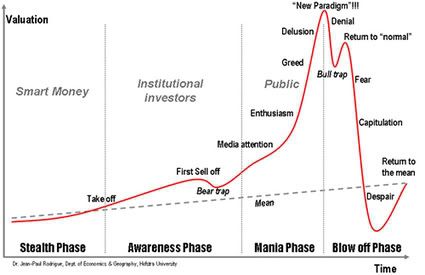

I am attaching two graphs of the S&P500, which for purposes simplicity I will use as a proxy for equity markets. I find it hard to watch too many different markets at the same time (and get any real work done!).

The monthly gives the long-term trend that I think we need to keep in perspective, and the second, the weekly shows the pattern I would like to highlight. I will not post them because it really distorts the screen due to their size. I hope you can read the detail in any case.

S& P 500 montly chart Bull Rally

I am referring to your question about volatile swings on top of high volume. Basically, what we have is a bull rally that started back in 2002 near 570 and topped-out at 1577. At the tail end of the rally starting in Q1'07 and then confirmed late last summer as we started to see the rally unwind at the seams in a perfectly detectable pattern that we have seen often enough including at the start of the great stock market crash in 1929.

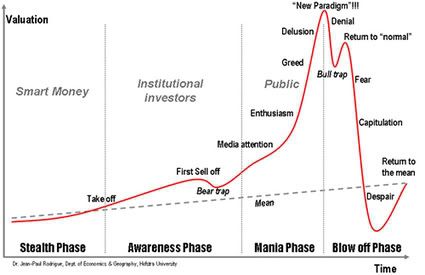

S&P 500 chart Broadening Out Formation

That pattern is called A Broadening Out Formation. You can see it unfolding best on the weekly chart. Basically, if you look at the pattern unfolding it looks something like a reverse wedge

/[sup]<[/sup]

A high after a long rally

A low from which it recovers as player's are still buying on dips

A new high that seems to prove their optimism correct

Another low that takes out the previous low

Another new high that we call The Bull Trap

And then finally the collapse or capitulation!

This pattern when accompanied by high volumes shows that traders do not know whether to buy or to sell. They think the market is over-valued, but they are equally afraid to miss the next big rally. So we see this whipsaw action unfolding as the bulls and bears fight it out.

Of course, this pattern does not unfold exactly the same each time. For instance, you had the Fed cutting rates in August and then again in November before proper lows could be put into place. So it would be foolish to say, ah, but the previous low was not taken out, so the 10% correction and subsequent high is not valid!

That's the difference between practitioners and academics. Whatever works to give an information advantage when trading, and not a fixed set of rules that can be programmed into a computer! Those do not exist because if they did then anyone could do it and then smart traders would start putting their orders in every time just slightly ahead of the important turning points and it would invalidate the model! ; - )

The organized state is a wonderful invention whereby everyone can live at someone else's expense.

![new_popcornsmiley [smilie=new_popcornsmiley.gif]](https://udev.peakoil.com/forums/images/smilies/new_popcornsmiley.gif)