The 2011 PO.com Oil Price Challenge

Re: The 2011 PO.com Oil Price Challenge

2011 already appears to me that it's going to be a real struggle, for a variety of reasons.

Let's see, looks like we start the year at $90ish.

Dollar plunges in spite of economy leveling off - $115ish.

Economy and dollar tank but economy goes first so back to $90 (the new normal) before the end of the year after a dance with $75.

High: $116

Low: $76

Close: $86

I feel comfortable with the way I think it'll play out, but not with my actual numbers.

Let's see, looks like we start the year at $90ish.

Dollar plunges in spite of economy leveling off - $115ish.

Economy and dollar tank but economy goes first so back to $90 (the new normal) before the end of the year after a dance with $75.

High: $116

Low: $76

Close: $86

I feel comfortable with the way I think it'll play out, but not with my actual numbers.

-

basil_hayden - Heavy Crude

- Posts: 1581

- Joined: Mon 08 Aug 2005, 03:00:00

- Location: CT, USA

Re: The 2011 PO.com Oil Price Challenge

2011 already appears to me that it's going to be a real struggle, for a variety of reasons.

Let's see, looks like we start the year at $90ish.

Dollar plunges in spite of economy leveling off - $115ish.

Economy and dollar tank but economy goes first so back to $90 (the new normal) before the end of the year after a dance with $75.

High: $116

Low: $76

Close: $86

I feel comfortable with the way I think it'll play out, but not with my actual numbers.

Let's see, looks like we start the year at $90ish.

Dollar plunges in spite of economy leveling off - $115ish.

Economy and dollar tank but economy goes first so back to $90 (the new normal) before the end of the year after a dance with $75.

High: $116

Low: $76

Close: $86

I feel comfortable with the way I think it'll play out, but not with my actual numbers.

-

basil_hayden - Heavy Crude

- Posts: 1581

- Joined: Mon 08 Aug 2005, 03:00:00

- Location: CT, USA

Re: The 2011 PO.com Oil Price Challenge

Most people seem to be betting conservatively after 2010's relatively stable pricing. Hmmm.

Low: 65

High: 145

Close: 135

Low: 65

High: 145

Close: 135

What we think, we become.

-

davep - Senior Moderator

- Posts: 4579

- Joined: Wed 21 Jun 2006, 03:00:00

- Location: Europe

Re: The 2011 PO.com Oil Price Challenge

Low 85

High 145

Close 130

And I predict a very serious geopolitical event triggering that high...prob massive terrorist attack...

High 145

Close 130

And I predict a very serious geopolitical event triggering that high...prob massive terrorist attack...

No Soup for You!!

-

thuja - Intermediate Crude

- Posts: 2202

- Joined: Sat 15 Oct 2005, 03:00:00

- Location: Portland, Oregon

Re: The 2011 PO.com Oil Price Challenge

Here are a few of the expert opinions I could find:

Russia Low: $81

Russia High: $81

Russia Close: $81

Russia raises 2011 oil price forecast to $81 per barrel

EIA Low: $84

EIA High: $89

EIA Close: $89

EIA Short Term Energy Outlook

Goldman Sachs Low: $91

Goldman Sachs High: $107

Goldman Sachs Close: $107

Goldman Sachs Crude Oil Prediction for 2011

JPMorgan Low: $92

JPMorgan High: $100

JPMorgan Close: $100

JP Morgan expects oil prices to exceed $100 per barrel

Russia Low: $81

Russia High: $81

Russia Close: $81

Russia raises 2011 oil price forecast to $81 per barrel

EIA Low: $84

EIA High: $89

EIA Close: $89

EIA Short Term Energy Outlook

Goldman Sachs Low: $91

Goldman Sachs High: $107

Goldman Sachs Close: $107

Goldman Sachs Crude Oil Prediction for 2011

JPMorgan Low: $92

JPMorgan High: $100

JPMorgan Close: $100

JP Morgan expects oil prices to exceed $100 per barrel

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5064

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: The 2011 PO.com Oil Price Challenge

High: $137.58

Low: $79.58

Close: $125.58

The world economy continues a sluggish overall recovery. Third world crude oil demand growth inexorably continues apace.

