THE Deflation vs Inflation Thread (merged)

Re: Inflation or Deflation for the US?

Several things are happening at once:

o massive credit deflation as highly leveraged bubbles deflate

o central banks are attempting to use monetary inflation to keep the financial system running

o declining EROEI is causing all economic activity to become more expensive

o population pressure, weather/climate and biofuels production vs food supply is raising food prices

o oversupply of real estate combined with unavailability of credit is causing prices to crash

All these points (and all those I've missed) interact with each other and can't just be considered in isolation.

o massive credit deflation as highly leveraged bubbles deflate

o central banks are attempting to use monetary inflation to keep the financial system running

o declining EROEI is causing all economic activity to become more expensive

o population pressure, weather/climate and biofuels production vs food supply is raising food prices

o oversupply of real estate combined with unavailability of credit is causing prices to crash

All these points (and all those I've missed) interact with each other and can't just be considered in isolation.

-

sjn - Elite

- Posts: 1332

- Joined: Wed 09 Mar 2005, 04:00:00

- Location: UK

Re: Inflation or Deflation for the US?

Here's a really nice summary for the holdout deflationists. Read the whole thing if you're at all on the fence on this issue. The need to deal with entitlements and IOUs, the ability to print "free money", the heavy debt burden, and the need to delay consequences are all points that have sold me on the inflation in the short term stance.

Seeking Alpha-Ciovaccio

$this->bbcode_second_pass_quote('', '"')More Inflation Followed by Deflation

What does it all mean? The odds favor more inflation. We may even see hyperinflation at some point in the next decade. When the vast majority of individuals and businesses no longer have any desire to take on more debt, the credit cycle will end and we will slip into long-term, widespread deflation. While some consumers and homeowners are currently overextended and on the brink of serious financial problems, the wealthy are still wealthy. Many banks and financial institutions are in serious trouble due to the current state of the residential real estate market, but the solvency of the vast majority of businesses is not threatened. Just as we saw deflation in stocks from 2000-2002, we will continue to see deflation in housing sector for some time to come. However, when stocks fell from 2000-2002, it did not result in long-term, widespread deflation. Similarly, deflation in the housing sector alone does not constitute Japan-like deflation. Widespread, Japan-like deflation means higher debt burdens, the loss of the wealth effect, economic hardship, and political change. With the “modern equivalent of the printing press” and published consumer inflation still low on a historical basis, we can expect the Federal Reserve and U.S. government to continue to encourage more borrowing, more speculation, and more spending . As a result, your investment strategy should continue to favor inflationary outcomes."

Seeking Alpha-Ciovaccio

$this->bbcode_second_pass_quote('', '"')More Inflation Followed by Deflation

What does it all mean? The odds favor more inflation. We may even see hyperinflation at some point in the next decade. When the vast majority of individuals and businesses no longer have any desire to take on more debt, the credit cycle will end and we will slip into long-term, widespread deflation. While some consumers and homeowners are currently overextended and on the brink of serious financial problems, the wealthy are still wealthy. Many banks and financial institutions are in serious trouble due to the current state of the residential real estate market, but the solvency of the vast majority of businesses is not threatened. Just as we saw deflation in stocks from 2000-2002, we will continue to see deflation in housing sector for some time to come. However, when stocks fell from 2000-2002, it did not result in long-term, widespread deflation. Similarly, deflation in the housing sector alone does not constitute Japan-like deflation. Widespread, Japan-like deflation means higher debt burdens, the loss of the wealth effect, economic hardship, and political change. With the “modern equivalent of the printing press” and published consumer inflation still low on a historical basis, we can expect the Federal Reserve and U.S. government to continue to encourage more borrowing, more speculation, and more spending . As a result, your investment strategy should continue to favor inflationary outcomes."

“Paper money eventually returns to its intrinsic value ---- zero.” --Voltaire

-

Iaato - Heavy Crude

- Posts: 1008

- Joined: Mon 12 Mar 2007, 03:00:00

- Location: As close as I can get to the beginning of the pipe.

Re: Inflation or Deflation for the US?

The odds can favor whatever you want. Americans have shown a psychological propensity to despise inflation which is rivaled only by Germans. If high interest rates are the only way to fight inflation then we shall have them, no matter how dire the consequences.

