Peak Oil: Beyond the Point of No Return

Re: Peak Oil: Beyond the Point of No Return

$this->bbcode_second_pass_quote('crapattack', '.')..I would argue that building all these hundreds of plants is completely irresponsible...

I just realized that we're coming up on the 20th anniversary of Chernobyl: April 26.

-

Zardoz - Expert

- Posts: 6323

- Joined: Fri 02 Dec 2005, 04:00:00

- Location: Oil-addicted Southern Californucopia

Re: Peak Oil: Beyond the Point of No Return

I think the issue with nuclear power isn't going to be are we going to leave derelict plants to kill in various places upon the earth? Of course we are. Somewhere man will do just that, no doubt brought on by desperation. The issue is actually, do you live near a nuclear plant?

I think man's best hope lies in developing more efficient electrical generators. Imagine the kind of advances in coiling or interfaces or superconductivity or whatever that deliver efficiencies on the level with the advances in computer processing power. Imagine a single wind turbine generating the same power that a whole field of them do now. Of course the oil based power structure doesn't like to think of it unless they own the rights.

Twenty years ago we needed to get rolling with this. You don't just need more efficient ways to produce electricity, you need systems that use electricity as well. America still doesn't have a high-speed rail network. The transmission lines could never handle the demand that full electric would place on them. And that is just America. By now it ought to be possible to travel Africa by means other than foot or Land Rover. Europe definitely holds the edge.

I think man's best hope lies in developing more efficient electrical generators. Imagine the kind of advances in coiling or interfaces or superconductivity or whatever that deliver efficiencies on the level with the advances in computer processing power. Imagine a single wind turbine generating the same power that a whole field of them do now. Of course the oil based power structure doesn't like to think of it unless they own the rights.

Twenty years ago we needed to get rolling with this. You don't just need more efficient ways to produce electricity, you need systems that use electricity as well. America still doesn't have a high-speed rail network. The transmission lines could never handle the demand that full electric would place on them. And that is just America. By now it ought to be possible to travel Africa by means other than foot or Land Rover. Europe definitely holds the edge.

-

evilgenius - Intermediate Crude

- Posts: 3730

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Peak Oil: Beyond the Point of No Return

Bump up.

A Saudi saying, "My father rode a camel. I drive a car. My son flies a jet-plane. His son will ride a camel."

-

MonteQuest - Expert

- Posts: 16593

- Joined: Mon 06 Sep 2004, 03:00:00

- Location: Westboro, MO

Re: Peak Oil: Beyond the Point of No Return

$this->bbcode_second_pass_quote('MonteQuest', 'O')ne of the things that has continuously puzzled me is that amongst the optimistic solutions posited to solve hydrocarbon depletion, I see an assumption that we have, or will have, the time to mitigate the consequences of peak oil. Mitigation, of any sort, will take time and a lot of money. And it will have to be applied world-wide, not just in the first world.

The only crash plan I see in place at the moment is one to escalate the debt beyond the comprehension of man.

If it takes decades to prepare for this, and we have just a few years at best by most accounts and predictions, why is it that people continue to think complex, technical, and highly capital intensive solutions can be developed and implemented literally overnight?

{edit: literally overnight is a hyperbole}

If peak oil is at our door, and in planning terms—tomorrow, are we not beyond the point of no return?

The only crash plan I see in place at the moment is one to escalate the debt beyond the comprehension of man.

If it takes decades to prepare for this, and we have just a few years at best by most accounts and predictions, why is it that people continue to think complex, technical, and highly capital intensive solutions can be developed and implemented literally overnight?

{edit: literally overnight is a hyperbole}

If peak oil is at our door, and in planning terms—tomorrow, are we not beyond the point of no return?

