by AdamB » Mon 22 Feb 2016, 17:04:06

by AdamB » Mon 22 Feb 2016, 17:04:06

$this->bbcode_second_pass_quote('pstarr', 'I') don't see how a book cover refutes OPEC's death? Nor your lie regarding SA oil production.

I checked. It wasn't a lie, anymore than you knew Jeffrey's profession, or that the chart I utilized came from the EIA, rather than the IEA.

Do you do this stuff on purpose, or do you really not know and just make stuff up?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB

- Volunteer

-

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

-

by Shaved Monkey » Mon 22 Feb 2016, 18:41:33

by Shaved Monkey » Mon 22 Feb 2016, 18:41:33

$this->bbcode_second_pass_quote('ennui2', 'S')o you think the last remaining vestige of Pravda (the USSR propaganda outlet) carries more weight than Reuters?

That's cherry-picking for you.

They both have their barrows to push neither is more legitimate than the other.

Ready to turn Zombies into WWOOFers

-

Shaved Monkey

- Intermediate Crude

-

- Posts: 2578

- Joined: Wed 30 Mar 2011, 01:43:28

-

by AdamB » Mon 22 Feb 2016, 21:35:56

by AdamB » Mon 22 Feb 2016, 21:35:56

$this->bbcode_second_pass_quote('pstarr', 'L')isten Adam, I got carried away with my claim that SA total production peaked. It has not.

And "carried away" is a euphemism for....making stuff up? And yes...WE already knew that SA hadn't peaked, you were the one getting "carried away" and not knowing it.

This isn't new information, it isn't as though some blog somewhere published yesterday afternoon that surprise surprise, the ELM was wrong because SA production had just squeaked out a tiny bit more, this stuff has been going on since last year.

$this->bbcode_second_pass_quote('pstarr', '

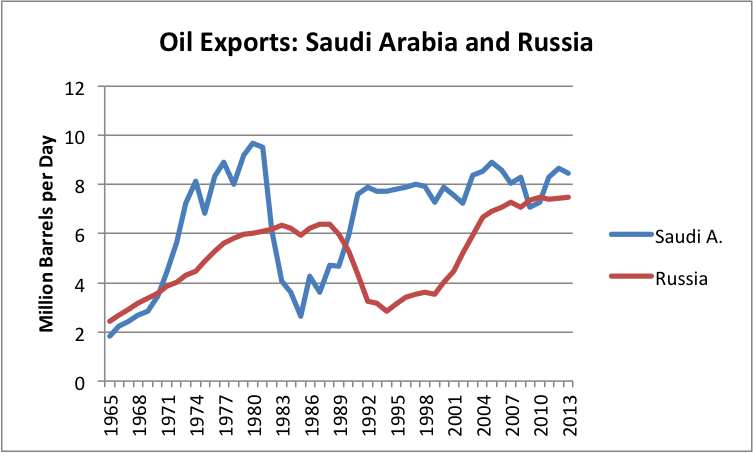

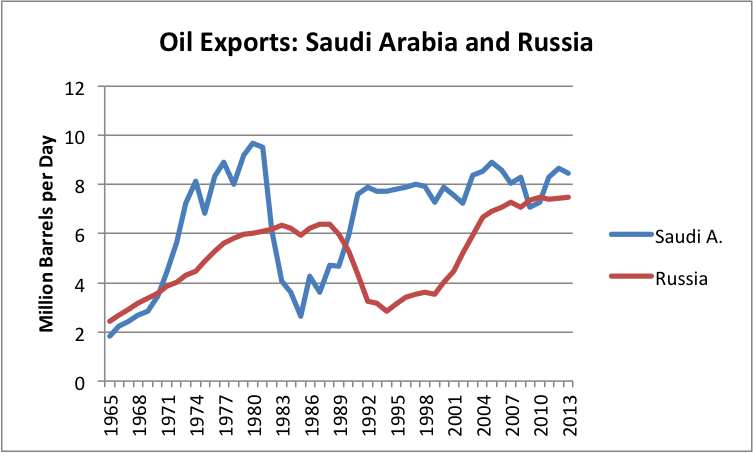

') But rather it's exports peaked, for most of a decade in the face of relentless high oil prices above $100 dollars/barrel.

