by kublikhan » Wed 11 Sep 2024, 03:31:18

by kublikhan » Wed 11 Sep 2024, 03:31:18

I'm not surprised Zerohedge dumbs everything down to "Duuur, EV bad now VW suffer, duuur". But like most things in life things are not so simple. Take this little nugget of news for example:

$this->bbcode_second_pass_quote('', 'V')olkswagen announced on Thursday plans to invest 2.5 billion euros ($2.68 billion) in China to expand its production and innovation hub in the city of Hefei in Anhui Province.

Preparations are also being made for the production of the two Volkswagen brand models being developed together with Chinese partner XPENG to begin in 2026.

Ralf Brandstaetter, Volkswagen Group's management board member for China, said the Hefei site would help bring technologies to market around 30% faster as the carmaker boosts electric vehicle production there.

Volkswagen ceded its title of best-selling car brand in China to local EV manufacturer BYD in late 2022 and has announced a series of new models to electrify its portfolio in China as it battles to regain ground.

Volkswagen to invest $2.7 billion in Chinese production siteFor years VW was the #1 selling brand in China. Half of VW's profits came from China. Then the Chinese EV craze came along and the traditional automotive companies went "Meh" and continued to make and sell the more profitable ICE. Unfortunately for them, EVs and hybrids continue to grow in popularity in China while VW(and some other traditional automakers) continued to see their ICE market share in China slide. VW's market share in China nearly halved between 2017 and 2024 and BYD passed them as the biggest carmaker in China. China was a huge cash cow for VW. Now that cash cow is going away. And it seems if they want to compete in China, they have to play the EV game too. They didn't want to do this. EVs are expensive. Expensive R&D, retooling and new supply chains, expensive batteries, etc. But they are seeing one of their major markets slip from their grasp right before their eyes. They are a bit late to the EV party however. Tesla and Chinese start ups have years invested in EVs by this point.

As if that were not bad enough there was the European energy crisis. For years Germany relied on cheap Russian gas to keep it's economy humming. Then the energy crisis hit and energy prices sky rocketed. This hit German manufacturers like VW hard.

And of course there is the age old problem of workers in an advanced economy like Germany are much more expensive than the much cheaper workers in China. So they close factories in expensive Germany and open them in cheap China.

So VW has expensive workers vis a vis cheap Chinese rivals, rapidly falling market share as their ICE products fall out of favor in China, a surge in domestic energy costs, Chinese rivals threating to flood their domestic market with cheap imports, and on top of all that they have to spend big on getting some EV models out the door.

$this->bbcode_second_pass_quote('', 'S')ept 9, 2024 - The bombshell that Volkswagen is considering the first ever closure of its German factories has sparked a fresh debate about the company - and the country's - exposure and strategy towards China.

Last week, Volkswagen chief executive Oliver Blume said the group was considering closing a large vehicle plant and a component factory, amid stiff competition from Chinese rivals.

"The European automotive industry is in a very demanding and serious situation. The economic environment became even tougher, and new competitors are entering the European market," he said, while also pointing to Germany's comparative weakness as a manufacturing location.

For economists and analysts, it is the latest symptom of the rapid march of cutthroat competitors from China, at a time when European companies are struggling with rising energy costs associated with decoupling from Russia, and grappling with an increasingly volatile geopolitical picture.

Germany's economic success in the first two decades of the 21st century was built on three pillars: "cheap energy from Russia, an open global trading system and highly competitive industrial products".

"In the span of a few years, the first pillar has collapsed and the other two are showing deep cracks," he said.

"China has played an important role here. In the sectors Germany once dominated, from cars to machine tools, China has evolved into a formidable competitor. This has major implications for the German economy and employment."