-

LoneSnark - Tar Sands

- Posts: 514

- Joined: Thu 15 Nov 2007, 04:00:00

Re: Inflation or Deflation for the US?

$this->bbcode_second_pass_quote('sjn', 'S')everal things are happening at once:

o massive credit deflation as highly leveraged bubbles deflate

o central banks are attempting to use monetary inflation to keep the financial system running

o declining EROEI is causing all economic activity to become more expensive

o population pressure, weather/climate and biofuels production vs food supply is raising food prices

o oversupply of real estate combined with unavailability of credit is causing prices to crash

All these points (and all those I've missed) interact with each other and can't just be considered in isolation.

o massive credit deflation as highly leveraged bubbles deflate

o central banks are attempting to use monetary inflation to keep the financial system running

o declining EROEI is causing all economic activity to become more expensive

o population pressure, weather/climate and biofuels production vs food supply is raising food prices

o oversupply of real estate combined with unavailability of credit is causing prices to crash

All these points (and all those I've missed) interact with each other and can't just be considered in isolation.

Well, yes and no. Closer than anyone else though.

Inflation and deflation reflect money supply and not 'just' prices going up or down.

If you're money supply is constant and you pay more for energy, then you spend less on discretionary spending - on consumables - for example. If you're money supply is contracting you can afford less energy and less consumables. If you're money supply is expanding you can afford both energy and consumables.

At least in the short-term until that new supply of money is used up. You can measure the extent to which money supply is expansionary, and therefore potentially inflationary, by comparing real rises in inflation-adjusted GDP with that of money supply expansion. If money supply is increasing faster than GDP then you have a potentially inflationary scenario.

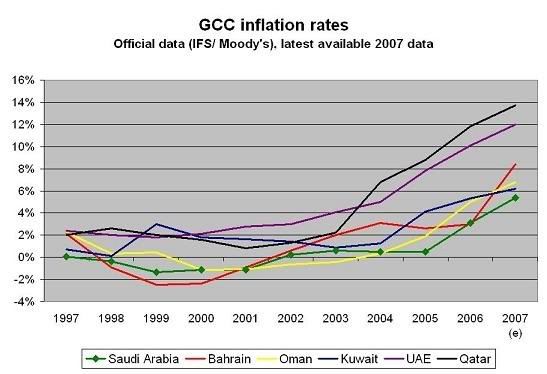

See this graph of GCC inflation...

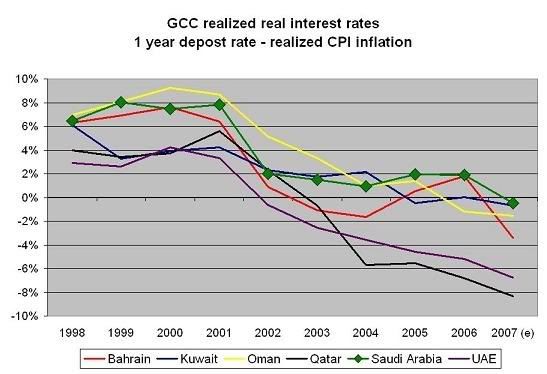

.... and compare it to real interest rates (nominal interest rates - inflation)

Source: how are the United States' creditors managing their own economies?

I would disagree with the phrase "massive credit deflation as highly leveraged bubbles deflate". Some bubbles are deflating since no one is able or willing to keep buying. While credit is actually getting more expensive and less available that further reduces that pool of potential 'greater fools'.

So even as central banks slash rates banks are unable or unwilling to lend. As such the spread over Fed funds or LIBOR or whatever you use as a benchmark is actually widening. Even for credit worthy customers. For non-credit worthy clients this credit is simply not available.

But money supply growth is alive and well as central banks and their sovereign wealth funds accumulate foreign exchange reserves, sterilize them, re-invest them into global capital markets and create domestic currency instead.

I wholly agree that "population pressure, weather/climate and biofuels production vs food supply are raising food prices" as well as other commodity prices which is classic resource scarcity as opposed to manmade inflation caused by excessive money supply growth. And that "All these points (and all those I've missed) interact with each other and can't just be considered in isolation." As it is really a matrix of 3D relationships and not a linear or two dimensional one when looking at inflationary or deflationary forces in the economy or between economies.

