no matter how much electric you use. One rate for households, one for industry.

Pipe dream… never gonna happen…too many out there motivated by one factor only…Money.

Eric F Jordan on Mon, 19th Sep 2016 2:25 am

Not sure what gold and silver have to do with the price of oil and gas in the Bakken or Texas. Seems the article may be be a ploy to sell something.

I am a business evaluator by profession and I don’t buy what this guy is saying.

Peter Tibbetts on Mon, 19th Sep 2016 3:01 am

Don’t any of you oil-sucking hydrocarbon-hoarding morons get it? If you want to leave to our descendants a Planet Earth upon which our Grandchildren & Great Grandchildren can survive & thrive, ALL Carbon-based fuels now in the ground MUST STAY in the ground.

Alternative energy development and production will more than fill the economic gap left by abandoning carbon fuels and the lying, murdering scumsuckers who profit from them.

It’s just a matter of de-greasing the oily bastards who can’t gain the traction to progress towards a sustainable, SURVIVABLE future.

Tom on Mon, 19th Sep 2016 3:10 am

Dumbbutt,

Anyone around the oilfield knows that shale fields have a limited life expectancy. You think you’re brilliant for pointing this out, but this has been simple knowledge since the 1920’s.

Tom

Paul Lambert on Mon, 19th Sep 2016 3:21 am

The writer is an idiot and doesn’t understand the oil business. I lived in the Odessa/Midland area, where oil is big. If one looks around, one can see that they have the oil wells turned off, even the brand new ones. They don’t want to see oil at today’s prices so they cap them off. One can drive to Midland, Odessa, Pecos, … and one can see all of the oil wells that aren’t pumping, not because they are out of oil because these are very new wells and new pumps. I have been watching them closing down these wells right after they built them because of current oil prices. I knew oil would not come back up in price because if it starts to climb, they will uncap the oil wells, forcing the prices back down. The higher the price the more oil wells that will open back up. Hardly any of the wells are open right now.

There is a whole lot more to this story. Saudi Arabia doesn’t want the price to climb too much because if it does then America will open their wells back up. They know what our price point, profit, is at and they have decided that they don’t want America pumping oil. They want us dependent on us.

Then there are the windmills and the solar down in Texas. There appears to be more windmills than oil wells, for the tens of thousands of wells down here, it is nothing compared to the windmills. Take a drive some time and in hundreds of square miles, all one sees is windmills. Windmills are coming up, everyday. One doesn’t realize how big these windmills are unless one is in the business or one has gone up to them and and gone into them. They are massive. When one drives by, one is so far away from them that one doesn’t realize how gigantic these windmills are. I took my family on a tour through one, and they were shocked. They knew they were big, but they had no idea how much they produce and how big they are. I kept telling people oil is going going back up for a long time, and people just didn’t understand and they didn’t believe. They didn’t understand facts, take a drive and learn, Pecos, Odessa, Midland, Fort Stockton, Kermit, Monahans, … Forget about what they say, see what you see.

Daryl Rollings on Mon, 19th Sep 2016 3:30 am

This was written by another Obama p.o.s liberal democrat who doesn’t know squat about boom and bust cycles of the patch. Democrat libtards who dispise the oilfield and the workers. The Bakkeen will be back. As will the Barnett, the Marcelles, Eagle Ford, the Fayettville and others. We barely scratch the surface of these shale formations. Invest in gold and silver he says. 80% of other investers are saying gold will crash in 2017. Talk about a ponzi scheme- tghis idiot should go to prison. Enjoy this $2 a gallon gas America. The day is coming when you will be hoping to see it drop below $7 a gallon. Day is coming when $200/ bbl oil will be cheap.

Rob K. on Mon, 19th Sep 2016 3:43 am

I’m originally from N.Dak. and back in the late ’70’s,stood “Worms Corner” while we “tripped” 13,000+ feet of #F drill pipe out of the ground. That”s not quite 2 1/2 miles down to the “bed” of the Williston Basin. Think of a large bowl or “basin”. The Western edge is over by the Overthrust in Idaho and the eastern edge of the bowl is where bed rock is exposed in Northeastern Minnesota. The Northern edge is the Canadian Sands and the Southern edge is down in southern S.Dak. That’s full of oil. As is the North Slope. As is Wyoming,California, and most of the North American Continent. If your interested, I have 160 acres that I will sell you just outside of Watford City. Surface rights and access to the aquifer than runs under the property. You can drill two wells and this Artesian aquifer will produce Two wells with a flow of 10,000 gal/hour/well and the State Of N.Dak. Water says it will flow till the end of time. The surface rights contain an estimated 20,000,000 cubic yards of washable gravel to a depth of 80 feet. A deeper survey is planned and we believe the cubic yards will double. Why all this information? The oil and gas companies have projected another 20 years of drilling in the Bakken. They need the water and the State Highway Dept. McKinnsey County Roads and Bridges as well as the drillers need the gravel for concrete. This guy is selling Gold and Silver. We like land. Just like Will Rodgers said 75-80 years ago, “They ain’t making anymore of it”. By the way, the drillers that worked back in 1950’s and those in the 70’s, used to go stand at the shakers and pick out the gold nuggets brought up through the pipe. Should he call, maybe we can put him at a source. Hey Peter Tibbetts, shut off all of your electricity, plant a garden and start walking.

Solar WInd on Mon, 19th Sep 2016 4:15 am

And here I thought oil production had been cut back due to the precipitous DECLINE in the value of a barrel of oil that made it unprofitable to drill/pump/transport. How silly of me. Better I should interpret the decline to… OH NOES… the peak oil fairies!

You know where writers like this end up? As bloggers “reporting” on Yahoo.

jack jack on Mon, 19th Sep 2016 6:54 am

oil, oil, oil; Greed, greed every bbodys right on with thier articals! But greed is the number one culprit here.It is the control of the population by consumabulls oil is one of them.Why haven’t auto makers been made to make the vehicals world wide get 100mpg because of GREED money thats what this is all about come to america its free nuttins free here my dear if u work u gonna pay taxs if u own propertys u gonna pay taxs. It’s all about tax’s an greed.Thank u now I feel better

dissident on Mon, 19th Sep 2016 7:02 am

To the retard that is spamming this thread: your pathetic drivel will not alter reality. You bet the farm on tight oil and now it is evident that it is a flash in the pan. Tough shit, loser.

Mark ziegler on Mon, 19th Sep 2016 7:43 am

The one thing pulling at our economy is the fact that the world uses 1 billion barrels of oil every 11 to 12 days. Investing of any sort will not even begin to solve the forthcoming energy shortages and the halt of economic growth that will come with it.

yoshua on Mon, 19th Sep 2016 8:11 am

Did anyone mention the Spanish inquisition ?

What are they going to dilute the Canadian Tar Sands with if LTO collapses ? How are they going to pipe the Tar Sands ? Will they start to transport it in Coke cans ?

searcher on Mon, 19th Sep 2016 8:15 am

When the boom began it was reported that oil prices would need to exceed $70 dollars per barrel to be profitable due to high production costs. OPEC (Saudi Arabia) holding prices to about $50 per barrel not only limits the amount of money available to ISIS for their crude, it makes shale oil un-profitable and allows OPEC to remain the primary source.

Wondering One on Mon, 19th Sep 2016 8:23 am

Being from ND and a petroleum engineer, this is reasonable. Resource plays are dependent on locations, as one is always chasing the Red Queen. In 2009, when drilling stopped due to prices the decline was also evident.