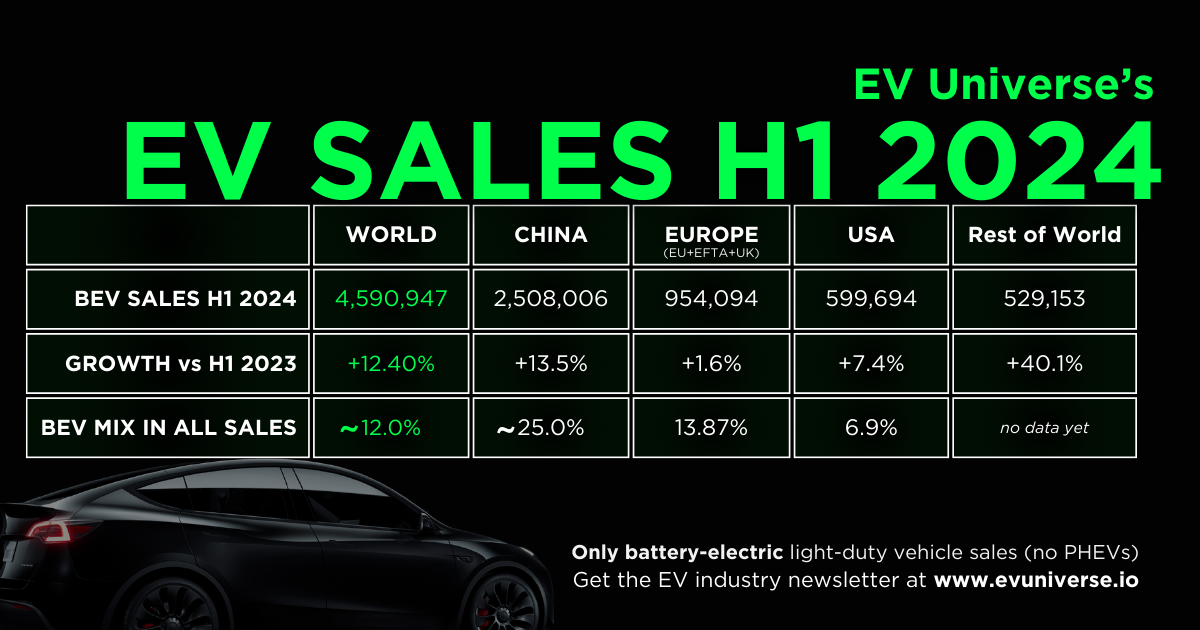

Between 2017 and 2024, Volkswagen sales in China fell from 4 million units to 2.5 million. Last year, it was overtaken by BYD as biggest selling carmaker in China, with Chinese companies' sales rocketing from 420,000 to 3.6 million in the same period.

Yet figures from the Bundesbank - Germany's central bank - reported by the Financial Times showed that German vehicle companies were doubling down on investments in China, even as sales dwindled.

In the first half of 2024, total German investment in the world's second economy was €7.3 billion (US$8 billion), compared with €6.5 billion (US$7.2 billion) for the whole of 2023.

At the same time, German machinery makers find that Chinese competitors are showing up in their home markets with products well below what local firms can afford to sell for.

"German carmakers are eager for the EU to maintain 'open' trade policies mainly, it seems, so that they can reduce costs by switching manufacturing into China. This probably benefits German carmakers more than it benefits the German economy." Chancellor Olaf Scholz, along with a steady stream of car industry executives, has railed against an EU move to slap anti-subsidy duties on Chinese EV imports.

These developments have provided further ammunition for those predicting a "second China shock" - a sequel to the first supposed shock of 20 years ago when China joined the World Trade Organization, ushering in a wave of outsourcing and a hollowing out of American manufacturing.

This time around, it is seen to be caused by exported industrial capacity in key hi-tech industries.

"The second China shock will play out differently around the world because for many economies, like Germany, it will be associated with the loss of export markets, not just a surge in imports."

"This process is already well under way. German exports to China as a share of German GDP have been falling for the last two to three years."

"I think it's really important to just add up all the profits that Volkswagen Group has had since 1998 - Volkswagen would not be who they are without the China market. Fifty per cent of their profits come from China, so it's not like they didn't gain anything from it. I feel like they want to play the victim, yet they've been counting their money for the last 35 years."

A Classic!

A Classic!