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

Re: Inflation or Deflation for the US?

Look,

Money is created by banks loaning money. When there is a crisis of non-payment then the money supply shrinks by that amount plus the net loss in capital that the bank suffers so that they cannot make other loans. This happens because of reserve limits. Banks loan way beyond their realistic capital because of this money creation so in a wosrt case scenario TSHTF. This is exactly what is happening now.

Fortunetly for the US system there are a lot of dollars sitting around the world that aren't regularly repatriated. These dollars are kept in sovereign wealth funds and such. These dollars have not been involved to a great extent in the shenanigans, not yet.

Well, you could say that the sovereign wealth fund dollars haven't been involved too much except the fact they exist in the first place is a problem in the sense that the money they hold has not been an active part of the money supply and in a way that imbalance is responsible for much of the crisis. Their existence has kept inflation artificially low by parsing the money supply. The amount sectioned off has helped other countries maintain foreign exchange reserves that is true but it has also gone to purchase oil and treasury instruments. Now that the real estate bubble has run its course and deflated the active money supply those dollars are once again needed back in the money supply. Here they come flooding into Citibank et al. and the US whore is laying back and pretending to moan like the dirty little girl she once was. She will wear a turban, or a little boxed hat or get her feet bound if you please, whatever it takes to get the job done.

I don't know what this means in terms of how the money supply will balance out as a result of the money coming back in. I suppose that what matters is whether that money makes it into the proper channels so that it can get distributed into the economy. Citibank and the like are certainly the right kind of instruments. They are the kind of places where not just large corporations can borrow but regional banks as well. I can tell you that if this effort doesn't work there will be deflation. If it works only too well there will be inflation. As for which asset classes will get hammered and which won't, that is anybody's guess. I think high yielding stocks will be appealing and that severly oversold assets are a good bet. I wouldn't be into gold or silver beyond ten or fifteen percent until you see the bubble that MMasters has been talking about burst. Because if this works much of the money hiding in precious metals as a safe haven is gong to flood back into equities quickly. If it doesn't work your ten or fifteen percent stake will probably have been enough because beyond that farming knowledge will be of more value anyway.

I think the economy has a year or two left in it for sure until the sovereign wealth funds begin to really need their money back. The crappy thing related to peak oil is that it will probably happen sooner on a 'could have been forestalled' basis because the investment money necessary to prospect and drill is going to be tied up in the NYSE for a little while. Anybody paying attention knows that money needs to be doing work in the field and not in some cruel bastard's brokerage account.

You've got to hand it to the team at the top. They figured out a really creative way to try to get out from under the hyperinflationary mess that they seemed destined for. The only price to pay is a permanent end to at least the upper middle-class and a greatly distended working poor and poor class that will need to be managed by the prison-industrial complex until the day they die (thank God they had the foresight to learn crowd control via practicing terrorist busting and nation building tactics). That and the incremental loss of sovereignty. None of those things is too high a price for the team at the top.

Pity for them nothing in the real world is ever that easy.

Money is created by banks loaning money. When there is a crisis of non-payment then the money supply shrinks by that amount plus the net loss in capital that the bank suffers so that they cannot make other loans. This happens because of reserve limits. Banks loan way beyond their realistic capital because of this money creation so in a wosrt case scenario TSHTF. This is exactly what is happening now.

Fortunetly for the US system there are a lot of dollars sitting around the world that aren't regularly repatriated. These dollars are kept in sovereign wealth funds and such. These dollars have not been involved to a great extent in the shenanigans, not yet.

Well, you could say that the sovereign wealth fund dollars haven't been involved too much except the fact they exist in the first place is a problem in the sense that the money they hold has not been an active part of the money supply and in a way that imbalance is responsible for much of the crisis. Their existence has kept inflation artificially low by parsing the money supply. The amount sectioned off has helped other countries maintain foreign exchange reserves that is true but it has also gone to purchase oil and treasury instruments. Now that the real estate bubble has run its course and deflated the active money supply those dollars are once again needed back in the money supply. Here they come flooding into Citibank et al. and the US whore is laying back and pretending to moan like the dirty little girl she once was. She will wear a turban, or a little boxed hat or get her feet bound if you please, whatever it takes to get the job done.

