THE Silver & Gold Thread (merged) Pt. 1

Re: Is gold and silver worth investing in?

I think most people say that you should put 10% of your assets in gold and silver. I like silver better, because it's going to more marketable when things start to happen. I like what is called "junk silver", which is pre-65 US or pre 1968 Canandian silver coins. US are 90%, and Canadian are 80% silver. It sounds complicated, but it's pretty easy to figure out what to pay for coins if you check out this website: http://www.coinflation.com

Scroll down for silver coin values. You can find junk silver in most coin shops for a little more than the price you find on Coinflation. It consists of dimes, quarters and half dollars. Silver dollars usually have a little extra "numismatic value" or collectors value.

The trick is to catch silver on the downside and ride it up, if it ever goes up again. Good luck with it!

Scroll down for silver coin values. You can find junk silver in most coin shops for a little more than the price you find on Coinflation. It consists of dimes, quarters and half dollars. Silver dollars usually have a little extra "numismatic value" or collectors value.

The trick is to catch silver on the downside and ride it up, if it ever goes up again. Good luck with it!

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Is gold and silver worth investing in?

Check out the Canadian silver values. These make it really easy to buy. A dollar for a dime, $2.50 for a quarter and $5.00 for a pre-68 fifty cent piece. How hard is that? 10 times face value.

http://www.coinflation.com/canada/

http://www.coinflation.com/canada/

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Is gold and silver worth investing in?

Gold and silver are NOT investing. They are a reset switch protection. If you use the word "investing" you are talking within the current working system, making or losing money based upon price; and for that purpose, you live in a country where any random citizen can deposit a little money in a cash basis trading account and start direct investing.

The point of gold and silver, is that if the idiots in charge take their stupidity to the max and trade nukes, or crash the entire financial system, or go to war with Mexico, or find space aliens and start shooting at them; when its all over, if you're still alive, you have a small, portable package of tradable objects that almost all humans have recognized as a store of value for as long as humans have known what refined metal was. For whatever reason, we generally LIKE gold and silver; and even in a post civilization hell, you'll find someone that will trade you some dried meat or a sack of grain for an ounce of silver... and thus, they'll always be tradable for some object of immediate or productive use.

If you have some, do not think of their value in $; ignore it. Put them in a safe somewhere hidden and forget they exist. They don't exist to pay your next vehicle down payment; they exist to buy a sack of wheat at a moment when you are really going to want that sack of wheat. With any luck, you'll never use them, pass them on to your kids, and they'll use them to buy some stupid electronic toy. LOL. THAT would be the ultimate success in my book.

The point of gold and silver, is that if the idiots in charge take their stupidity to the max and trade nukes, or crash the entire financial system, or go to war with Mexico, or find space aliens and start shooting at them; when its all over, if you're still alive, you have a small, portable package of tradable objects that almost all humans have recognized as a store of value for as long as humans have known what refined metal was. For whatever reason, we generally LIKE gold and silver; and even in a post civilization hell, you'll find someone that will trade you some dried meat or a sack of grain for an ounce of silver... and thus, they'll always be tradable for some object of immediate or productive use.

If you have some, do not think of their value in $; ignore it. Put them in a safe somewhere hidden and forget they exist. They don't exist to pay your next vehicle down payment; they exist to buy a sack of wheat at a moment when you are really going to want that sack of wheat. With any luck, you'll never use them, pass them on to your kids, and they'll use them to buy some stupid electronic toy. LOL. THAT would be the ultimate success in my book.

Yes we are, as we are,

And so shall we remain,

Until the end.

And so shall we remain,

Until the end.

- AgentR11

- Light Sweet Crude

- Posts: 6589

- Joined: Tue 22 Mar 2011, 09:15:51

- Location: East Texas

Re: Is gold and silver worth investing in?

I agree with you, but I also think that silver could be useful before things go really crackerdog. We live in a slowly collapsing world, so any kind of thing we can do to preserve our ability to survive in the future is great. In the past 50-100 years it was enough to pile up paper assets. These paper assets were used as we got older for the necessities of life. I think of it as a big warehouse where all you need is stored. We all pile up paper chits which we think will be redeemable when we need things. Unfortunately we aren't thinking that the warehouse might not have all we need when it's time to turn these chits in. The value of the chits might go down as well. Gold and silver shouldn't go down in terms of what they can buy. An example is that a gallon of gas in 1964 cost about a silver quarter. Right now a 1964 silver quarter is worth about $2.87, which turns out to be the price of a gallon of gas around here.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Is gold and silver worth investing in?

$this->bbcode_second_pass_quote('Keith_McClary', '')$this->bbcode_second_pass_quote('GregT', 'T')here is no such thing as hyperinflation, and the peak oil theory has been debunked.

Yah, fiat currencies and oil are infinite.At least fiat currenc actually is, what is your problem?

- Ulenspiegel

- Lignite

- Posts: 260

- Joined: Thu 04 Jul 2013, 03:15:29

Re: Is gold and silver worth investing in?

Interesting, I looked up metal prices just recently, maybe for the first time ever. That was after I started thinking about the value of housing re: Piketty. My thinking is to downsize drastically and put away several forms of "cash." Here are my convoluted thoughts in the midst of reevaluating the wisdom of holding "wealth" (such as it is) is housing or switching to something else.

I'm pretty sure no one knows what happens in a big US crash. In the great depression the government "bought" up all the gold and made metal illegal to use as money or even to hold as savings. In '08 they used fiat currency as it is designed to be used and increased it's availabilty in order to revive a frozen credit market — yet to know if it was successful or not.

Inflation happens when there are too many dollars because either .gov mishandles things or because the economy is too hot, prices and wages are climbing too rapidly, the economy is expanding from increasing wages chasing too few products. Deflation happens when there are too few dollars because there is too little work, too little demand, too few dollars circulating — doesn't matter how many dollars there are under various mattresses, elevatored garages, offshore accounts, corporate coffers — all that matters is how many are circulating in and out of your hands. In a scenario where the economy is shrinking and people are scared, dollars become more valuable because people hang on to them.

That is the real danger, Weimar was isolated to one country when Germans were forced to make reparations and made to do it in something other than marks, as they traded for other currency (that still had value), the mark fell so they traded more and so it fell further and further. Global deflation will likely be the result of global de-growth, there will be no "other" currency.

Doomers and apocalyptic fantasizers have this idea that metal has some intrinsic value that is immutable. Fact is, when used as a currency it is just like any other, be it paper, sea shells or buffalo chips; it is only worth as much as the parties to the transaction decide it is worth - and therein lies the biggest problem.

Let's say it is the end of the world. You whip out your sack of hoarded pre-64 silver to buy some beans, toss a quarter out on the counter and the kid says, "Sorry, the beans are $5, not 25¢."

Or, you and I both want to buy our neighbor's wheelbarrow to bug-out to the Territories. I whip out a couple of Franklins and you whip out a handful of dimes. Honestly, which is he gonna want? Or you go to the friendly local money changer to redeem some gold for seashells and he tells you that everyone and their brother is selling gold these days so it's value is pretty well nil.

Beyond that, it doesn't make sense to me to buy a commodity at retail and sell it at wholesale, which is what happens buying and selling gold – if you're lucky. If you aren't lucky you buy high and sell low. Metals are a speculative bet, and "traders" bet on every conceivable thing in the world (including other bets) it is hard for me to believe they don't speculate on metals.

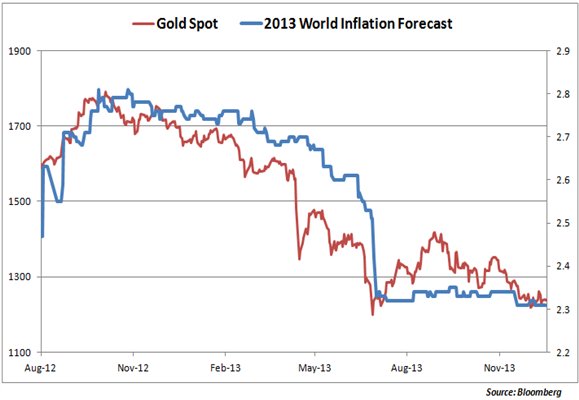

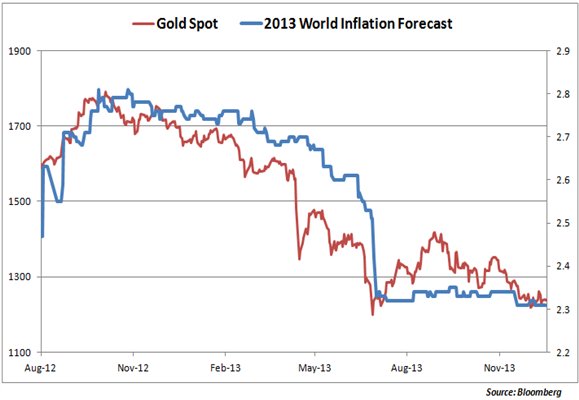

The great dollar apocalypse was 1970's thinking after Nixon took the dollar off gold completely. US has "debased" the currency terribly yet the US$ price of gold has fallen by 25% in the last couple of years, that's deflation.

But overall, the value of gold is directly linked to global inflation. If you think the global economy is going to boom and inflation is going to take off then buy gold and sunglasses, if you think something different is going to happen there are probably lots of things that will store value better.

I'm pretty sure no one knows what happens in a big US crash. In the great depression the government "bought" up all the gold and made metal illegal to use as money or even to hold as savings. In '08 they used fiat currency as it is designed to be used and increased it's availabilty in order to revive a frozen credit market — yet to know if it was successful or not.

Inflation happens when there are too many dollars because either .gov mishandles things or because the economy is too hot, prices and wages are climbing too rapidly, the economy is expanding from increasing wages chasing too few products. Deflation happens when there are too few dollars because there is too little work, too little demand, too few dollars circulating — doesn't matter how many dollars there are under various mattresses, elevatored garages, offshore accounts, corporate coffers — all that matters is how many are circulating in and out of your hands. In a scenario where the economy is shrinking and people are scared, dollars become more valuable because people hang on to them.

That is the real danger, Weimar was isolated to one country when Germans were forced to make reparations and made to do it in something other than marks, as they traded for other currency (that still had value), the mark fell so they traded more and so it fell further and further. Global deflation will likely be the result of global de-growth, there will be no "other" currency.

Doomers and apocalyptic fantasizers have this idea that metal has some intrinsic value that is immutable. Fact is, when used as a currency it is just like any other, be it paper, sea shells or buffalo chips; it is only worth as much as the parties to the transaction decide it is worth - and therein lies the biggest problem.

Let's say it is the end of the world. You whip out your sack of hoarded pre-64 silver to buy some beans, toss a quarter out on the counter and the kid says, "Sorry, the beans are $5, not 25¢."

Or, you and I both want to buy our neighbor's wheelbarrow to bug-out to the Territories. I whip out a couple of Franklins and you whip out a handful of dimes. Honestly, which is he gonna want? Or you go to the friendly local money changer to redeem some gold for seashells and he tells you that everyone and their brother is selling gold these days so it's value is pretty well nil.

Beyond that, it doesn't make sense to me to buy a commodity at retail and sell it at wholesale, which is what happens buying and selling gold – if you're lucky. If you aren't lucky you buy high and sell low. Metals are a speculative bet, and "traders" bet on every conceivable thing in the world (including other bets) it is hard for me to believe they don't speculate on metals.

The great dollar apocalypse was 1970's thinking after Nixon took the dollar off gold completely. US has "debased" the currency terribly yet the US$ price of gold has fallen by 25% in the last couple of years, that's deflation.

But overall, the value of gold is directly linked to global inflation. If you think the global economy is going to boom and inflation is going to take off then buy gold and sunglasses, if you think something different is going to happen there are probably lots of things that will store value better.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Is gold and silver worth investing in?

Great points Pops! I say we should move back to wampum. After all with the oceans acidifying sea shells are going to get rare.

The things that will destroy America are prosperity-at-any-price, peace-at-any-price, safety-first instead of duty-first, the love of soft living, and the get-rich-quick theory of life.

... Theodore Roosevelt

... Theodore Roosevelt

-

Lore - Fission

- Posts: 9021

- Joined: Fri 26 Aug 2005, 03:00:00

- Location: Fear Of A Blank Planet

Re: Is gold and silver worth investing in?

Why such short spans of time on the charts though? The gold I have was bought in the $200-$400 /oz range; silver was $4-$6 or something like that. Even still though, most of the examples you're using are in the presence of a working currency market; so of course gold or silver will be a very poor second in comparison. As long as people are performing transactions and paying taxes in a government managed currency; that currency will be far superior to the commodity with regards to trade.

The question arises, if there is no managed currency to use; that is when silver or gold can enable you to purchase that small piece of land or shop that you need to restart a life devastated by war or other calamity of the scale that kills nations. Its not a guarantee of course; there aren't even guarantees that some ten year old male won't just shoot you for amusement in such an event; but it does permit possibilities that would otherwise be unavailable.

To use an ag pov; say we're in the world where dollars and euros and pesos have no value because collapse has taken their managing bodies down into oblivion; but I still have x-odd acres to plant, and seed, so I put down 60 acres of corn, (say lowtech yield gives me 1500 bushels) plus my house garden (East Texas 1-2acre version of garden with lots of calorie yield). Well, the chance of being able to barter the production of my "money" crop efficiently is mediocre, but I bet I can get some silver for it; and I bet the local warlord will accept silver for the taxes, and I bet the local merchant Bob will accept silver from the warlord for goods and services. Its not efficient, its not scalable, but it will keep the warlord flush with rations, water, and repaired gear, it will keep the blacksmith in coal and recovered scrap; and it will keep the local warlord from viewing me as a pest to eliminate as opposed to an asset to own and keep alive. Eventually real, fiat money enables a local economy to resume; but silver and gold have always functioned as a store of value in extremis; long before countries even existed; a shiny bobble would get you a meal or some arrows made.

Traders and speculators are a different kettle of course; they do what they do; but unless you're putting big chunks of money in play, and trading very fast; you'll always be holding the short end of the stick...

The question arises, if there is no managed currency to use; that is when silver or gold can enable you to purchase that small piece of land or shop that you need to restart a life devastated by war or other calamity of the scale that kills nations. Its not a guarantee of course; there aren't even guarantees that some ten year old male won't just shoot you for amusement in such an event; but it does permit possibilities that would otherwise be unavailable.

To use an ag pov; say we're in the world where dollars and euros and pesos have no value because collapse has taken their managing bodies down into oblivion; but I still have x-odd acres to plant, and seed, so I put down 60 acres of corn, (say lowtech yield gives me 1500 bushels) plus my house garden (East Texas 1-2acre version of garden with lots of calorie yield). Well, the chance of being able to barter the production of my "money" crop efficiently is mediocre, but I bet I can get some silver for it; and I bet the local warlord will accept silver for the taxes, and I bet the local merchant Bob will accept silver from the warlord for goods and services. Its not efficient, its not scalable, but it will keep the warlord flush with rations, water, and repaired gear, it will keep the blacksmith in coal and recovered scrap; and it will keep the local warlord from viewing me as a pest to eliminate as opposed to an asset to own and keep alive. Eventually real, fiat money enables a local economy to resume; but silver and gold have always functioned as a store of value in extremis; long before countries even existed; a shiny bobble would get you a meal or some arrows made.

Traders and speculators are a different kettle of course; they do what they do; but unless you're putting big chunks of money in play, and trading very fast; you'll always be holding the short end of the stick...

Yes we are, as we are,

And so shall we remain,

Until the end.

And so shall we remain,

Until the end.

- AgentR11

- Light Sweet Crude

- Posts: 6589

- Joined: Tue 22 Mar 2011, 09:15:51

- Location: East Texas

Re: Is gold and silver worth investing in?

AR, I'm not arguing that floating fiat doesn't lose value over time. Contrary to popular opinion, that's a feature, not a bug or tptb would not be concerned that inflation is below target.

When you bought your gold a $300, you could probably have bought oil futures for $10 as well, right?

I guess my question is when does the currency market stop working?

Not many folks own gold or silver. This gold-bug article guesses certainly less than 10%, maybe only a couple. Can't make much of a market like that.

When you bought your gold a $300, you could probably have bought oil futures for $10 as well, right?

I guess my question is when does the currency market stop working?

Not many folks own gold or silver. This gold-bug article guesses certainly less than 10%, maybe only a couple. Can't make much of a market like that.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Is gold and silver worth investing in?

$this->bbcode_second_pass_quote('Pops', 'W')hen you bought your gold a $300, you could probably have bought oil futures for $10 as well, right?

I guess my question is when does the currency market stop working?

I guess my question is when does the currency market stop working?

It was oscillating in the 10-40 range across those years if I recall. $40 was considered an awesome price. As a payee as opposed to a payor, of course.

As to when it stops working. That would be the day when the Army guys don't show up at Fort Hood. Till then, USD is the coin of the realm and is superior in any and all respects to a commodity based trade.

$this->bbcode_second_pass_quote('', ' ')Can't make much of a market like that.

Enough of a market to avoid starvation is sufficient. People that think they'll be high on the hog because they have some gold or silver are delusional. The point is to have enough to be not dead.

Yes we are, as we are,

And so shall we remain,

Until the end.

And so shall we remain,

Until the end.

- AgentR11

- Light Sweet Crude

- Posts: 6589

- Joined: Tue 22 Mar 2011, 09:15:51

- Location: East Texas