Really? Looks like you should have checked this info as well, prior to getting "carried away" again. Saudi exports peaked back in the late 1970's....and I can promise you, oil wasn't $100/bbl then. So, you were saying...about getting "carried away"....?

So, Jeff has been all atwitter about Saudi peak exports back in 1978 or so, and claimed that by 2006 the world would be in the grip of a an export shock! And a decade later, when that didn't happen, you want us to pretend that the peak in Saudi exports was because of $100/bbl oil....back when they peaked in exports in 1978?

How does this work, exactly?

$this->bbcode_second_pass_quote('pstarr', '

')How would one expect the country to constrain its income at $30 (by reducing exports) when it was unable to do so at $100 dollars? That makes no sense.

Oh, I think it is obvious what doesn't make sense, but you are doing such a good job highlighting it, I don't think I need to rub it in.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

by ennui2 » Tue 23 Feb 2016, 03:12:10

by ennui2 » Tue 23 Feb 2016, 03:12:10

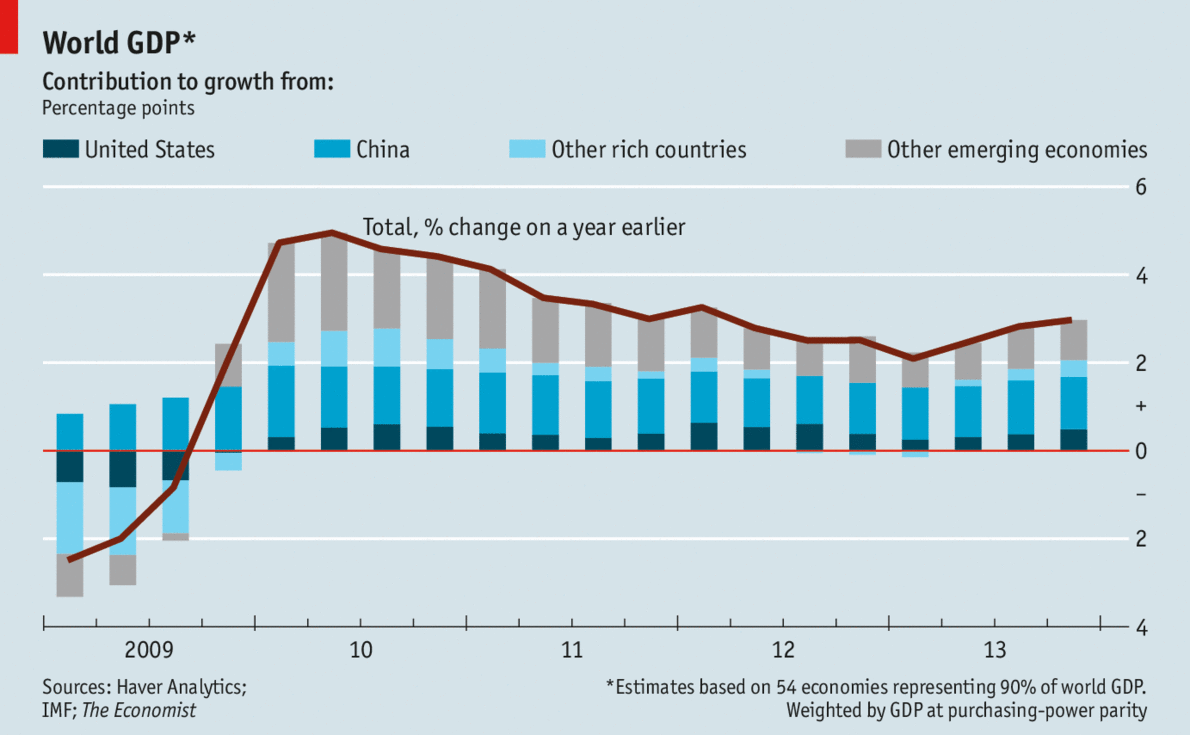

$this->bbcode_second_pass_quote('pstarr', '

')The Export Land Model simply states that oil exporting nations, enriched by sales, will consume more of their production at the expense of exports. This simple fact explains the current world Depression.

