Peak Oil: A Love Story

Re: Peak Oil: A Love Story

$this->bbcode_second_pass_quote('Revi', '

') Peak Oil: A Love Story is a good way to get people who aren't that interested in peak oil thinking about it. It's an entertaining way of getting the message across. We hope the new film will be like that also.

') Peak Oil: A Love Story is a good way to get people who aren't that interested in peak oil thinking about it. It's an entertaining way of getting the message across. We hope the new film will be like that also.

Peak oil as entertainment works for me!

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak Oil: A Love Story

I just sent a copy to Pstarr. I would love to know what he thinks of it!

It's a little less than an hour and we are entering it into a bunch of film festivals.

So far it's been fun!

It's a little less than an hour and we are entering it into a bunch of film festivals.

So far it's been fun!

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Peak Oil: A Love Story

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Peak Oil: A Love Story

Revi - If you haven't ready my responses on the electric grid check of the details on the grid interconnections with the Canadians. I haven't researched it but there a hint that those need farms built by Canadians might be shipping much if not all the power out on the state to Canada. Might see if you can find info on long term electricity supply contracts. Much of Texas alt economics was justified with such fixed sales agreements.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Peak Oil: A Love Story

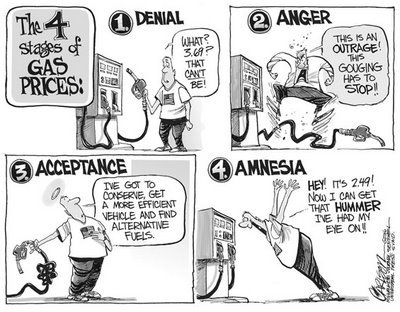

$this->bbcode_second_pass_quote('AdamB', '')$this->bbcode_second_pass_quote('pstarr', 'I')f you want to move the the public you have to either stroke or scare them. More rational science does not get through the numbskulls lol

The public isn't the only gang that isn't bothered much by rational science.

$this->bbcode_second_pass_quote('pstarr', '

')We would need a big giant special effects Hollywood blockbuster to awaken the herd to the threat of Peak oil. Unfortunately empty shelves and unemployment don't make for a good screenplay. I have tried.

Trust me.

Trust me.The threat of peak oil? Oh...you mean the one that happened a decade or so ago? All the conventional oil supply disappeared and whatever replaced it gave us glut, oversupply and lower prices. Like most consumers, I thought the ongoing transition had already handled it? Anyway...I don't think it worked very well because, well, most consumers fill up their autos once or twice a month can get a good look at what their costs for fuel are, more than a decade after all that conventional peak oil stuff and really, they don't appear all that afraid.

We'll see. It seems like the Net Energy paradigm is what is the current name for what we are talking about.

The amount of energy that is left after paying to get it out is what I'm talking about.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine