Bold Predictions about the Debt Ceiling

Re: Bold Predictions about the Debt Ceiling

Tax cut's for the wealthy an more jobs offshored?

The partisan bickering here is hilarious. As if there is some substantive difference between the core policies of either party (take out God, Guns, and Gays just for giggles).

Anyway VM and other Democrats who blame Bush for all the off-shoring, did you all forget about the CEO of GE, Jeffrey Immelt? The guy who Obama appointed as the 'jobs czar'

http://en.wikipedia.org/wiki/Jeffrey_R._Immelt

$this->bbcode_second_pass_quote('', 'I')n February 2009, Immelt was appointed as a member to the President's Economic Recovery Advisory Board to provide the president and his administration with advice and counsel in fixing America's economic downturn.[10]

On January 21, 2011, President Obama announced Immelt's appointment as chairman of his outside panel of economic advisers, succeeding former Federal Reserve chairman Paul Volcker.[11] The New York Times reported that Obama's appointment of Immelt was "another strong signal that he intends to make the White House more business-friendly."[11] Immelt will retain his post at G.E. while becoming "chairman of the Council on Jobs and Competitiveness, a newly named panel that President Obama is creating by executive order."[11]

Obama can sure pick the good ones:

http://en.wikipedia.org/wiki/Jeffrey_R._Immelt

$this->bbcode_second_pass_quote('', 'I')mmelt was named to Time magazine's 100 most influential people in the world in 2008.[5] He was also named one of the five worst Non-Financial-Crisis-Related CEOs of 2008 by the Free Enterprise Action Fund.[6] Since taking over, GE's stock has dropped nearly 60%.

How much does this guy make per year?

http://en.wikipedia.org/wiki/Jeffrey_R._Immelt

$this->bbcode_second_pass_quote('', 'A')s CEO of General Electric in 2007, Immelt earned a total compensation of $14,209,267, which included a base salary of $3,300,000, a cash bonus of $5,800,000, stocks granted of $4,713,000, and options granted of $0.

And with this week's announcement of GE moving its medical imaging products division to China, along with an additional $2 billion investment in 6 'customer innovation' centers, you have to wonder where this guy's loyalties lie.

http://articles.boston.com/2011-07-26/business/29817324_1_ge-healthcare-x-ray-business-china-last-year

$this->bbcode_second_pass_quote('', ' ') General Electric Co.’s health care unit, the world’s biggest maker of medical imaging machines, is moving the headquarters of its 115-year-old X-ray business to Beijing.

“A handful’’ of top managers will move to the Chinese capital and there won’t be any job cuts, said Anne LeGrand, general manager of X-ray for GE Healthcare. The headquarters will move from Wisconsin amid a broader plan to invest about $2 billion across China, including opening six “customer innovation’’ and development centers.

You'd think, based on partisan beliefs about a party's core values, that the Democratic President would have more of a man of the people to chair the Council on Jobs and Competitiveness.

Hence my contention that there is no substantive difference between the 2 parties -- their evolution has converged -- one is a whale and the other a fish -- they live in an ocean of debt and they subsist from the efforts of others.

They are effectively sponsored by the same people and while their rhetoric sounds different, they continue to follow the same destructive policies... even Pop's graphic showed how Obama hasn't attempted to repeal any of Bush's foolish policy implementations. Instead, he's basically continued them and in some cases accelerated them.

back on topic....

My prediction: nothing will change right away. The debt ceiling will be raised and the status quo will continue. As bad as that is for the future generations of Americans, that is what will happen.

There is no political will in DC to live within our means. From either party. Evidently they think we can borrow money infinitely or to borrow a metaphor from Karl Denninger, they believe in skittle shitting unicorns.

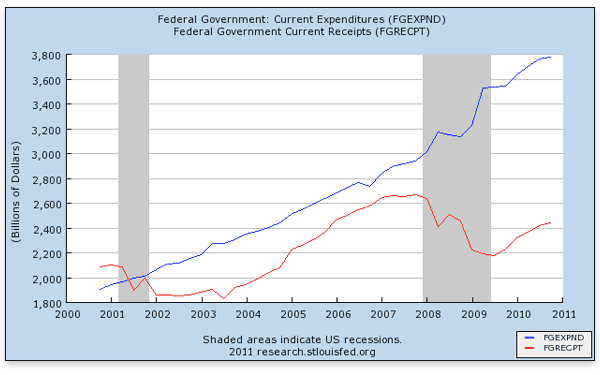

I close with this graph:

Under Bush, the 'conservative' the US gov annual budget went from $2T to $3.4T while revenues ranged from $2t to $2.6T. What on earth is conservative about spending more than you make? Consistently year after year? About almost doubling a government budget?

There are no fiscal conservatives in DC. If there were that graph wouldn't look like that.

Shooting the messenger is typical when you are incapable of arguing against them. -- Airline Pilot

- Roy

- Expert

- Posts: 1359

- Joined: Fri 18 Jun 2004, 03:00:00

- Location: Getting in touch with my Inner Redneck