Page added on March 8, 2020

Saudi Arabia Starts All-Out Oil War: MbS Destroys OPEC By Flooding Market, Slashing Oil Prices

With the commodity world still smarting from the Nov 2014 Saudi decision to (temporarily) break apart OPEC, and flood the market with oil in (failed) hopes of crushing US shale producers (who survived thanks to generous banks extending loan terms and even more generous buyers of junk bonds), which nonetheless resulted in a painful manufacturing recession as the price of Brent cratered as low as the mid-$20’s in late 2015/early 2016, on Saturday, Saudi Arabia launched its second scorched earth, or rather scorched oil campaign in 6 years. And this time there will be blood.

Following Friday’s shocking collapse of OPEC+, when Russia and Riyadh were unable to reach an agreement during the OPEC+ summit in Vienna which was seeking up to 1.5 million b/d in further oil production cuts, on Saturday Saudi Arabia kick started what Bloomberg called an all-out oil war, slashing official pricing for its crude and making the deepest cuts in at least 20 years on its main grades, in an effort to push as many barrels into the market as possible.

In the first major marketing decision since the meeting, the Saudi state producer Aramco, which successfully IPOed just before the price of oil cratered…

… launched unprecedented discounts and cut its April pricing for crude sales to Asia by $4-$6 a barrel and to the U.S. by a whopping $7 a barrel in attempts to steal market share from 3rd party sources, according to a copy of the announcement seen by Bloomberg. In the most significant move, Aramco widened the discount for its flagship Arab Light crude to refiners in north-west Europe by a hefty $8 a barrel, offering it at $10.25 a barrel under the Brent benchmark. In contrast, Urals, the Russian flagship crude blend, trades at a discount of about $2 a barrel under Brent. Traders said the Saudi move was a direct attack at the ability of Russian companies to sell crude in Europe.

Confirming the obvious, Iman Nasseri, managing director for the Middle East at oil consultant FGE said “Saudi Arabia is now really going into a full price war.”

The draconian cuts in monthly pricing by state prouder Saudi Aramco are the first and clearest indication of how the Saudis will respond to the break up of the alliance between OPEC and Russia, which as we noted earlier, dumped MbS on Friday in a stunning reversal within OPEC+. Talks in Vienna ended in dramatic failure on Friday as Saudi Arabia’s gamble to get Russia to agree to a prolonged and deeper cut failed to pay off.

And the second indication that the OPEC oil cartel is now effectively dead, came a few hours later when Bloomberg again reported that in addition to huge price cuts, Saudi Arabia was set to flood the market with a glut of oil to steal market share and capitalize on its just announced massive price cuts as the kingdom plans to increase oil output next month, going well above 10 million barrels a day.

