Reuters: "World refiners are CLOGGED with oil"

Re: Reuters: "World refiners are CLOGGED with oil"

pstarr - Just as I've always suspected: you really are a "pussy" lover. LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Reuters: "World refiners are CLOGGED with oil"

Anyone who takes StarvingLion's rants seriously has their head up their doomer butt.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5064

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: Reuters: "World refiners are CLOGGED with oil"

$this->bbcode_second_pass_quote('ROCKMAN', 'C')og - "There is also an ideological side of doomerism." Not just cookers but "environmentallists" and cornucopians. Did you follow my long running battle with a variety of "environmentalists" that could not contain their excitement over President Obama's refusal to approve the Keystone XL permit. A great "victory" to save the climate. Eventually as oil sands production continued to increase they moved on to other "victories" like the Paris Accord. But I don't recall a single post here or an article in the MSM admitting the lack of the permit made no difference at all.

Lots of cornie examples as well as greenies who try to stretch reality to fitting their "hopes".

Lots of cornie examples as well as greenies who try to stretch reality to fitting their "hopes".

There are also those whose ideological position revolves around the fact they derive their livelihood from the fossil fuel industry.

BOLD PREDICTIONS

-Billions are on the verge of starvation as the lockdown continues. (yoshua, 5/20/20)

HALL OF SHAME:

-Short welched on a bet and should be shunned.

-Frequent-flyers should not cry crocodile-tears over climate-change.

- asg70

- Permanently Banned

- Posts: 4289

- Joined: Sun 05 Feb 2017, 14:17:28

Re: Reuters: "World refiners are CLOGGED with oil"

$this->bbcode_second_pass_quote('kublikhan', 'A')nyone who takes StarvingLion's rants seriously has their head up their doomer butt.

Yes I would not be surprised to learn the StarvingLion lived in Colorado and was consuming large amounts of legal weed.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Reuters: "World refiners are CLOGGED with oil"

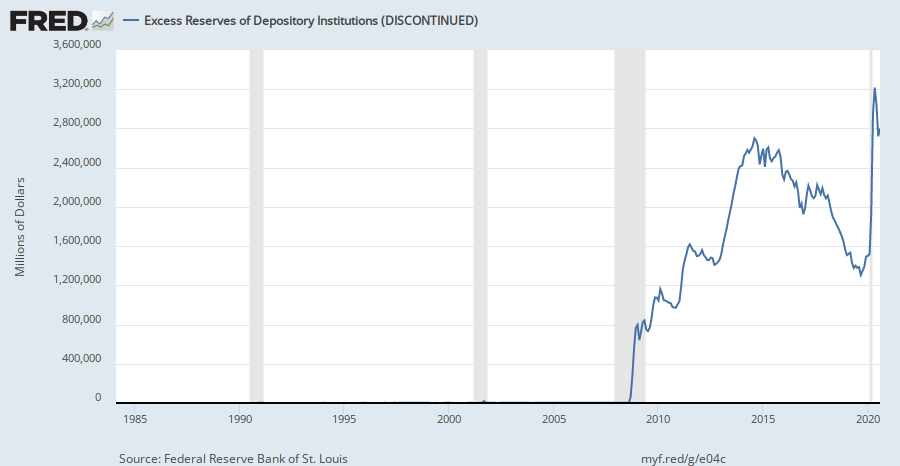

$this->bbcode_second_pass_quote('', 'W')hen the Fed's balance sheet will finally shrink, the current large amount of excess reserves will begin to adjust to a new reality. There are three distinct effects that could occur: monetary base contraction, the revival of the federal funds market and an increase in velocity of money.

For those who may still occasionally visit the late great planet earth:

http://greshams-law.com/2012/02/13/char ... 5-to-2012/

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: Reuters: "World refiners are CLOGGED with oil"

That article is 5 years old short. Why don't you try looking at what the FED is saying today:

$this->bbcode_second_pass_quote('', 'F')ederal Reserve officials said the shedding of the $4.5 trillion in bonds the central bank is holding on its balance sheet will begin this year. Unwinding the balance sheet is significant both because of its sheer size and the impact it could have on markets.

Federal Reserve wants to start unwinding the $4.5 trillion in bonds on its balance sheet this year$this->bbcode_second_pass_quote('', 'F')ederal Reserve officials said the shedding of the $4.5 trillion in bonds the central bank is holding on its balance sheet will begin this year. Unwinding the balance sheet is significant both because of its sheer size and the impact it could have on markets.

$this->bbcode_second_pass_quote('', 'T')he Federal Reserve is actively considering a profound change in US monetary policy, in effect the reversal of quantitative easing (QE). In its March meeting, the FOMC discussed its strategy for the future run down of its balance sheet, and said that further debate would take place in upcoming meetings.

The FOMC has already concluded that “a change in the Committee’s reinvestment policy would likely be appropriate later this year.” Investors are therefore beginning to focus on the possible consequences of the reversal of QE on interest rates and the shape of the yield curve.

The FOMC has already outlined some of the principles that will guide the shrinkage of its balance sheet. The central bank’s portfolio of treasuries and mortgage backed securities will almost certainly be run down in a gradual and predictable manner, allowing bonds to run off as they mature, instead of reinvesting the proceeds in more bonds. There will be no direct sales of bonds into the open market.

Some of the effects of balance sheet normalisation may already be in the market. According to to New York Fed’s Primary Dealer Survey in March, market participants already expect the run down to start in mid 2018, when the Fed funds rate has reached 1.63 per cent.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5064

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois