The Last Days of the Dollar?

Re: The Last Days of the Dollar?

10yr is spiking on this. Thought housing was going down. Wait till this starts hitting the sheeple's consciousness.

[web]http://ichart.finance.yahoo.com/w?s=%5ETNX[/web]

And the yield curve is still inverted so more rate cuts to come. I wonder if Ben is building any muscles from all the strings he's pushing on.

This by the way is extremely bad for gold and now is a good time to think about shorting (the current sucker's rally is making some good opportunities.

That was of course until the rally ended

[web]http://ichart.finance.yahoo.com/z?s=%5EDJI&t=1d&q=l&l=on&z=m&c=%5EGSPC,%5EIXIC&a=v&p=s[/web]

p.s.: hmm, a spike. Guess the market hasn't run out of suckers yet

[web]http://ichart.finance.yahoo.com/w?s=%5ETNX[/web]

And the yield curve is still inverted so more rate cuts to come. I wonder if Ben is building any muscles from all the strings he's pushing on.

This by the way is extremely bad for gold and now is a good time to think about shorting (the current sucker's rally is making some good opportunities.

That was of course until the rally ended

[web]http://ichart.finance.yahoo.com/z?s=%5EDJI&t=1d&q=l&l=on&z=m&c=%5EGSPC,%5EIXIC&a=v&p=s[/web]

p.s.: hmm, a spike. Guess the market hasn't run out of suckers yet

Angry yet?

- FoxV

- Heavy Crude

- Posts: 1321

- Joined: Wed 02 Mar 2005, 04:00:00

- Location: Canada

Re: The Last Days of the Dollar?

Can someone explain all of this. I understand the 30 yr bond auction didn't go well today, but what does that mean? Did the bonds not sell? Sell for less than expected? How does this affect yields of bonds?

-

seahorse2 - Expert

- Posts: 2042

- Joined: Mon 18 Oct 2004, 03:00:00

Re: The Last Days of the Dollar?

$this->bbcode_second_pass_quote('seahorse2', 'C')an someone explain all of this. I understand the 30 yr bond auction didn't go well today, but what does that mean? Did the bonds not sell? Sell for less than expected? How does this affect yields of bonds?

$this->bbcode_second_pass_quote('', ' ')It means that the 30-year auction today was a bust and a near failure. Bid to cover ratio was 1.82 and the yield was 4.449, a big drop.

It means that few are buying 30-year treasuries.

This could mean many things:

-They think the rates will spike higher in the short term and are waiting to rotate.

-They think the .gov is going to bailout someone and that this will devalue .gov debt.

-They think the 30-yr is too risky and are putting it into the IRX or their mattress.

http://www.tickerforum.org/cgi-ticker/a ... 033&page=1

"There must be a bogeyman; there always is, and it cannot be something as esoteric as "resource depletion." You can't go to war with that." Emersonbiggins

-

roccman - Light Sweet Crude

- Posts: 4065

- Joined: Fri 27 Apr 2007, 03:00:00

- Location: The Great Sonoran Desert

Re: The Last Days of the Dollar?

Just to add to that, a quick Bond refresher...

Bonds are basically a loan you give to a company for a certain number of years. For the service of doing this, the company says they will pay you interest until the loan is due. No Problems there.

The tricky part comes in when you start talking about the chances of the company defaulting, or the effects of inflation, or both. This is where pricing comes and yields come in.

Lets say you lend a company $1000 for 5 years and there's a 5% chance of that company going bankrupt in that time. Then value of the bond is $950 (as an example). So you're obviously going to want something to compensate you for this possible loss. And that is where interest comes in.

If you're bond is going to be worth 5% less at the end of the 5 years then you're going to want an additional 1% in interest to make up for it.

That's the theory behind it. How it actually works in real life is they offer up a bond auction and say "Any Takers". If there are no takers then they reduce the price, but you still pay the full bond face value, so you ask for more interest to make up for it.

This is also where the "Bond Market Vigilantes" step in. If the bond market does not like the inflation/Risk that banks/fed/government are putting into the economy, then interest rates go up. This reduces inflation and risk because it makes borrowing money too expensive to buy things or take on new "adventures"

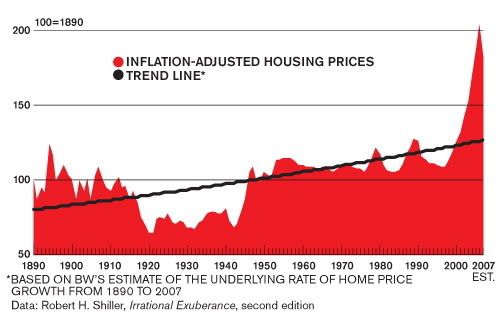

One of the reasons we have gotten into this mess is Greenspan's "Conundrum" where the bond market did not respond properly to the risks of the tech bubble (and subsequent housing bubble) and everyone got greedy and out of hand.