There you go trying to reclassify the cause of recessions again. ELM has nothing to do with what's going on with stock retrenchment and China. It has everything to do with markets overheating and what comes up must come down.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2

- Permanently Banned

-

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

-

by ennui2 » Tue 23 Feb 2016, 03:14:58

by ennui2 » Tue 23 Feb 2016, 03:14:58

$this->bbcode_second_pass_quote('Shaved Monkey', '')$this->bbcode_second_pass_quote('ennui2', 'S')o you think the last remaining vestige of Pravda (the USSR propaganda outlet) carries more weight than Reuters?

That's cherry-picking for you.

They both have their barrows to push neither is more legitimate than the other.

Then why are you citing Pravda if you concede they are biased? Don't you think it would be in their best interest to pump up the idea of oil prices spiking?

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

by Tanada » Tue 23 Feb 2016, 13:19:24

by Tanada » Tue 23 Feb 2016, 13:19:24

$this->bbcode_second_pass_quote('pstarr', 'T')his is not an oil glut, rather it is an economic slowdown. Too much oil and money have essentially disappeared forever down the bore hole on energy-intensive oil production. I would be surprised if oil rebounds much higher than $40 for any appreciable length of time. That is still not enough to produce what is left in the ground. Much of that oil will remain in the ground forever.

Ever-increasing amounts of money continue to be lost daily to the general economy as oil companies are forced to buy back and squander their own oil on expensive energy-intensive operations like tight-shale, tar sands, and deep offshore GOM. Little gets multiplied in the general economy. This is the economic consequence of falling net-energy.

Money is also lost to the general economy when oil is purchased overseas; some $600 billion/year essentially disappeared when we were forced to purchase oil on the open international market at $100 barrel.

Economic slowdowns do not lead to large increases in world demand. Ignoring this fundamental reality will not make it go away.

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

by Tanada » Tue 23 Feb 2016, 15:01:33

by Tanada » Tue 23 Feb 2016, 15:01:33

$this->bbcode_second_pass_quote('pstarr', 'T')anada, if demand is so great why has the price of oil collapsed to $35? Shouldn't it be back to $100? Or $147? Is this a glut or demand destruction?

If Supply were not exceeding demand it might be, however world oil demand

1Q 2013 90.74 MM/bbl/d

1Q 2014 91.89 MM/bbl/d

1Q 2015 93.50 MM/bbl/d

1Q 2016 94.50 MM/bbl/d

IOW the world has consumed more oil every year for the last four year despite prices in 1Q 2013 and 1Q 2014 being in the $75/bbl-$90/bbl range.

There Is No Demand Destruction! That leaves the other side of the supply/demand equation, to wit supply. Price barring artificial factors like taxes is a relationship of supply available and the price at which that supply meets demand. As ROCKMAN has pointed out many times every barrel being offered for sale is finding a buyer at the current price. Reduce the number of barrels for sale or raise the demand to meet the supply at a higher price point and the price will go up until they are once again in balance at that new price.

If Russia tomorrow morning declared they would sell the same number of barrels of oil as they are selling today, but they require $40/bbl for every one of those barrels what would happen? I am asking you Pstarr, I want to know what you think would happen in that scenario. Remember they are not restricting supply at all, just requiring a fixed price for their supply.

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

by ennui2 » Tue 23 Feb 2016, 15:07:47

by ennui2 » Tue 23 Feb 2016, 15:07:47

$this->bbcode_second_pass_quote('pstarr', 'T')anada, if demand is so great why has the price of oil collapsed to $35? Shouldn't it be back to $100? Or $147? Is this a glut or demand destruction?

