Crude price record ($ 147.27) pt 2

Re: Another Record ($147.27) (crude oil prices)

$this->bbcode_second_pass_quote('threadbear', 'M')oney is flowing out of treasuries and into commodities. It's that simple. Watch the dollar weaken as prices for anything other than deflated assets, rise. But be careful here. There's a different administration controlling things now, one that WILL crack down on the ICE, the energy desks at major banks, and other agencies that game the energy markets too high. Anything over 70.00 is going to set off alarm bells and get the pols involved. Like it or not.

The best words of wisdom I have seen on this site in a while. Thanks threadbear.

How can Ludi spend 8-10 hrs/day on the internet and claim to be homesteading???

-

AAA - Tar Sands

- Posts: 702

- Joined: Wed 12 Nov 2008, 04:00:00

Re: Another Record ($147.27) (crude oil prices)

$this->bbcode_second_pass_quote('threadbear', 'L')ows--35.00

Highs--60.00

Close--58.00

Post from Dec 21, 2008. Do you still think it'll bottom out where it is now, basically?Highs--60.00

Close--58.00

$this->bbcode_second_pass_quote('', 'M')oney is flowing out of treasuries and into commodities. It's that simple. Watch the dollar weaken as prices for anything other than deflated assets, rise. But be careful here. There's a different administration controlling things now, one that WILL crack down on the ICE, the energy desks at major banks, and other agencies that game the energy markets too high. Anything over 70.00 is going to set off alarm bells and get the pols involved. Like it or not.

No doubt, but after finding out the derivatives market is still growing I'm dubious that Schapiro will be able to put out the fire with her squirt gun. Haven't read anything about the SEC recently baring its fangs and promising to crack rulers over wrists.

Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Re: Another Record ($147.27) (crude oil prices)

US oil consumption has not fallen that much. Industrial consumption has fallen much more than transportation.

Any perceived improvement in the economy will drive the price of oil higher. I think we will see another oil price spike this summer in spite of a bad economy. In the US, driving a car is one of the last things the masses will give up.

Peak oil is coming and TSWHTF.

Any perceived improvement in the economy will drive the price of oil higher. I think we will see another oil price spike this summer in spite of a bad economy. In the US, driving a car is one of the last things the masses will give up.

Peak oil is coming and TSWHTF.

- OutOfGas

- Peat

- Posts: 152

- Joined: Sat 21 Mar 2009, 19:31:45

Re: Another Record ($147.27) (crude oil prices)

AAA, Thanks for compliment. I'm flattered but feel somewhat undeserving.

Dude, Do I think the market will top out at 60.00 still? Hmmm...It could shoot the moon again, but I'm pretty sure 70.00 will be the upper limit. If the govt. is on top of it, they should start sending out some serious warning signals to gamers, at around 60.00. That might bring it back to earth. If they quit flooding the market with gold leases, every time gold goes over 900.00 per oz., that will help. Gold will start behaving like an inflation hedge, if it is allowed. So far, they've only trained swing traders like synchronized dancing bears, to perform on command.

Dude, Do I think the market will top out at 60.00 still? Hmmm...It could shoot the moon again, but I'm pretty sure 70.00 will be the upper limit. If the govt. is on top of it, they should start sending out some serious warning signals to gamers, at around 60.00. That might bring it back to earth. If they quit flooding the market with gold leases, every time gold goes over 900.00 per oz., that will help. Gold will start behaving like an inflation hedge, if it is allowed. So far, they've only trained swing traders like synchronized dancing bears, to perform on command.

-

threadbear - Expert

- Posts: 7577

- Joined: Sat 22 Jan 2005, 04:00:00

Re: Another Record ($147.27) (crude oil prices)

They're baa-aack. http://www.cnbc.com/id/30603801

$this->bbcode_second_pass_quote('', '[')b]Oil Prices Ignore Supply, Demand Picture: Here's Why By: Sharon Epperson, CNBC Senior Energy Correspondent | 06 May 2009 | 03:46 PM ET

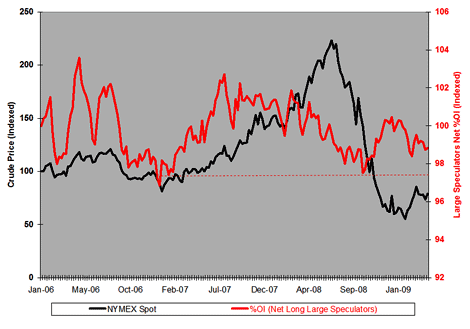

Why is oil trading near a 6-month high—breaking into a new range—and rallying above $56 a barrel, when oil supplies are at the highest level we've seen since 1990 and demand is tanking?

Oil remains technically strong today, despite rather bearish fundamentals, as traders continue to follow the equities market. Crude's broken into a new range and a settlement above $55 is significant.

What's fueling the momentum? Nymex traders tell me they're seeing new money coming in from passive funds that are reallocating assets away from precious metals and into energy holdings. It's this money flow—rather than the fundamental supply/demand data—that's driving oil prices higher.[...]

$this->bbcode_second_pass_quote('', '[')b]Oil Prices Ignore Supply, Demand Picture: Here's Why By: Sharon Epperson, CNBC Senior Energy Correspondent | 06 May 2009 | 03:46 PM ET

Why is oil trading near a 6-month high—breaking into a new range—and rallying above $56 a barrel, when oil supplies are at the highest level we've seen since 1990 and demand is tanking?

Oil remains technically strong today, despite rather bearish fundamentals, as traders continue to follow the equities market. Crude's broken into a new range and a settlement above $55 is significant.

What's fueling the momentum? Nymex traders tell me they're seeing new money coming in from passive funds that are reallocating assets away from precious metals and into energy holdings. It's this money flow—rather than the fundamental supply/demand data—that's driving oil prices higher.[...]

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

As a result of all the above,you have this steady and sure rise in crude price. Calling a top to this is a crap shoot. Too many moving parts at the moment and several of them could swing things very dramatically. Overall unless we have a global systemic financial collapse, the trend is up IMHO.

As a result of all the above,you have this steady and sure rise in crude price. Calling a top to this is a crap shoot. Too many moving parts at the moment and several of them could swing things very dramatically. Overall unless we have a global systemic financial collapse, the trend is up IMHO.