This "Conundrum" is a direct effect of derivatives (and why the Bond Market Vigilantes did not step in after the Tech collapse and stop the Fed rate from going below inflation). Under the guise of "shared risk" through derivatives, the bond market felt there was no risk in the economy so they didn't demand higher interest rates.

Now that the entire economy is flying apart at the seems, the Bond Market is noticing.

If the Treasury/Mortgage/Car loans/Credit card interest rates go up significantly this spells big time

D-E-F-L-A-T-I-O-N

And much more than in the 1930s because in the 1930s people still had savings to be able to spend. If interest rates go up now, North America is basically screwed because of the negative savings rate and no cushion till times get better.

btw, Long term I'm a big time Inflationist. However in the short term I believe we'll have a huge deflationary crash. But it will only last as long as it takes Ben to get the helicopters warmed up.

Anyways, sorry for the long post, but this is a HUGE development in the current collapse

P.S.: please correct me where I am wrong about how bonds work. I'm stretching my knowledge a bit

Bonds are basically a loan you give to a company for a certain number of years. For the service of doing this, the company says they will pay you interest until the loan is due. No Problems there.

The tricky part comes in when you start talking about the chances of the company defaulting, or the effects of inflation, or both. This is where pricing comes and yields come in.

Lets say you lend a company $1000 for 5 years and there's a 5% chance of that company going bankrupt in that time. Then value of the bond is $950 (as an example). So you're obviously going to want something to compensate you for this possible loss. And that is where interest comes in.

If you're bond is going to be worth 5% less at the end of the 5 years then you're going to want an additional 1% in interest to make up for it.

That's the theory behind it. How it actually works in real life is they offer up a bond auction and say "Any Takers". If there are no takers then they reduce the price, but you still pay the full bond face value, so you ask for more interest to make up for it.

This is also where the "Bond Market Vigilantes" step in. If the bond market does not like the inflation/Risk that banks/fed/government are putting into the economy, then interest rates go up. This reduces inflation and risk because it makes borrowing money too expensive to buy things or take on new "adventures"

One of the reasons we have gotten into this mess is Greenspan's "Conundrum" where the bond market did not respond properly to the risks of the tech bubble (and subsequent housing bubble) and everyone got greedy and out of hand.

This "Conundrum" is a direct effect of derivatives (and why the Bond Market Vigilantes did not step in after the Tech collapse and stop the Fed rate from going below inflation). Under the guise of "shared risk" through derivatives, the bond market felt there was no risk in the economy so they didn't demand higher interest rates.

Now that the entire economy is flying apart at the seems, the Bond Market is noticing.

If the Treasury/Mortgage/Car loans/Credit card interest rates go up significantly this spells big time

D-E-F-L-A-T-I-O-N

And much more than in the 1930s because in the 1930s people still had savings to be able to spend. If interest rates go up now, North America is basically screwed because of the negative savings rate and no cushion till times get better.

btw, Long term I'm a big time Inflationist. However in the short term I believe we'll have a huge deflationary crash. But it will only last as long as it takes Ben to get the helicopters warmed up.

Anyways, sorry for the long post, but this is a HUGE development in the current collapse

P.S.: please correct me where I am wrong about how bonds work. I'm stretching my knowledge a bit

Angry yet?

- FoxV

- Heavy Crude

- Posts: 1321

- Joined: Wed 02 Mar 2005, 04:00:00

- Location: Canada

Re: The Last Days of the Dollar?

$this->bbcode_second_pass_quote('BIS', '"')Virtually nobody foresaw the Great Depression of the 1930s, or the crises which affected Japan and Southeast Asia in the early and late 1990s. In fact, each downturn was preceded by a period of non-inflationary growth exuberant enough to lead many commentators to suggest that a 'new era' had arrived", said the bank.

$this->bbcode_second_pass_quote('', 'H')ayek, writing for the Austrian Institute of Economic Research Report in February 1929 predicted the economic downturn, stating that "the boom will collapse within the next few months."

$this->bbcode_second_pass_quote('', 'L')udwig von Mises also expected this financial catastrophe, and is quoted as stating "A great crash is coming, and I don't want my name in any way connected with it." [12] when he turned down an important job at the Kreditanstalt Bank in early 1929.

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

.png)