Hello? Hello? Anybody home? Huh? Think, McFly!

it's a glut

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2

- Permanently Banned

-

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

-

by AdamB » Tue 23 Feb 2016, 17:29:12

by AdamB » Tue 23 Feb 2016, 17:29:12

$this->bbcode_second_pass_quote('pstarr', '')$this->bbcode_second_pass_quote('AdamB', 'E')LM was wrong . . . Saudi exports peaked back in the late 1970's

How do you reconcile your two contrary statements. You agree that SA exports peaked in the 1970's . . . yet you consider ELM wrong. That makes no sense?

It does. Jeff didn't say that the decline in exports would be so slow that 35 years later, the amounts would be fairly close. He said it would cause the world an export crisis in 2006.

Here we are, a decade later, and there is no export crisis. Even more interesting, it came about because his assumption of bell shaped curves for decline didn't work either, in the case that matters most, right here in the US, the place used to prove the bell shaped curve.

Hubbert must be spinning in his grave, right, like a helicopter blade!

$this->bbcode_second_pass_quote('pstarr', '

')The Export Land Model simply states that oil exporting nations, enriched by sales, will consume more of their production at the expense of exports.

And assigned rates of how fast it happens. Which is why it didn't work for SA. For all it know, it didn't work anywhere, or only in countries that don't matter.

JD had this figured out like...a CENTURY ago....what appears to be holding up your understanding?

http://peakoildebunked.blogspot.com/200 ... gence.html$this->bbcode_second_pass_quote('pstarr', '

') This simple fact explains the current world Depression. We saw it in the US with the devistating stagflation in the 1970's, several years after its 1972 peak.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

by AdamB » Tue 23 Feb 2016, 17:35:51

by AdamB » Tue 23 Feb 2016, 17:35:51

$this->bbcode_second_pass_quote('pstarr', 'T')his is not an oil glut, rather it is an economic slowdown.

One minute it is a global depression, the next an economic slowdown. Pick one already, and please, CHECK first, before pretending that your getting "carried away" generates facts, as opposed to things that are exactly opposite of facts.

$this->bbcode_second_pass_quote('pstarr', '

') Too much oil and money have essentially disappeared forever down the bore hole on energy-intensive oil production. I would be surprised if oil rebounds much higher than $40 for any appreciable length of time. That is still not enough to produce what is left in the ground. Much of that oil will remain in the ground forever.

It might. Then again, you might just be carried away again.

$this->bbcode_second_pass_quote('pstarr', '

')Ever-increasing amounts of money continue to be lost daily to the general economy as oil companies are forced to buy back and squander their own oil on expensive energy-intensive operations like tight-shale, tar sands, and deep offshore GOM. Little gets multiplied in the general economy. This is the economic consequence of falling net-energy.

Now you are confusing energy with money? Seriously? So now when people become more efficient, it is falling net-energy. How does that work? When I run my household off less energy, I pay out less money. I now have MORE money to generate other kinds of economic activity, because of my increased efficiency. And my efficiency is doing the same things I did yesterday, except with less energy.

And presto! increased discretionary. Woo Hoo! And you think this is BAD? It isn't.

I recommend you insulate, bicycle, use natural gas instead of fuel oil, you too can benefit by increased efficiency.

$this->bbcode_second_pass_quote('pstarr', '

')Money is also lost to the general economy when oil is purchased overseas; some $600 billion/year essentially disappeared when we were forced to purchase oil on the open international market at $100 barrel.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

by ennui2 » Wed 24 Feb 2016, 12:28:40

by ennui2 » Wed 24 Feb 2016, 12:28:40

$this->bbcode_second_pass_quote('AdamB', '

')And my efficiency is doing the same things I did yesterday, except with less energy.

And presto! increased discretionary. Woo Hoo! And you think this is BAD? It isn't.

It seems Monte has decided to leave the site again, otherwise he'd have chimed in again that by not "wasting" energy we're putting millions out of work, like "NASCAR workers".

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2

- Permanently Banned

-

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

-