THE Silver & Gold Thread (merged) Pt. 1

Re: THE Silver & Gold Thread (merged)

')What happens when Saudi Arabia, "the latest BRICS entrant", demands Gold in exchange for it's oil? When Russia demands the same for it's Gas and fertilizer?

Good questions. I don't know the answers myself. But I do know that nobody on the planet is going to care what Australia thinks about it. And Australia doesn't care what the local neoNazi club thinks. Just make sure you boys use condoms. Now go back to being impotent and we promise not to invade you with a platoon of Marines and take away your entire nations supply of oil...otherwise known as a single counties worth of production in a single US state somewhere.

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: THE Silver & Gold Thread (merged)

')

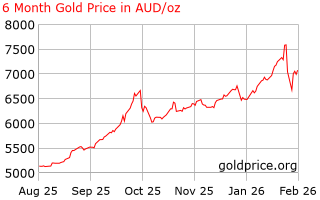

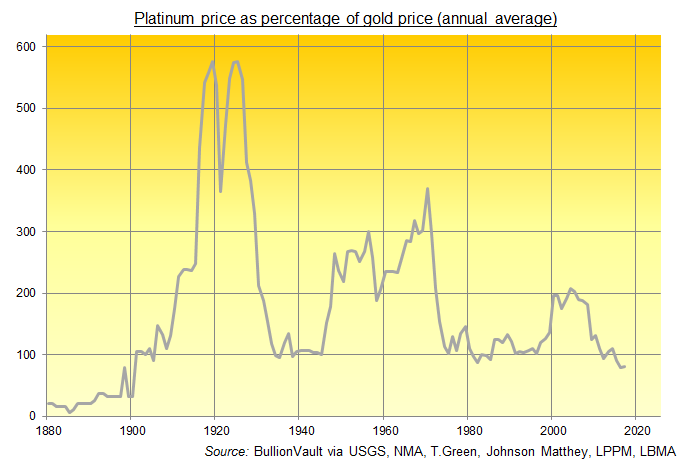

Just confirms what many have already known, that China is loading up on Gold in preparation for the $US collapse as the world reserve. Russia, one the leading Gold producers simply keeps it's own production to achieve the same ends. While people in the WEST load up on $US based paper/Digital assets, believing them to be the secret to future prosperity, the East/BRICS nations are preparing for what always happens, a switch to a Gold backed international monetary system.

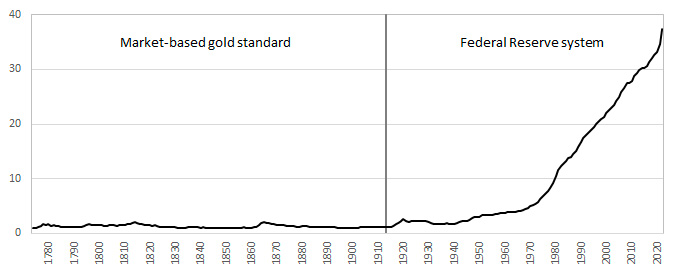

World GDP has grown well beyond the point where we could have gold backed currencies.

- yellowcanoe

- Tar Sands

- Posts: 965

- Joined: Fri 15 Nov 2013, 14:42:27

- Location: Ottawa, Canada

Re: THE Silver & Gold Thread (merged)

That is if you calculate it as we do now, not 50 years ago before they added Debt; insurance costs, rabid share appreciation, etc etc. Finance, it used to grease the wheels of industry, now it is industry and the GDP is now just a measure of money shuffling

$this->bbcode_second_pass_quote('', ' ')business spending on fixed assets such as land, buildings and equipment, plus investment in unsold inventory; also includes purchases of homes by consumers.

is one opinion on the web, but this doesn't include all the rest. GDP is simply a statistical lie. If it was reset, or... all the borrowing stopped, it would plummet!

But ignoring all that Gold could quite easily be used as backing, it just a matter of repricing it. Like in 1933 when Roosevelt changed the statutory price from $20.67 per troy ounce to $35. Of course the government stole it all off the the majority of people first

In typical government fashion.

In typical government fashion. But we're talking about the BRICS, not the corrupt West. I can't see the west getting on board, they have very little Gold.

$this->bbcode_second_pass_quote('', 'T')his initiative is a bold move aimed at reducing reliance on the U.S. dollar, which has long dominated global trade and reserves. By leveraging their substantial gold reserves and diverse natural resources, the BRICS countries aim to provide a more stable, asset-backed alternative to traditional fiat currencies.11 Oct 2024

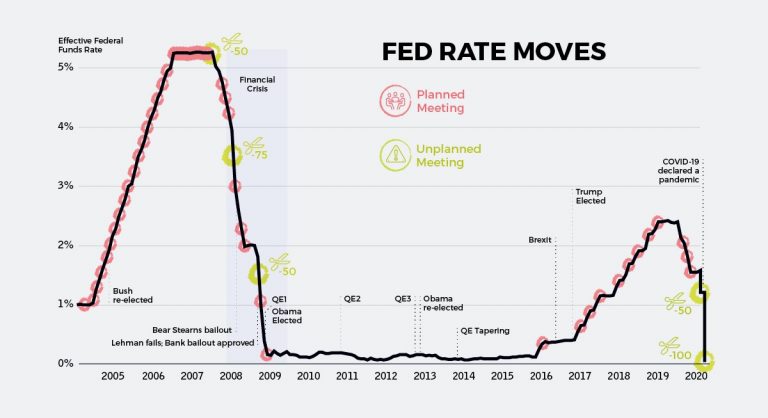

Of course it's all hush hush, just like the 1933 theft and repricing of Gold was. You'll find out when you wake up to it in the news feeds. Why did it happen in 1933? Because of the debt of course, debts were so high no one trusted anyone to repay in real value. The pound was the reserve then, on it's way out as far as international trade was concerned.

$this->bbcode_second_pass_quote('', 'T')he United Kingdom's pound sterling was the primary reserve currency of much of the world in the 19th century and first half of the 20th century. That status ended when the UK almost bankrupted itself fighting World War I and World War II and its place was taken by the United States dollar.

Imagine that. If you as an american company wanted to trade with overseas nations you had to come up with British pounds. Because that's what the world trusted, Not the $US. And eventually neither! Just Gold.