THE Silver & Gold Thread (merged)

Re: THE Silver & Gold Thread (merged)

This has never happened before:

S&P 500: all-time high

US Home Prices: all-time high

Bitcoin: all-time high

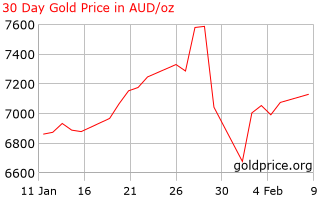

Gold: all-time high

Money Supply: all-time high

Public Debt: A RECORD $37.5 TRILLION

US labor market: in a RECESSION

https://x.com/globalmktobserv/status/19 ... aq1VBSCqtg

S&P 500: all-time high

US Home Prices: all-time high

Bitcoin: all-time high

Gold: all-time high

Money Supply: all-time high

Public Debt: A RECORD $37.5 TRILLION

US labor market: in a RECESSION

https://x.com/globalmktobserv/status/19 ... aq1VBSCqtg

-

Armageddon - Light Sweet Crude

- Posts: 7450

- Joined: Wed 13 Apr 2005, 03:00:00

- Location: St.Louis, Mo

Re: THE Silver & Gold Thread (merged)

They’ll keep inflating, causing GDP and the stock market to look great and claim the economy is booming.

Meanwhile, 70% of Americans don’t have $1000 to their name.

Meanwhile, 70% of Americans don’t have $1000 to their name.

-

Armageddon - Light Sweet Crude

- Posts: 7450

- Joined: Wed 13 Apr 2005, 03:00:00

- Location: St.Louis, Mo

Re: THE Silver & Gold Thread (merged)

$this->bbcode_second_pass_quote('Armageddon', 'T')his has never happened before:

S&P 500: all-time high

US Home Prices: all-time high

Bitcoin: all-time high

Gold: all-time high

Money Supply: all-time high

Public Debt: A RECORD $37.5 TRILLION

US labor market: in a RECESSION

S&P 500: all-time high

US Home Prices: all-time high

Bitcoin: all-time high

Gold: all-time high

Money Supply: all-time high

Public Debt: A RECORD $37.5 TRILLION

US labor market: in a RECESSION

Hey Armie, do you know what the definition of "recession" is?

noun

1.

a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

I don't see the word "labor market" in there. It is defined by a two quarter of fall in GDP.

How about you go for defining "collapse" finally before this becomes such a running joke I need to ask you if you know the definition to ANY words you use? Did the Born Agains teach you to ignore the meaning of words, or did you decide to do that when becoming a MAN and buying a truck?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: THE Silver & Gold Thread (merged)

$this->bbcode_second_pass_quote('AdamB', '')$this->bbcode_second_pass_quote('Armageddon', 'T')his has never happened before:

S&P 500: all-time high

US Home Prices: all-time high

Bitcoin: all-time high

Gold: all-time high

Money Supply: all-time high

Public Debt: A RECORD $37.5 TRILLION

US labor market: in a RECESSION

S&P 500: all-time high

US Home Prices: all-time high

Bitcoin: all-time high

Gold: all-time high

Money Supply: all-time high

Public Debt: A RECORD $37.5 TRILLION

US labor market: in a RECESSION

Hey Armie, do you know what the definition of "recession" is?

noun

1.

a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

I don't see the word "labor market" in there. It is defined by a two quarter of fall in GDP.

How about you go for defining "collapse" finally before this becomes such a running joke I need to ask you if you know the definition to ANY words you use? Did the Born Agains teach you to ignore the meaning of words, or did you decide to do that when becoming a MAN and buying a truck?

Do you ever add anything meaningful to the conversation? You just parrot the same thing on every topic. No wonder you’ve ran everybody off on the site.

-

Armageddon - Light Sweet Crude

- Posts: 7450

- Joined: Wed 13 Apr 2005, 03:00:00

- Location: St.Louis, Mo

Re: THE Silver & Gold Thread (merged)

$this->bbcode_second_pass_quote('Armageddon', '

')Do you ever add anything meaningful to the conversation?

')Do you ever add anything meaningful to the conversation?

I do THE MOST MEANINGFUL THING. I seek the meaning of terms, in order to establish you and I are talking about the same thing. Without a common meaning of terms, half wits can say..."Gee collapse just happened!" when in fact no such thing happened. Why? Because someone knows the meaning of collapse, and someone does not.

I am perfectly willing to accept someone else's change in the common meaning of a term...IF THEY CAN DEFINE WHAT THEY MEAN.

This leaves people who just spew horseshit, for example, "collapse" means "gee Ruppert told me so" out in the cold because they are in a make believe world. Why? BECAUSE THEY DON'T KNOW THE MEANING OF THE WORDS.

$this->bbcode_second_pass_quote('Armageddon', '

')You just parrot the same thing on every topic. No wonder you’ve ran everybody off on the site.

Peak oil happening 7 years ago and nobody noticing is what caused folks to leave. As someone who knew better, I am allowed to gloat over the users who used the power of science and experience in the field over the hoebunkle religious based training of Missourians, or citizens of a country that doesn't have the cajones to free themselves from a King that Americans cast aside with muskets. The country in question probably can't even manufacture those.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26