How much longer can this oil glut last?

Re: How much longer can this oil glut last?

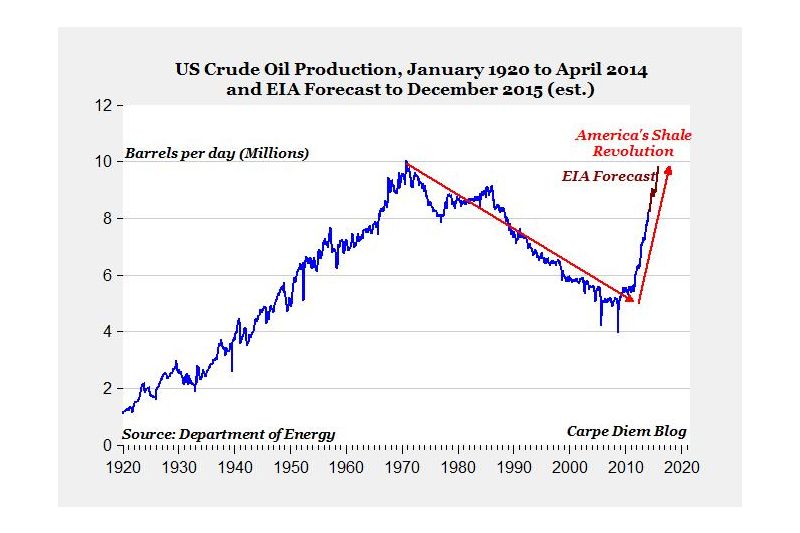

I think this glut can last a little while longer. The oil being produced in Texas has plateaued and North Dakota is declining slightly, and that was the oil that really lifted the world higher. We'll see, but it looks like it might have hit a top and is declining now:

http://peakoilbarrel.com/bakken-decembe ... g-decline/

http://peakoilbarrel.com/texas-oil-prod ... a-plateau/

http://peakoilbarrel.com/bakken-decembe ... g-decline/

http://peakoilbarrel.com/texas-oil-prod ... a-plateau/

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: How much longer can this oil glut last?

$this->bbcode_second_pass_quote('ennui2', '')$this->bbcode_second_pass_quote('AdamB', '

')And my efficiency is doing the same things I did yesterday, except with less energy.

And presto! increased discretionary. Woo Hoo! And you think this is BAD? It isn't.

')And my efficiency is doing the same things I did yesterday, except with less energy.

And presto! increased discretionary. Woo Hoo! And you think this is BAD? It isn't.

It seems Monte has decided to leave the site again, otherwise he'd have chimed in again that by not "wasting" energy we're putting millions out of work, like "NASCAR workers".

I'm not sure I would be thrilled with everyone taking what I'm saying today, and comparing to what I said a decade ago, and being able to show the 180 right to my face, or just how outright wrong I was. Some people can learn from their mistakes, but if all you want to do is repeat how right you have been all along, it would come in handy to have actually been right.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: How much longer can this oil glut last?

$this->bbcode_second_pass_quote('pstarr', '')$this->bbcode_second_pass_quote('AdamB', '')$this->bbcode_second_pass_quote('pstarr', '

')Money is also lost to the general economy when oil is purchased overseas; some $600 billion/year essentially disappeared when we were forced to purchase oil on the open international market at $100 barrel.

')Money is also lost to the general economy when oil is purchased overseas; some $600 billion/year essentially disappeared when we were forced to purchase oil on the open international market at $100 barrel.

And obviously it was worth it, otherwise the people coughing up the cash would have chosen to do something else.

No one chose that. Instead, they bought a Prius and became happy to not contribute to the problem as much. Plus saved themselves some of that coin, even if the Hummer drivers decided they preferred to pay more for their fuel.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26