Our wonderful congress (both parties) continue to lead like absolute idiots and refuse to meaningfully attack deficits. Dollar holders are NOT amused.

Each of the above are somewhat bullish for crude pricing in 2011.

One good bout of overdoing it on economic optimism, and then pessimism leads to a fairly wide price range for 2011, but by yearend, the net bullish factors for crude oil prevail.

Low: $79.58

Close: $125.58

The world economy continues a sluggish overall recovery. Third world crude oil demand growth inexorably continues apace.

Our wonderful congress (both parties) continue to lead like absolute idiots and refuse to meaningfully attack deficits. Dollar holders are NOT amused.

Each of the above are somewhat bullish for crude pricing in 2011.

One good bout of overdoing it on economic optimism, and then pessimism leads to a fairly wide price range for 2011, but by yearend, the net bullish factors for crude oil prevail.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: The 2011 PO.com Oil Price Challenge

Low - $77

High - $165

Close - $135

Recovery becomes a dead word. It won't happen, and people will stop expecting any such thing.

Actual discussion begins in the US of downsizing, meaning states like Alaska, Hawaii, Arizona, and Texas might stand the risk of becoming their own countries.

Cities actross the US start going bankrupt, raising the unemployment rate above 13%.

Investments in renewable energies are the sole domain of countries like China and Japan.

2012 - The world population actually levels off, precipitated by famine, disease, lack of water, and lack of hope.

High - $165

Close - $135

Recovery becomes a dead word. It won't happen, and people will stop expecting any such thing.

Actual discussion begins in the US of downsizing, meaning states like Alaska, Hawaii, Arizona, and Texas might stand the risk of becoming their own countries.

Cities actross the US start going bankrupt, raising the unemployment rate above 13%.

Investments in renewable energies are the sole domain of countries like China and Japan.

2012 - The world population actually levels off, precipitated by famine, disease, lack of water, and lack of hope.

- Timo

Re: The 2011 PO.com Oil Price Challenge

Thought I'd better give it a go...

Yea, the new normal ain't what it used to be...

China is liking oil (+13% YoY in Nov)

Russia is the worlds largest exporter (not peaked yet!?) and is making nice sweetheart deals with China and India (china pipeline started flowing on Monday)

Depleting Mexico is no longer the number two source for US oil (they are still good for dope tho)

Venezuela (the new No. 2) capacity is deteriorating (-200k b/day from '08) and sales to China increasing too: +500kb/d - big dot...

KSA is in it's comfort zone and can't sustain more than it's doing now for more than a few months and I don't think it really wants to either.

Iraq is a flat line... Big Dot

Oh yea, the IEA admitted Conventional oil peaked a few years back and they missed it.

Kinda on the plus side is US reserves are up for the first time in years because higher prices make crappy oil (and "almost oil") fields profitable so they can move them to the positive side of the page - the down side of course is that sorta-oil is only viable at the higher price.

The record amount of oil in storage this summer (26 days) is being drawn down in record fashion (though still in contango) as people tired of the recession get into the holiday spirit of borrowing money - at $90 this is also a big dot.

So I'm not sure there is a whole lot of spare capacity available on short notice, after all, we are at the all time high production of liquids right now even with the crude price at $90 and China says it's going to keep gdp growth to ONLY 9% in 2011...

Speaking of the recession, layoffs have pruned some deadwood from the expense side of the corporations' ledgers making them look profitable again (not to mention the number of deadwood companies no longer around) and the last run-up in energy prices likewise helped shake out vulnerable homeowners/cardholders, so as far as demand in the US goes (and other Formerly Rich Worders), the 99ers will go out with a whimper as their UI checks run out.

On the flip side of positive demand might be muni defaults and layoffs, increasing "Starve the Beast" sentiment in US politics, perhaps Moodys downgrading US debt(!?), on top of the woes of the EU and elsewhere and of course there could be a Chinese RE bubble implosion or the Euro might collapse killing demand And driving up the value of the US$...