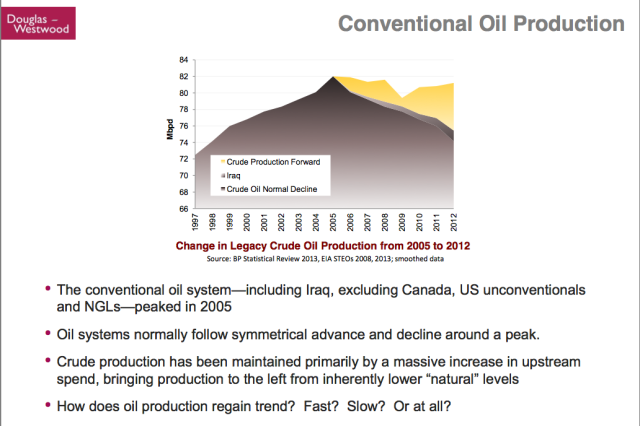

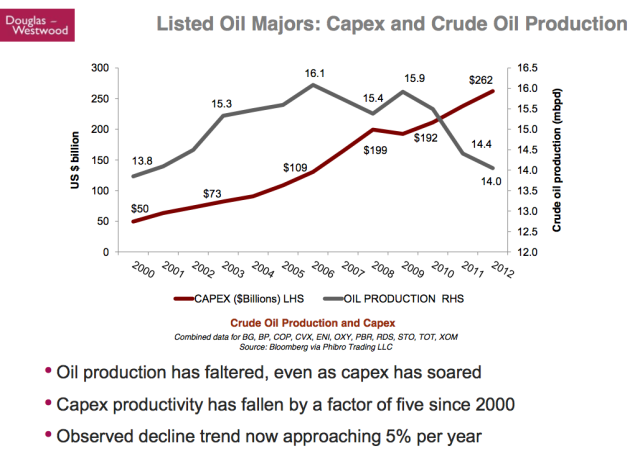

When I am feeling depressed I think just maybe MQ hit the nail on the head with this one, all we have done since 2005 is spend lots of money we didn't have to chase the Red Queen along the Plateau.

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4705

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: Peak Oil: Beyond the Point of No Return

$this->bbcode_second_pass_quote('pstarr', 'A')h Yes. The Late Great MQ. All bow before his Eloquence.

He swims in deeper seas. LOL

He swims in deeper seas. LOL

Naw....just had to take a break. But debt beyond human comprehension is still the water that floats the boat, is it not?

A Saudi saying, "My father rode a camel. I drive a car. My son flies a jet-plane. His son will ride a camel."

-

MonteQuest - Expert

- Posts: 16593

- Joined: Mon 06 Sep 2004, 03:00:00

- Location: Westboro, MO

Re: Peak Oil: Beyond the Point of No Return

Monte – Speaking of debt I was just discussing with my CFO the predicament the Eagle Ford players will be facing soon. Everyone understands that they’ve been using a lot of borrowed capex to keep the drilling machine lubricated. But almost all credit lines are linked to a company’s PDP assets (Proved Developed Producing) and lesser value assets. But a key to that valuation is the oil price used…an oil price calculated using the required SEC regs. Fortunately those rules changed a few years ago. Before companies had to use the closing price on the last market day of the year in December. Given where oil prices appear to be heading that would have led to devastating reductions in book values 1Q 2015. And also a reduction in credit lines which could significantly reducing drilling. Which would reduce reserve replacement efforts. Which would be the beginning of the death spiral we’ve seen before in the oil patch before.

Fortunately now the SEC uses a weighted yearly average for oil pricing so pricing changes used for valuation will fall more slowly then what we’ve just experienced. But if oil stays low for the next 12+ months the reserve reductions will eventually catch up with the companies. Not yet panic time for the pubcos playing the shales. But all the hands I know are beginning to position themselves for a fall out. At lunch where some of them gather I don’t have to ask…you can see it on their faces.

Fortunately now the SEC uses a weighted yearly average for oil pricing so pricing changes used for valuation will fall more slowly then what we’ve just experienced. But if oil stays low for the next 12+ months the reserve reductions will eventually catch up with the companies. Not yet panic time for the pubcos playing the shales. But all the hands I know are beginning to position themselves for a fall out. At lunch where some of them gather I don’t have to ask…you can see it on their faces.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Peak Oil: Beyond the Point of No Return

Looked at Texas RRC August, 2014 production info and compared it to previous months in 14 and 2013. I know there is a significant reporting lag, but looks to me like a plateau forming in production growth? Or is the reporting lag that bad, even several months out? Next looked at some PB and EFS counties, appears to be more pronounced in EFS. Is reporting lag worse in EFS or have things already slowed some there?

- shallow sand

- Lignite

- Posts: 256

- Joined: Wed 20 Aug 2014, 23:54:55

Re: Peak Oil: Beyond the Point of No Return

shallow - Always a lag with revised numbers out several months later.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Peak Oil: Beyond the Point of No Return

$this->bbcode_second_pass_quote('ROCKMAN', 'M')onte – Speaking of debt I was just discussing with my CFO the predicament the Eagle Ford players will be facing soon. Everyone understands that they’ve been using a lot of borrowed capex to keep the drilling machine lubricated.

Capital expenditures (capex) is off the charts recently. Oil companies assumed the market would reward their increased production costs. Not.

A Saudi saying, "My father rode a camel. I drive a car. My son flies a jet-plane. His son will ride a camel."

-

MonteQuest - Expert

- Posts: 16593

- Joined: Mon 06 Sep 2004, 03:00:00

- Location: Westboro, MO