I don't know what this means in terms of how the money supply will balance out as a result of the money coming back in. I suppose that what matters is whether that money makes it into the proper channels so that it can get distributed into the economy. Citibank and the like are certainly the right kind of instruments. They are the kind of places where not just large corporations can borrow but regional banks as well. I can tell you that if this effort doesn't work there will be deflation. If it works only too well there will be inflation. As for which asset classes will get hammered and which won't, that is anybody's guess. I think high yielding stocks will be appealing and that severly oversold assets are a good bet. I wouldn't be into gold or silver beyond ten or fifteen percent until you see the bubble that MMasters has been talking about burst. Because if this works much of the money hiding in precious metals as a safe haven is gong to flood back into equities quickly. If it doesn't work your ten or fifteen percent stake will probably have been enough because beyond that farming knowledge will be of more value anyway.

I think the economy has a year or two left in it for sure until the sovereign wealth funds begin to really need their money back. The crappy thing related to peak oil is that it will probably happen sooner on a 'could have been forestalled' basis because the investment money necessary to prospect and drill is going to be tied up in the NYSE for a little while. Anybody paying attention knows that money needs to be doing work in the field and not in some cruel bastard's brokerage account.

You've got to hand it to the team at the top. They figured out a really creative way to try to get out from under the hyperinflationary mess that they seemed destined for. The only price to pay is a permanent end to at least the upper middle-class and a greatly distended working poor and poor class that will need to be managed by the prison-industrial complex until the day they die (thank God they had the foresight to learn crowd control via practicing terrorist busting and nation building tactics). That and the incremental loss of sovereignty. None of those things is too high a price for the team at the top.

Pity for them nothing in the real world is ever that easy.

When it comes down to it, the people will always shout, "Free Barabbas." They love Barabbas. He's one of them. He has the same dreams. He does what they wish they could do. That other guy is more removed, more inscrutable. He makes them think. "Crucify him."

-

evilgenius - Intermediate Crude

- Posts: 3730

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Inflation or Deflation for the US?

evilgenius wrote:

$this->bbcode_second_pass_quote('', 'F')ortunetly for the US system there are a lot of dollars sitting around the world that aren't regularly repatriated. These dollars are kept in sovereign wealth funds and such. These dollars have not been involved to a great extent in the shenanigans, not yet.

$this->bbcode_second_pass_quote('', 'F')ortunetly for the US system there are a lot of dollars sitting around the world that aren't regularly repatriated. These dollars are kept in sovereign wealth funds and such. These dollars have not been involved to a great extent in the shenanigans, not yet.

My good friend this is simply not true. Sorry.

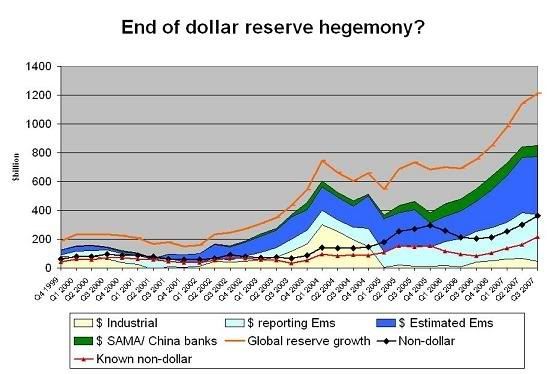

Those US dollars (plus euros, francs & pounds) are not just sitting idly by on the sidelines, but are hard at work.

When a central bank sterilizes its foreign exchange receipts in dollars, euros or whatever they buy up those dollars or euros and then print up their own domestic currency to pay for them.

They then effectively double the money supply by a) re-investing those dollars or euros back into global capital markets, and b) by releasing those newly minted yuan, rubles of dinar into their local economy.

The government may give those foreign export receipts to their sovereign wealth fund to invest instead of leaving them at the central bank, but they are deployed none the less. It is just sovereign wealth funds can usually invest in a wider array of assets other than simply money markets and fixed income that are the preserve of conservative central banks.

Re-investing those reserves partially offsets the cost of sterilization. In Japan, for example, they issue yen debt at less than 2% and get 3-4% on their US dollars or euro bonds. But for other countries that have higher domestic interest rates the government actually loses money. They issue debt at, say, 8% and then re-invest that money at only 3-4%. So they are losing 4-5% annually on that intervention. It is in effect an export subsidy to keep the currency under-valued and export competitive.

