4% of GDP is $80 oil = Recession

Re: 4% of GDP is $80 oil = Recession

$this->bbcode_second_pass_quote('dorlomin', '

')Were smallpox girl around I may have been able to elicit a conversation on human cognition based on this... actualy it is probibly worth a thread of its own in the psychology forum.

')Were smallpox girl around I may have been able to elicit a conversation on human cognition based on this... actualy it is probibly worth a thread of its own in the psychology forum.

I call myself a "myriadist" because I tend to see things as a bunch of different things instead of one thing or another (not a monist, not a dualist), so I tend to see things as a result of multiple causes, usually, myself.

I think seeing things as one thing may be cultural, not innately human. I suspect those researchers were only looking at civilized humans, and not at non-civilized peoples also.

- Ludi

Re: 4% of GDP is $80 oil = Recession

$this->bbcode_second_pass_quote('Ludi', 'I') think seeing things as one thing may be cultural, not innately human. I suspect those researchers were only looking at civilized humans, and not at non-civilized peoples also.

True, it is most likely a product of reducing information to numbers. We can process vast amounts of contraditory sensory data in a pretty 'fuzzy' means but it is much harder when we have already reduced the data to numbers. This is probibly where people start becoming myopic.

-

dorlomin - Light Sweet Crude

- Posts: 5193

- Joined: Sun 05 Aug 2007, 03:00:00

Re: 4% of GDP is $80 oil = Recession

$this->bbcode_second_pass_quote('pstarr', '

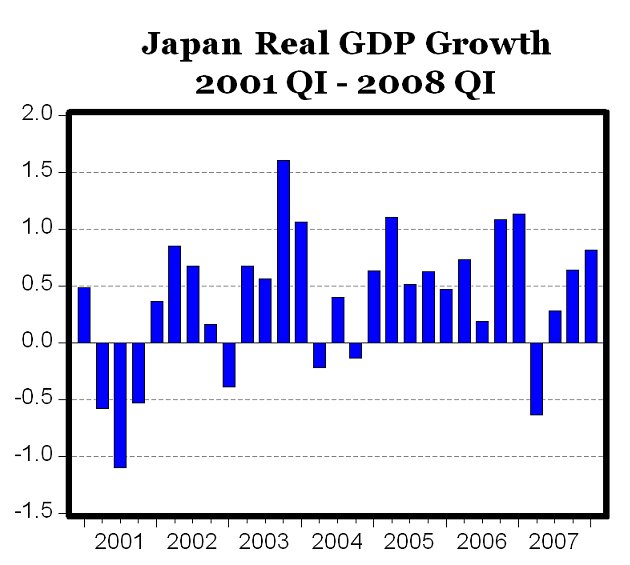

')you can prattle on about the US housing crisis in Cleveland, but you have yet to explain what caused the German and Japanese recessions that predated it.

')you can prattle on about the US housing crisis in Cleveland, but you have yet to explain what caused the German and Japanese recessions that predated it.

You are using the equivalent of the"global warming on mars" argument to show that AGW is caused by sunspots.

$this->bbcode_second_pass_quote('pstarr', '

')How much clearer can we get. Too much GDP/$$ going to energy, not enough to salaries BOING: people are strapped. Can't pay mortgages. Is this so complex? Are are you a troll?

My point is that the pain of $4 gas was mostly psychological. People whined and complained about it, but were pretty much able to keep functioning by driving less, bagging a lunch, etc...

What people could not do, however, was adapt their finances to the huge jump in their mortgages with the ARM resets. That is what put people into tent cities and what destroyed the economy.

You have no sense of proportion in measuring the impact of gas on home finances vs. mortgage resets.

That being said, I do think _sustained_ $150 oil would have destroyed the airline industry and who knows what else. But it never got that far. When you look at the damage the oil spike caused, most of it was at the $100-120 pricepoint.

- mos6507