Robert on Mon, 19th Sep 2016 8:24 am

Production has slowed because the price is too low to drill not because the field is running dry. You sir are a complete idiot.

carbonates on Mon, 19th Sep 2016 8:27 am

It appears there is a lot of ignorance about Peak Oil, but most of it is confined to the Peak Oil crowd that fails to understand the economics of oil production. The peak in those graphs has nothing to do with science or natural limitations. It has everything to do with the poor economics of Bakken production.

makati1 on Mon, 19th Sep 2016 8:31 am

I’m done commenting until someone cleans out all of the bot trash. I’ll check back tomorrow.

jo jo on Mon, 19th Sep 2016 8:31 am

Having experienced being laid off numerous times going way back to my father, the enormously greedy and tax belay-den US oil industry does not have my sympathies if they should die off like the old dinosaur liquid they pump from the ground.

This article makes no mention that SA and middle wast have proven reserves that can supply the world for next 2-300 years. Not to mention alternative energies will surely put them all to sleep permanently in the not to distant future.

James Justiss on Mon, 19th Sep 2016 8:32 am

This is not news.The industry has known for years the steep decline in shale plays the first year.You get a large part of your investment back with high initial flow and the rest over many years of lower rates.Same with deep water drilled wells.Despite public wishes for cheap energy,will require higher prices to have substantial investments in shale production.Even some operators will be fooled in thinking high prices are imminent but timing is everything.

ghung on Mon, 19th Sep 2016 8:35 am

dissident said; “To the retard that is spamming this thread: your pathetic drivel will not alter reality. You bet the farm on tight oil and now it is evident that it is a flash in the pan. Tough shit, loser.”

It occurs to me that the spammer/bot isn’t using any foul language so far (words on George Carlin’s list of words you can’t say on TV). Maybe regular posters should foul-up their language a bit; see if the bot adapts. At least we’ll know who’s who, eh?

dave thompson on Mon, 19th Sep 2016 8:45 am

Wow crazy amount of comments for this well written, thought out and informative article about the realities of the Bakken and oil industries death throws. LOL

Cloggie on Mon, 19th Sep 2016 8:45 am

“Maybe regular posters should foul-up their language a bit; see if the bot adapts. At least we’ll know who’s who, eh?”

ghung giving me the green light for some heavy duty industrial strength insults?

Hey you bescumbing, coccydynian, hircismusian, microphallus & ninnyhammer!

/end test

Hope this helps.

http://www.neatorama.com/2008/05/03/10-insulting-words-you-should-know/

shortonoil on Mon, 19th Sep 2016 9:23 am

OH boy, bots with photos? Hay ghung, is that really you? No wonder they want to shut us down (sarc off).

Just got an email from Steve. This has gone viral on the net. We are getting a landslide of hits everywhere. Our site is up triple. Thanks (you out there is diggy world) you have done us more good than our last two years of effort. I should have done the same thing, but didn’t want to spend the half million bucks for the app. Can anyone at PO News admin tells how much your hits have increased.

BW

curlyq3 on Mon, 19th Sep 2016 9:26 am

Good morning regular Peak Oilers … 289 posts to this article ? I suppose that it is just too sensitive of a topic for folks to let go of … when I had my first glimpse of the implications of collapse I was unsettled a bit also!

curlyq3

ghung on Mon, 19th Sep 2016 9:38 am

@Short: Interesting that the source article at zerohedge hasn’t been attacked as this site has. Maybe they took measures early on. It doesn’t appear that the original article (https://srsroccoreport.com/the-death-of-the-bakken-field-has-begun-big-trouble-for-the-u-s/) had this type of attack either.

As for “This has gone viral on the net.” Viral where/how?

ghung on Mon, 19th Sep 2016 9:39 am

@curlyq3: Late to the party? Most of these comments seem to be bot-generated. We’re under attack. Run for your lives!

Clint Wilde on Mon, 19th Sep 2016 10:16 am

What is not really clear in this story, is the downturn in output because they are not pumping due to oversupply, or diminished underground resource?

shortonoil on Mon, 19th Sep 2016 10:31 am

Everyone is seeing a massive number of increased hits to their sites. Steve says his is up 10 times, ours has tripled and Ugo Bardi is seeing a big jump. We are still getting reports, and waiting for more out of Europe. That is why I was curious about PO News?