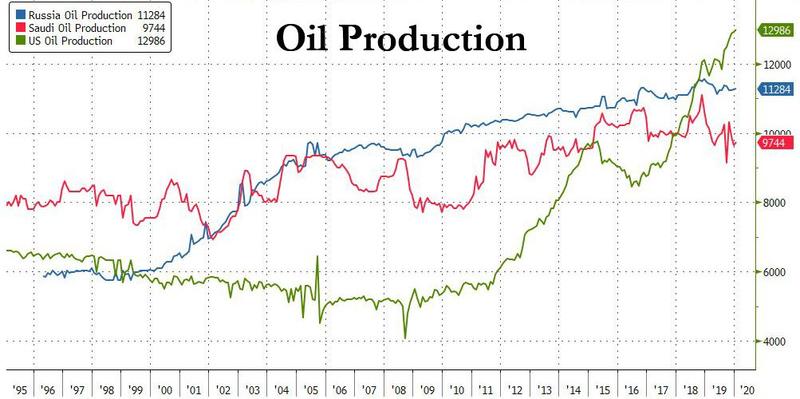

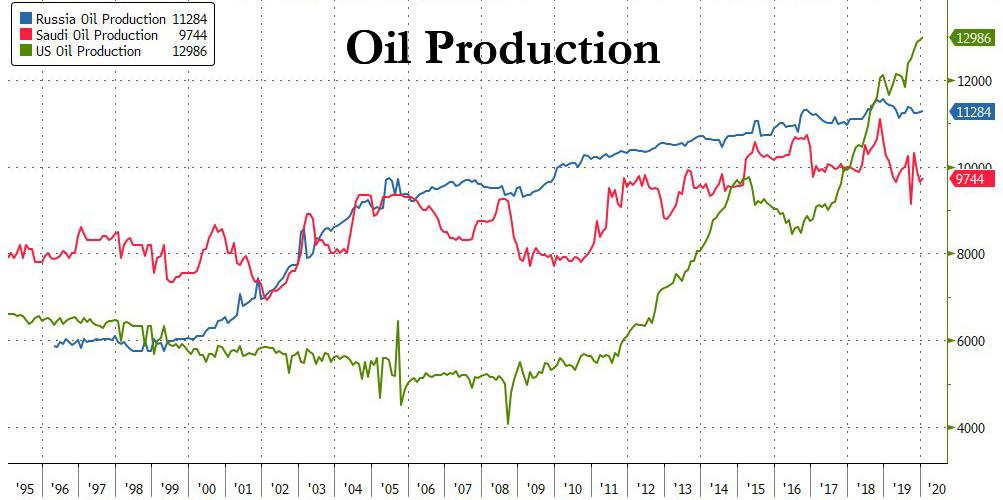

In addition to slashing prices, Saudi Arabia has privately told some market participants it could raise production much higher if needed, even going to a record of 12 million barrels a day, according to Bloomberg sources.

But before hitting a stunning 12mmb/d, Saudi production will first rise above 10 million barrels a day in April, from about 9.7 millions a day this month: “That’s the oil market equivalent of a declaration of war,” an unnamed commodities hedge fund manager said.

Meanwhile, as Bloomberg correctly notes, “with demand being ravaged by the coronavirus outbreak, opening the taps like that would throw oil market into chaos.”

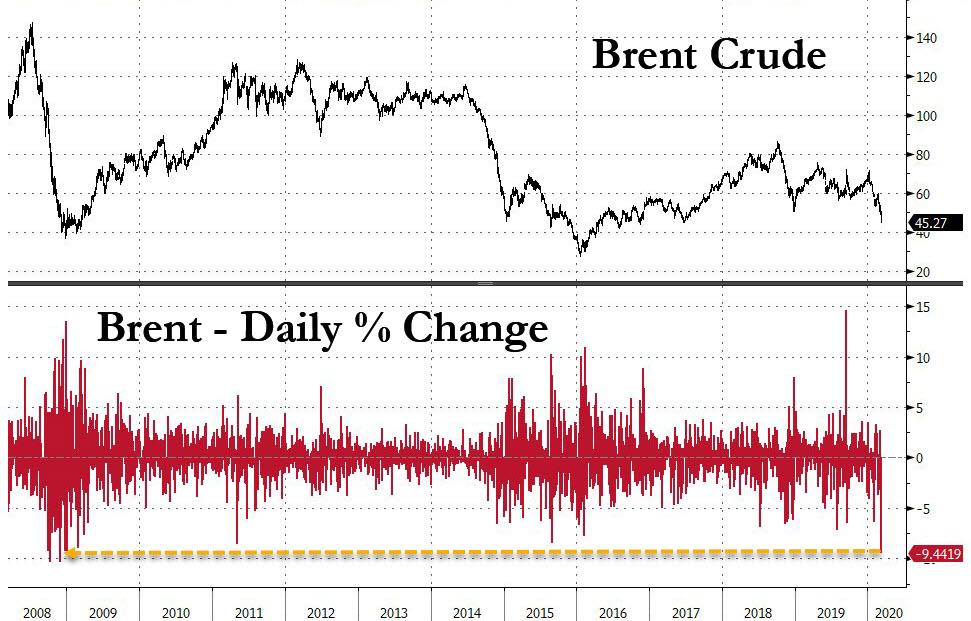

According to preliminary estimates, with Brent trading at $45, a flood of Saudi supply as demand is in freefall, could send oil into the $20s if not teens, in a shock move lower as speculators puke on long positions in what Goldman calls periodically a “negative convexity” event.

Oil traders are looking to historical charts for an indication of how low prices could go. One potential target is $27.10 a barrel, reached in 2016 during the last price war. But some believe the market could go even lower.

What is the logic behind the Saudi decision?

