Bitcoin & crypto? Pt. 3

Re: Bitcoin & crypto? Pt. 3

1 BTC = $113,385

Look out below!

For those who actually give a shit.

Bitcoin Bull Market Is Over? Analyst Calls 50% Crash To $60,000

$this->bbcode_second_pass_quote('', 'T')he crypto fear and greed index continues to flash “greed,” and most analysts still argue that Bitcoin is setting up for another leg upward. However, an interesting technical outlook challenges this bullish consensus and issues a crash warning.

Notably, crypto analyst Xanrox identified a sell signal on the weekly candlestick timeframe chart after Bitcoin reached the 1.618 Fibonacci extension and touched the long-term 2017–2021–2025 trendline, with the latest touch of the trendline aligning to Bitcoin’s recent all-time high at $122,800.

According to him, the most recent touch of this trendline might be the top of the current cycle. Furthermore, he noted that the Elliott Wave structure has now completed Wave 5 of a rising wedge and a larger Wave 5 impulse move. As such, a corrective phase is about to start.

https://www.tradingview.com/news/newsbt ... to-60-000/Look out below!

For those who actually give a shit.

Bitcoin Bull Market Is Over? Analyst Calls 50% Crash To $60,000

$this->bbcode_second_pass_quote('', 'T')he crypto fear and greed index continues to flash “greed,” and most analysts still argue that Bitcoin is setting up for another leg upward. However, an interesting technical outlook challenges this bullish consensus and issues a crash warning.

Notably, crypto analyst Xanrox identified a sell signal on the weekly candlestick timeframe chart after Bitcoin reached the 1.618 Fibonacci extension and touched the long-term 2017–2021–2025 trendline, with the latest touch of the trendline aligning to Bitcoin’s recent all-time high at $122,800.

According to him, the most recent touch of this trendline might be the top of the current cycle. Furthermore, he noted that the Elliott Wave structure has now completed Wave 5 of a rising wedge and a larger Wave 5 impulse move. As such, a corrective phase is about to start.

We all knew it was doomed to crash eventually, like it's cyclical crash and burn I mean.

This guy's a mathematician, if you haven't seen his youtubes you haven't fully explored the exponential function. He comes from Boulder Colorado, I got his picture off the side display here.

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Bitcoin & crypto? Pt. 3

How to get Royally Screwed with bitcon

How to recover psychologically and keep on believing in Bitcoin after getting silent-hacked?

https://www.reddit.com/r/Bitcoin/commen ... t3_1mewe69

How to recover psychologically and keep on believing in Bitcoin after getting silent-hacked?

https://www.reddit.com/r/Bitcoin/commen ... t3_1mewe69

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Bitcoin & crypto? Pt. 3

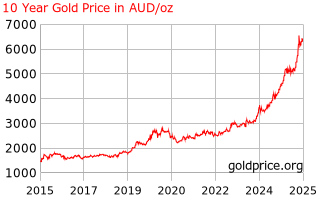

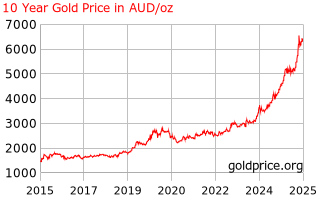

It's a different world to Gold, all these paper/digital markets. Gold holders never worry, or Panic, or fret over if they should sell. The metals just keep going up, year after year, decade after decade. Even when they do post a drop, a retracement, it's never a deal breaker, just a true buying opportunity.

Little different in AUD

So why subject yourself to all the stress with crypto? It's the get rich quick gambler mindset. It's endemic in a certain fraction of society, in the lower classes typically, the loser class. They know they'll never attain economic security following their lifestyles and instead of working smarter, they buy these lottery tickets and then turn it into a religion. BC will always go up because it's always gone up.

A big part of the Gambler mindset is a feeling of relief when they lose, yes, true. To them it's confirmation that they are an underdog, a loser, they go away saying "next time I'll beat the odds."

Little different in AUD

So why subject yourself to all the stress with crypto? It's the get rich quick gambler mindset. It's endemic in a certain fraction of society, in the lower classes typically, the loser class. They know they'll never attain economic security following their lifestyles and instead of working smarter, they buy these lottery tickets and then turn it into a religion. BC will always go up because it's always gone up.

A big part of the Gambler mindset is a feeling of relief when they lose, yes, true. To them it's confirmation that they are an underdog, a loser, they go away saying "next time I'll beat the odds."

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Bitcoin & crypto? Pt. 3

$this->bbcode_second_pass_quote('careinke', ' ')Thanks for the call, my personal Jim Kramer inverse market indicator call maker. Maybe I should go all in based on your call.

BTC $112

Since July 14 top of $123k it's been all lower highs and lower lows. Where will it go from here? Just watch the DOW. BC is son of DOW, one of it's bastard offspring, ruled by equity wrappers, ETF's, Credit agreements, and on a personal level, Big CC debts. But don't ever forget, Buffett, the King of smart market moves has bailed out of the stock market in a big big way. Sitting on half a Trillion in cash he's waiting. For what?

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia

Re: Bitcoin & crypto? Pt. 3

This next collapse will be EPIC. The BRICS are all in Gold, so if the US wants trade with them it will have to go back to a Gold based currency, and actually settle accounts in Gold, just as it did before all this madness and inflation took hold after August 15 1971. What will the price of Gold be? Much higher of course, just like the 1933 reset. Reset, Reset, get that word into your lexicon. That's the solution and always is to huge debts.

Oh the Gold in storage across the BRICS nations, it's massive! And the Gold america claims to hold? Well it's never been audited, so you don't really know. A big financial machination for the last two decades had been Gold leasing.

$this->bbcode_second_pass_quote('', 'G')old leasing involves a financial arrangement where an institution, usually a bank, leases gold to an entity or individual for a predetermined period. The process begins when a lessee approaches a lessor (such as a bank) to lease a specific amount of gold.

Oh the Gold in storage across the BRICS nations, it's massive! And the Gold america claims to hold? Well it's never been audited, so you don't really know. A big financial machination for the last two decades had been Gold leasing.

$this->bbcode_second_pass_quote('', 'G')old leasing involves a financial arrangement where an institution, usually a bank, leases gold to an entity or individual for a predetermined period. The process begins when a lessee approaches a lessor (such as a bank) to lease a specific amount of gold.

Why have all that Gold just sitting there doing nothing, lease it out and make some income. But then the Gold is Gone! All you have is a promise to return it. And if the borrower can't return it, then they must pay the value in inflated American dollars. Sounds like a good way to dump dollars doesn't it.

$this->bbcode_second_pass_quote('', 'T')hroughout 2024, significant amounts of gold have left Western vaults, triggering liquidity shortages and refinery delays of up to 12 weeks. Despite official reports, much of the gold held in London is already allocated, leaving the US scrambling to secure bullion for fractionally backed reserves.

https://kinesis.money/blog/gold-flows-e ... set-looms/

We're 17 years past the peak now and the 3rd World is going hungry and dark. We'll be next, we're well on the way in fact.

- theluckycountry

- Light Sweet Crude

- Posts: 5254

- Joined: Tue 20 Jul 2021, 18:08:48

- Location: Australia