John on Mon, 19th Sep 2016 10:36 am

You know something’s amiss when Agnes starts making comments.

Richard Simpkins on Mon, 19th Sep 2016 10:44 am

What we are experiencing is peak oil demand, not peak supply. Even though this article asserts “the Bakken was going to peak and decline in 2016-2017 regardless of the price,” it only shows graphs showing a drop in the quantity supplied. Quantity supplied is not the same as supply. It is impacted by price. When oil was expensive, it was worth it to drill at a much higher cost. Now that it’s bouncing around in the 40s, many sites aren’t worth drilling . That doesn’t mean the oil has dried up, only that it is no longer cost effective to get it.

If oil supply really were drying up (globally), prices would rise and Bakken would once again start breaking production records. Consider Bakken (and shale in general) as a safety valve against high oil prices. Whenever demand is strong enough drain supply, Bakken kicks in. This is true with American shale in general, since it is more expensive to get at shale oil.

The real question should be: Why are oil prices so low? The answer is both an oversupply due to conflicting goals (from Iraq, Russia and Saudi Arabia as well as from the added production of American shale) and a slowdown in the growth of oil demand (due to more energy efficient cars and the nascent rise of electric cars). It is the demand, not supply, that has peaked.

satan on Mon, 19th Sep 2016 10:48 am

good hope these oil assholes all go out of business-who cares they polute and ruin our earth the deserve unemployment!

donstewart on Mon, 19th Sep 2016 10:55 am

@short

From Richard Heinberg’s essay today at Resilience.org:

‘The oil industry appears to have entered a terminal crisis due to its requirement for ever-higher levels of investment in order to find, produce, refine, and deliver ever-lower-quality resources.’

You seem to have convinced him….Don Stewart

Davy on Mon, 19th Sep 2016 11:10 am

The façade is cracking and anxiety is creeping into the body public. We are seeing this with politics, economy, climate, and energy. You can manufacture stories but eventually the truth shines through the fog. What does this mean? I would say it has a duel meaning. The truth is getting out but with that will be systematic turbulence. What most fail to understand is one there is no alternative other than collapse and two we can accelerate of decelerate this process. We are a global interconnected people but we don’t want to admit that. We want problems to be the other guys and ourselves be left alone. IOW we want to put our head in the sand instead we are putting our heads up our asses. Change is only skin deep in our brittle modern world. Niches have been filled leaving no room for change. Yet, many think they can change the world and not hurt the status quo in the process. Major changes are needed everywhere but these changes are too extreme to maintain the status quo. Change farming methods and we starve. Eliminate banks and the economy fails. Transition away from oil and the lights go out.

Real change will only come with a massive crisis and when that comes it may be too late. You ask too late? Too late for what? Too late to manage a transition to a collapse process. What is a transitioning collapse process? This is civilization in an orderly retreat. A retreat is a powerdown and a simplification. The problem we have today is many understand we have serious problems but they do not realize these are predicaments. Predicaments that are traps without any positive outcomes. Catch 22 circumstances that are bad or worse. You are not going to fix the climate and you are not going to fix energy. Civilization is in decay and deflation so that cannot be fixed. We can adapt to destructive change by making it worse or a little less bad.

What we can fix is attitudes but this will only come in an extreme crisis. An extreme crisis will have collateral damage. We are facing a die off because there is no way we can feed 7BIL people with a declining economy, depleting energy, and destabilizing climate. It will be a huge feat of courage and achievement if we can avoid destroying ourselves in war. There are problems we can avoid by better decisions. There are existing problems that can be reduced by tough decisions. The majority of what is coming cannot be manage it will just have to be lived through and died in. We spent a hundred plus years getting here in a generally smooth rate of growth. Population has exploded far in excess of carrying capacity. Soon we are going to experience a compression of these many years in a quick and painful destructive process none of us will escape. There will be winners and losers but most of us will lose something. Winners will be few.