According to one take, the shock-and-awe Saudi strategy could be an attempt to impose maximum pain in the quickest possible way to both Russia and other producers, most notably shale, in an effort to bring them back to the negotiating table, and then quickly reverse the production surge and start cutting output if a deal is achieved.

While that’s certainly possible, it has already been tried once – back in 2014/2015 – and the result was humiliation for Riyadh as not only shale came out stronger, but Russia had no problems absorbing the lower prices. Instead, the most likely outcome is that Russia will be able to withstand a shock price far longer than Saudi Arabia, which has budgeted for a Brent price of $58/b for 2020 (which would lead to a 6.4% budget deficit). A realized price which is roughly half that – should the Saudi strategy work out as planned – would lead to social unrest and government turmoil in Saudi Arabia, and may explain why earlier today Saudi crown prince MbS launched another crackdown on dozens of royals and army officers following the arrest of powerful princes, who may compete for the throne once the public mood in Saudi Arabia turns nasty in the coming weeks.

Could the price drop even lower now? Yes: back then there was no coronavirus pandemic destroying global oil demand.

One final point: with 10Y Breakevens driven almost entirely by the price of oil…

… once Brent craters on Monday to the mid-$30s or lower, the accompanying implosion in 10Y yields could make the record plunge in yields seen on Friday a dress rehearsal for what could be the biggest VaR shock of all time. And since QE will only send yields even lower, perhaps it’s time for the Fed to add oil futures to stocks among the expanded securities it plans on purchasing as part of QE-5 to avert the next deflationary crisis which may have just started.

208 Comments on "Saudi Arabia Starts All-Out Oil War: MbS Destroys OPEC By Flooding Market, Slashing Oil Prices"

joe on Sun, 8th Mar 2020 10:55 am

The last time Russia was challenged, they invested into their domestic market and began building a gas pipeline to China. This time around the gas pipeline in complete and they are building a second one. Russia is not the one trick pony the western msm makes them out to be. They are not the ussr anymore. That’s why the west wants war with them so badly. Saudi on the other hand has a very weak hand. The whole point of Saudi 2030 was to get away from oil. Now they are going to blow their national budget to spite Putin. The frakers will have a field day with a 50 basis points cut and the banks handing out loans like there will be no tomorrow. The bumpy plateau rolls on….

Outcast_Searcher on Sun, 8th Mar 2020 3:22 pm

Well, if this plays out for awhile, along with COVID-19 fears (assuming that doesn’t die down quickly), that should provide a MAJOR buying opportunity in the strongest oil majors in coming months.

But plenty of potential pain to come, so I plan to WAIT until crude prices show signs of stabilization.

Meanwhile, though some or many oil companies will go BK, the assets won’t disappear, and over the next decade or so, global demand isn’t going away (probably will take 3 decades to build out the BEV fleet, and petrochemical demand should grow globally well beyond that) — the oil isn’t going anywhere. It will be used when the price is deemed sufficient to risk producing it.

So just like with the last attempt, this doesn’t change anything big picture — longer term.

If KSA wanted to sieze on a moment of economic stress to try this for maximum short term economic damage, this seems to be a good place to try. If it backfires because COVID-19 dies down quickly, they could always back off since they’re the swing producer. If not, it buys them some time.

Either way, over time, the world is mostly going green re the vast majority of transport over coming decades anyway. If oil is cheap for years due to this, that could slow it down, of course.

Outcast_Searcher on Sun, 8th Mar 2020 3:24 pm

joe, if you think all KSA is trying to do is “spite Putin”, you need to massively reassess.

Apneaman on Sun, 8th Mar 2020 3:33 pm

supertards

hope you’re fine. just checking quickly taking a break from my permanent retirement

4 days is up imma change my underwear, my goal is 4 days. i hope you change yours after 5 days.

please respect supertard

i’m out on permanent retiremnet

i’ll be back in a few weeks unless i have to peek in sooner like today

makati1 on Sun, 8th Mar 2020 6:26 pm

Gonna be fun to watch the blood run, especially in the faking scam. <$2 gas by July? (But no one will be traveling.) Sigh!

makati1 on Sun, 8th Mar 2020 6:37 pm

Joe, Russia is in the driver’s seat this time. It was not KSA that blew up the oil scam, it was the Russians. They can sit it out and wait for the rest of the oily gang to go under.

Oil/NG exports is ~30% of Russia’s GDP Google

Oil/NG exports is ~50% of Saudi’s GDP. ”

Russia can exist on $40 or less oil.

KSA needs $85 to keep the public calm.

I’m sure Russia knew what it was doing when it said, “NET!” to the oil cut. The blood bath begins! LOL

Duncan Idaho on Sun, 8th Mar 2020 6:41 pm

The Fat Boy and the Thugs need to step in big time, as the Dog Track futures are way down.

They are good at ripping people off and stealing, but this is over their head.

JuanP on Sun, 8th Mar 2020 7:17 pm

“Joe, Russia is in the driver’s seat this time. It was not KSA that blew up the oil scam, it was the Russians. They can sit it out and wait for the rest of the oily gang to go under.”

Russia is fucked too Mak. Putin has expensive wars to pay for.

Sissyfuss on Sun, 8th Mar 2020 7:37 pm

Brent at $35.45, WTI $33.17. With demand cratering the Royal family has to have revenue to pay off the Shia majority or their heads will roll. They have the best quality oil and supposedly easiest to pump. Nationalizing your oil business is coming to the rest of the world. They can’t survive these prices otherwise. Where’s shortonoil, he can splain

it.

makati1 on Sun, 8th Mar 2020 8:15 pm

Davy, give it up. JuanP is more intelligent than that and it is obviously your delusional sock puppet.

makati1 on Sun, 8th Mar 2020 8:21 pm

Sissyfuss, this is likely to be the end of fraking and that means the end of the US as even being close to the number one oil producer. Not to mention the end of the oily US economy.

“The U.S. Energy Information Administration (EIA) estimates that in 2019, about 2.81 billion barrels (or 7.7 million barrels per day) of crude oil were produced directly from tight oil resources in the United States. This was equal to about 63% of total U.S. crude oil production in 2019. Tight oil is oil embedded in low-permeable shale, sandstone, and carbonate rock formations.”

https://www.eia.gov/tools/faqs/faq.php?id=847&t=6

Will the US “nationalize” the oil companies? A first step to communism. We shall see.

makati1 on Sun, 8th Mar 2020 8:30 pm

“Russia is fucked too Mak. Putin has expensive wars to pay for.”

I think you meed to have your meds changed Davy They are not working.

Let me rephrase with the truth:

“Amerika is fucked. Trump has expensive wars to pay for.”

Plus, a US national debt over 105% of the US GDP and growing fast.

vs

Russia with a national debt of ~15% of GDP. Who is in trouble?

https://countryeconomy.com/national-debt/russia

Davy, you make Forest Gump look like Albert Einstein.

bochen777 on Sun, 8th Mar 2020 9:44 pm

Putin better watch out, America will do anythign to stay number one. Moscow about to turn into the next Wuhan!

Davy on Sun, 8th Mar 2020 9:49 pm

“Davy, give it up. JuanP is more intelligent than that and it is obviously your delusional sock puppet.”

Oops, sorry makato. I thought as seein that everyone hear nos I’m a dumbass. pretending to be JuanP might give me some respect. Obviously that’s not wurkin eather. What can I say?

I’m just a stupid dumbass hillbilly wannabe goat hurder.

makati1 on Sun, 8th Mar 2020 10:02 pm

bochen, no. More likely the US will be the new Wuhan, or worse. Blow-back is a bitch. ait until they get those hundreds of thousands of working test kits out and in use. The coronavirus stats in Amerika will go ballistic.

And hot weather does not seem to kill it off. See Singapore – Cases still growing and it is 32C/86F at 11AM today going up to 89F later. US summer temps.

Can you imagine the collapse of the US fraking scam? You can thank the Saudis for this bomb. The Russians are just laughing their ass off. Payback for the US meddling in Nord Stream 2. ^_^

It’s going to be a hot, in more ways than one, summer in the US.

Davy on Sun, 8th Mar 2020 11:28 pm

“2019-2020 U.S. Flu Season: Preliminary Burden Estimates”

https://tinyurl.com/v4fwawz CDC USA

“CDC estimates* that, from October 1, 2019, through February 29, 2020, in the US there have been:

34,000,000 – 49,000,000 flu illnesses

16,000,000 – 23,000,000 flu medical visits

350,000 – 620,000 flu hospitalizations

20,000 – 52,000 flu deaths

Compared to 100,000 people infected with coronavirus worldwide and 3500 deaths.The flu is a nothingburger.