On balance I'm thinking there is room for the price to move up considerably and stay there for some time simply because of economic Darwinism - basically the people left in the economy right now are in relatively better shape compared to the population in '07 so they can stand a higher energy price. Oh yea and The Bernack is pumping out US$ as fast as he can...

Low $89.99 - January 3, 2011

High - $138.99 - July 25, 2011

Close $109.99

(+/- $50)

Yea, the new normal ain't what it used to be...

China is liking oil (+13% YoY in Nov)

Russia is the worlds largest exporter (not peaked yet!?) and is making nice sweetheart deals with China and India (china pipeline started flowing on Monday)

Depleting Mexico is no longer the number two source for US oil (they are still good for dope tho)

Venezuela (the new No. 2) capacity is deteriorating (-200k b/day from '08) and sales to China increasing too: +500kb/d - big dot...

KSA is in it's comfort zone and can't sustain more than it's doing now for more than a few months and I don't think it really wants to either.

Iraq is a flat line... Big Dot

Oh yea, the IEA admitted Conventional oil peaked a few years back and they missed it.

Kinda on the plus side is US reserves are up for the first time in years because higher prices make crappy oil (and "almost oil") fields profitable so they can move them to the positive side of the page - the down side of course is that sorta-oil is only viable at the higher price.

The record amount of oil in storage this summer (26 days) is being drawn down in record fashion (though still in contango) as people tired of the recession get into the holiday spirit of borrowing money - at $90 this is also a big dot.

So I'm not sure there is a whole lot of spare capacity available on short notice, after all, we are at the all time high production of liquids right now even with the crude price at $90 and China says it's going to keep gdp growth to ONLY 9% in 2011...

Speaking of the recession, layoffs have pruned some deadwood from the expense side of the corporations' ledgers making them look profitable again (not to mention the number of deadwood companies no longer around) and the last run-up in energy prices likewise helped shake out vulnerable homeowners/cardholders, so as far as demand in the US goes (and other Formerly Rich Worders), the 99ers will go out with a whimper as their UI checks run out.

On the flip side of positive demand might be muni defaults and layoffs, increasing "Starve the Beast" sentiment in US politics, perhaps Moodys downgrading US debt(!?), on top of the woes of the EU and elsewhere and of course there could be a Chinese RE bubble implosion or the Euro might collapse killing demand And driving up the value of the US$...

On balance I'm thinking there is room for the price to move up considerably and stay there for some time simply because of economic Darwinism - basically the people left in the economy right now are in relatively better shape compared to the population in '07 so they can stand a higher energy price. Oh yea and The Bernack is pumping out US$ as fast as he can...

Low $89.99 - January 3, 2011

High - $138.99 - July 25, 2011

Close $109.99

(+/- $50)

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('', 'v')tsnowedin 137 77 119

dolanbaker 124 82 115

sparky 150 80 122

obixman 135 82.5 130

Ibon 147 72 123

eXpat 140 90 120

SteinarN 112 79 102

TheDude 110 82 98

careinke 151 69.15 148

Carlhole 110 80

PeakOiler 115.49 79.65 110.11

Daniel_Plainview 99 83 88

ColossalContrarian 119 83 101

basil_hayden 116 76 86

davep 145 65 135

thuja 145 85 130

Outcast_Searcher 137.58 79.58 125.58

Timo 165 77 135

Pops 138.99 89.99 109.99

Current Avgs 131.4242105 79.57210526 116.5377778

dolanbaker 124 82 115

sparky 150 80 122

obixman 135 82.5 130

Ibon 147 72 123

eXpat 140 90 120

SteinarN 112 79 102

TheDude 110 82 98

careinke 151 69.15 148

Carlhole 110 80

PeakOiler 115.49 79.65 110.11

Daniel_Plainview 99 83 88

ColossalContrarian 119 83 101

basil_hayden 116 76 86

davep 145 65 135

thuja 145 85 130

Outcast_Searcher 137.58 79.58 125.58

Timo 165 77 135

Pops 138.99 89.99 109.99

Current Avgs 131.4242105 79.57210526 116.5377778

20 so far, I think we had about 40 this year, didn't we? Pretty good.

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

Re: The 2011 PO.com Oil Price Challenge

High $95

Low $80

Close $95

My theory is that demand destruction will kick in around $95/bbl and we will oscillate between $80-$95 with supply issues resulting in an increase by the end of the year.

Low $80

Close $95

My theory is that demand destruction will kick in around $95/bbl and we will oscillate between $80-$95 with supply issues resulting in an increase by the end of the year.

-

Cog - Fusion

- Posts: 13416

- Joined: Sat 17 May 2008, 03:00:00

- Location: Northern Kekistan

Re: The 2011 PO.com Oil Price Challenge

For your viewing pleasure, here's the high, low, close and average for the last few years.....

note that it is pretty unusual for the high to be at year end....Note also that this was a pretty orderly situation until about 2005.....

Do with this information what you will....

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

Re: The 2011 PO.com Oil Price Challenge

High: $137.52

Low: $74.68

Close: $135.14

Low: $74.68

Close: $135.14

"With man gone will there be hope for gorilla? With gorilla gone will there be hope for man?" --Ishmael by D. Quinn

-

biofuel13 - Tar Sands

- Posts: 606

- Joined: Wed 07 May 2008, 03:00:00

- Location: Chaska, MN

Re: The 2011 PO.com Oil Price Challenge

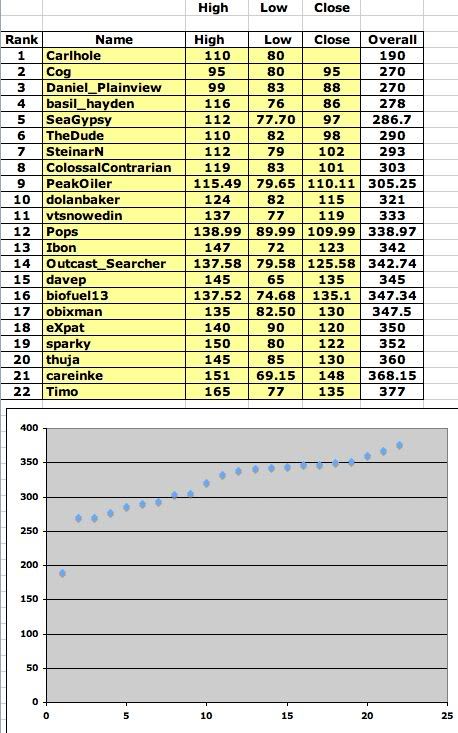

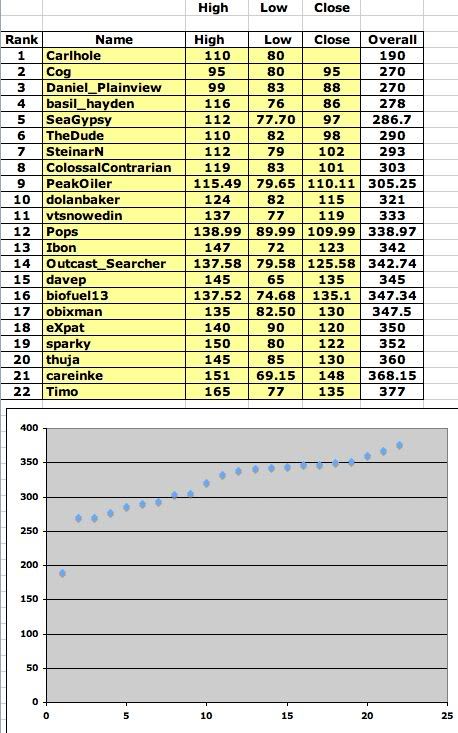

Here's my list so far. 22 players. (pupp55: I think you left out SeaGypsy's estimate in your last posted list.) Otherwise our averages agreed when I omitted SeaGypsy's guesses from the calculation.

The graph shown below the list is a plot of the number of players vs. the overall differences.

The list is sorted by Name, then "overall diff". (Oil values being zero at this time...)

Note the outlier point. That's Carlhole's point because he didn't give a close value, so his "overall diff" is the lowest. That will change once the oil price values are entered.

Carlhole: Please post a closing value.

The graph shown below the list is a plot of the number of players vs. the overall differences.

The list is sorted by Name, then "overall diff". (Oil values being zero at this time...)

Note the outlier point. That's Carlhole's point because he didn't give a close value, so his "overall diff" is the lowest. That will change once the oil price values are entered.

Carlhole: Please post a closing value.

Last edited by PeakOiler on Wed 22 Dec 2010, 17:56:31, edited 1 time in total.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

I think he's suggesting that the singularity will occur in 2011 and consequently oil will no longer need to be traded by midnight on Dec 31st. That's a pretty bold prediction

What we think, we become.

-

davep - Senior Moderator

- Posts: 4579

- Joined: Wed 21 Jun 2006, 03:00:00

- Location: Europe

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('ColossalContrarian', '[')s]High - 119[/s]

Low - 83

Close - 101

Low - 83

Close - 101

With QE2+ I don't think we'll go below $88 anytime soon.

Time for some revisions...

High - $137

Low - $88

Close - $119

I'll stick with the 119 number this year high,low, close, it doesn't matter. 119 just seems like a good number.

- ColossalContrarian

- Heavy Crude

- Posts: 1374

- Joined: Tue 20 Jun 2006, 03:00:00

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('davep', 'I') think he's suggesting that the singularity will occur in 2011 and consequently oil will no longer need to be traded by midnight on Dec 31st. That's a pretty bold prediction

Or maybe he's waiting for Santa to bring him that simulated cat brain so he can game the system top to bottom.

Or maybe he's waiting for Santa to bring him that simulated cat brain so he can game the system top to bottom.Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Re: The 2011 PO.com Oil Price Challenge

Averages for YOY, with 3 year moving averages:

$this->bbcode_second_pass_code('', '

Year Ave YOY 3YMA

1987 4.14

1988 -3.19

1989 3.66 1.54

1990 4.83 1.77

1991 -2.97 1.84

1992 -0.94 0.31

1993 -2.11 -2.01

1994 -1.26 -1.44

1995 1.25 -0.71

1996 3.67 1.22

1997 -1.5 1.14

1998 -6.16 -1.33

1999 4.81 -0.95

2000 11.04 3.23

2001 -4.36 3.83

2002 0.17 2.28

2003 5.01 0.27

2004 10.32 5.17

2005 15.05 10.13

2006 9.53 11.63

2007 6.3 10.29

2008 27.26 14.36

2009 -37.92 -1.45

2010 17.67 2.34

')

Looks almost neatly cyclic through 1999. Must try this out with a longer time series later on.

$this->bbcode_second_pass_code('', '

Year Ave YOY 3YMA

1987 4.14

1988 -3.19

1989 3.66 1.54

1990 4.83 1.77

1991 -2.97 1.84

1992 -0.94 0.31

1993 -2.11 -2.01

1994 -1.26 -1.44

1995 1.25 -0.71

1996 3.67 1.22

1997 -1.5 1.14

1998 -6.16 -1.33

1999 4.81 -0.95

2000 11.04 3.23

2001 -4.36 3.83

2002 0.17 2.28

2003 5.01 0.27

2004 10.32 5.17

2005 15.05 10.13

2006 9.53 11.63

2007 6.3 10.29

2008 27.26 14.36

2009 -37.92 -1.45

2010 17.67 2.34

')

Looks almost neatly cyclic through 1999. Must try this out with a longer time series later on.

Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Re: The 2011 PO.com Oil Price Challenge

Here's mine:

Low: $90

High: $110

Close: $110

BTW, are we adding in the "expert" opinion's to the chart this year(EIA, JPMorgan, etc.)?

Low: $90

High: $110

Close: $110

BTW, are we adding in the "expert" opinion's to the chart this year(EIA, JPMorgan, etc.)?

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5064

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('davep', 'I') think he's suggesting that the singularity will occur in 2011 and consequently oil will no longer need to be traded by midnight on Dec 31st. That's a pretty bold prediction

Yeah, I thought "what if it's the worst case scenario this year" and there are no futures prices at year's end!

Yeah, I thought "what if it's the worst case scenario this year" and there are no futures prices at year's end!Yikes! Sorry, all bets are off!

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas