THE Sugar Thread (merged)

Invest in plantations and sugar - says Soros partner

$this->bbcode_second_pass_quote('', '[')b]Sugar, Not Oil or Stocks, May Be Best Investment (Update1)

March 20 (Bloomberg) -- Sugar, the best-performing commodity the past 12 months, may beat bonds, stocks and oil for a second straight year.

``Sugar could quadruple from here and it would still be below its all-time high,'' said former George Soros partner James Rogers, 63, who founded Lausanne, Switzerland-based Diapason Commodities Management SA, which oversees $3.5 billion. ``The rally hasn't even started yet. And the fundamentals are changing dramatically in a positive way.''

Prices are soaring as record gasoline costs prompt Brazil, the world's biggest sugar producer, to devote more than half of its crop to ethanol production to meet a goal of eliminating gas-fueled cars in four years. A drought in Thailand, the second-biggest exporter, and a 50 percent rise in Chinese sugar demand the past decade are compounding the supply squeeze.

`

March 20 (Bloomberg) -- Sugar, the best-performing commodity the past 12 months, may beat bonds, stocks and oil for a second straight year.

``Sugar could quadruple from here and it would still be below its all-time high,'' said former George Soros partner James Rogers, 63, who founded Lausanne, Switzerland-based Diapason Commodities Management SA, which oversees $3.5 billion. ``The rally hasn't even started yet. And the fundamentals are changing dramatically in a positive way.''

Prices are soaring as record gasoline costs prompt Brazil, the world's biggest sugar producer, to devote more than half of its crop to ethanol production to meet a goal of eliminating gas-fueled cars in four years. A drought in Thailand, the second-biggest exporter, and a 50 percent rise in Chinese sugar demand the past decade are compounding the supply squeeze.

`

Link to the article

This is exciting news, even big people like Soros (partners) are waking up to the biofuels future.

Not only sugar is up spectacularly, virtuall all tropical plantation indexes are very bullish. Both the Singapore Straight Times Plantation Index and the Kuala Lumpur Plantation Index gained 35% last year, on biofuels.

Troughout 2005, plantation stocks were some of the best performing on the Singapore exchange:

Biodiesel fuels Asia plantation stocks

$this->bbcode_second_pass_quote('', '

')Meanwhile, on Bursa Malaysia Bhd, the Kuala Lumpur Plantation Index has far outpaced the Kuala Lumpur Composite Index (KLCI).

On the 40-counter Kuala Lumpur Plantation Index, PPB Oil Palms Bhd gave the best return at 42.2 per cent followed by Asiatic Development Bhd (28 per cent), NPC Resources Bhd (27 per cent), United Plantations Bhd (26 per cent), IOI Corp Bhd (25 per cent) and Golden Hope Bhd (17 per cent).

I'm no expert, but I think investing in plantations is a great thing to do, and there's still some time to do so. Interesting plantation companies are those that own not only oil palm, but rubber as well. Natural rubber will become a hot commodity too.

Just remember this simple fact: a barrel of sugar cane ethanol costs US$35 today, a barrel of oil palm costs US$ 45. You have US$20 to play with! So a huge amount of these commodities is going to be converted into biofuels - as long as they're cheaper than petroleum - and that's going to be so for a long time. All the while, they're being demanded by food markets, increasing the pressure and their upward trend.

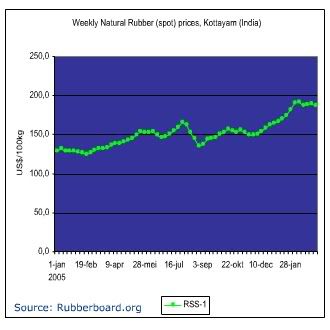

Rubber's up more than 30% on a year basis.

Last edited by lorenzo on Tue 21 Mar 2006, 11:25:11, edited 1 time in total.

-

lorenzo - Intermediate Crude

- Posts: 2184

- Joined: Sat 01 Jan 2005, 04:00:00

Re: Invest in plantations and sugar - says Soros partner

How do you invest in a plantation index?

-

Dukat_Reloaded - Tar Sands

- Posts: 953

- Joined: Sun 31 Jul 2005, 03:00:00

Re: Invest in plantations and sugar - says Soros partner

I agree with the synopsis, but I am wondering what plays are available for an American investor?

-

Jellric - Lignite

- Posts: 316

- Joined: Tue 11 Oct 2005, 03:00:00

- Location: Southern USA

Re: Invest in plantations and sugar - says Soros partner

$this->bbcode_second_pass_quote('Dukat_Reloaded', 'H')ow do you invest in a plantation index?

You open an account on the Kuala Lumpur Stock Exchange http://www.klse.com.my/ and you start trading.

-

lorenzo - Intermediate Crude

- Posts: 2184

- Joined: Sat 01 Jan 2005, 04:00:00

Re: Invest in plantations and sugar - says Soros partner

$this->bbcode_second_pass_quote('', 'I') am wondering what plays are available for an American investor?

Easy, just do what Jim Rogers did: buy up a bunch of sugar plantations. Oh wait, that's step two. Step one: get a billion dollars.

I'm not sure how seriously to take Rogers' advice. He bought up sugar plantations while his employer, Berkshire Hathaway, was heavily invested in Coca Cola. So gains in Coke meant more sugar profits. That's precisely the kind of serendipitous back-door relationship that scares me about mutual funds. How do you ever know that the management isn't just trying to invest your money in companies in a way that benefits their personal investments? If I buy Jim Rogers' Diapason Commodities Management fund, is my investment leveraged to benefit Rogers more than it benefits me?

It's hard to know.

-

Pique - Wood

- Posts: 25

- Joined: Thu 09 Mar 2006, 04:00:00