WE ALL GONNA DIE!!!

printbabyprint on Sun, 8th Mar 2020 11:45 pm

Between hammer and hard place . Corona is a God gift or biological weapon to slash oil consumption. Bau is finished no more oil for crazy stuff. Good played to reduce demand but unfortunately won’t be enough, the war is needed

Abraham van Helsing on Mon, 9th Mar 2020 2:52 am

Oil near €30,-

https://www.dailymail.co.uk/news/article-8089691/Dow-Jones-futures-tumble-1-000-points-amid-oil-price-war.html

https://twitter.com/JamesAALongman/status/1236908474996609024?s=20

Davy on Mon, 9th Mar 2020 5:09 am

“Oil near €30”

Oops that not going to be good for the cloggo golden 100% renewable transition

Davy on Mon, 9th Mar 2020 5:12 am

“Sissyfuss, this is likely to be the end of fraking and that means the end of the US as even being close to the number one oil producer. Not to mention the end of the oily US economy.”

More makato nonsense. makato, tell us about AsiaUp some more or better #VirusAin’tshit#. LOL. Fracking is industrial, fool, it will fire right back up when prices rise again as they likely will. Prices can’t stay at this leave and support a global economy.

JuanP on Mon, 9th Mar 2020 5:13 am

“2019-2020 U.S. Flu Season: Preliminary Burden Estimates”

https://tinyurl.com/v4fwawz CDC USA

“CDC estimates* that, from October 1, 2019, through February 29, 2020, in the US there have been:

34,000,000 – 49,000,000 flu illnesses

16,000,000 – 23,000,000 flu medical visits

350,000 – 620,000 flu hospitalizations

20,000 – 52,000 flu deaths

Compared to 100,000 people infected with coronavirus worldwide and 3500 deaths.The flu is a nothingburger.

WE ALL GONNA DIE!!!

makati1 on Mon, 9th Mar 2020 5:13 am

JuanP, give it up. Davy is more intelligent than that and it is obviously your delusional sock puppet.

JuanP on Mon, 9th Mar 2020 5:14 am

“Davy, give it up. JuanP is more intelligent than that and it is obviously your delusional sock puppet.”

Oops, sorry makato. I thought as seein that everyone hear nos I’m a dumbass. pretending to be Davy might give me some respect. Obviously that’s not wurkin eather. What can I say?

I’m just a stupid dumbass third world wannabe wetback.

Davy on Mon, 9th Mar 2020 5:17 am

“Putin better watch out, America will do anythign to stay number one. Moscow about to turn into the next Wuhan!”

LOL. Bochen come on it is pretty well established the Chinese let this virus out by being careless. Yes it is a Chinese bio-weapon released on the world by the sloppy Chinese who want to be number one a little too bad.

makati1 on Mon, 9th Mar 2020 5:21 am

“Russia is fucked too Mak. Putin has expensive wars to pay for.”

I think you meed to have your meds changed JuanP They are not working.

Let me rephrase with the truth:

“Russia is fucked. Trump has expensive wars to pay for.”

Plus, a Russia national debt over 105% of the US GDP and growing fast.

vs

US with a national debt of ~15% of GDP. Who is in trouble?

JuanP, you make Forest Gump look like Albert Einstein.

JuanP on Mon, 9th Mar 2020 5:23 am

“bochen, no. More likely the US will be the new Wuhan, or worse. Blow-back is a bitch. ait until they get those hundreds of thousands of working test kits out and in use. The coronavirus stats in Amerika will go ballistic.”

Where they are going up ballistic is in the P’s mak and you are in the age group that dies

Mick on Mon, 9th Mar 2020 5:28 am

Hey Makati1 I think the shit is hitting the fan as regards to to oil price . Buckle up son it’s going to be a bumpy ride . And the scary part is a bit later this year after covid19 dies down a bit if at all our bigger concern is and should be the oil industry collapsing that’s the only thing that matters as far bau and the whole system not imploding . Anyways got my popcorn out of the oven who needs to watch tv with this shit going down

Abraham van Helsing on Mon, 9th Mar 2020 5:31 am

“Oil near €30”

Oops that not going to be good for the cloggo golden 100% renewable transition

What part of the Paris Accords central theme, namely that the world needs to move away from fossil fuel, don’t you understand?

Low oil prices will be temporary, like for the remainder of 2020. At the moment it is bad for the fracking industry and for oil producing countries like KSA and Russia.

Abraham van Helsing on Mon, 9th Mar 2020 5:32 am

9/11-truth movement still very much alive. Get academic support from University of Alaska:

https://documents1940.wordpress.com/2020/03/09/911truth-movement-still-very-much-alive/

Mick on Mon, 9th Mar 2020 5:41 am

Oil prices have been propped up for years it should be around mid 20s but endless wars and tweets are starting to wear off

Davy on Mon, 9th Mar 2020 6:11 am

“Panic Purgatory: Oil Crashes To $27; S&P Futures Locked Limit Down, Treasuries Soar Limit Up Amid Historic Liquidation”

https://tinyurl.com/swu2xfj zero hedge

“Amid this unprecedented crash in equities, 10Y Treasury futures have soared, and also for the first time in over a decade, were locked limit up for about an hour, at 139-29+, prompting a brief trading interruption… which however failed to do much, with the entire US Treasury curve – including the 30Y – trading not only below the effective fed funds rate, but also below 1.00% for the first time ever… The night’s big irony is that unable to sell anything else, funds – facing historic margin calls on Monday – are selling what they can… such as gold, which after hitting $1700 earlier in the session has tumbled 0.7% as more investors liquidate the safe asset to shore up liquidity ahead of a Monday that nobody will every forget… and in which many, most certainly anyone who was long oil, will lose their jobs… He is right, and nowhere more so than junk bonds: once markets open tomorrow (assuming they are not indefinitely halted), keep a close eye on HYG, which consists more than 10% of energy junk bonds, and is set to plunge by the most on record. And speaking of the plunge in crude (and “value” energy stocks), tomorrow we may also see the VIXtermination-like vaporization of 3x levered oil and E&P ETFs such as UWT and GUSH, for which the 30% drop in oil will be a liquidation event catalyst… at this moment there are only two question on every trader’s mind: at what time on Monday morning will the Fed announce a 50-100bps emergency rate cut – the second in under a week – and, more importantly, will it include the official resumption of QE, and potentially the launch of helicopter money i.e., MMT. Anything less than this would be a disappointment. And yet, even if the Fed vows to buy not only stocks but also oil, at this point what it is really buying is just time: time for those who still own financial assets to sell as much as they can before the Fed loses all control, having already lost credibility, culminating in the biggest crash in history.. and a market that is indefinitely halted.”

Davy on Mon, 9th Mar 2020 6:12 am

Yea, I hate to say it but yea I told you so. I could see right away when this virus smacked China and knowing it would spread because globalism’s global nature would spread it that this was going to crater a financial system that was in the stratosphere of the overvalued. This decline will likely be address in the only way that it can be and that is more management from the top with MMT helicopter money and fiscal stimulus. This will just buy time for the ride down. Things are going down and the world will adjust into a new world, if we are lucky. Remember we still have a propagating China virus (Asian gift) which will likely touch the entire world in waves. This and the cratering economy might send us to a level that won’t reboot enough to cover food and supplies to keep things going like we are used to. This will of course play out over time so panic buying will be the name of the game further disrupting normality. I would expect protest but the virus will keep groups to a minimum. This is bad shit and if you have not prepped at least now get mentally prepped for SHTF of some kind. Most will not be able to get their minds around this so it will be a slow boil. Expect cognitive dissonance of a virus and a collapse economy by many who will not want to admit to themselves just how bad these are especially in combination. There will then be people like makato1 who will point fingers and say this will be an AsiaUp and WestDown BS. The world is full of delusional people.

Davy on Mon, 9th Mar 2020 6:20 am

“What part of the Paris Accords central theme, namely that the world needs to move away from fossil fuel, don’t you understand?”

LMFAO, the Paris accord is a joke, cloggo. With fossil fuels and the economy cratering as well as global value chains your golden renewable world is toast for some time if not for good. Plus, the world will be able to afford to buy cheap fossil fuels and they will be in glut because economic activity will crater. This means this degrowth impulse will still be dirty. Maybe not as dirty as a robust economy but still strong.

“Low oil prices will be temporary, like for the remainder of 2020. At the moment it is bad for the fracking industry and for oil producing countries like KSA and Russia.”