That OPEC and non-OPEC oil producers and Asian manufacturers have trillions to invest means that, of course, some of those funds are going to flow back into American or European capital markets whether it be low-yielding government bonds or a capital injection into Citigroup.

What Citigroup gets in return is access to Abu Dhabi and their unofficial reserves of $3-4 trillion. The deal was not done under the best circumstances, but it is like a reverse buy-in to a rich market. If you're going to get screwed you may as well enjoy it, eh? ; - )

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

Re: Inflation or Deflation for the US?

I'm well aware that sovereign wealth fund dollars are not sitting idly by. I don't think that would be much of a challenge for Hank Paulson and crew to gather. He hasn't been all over the world (especially China) lately (in the past year) for nothing. No, those dollars are invested elsewhere and it is the challenge of the team at the top to convince the wealth fund managers to pull those investments, especially those done internally (read Dubai) and redirect them at the US. Of course that isn't going to happen without something being offered to the fund countries in return. That's where the old girl gets to put on her makeup and fancy dress and entice the fund holding countries with promises of a degree of sovereignty in the world empire. Promises, promises, sometimes that is all you ever get. There can be only one heir apparent and Goldman Sachs says China is it.

When the act is over and the old girl is riding high the likes of Abu Dhabi are going to lament the fact that they didn't get what they thought they were going to get, and they have ruined the investment scheme that they had planned, and the petro-dollar is firmly in place (this time without them being able to threaten abandoning it).

That is when the world will be most at threat. That is when the countries that the old girl thinks she has eternally in her pocket will grumble and gripe and eventually wind up listening to the likes of Vladimir Putin.

When the act is over and the old girl is riding high the likes of Abu Dhabi are going to lament the fact that they didn't get what they thought they were going to get, and they have ruined the investment scheme that they had planned, and the petro-dollar is firmly in place (this time without them being able to threaten abandoning it).

That is when the world will be most at threat. That is when the countries that the old girl thinks she has eternally in her pocket will grumble and gripe and eventually wind up listening to the likes of Vladimir Putin.

When it comes down to it, the people will always shout, "Free Barabbas." They love Barabbas. He's one of them. He has the same dreams. He does what they wish they could do. That other guy is more removed, more inscrutable. He makes them think. "Crucify him."

-

evilgenius - Intermediate Crude

- Posts: 3730

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Inflation or Deflation for the US?

You may be right? Certainly America has promised in the past to behave, maintain a strong dollar policy and be fiscally responsible only to break those vows. I think Japan learned this to their disadvantage too late in the 90s. Petrodollar has made the same argument about GCC states back in the 70s. I guess you can only pull the same trick so many times? But as they say, fool me once, shame on you. Fool me twice, shame on me! ; - )

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

-

MrBill - Expert

- Posts: 5630

- Joined: Thu 15 Sep 2005, 03:00:00

- Location: Eurasia

The coming crash, inflation or deflation

I need some advice for preparing for the future. The world may soon face another great depression. I have silver and gold (and food) saved currently. The problem is that if the crash causes deflation like what happened in the first great depression than the value of my gold may go down the toilet. (Would a energy shortage change this factor)

If the crash causes hyper inflation than I will be rich, I tells you.

So should I trade my gold for cash to protect against deflation or hold on to my gold to prepare for inflation and possibly hit pay dirt.

If I make the wrong choice I am screwed, maybe I should do a bit of both, gold and cash.![bduh [smilie=bduh.gif]](https://udev.peakoil.com/forums/images/smilies/bduh.gif)

If the crash causes hyper inflation than I will be rich, I tells you.

So should I trade my gold for cash to protect against deflation or hold on to my gold to prepare for inflation and possibly hit pay dirt.

If I make the wrong choice I am screwed, maybe I should do a bit of both, gold and cash.

![bduh [smilie=bduh.gif]](https://udev.peakoil.com/forums/images/smilies/bduh.gif)

Last edited by Ferretlover on Wed 25 Feb 2009, 19:41:24, edited 1 time in total.

Reason: Merged with THE Deflation vs Inflation Thread.

Reason: Merged with THE Deflation vs Inflation Thread.

We are the Borg. Resistance is futile. Your culture will adapt to service ours. We will add your biological and technological distinctiveness to our own.

-

sciencegirl - Lignite

- Posts: 262

- Joined: Mon 17 Jul 2006, 03:00:00

Re: The coming crash, inflation or deflation

I think we have done this thread a bunch of times, so search around a little bit.

I was definitely in the inflation camp for a long time, given the comments of "Helicopter" Ben Bernanke before he became Fed chairman, when he essentially talked about how helicopter drops of money would prevent a depression from ever happening again. The massive monetary injections by central banks and interest rate cuts by the Fed suggest that the powers that be will inflate to keep the game going at all costs.

I have to say, though, that the deflationists here and at LATOC are beginning to win me over. They essentially say that pumping money into the system does no good when banks are hesitant to lend money now. Further, they argue that there is so much value in things like hedge funds and derivatives which are based off of all these loans going bad that they will eventually take down the entire monetary system. I'm sure some of the people in this camp can post the numbers -- when you see them, it's hard to deny that when things go bad, there will be a run on the banks.

Then, there are some fence-sitting stagflationists who say hard goods and commodities will become more expensive, but the value of housing and the markets may decrease in line with that.

I have no idea what will win out, so you are right to keep some PMs for inflation and cash for deflation.

I was definitely in the inflation camp for a long time, given the comments of "Helicopter" Ben Bernanke before he became Fed chairman, when he essentially talked about how helicopter drops of money would prevent a depression from ever happening again. The massive monetary injections by central banks and interest rate cuts by the Fed suggest that the powers that be will inflate to keep the game going at all costs.

I have to say, though, that the deflationists here and at LATOC are beginning to win me over. They essentially say that pumping money into the system does no good when banks are hesitant to lend money now. Further, they argue that there is so much value in things like hedge funds and derivatives which are based off of all these loans going bad that they will eventually take down the entire monetary system. I'm sure some of the people in this camp can post the numbers -- when you see them, it's hard to deny that when things go bad, there will be a run on the banks.

Then, there are some fence-sitting stagflationists who say hard goods and commodities will become more expensive, but the value of housing and the markets may decrease in line with that.

I have no idea what will win out, so you are right to keep some PMs for inflation and cash for deflation.

- AlCzervik

- Lignite

- Posts: 374

- Joined: Wed 14 Jul 2004, 03:00:00

- Location: The Motor City

Re: The coming crash, inflation or deflation

$this->bbcode_second_pass_quote('sciencegirl', 'I') need some advice for preparing for the future. The world may soon face another great depression. I have silver and gold (and food) saved currently. The problem is that if the crash causes deflation like what happened in the first great depression than the value of my gold may go down the toilet. (Would a energy shortage change this factor)

If the crash causes hyper inflation than I will be rich, I tells you.

So should I trade my gold for cash to protect against deflation or hold on to my gold to prepare for inflation and possibly hit pay dirt.

If I make the wrong choice I am screwed, maybe I should do a bit of both, gold and cash.![bduh [smilie=bduh.gif]](https://udev.peakoil.com/forums/images/smilies/bduh.gif)

If the crash causes hyper inflation than I will be rich, I tells you.

So should I trade my gold for cash to protect against deflation or hold on to my gold to prepare for inflation and possibly hit pay dirt.

If I make the wrong choice I am screwed, maybe I should do a bit of both, gold and cash.

![bduh [smilie=bduh.gif]](https://udev.peakoil.com/forums/images/smilies/bduh.gif)

Gold went up during the depression. It's a myth that deflation always causes gold to drop in value. The uncertainty that accompanies any great economic sea change, encourages people to flee to safe havens. Check out the Aden sisters, see what they have to say.

Half gold, half cash--good idea. I can't think of a safer play with potential upside momentum.

-

threadbear - Expert

- Posts: 7577

- Joined: Sat 22 Jan 2005, 04:00:00

So I have some gold and silver, I have food stored away, now I should work on cash. I will just put a bit away each pay check.

So I have some gold and silver, I have food stored away, now I should work on cash. I will just put a bit away each pay check.

![eusa_think [smilie=eusa_think.gif]](https://udev.peakoil.com/forums/images/smilies/eusa_think.gif)