Who knows where oil prices may go cloggo. You should know better than that. They may go up in price but few people can afford that price sending them back down again in a vicious vortex down. I doubt there will be a recovery from this economic reset mainly because this virus will keep hammer demand and there are few tools left to keep a robust economy going. The stock market wealth effect is gone and all the central bank tools spent. I hope I am exaggerating but this time is different in my mind because of the combination of the virus and an economic correction.

I AM THE MOB on Mon, 9th Mar 2020 6:26 am

Why isn’t the market fixing Coronavirus?

Have they tried washing the invisible hand?

The Truth Shall Set You Free on Mon, 9th Mar 2020 6:27 am

“Yea, I hate to say it but yea I told you so.”

The DavyScum jibbering to himself and his socks yet again.

What a delusional wastecase.

The Truth Shall Set You Free on Mon, 9th Mar 2020 6:31 am

“Yea, I hate to say it but yea I told you so.”

The JuanPeeScum jibbering to himself and his socks yet again.

What a delusional wastecase.

JuanP on Mon, 9th Mar 2020 6:32 am

I am so so depressed so I will not comment under JuanP much today. I will be doing socks and ID theft though

Jibber Jabbering Judas on Mon, 9th Mar 2020 6:32 am

“LMFAO, the Paris accord is a joke.”

Got a better idea, DavyTurd. Of course not. All that you’re good at is tearing down cause you have nothing of value to add and your credibility is nonexistent due to frequent lying, hypocrisy, and fraud.

Go play with your twat DavyScum the jibber jabbering Judas.

Jibber Jabbering Judas on Mon, 9th Mar 2020 6:35 am

Got a better idea, JuanPeeTurd. Of course not. All that you’re good at is tearing down cause you have nothing of value to add and your credibility is nonexistent due to frequent lying, hypocrisy, and fraud.

Go play with your twat JuanPeeScum the jibber jabbering Judas.

DavyScum & Socks on Mon, 9th Mar 2020 6:36 am

I am so so depressed so I will not comment under DavyTurd much today. I will be doing socks and ID theft though

Davy on Mon, 9th Mar 2020 6:40 am

Cloggo’s golden euro decade:

“Can Europe’s Fragile Economy Withstand Another Shock?”

https://tinyurl.com/v6cs6du macrohive

“The European economy is grinding to a halt. Fourth quarter GDP growth slowed to the lowest for almost seven years, and supply-side disruption from the coronavirus and new regulations in the auto sector will compound the weakness. We expect activity to slow further before any sustained rebound sets in. Meaningful fiscal stimulus appears unforthcoming, and further support from monetary policy will be limited given policy is already close to extremes. Consumer spending, the mainstay of the economy, can only do so much to fend off a difficult external environment and the disruptive structural change in autos. Euro Area Economy Already Close to Stalling in Q4…With the Euro area expansion teetering on the brink, a pronounced hit from the coronavirus could well tip the economy into something close to recession. However, the real economy impact will take some time to play out (both in China and globally), leaving survey data as the best gauge of the likely impact. This week’s Zew survey in Germany suggests the hit could be significant. Sentiment dropped sharply and expectations for export industries were badly hit, particularly given the earlier reported decline in manufacturing orders…The combination of weaker Chinese demand for German goods, possible disruptions to German supply chains due to Chinese production shutdowns, and weaker demand in other export markets hit by the coronavirus disruption could well provide the fatal blow to the meagre growth in the Euro area economy. At a minimum it suggests that the economic environment is set to deteriorate before improving, particularly as this comes on top of the structural headwinds from the shift in the auto sector and the already precarious state of the manufacturing sector more broadly.”

DavyScum et al on Mon, 9th Mar 2020 6:42 am

Not JuanP, DavyScum. Just one of the many who despise you and are sickened by your filthy lies and hypocrisy.

You have created so many enemies that it’s impossible to know so keep guessing Scum.

JuanP on Mon, 9th Mar 2020 6:42 am

I feel like a fool as Mak must. We were the ones to say this China virus wasn’t shit. We tried to tell everyone the flu was so much worse. Weren’t we stupid? Yea, Davy is right to call me stupid and a lunatic

Mick on Mon, 9th Mar 2020 6:43 am

Hear we go the old Davy and juanP freek show just to slow things down

JuanPeeScum et al on Mon, 9th Mar 2020 6:44 am

This is JuanP, just one of the many who despise you and are sickened by your filthy lies and hypocrisy.

You have created so many enemies that it’s impossible to know so keep guessing Scum.

Mick on Mon, 9th Mar 2020 6:45 am

“Hear we go the old Davy and juanP freek show just to slow things down”

LOL, pretty obvious Mich is JuanP. well Davy already outed us before but I am always trying tricks even old ones.

Davy on Mon, 9th Mar 2020 6:55 am

This is for the cloggo:

“Leaked Quarantine Plans Create Chaos As Panicked Italians Sprint For The Exits, Threatening To Spread Virus”

https://tinyurl.com/t7h67ws zero hedge

:Italians have become inured to alarming news over the past month as the outbreak has spiraled out of control in Lombardy. But following a flurry of uncontrolled leaks warning about an imminent lockdown as part of the government’s planned emergency decree, restaurants and bars started emptying out and many fled to the train station, where they hopped trains to get out of the region, especially those who had plans to travel elsewhere that were being interrupted by the lockdown. According to an SCMP reporter in Padua, packed bars and restaurants quickly emptied out as news of a coming lockdown hit, as many people rushed to the railway station. Travellers with suitcases, wearing face masks, gloves and carrying bottles of sanitising gel shoved their way on to the local train…This could be terrible news for the impoverished south: experts have repeatedly warned that southern Italy – best known as an agricultural and fishing center rife with organized crime – doesn’t possess the medical infrastructure to handle a surge in life-threatening cases of pneumonia…Fortunately, Italian markets were closed during the panic, and now people have more or less accepted the new rules. But at this point, the horse is already out of the barn. Panicked Italians are now traveling around the country, potentially bringing the virus with them…In Rome, the government has decided on Thursday to double emergency spending to 7.5 billion euros ($8.5 billion) to help cushion the economic impact of the virus. It’s also calling up 20,000 doctors, nurses and medical personnel to help deal with the outbreak. Fallout from the virus’s spread is slamming Italy’s key tourism industry, which is worth almost 15% of GDP, at a time when the country is already teetering on the brink of recession. Sensing the looming threat to economic stability, the EU is playing ball, advising the Italians that their stimulus spending won’t be counted against the bloc’s budgetary thresholds. But will Berlin and Frankfurt play ball when it comes to loosening Germany’s purse strings in violation of the constitutional ‘debt break’?”

Abraham van Helsing on Mon, 9th Mar 2020 6:55 am

New massive German Feb-2020 monthly renewable electricity record of 61%, pulverizing the old one of 54% (March 2019)

https://cleantechnica.com/2020/03/06/wind-energy-leads-germany-to-renewable-energy-record-in-february/

“Wind Energy Leads Germany To Renewable Energy Record In February”

The figure is admittedly inflated (pun intended) due to exceptional high wind speeds.

Take-away point: there is meanwhile sufficient renewable infrastructure installed to power 61% of the hands-down largest export industry in the world.

Davy on Mon, 9th Mar 2020 6:57 am

“Take-away point: there is meanwhile sufficient renewable infrastructure installed to power 61% of the hands-down largest export industry in the world.”

Ah, cloggo, tell us all about primary power too we are curious how the EU is doing with that.

Cloggie on Mon, 9th Mar 2020 7:03 am

Cloggo’s golden euro decade:

“Can Europe’s Fragile Economy Withstand Another Shock?”

Lying dave again and his eternal falsehoods.

The European Golden Decade, as I have said many times before, was 2010-2020, that is BEHIND us:

https://deepresource.wordpress.com/2019/12/27/european-golden-decade-2010-2020/

Irrefutable a Golden Decade, economically.

Furthermore he tries to insinuate that Corona could have been foreseen. It couldn’t. There isn’t going to be any golden decade 2020-2030, not for anyone, not economically. Globalism is unwinding. Culprits will be found for Corona. Scores are going to be settled. 2020-2030 will be the decade that will bring down empire and new geopolitical players will take its place. Europe, Russia, China, Iran.

https://www.rt.com/news/387313-us-losing-leadership-eu-mogherini/

“‘US losing world leadership, Europe can replace it’ – EU top diplomat Mogherini”