Saudi Aramco IPO

Re: Saudi Aramco IPO

The independent analysis by Moody's shows Saudi Aramco is immensely profitable, paying about 50 billion/year just in dividends to the royal family.

Moody's rated Aramco as investment grade, but did not give the company its top financial rating because of the direct control over Aramco by the Saudi Royal Family. It appears the dividend rate can be changed at any time by the royal family if they need more cash.

rare-glimpse-into-saudi-aramco

Cheers!

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26765

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Saudi Aramco IPO

The independent analysis by Moody's shows Saudi Aramco is immensely profitable, paying about 50 billion/year just in dividends to the royal family.

Moody's rated Aramco as investment grade, but did not give the company its top financial rating because of the direct control over Aramco by the Saudi Royal Family. It appears the dividend rate can be changed at any time by the royal family if they need more cash.

rare-glimpse-into-saudi-aramco

Cheers!

Until a down-hole analysis on all the depleting elephant wells is accomplished by a third party engineering firm, the "books" are just so much jihadi BS. What does Moody's know about oil reserves? They couldn't suss out the American mortgage bidness by 2005. So crap all to that 'audit', is what I say

$this->bbcode_second_pass_quote('', 'F')ebruary 12, 2019

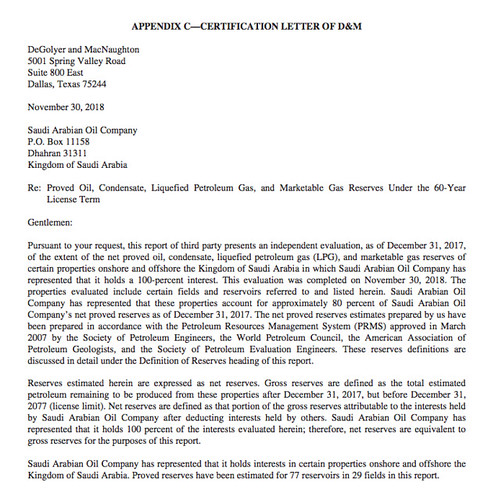

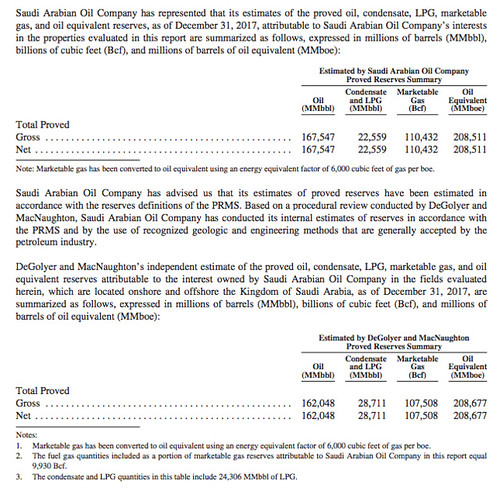

DeGolyer and MacNaughton is pleased to acknowledge the recent completion of the first contemporary independent assessment of reserves in Saudi Arabia for the Saudi Arabian Oil Company. The study encompassed a highly detailed independent analysis of a massive dataset and onsite review. More than 60 geophysicists, petrophysicists, geologists, simulation engineers, reserves engineering specialists, and economists were involved in the 30-month effort.

Below is a compilation of article links where you can find further information regarding our most recent work in Saudi Arabia.

From the articles D&M provided:

$this->bbcode_second_pass_quote('', 'T')op oil exporter Saudi Arabia announced Wednesday a slight rise in its crude oil reserves after an independent audit, the first time in decades the kingdom has released any of its closely guarded field data. Saudi Arabia’s total proven oil and gas reserves stood at around 268.5 billion barrels of oil and 325.1 trillion standard cubic feet of gas at the end of 2017, the Saudi Energy Ministry said in a statement.

$this->bbcode_second_pass_quote('', 'S')audi Arabia has opened up its vast energy reserves to independent auditors for the first time, a move that could help it revive plans to sell shares in state oil giant Aramco. The government of Saudi Arabia said in a statement Wednesday that US energy consultancy DeGolyer & MacNaughton had concluded that its oil reserves total 268.5 billion barrels. The estimate is slightly higher than the 266.3 billion barrel figure previously published by the Saudi government.

Allowing an independent company to assess its reserves represents a major shift for Saudi Arabia, which has for decades closely guarded data about its oil and gas industry.

-

kublikhan - Master Prognosticator

- Posts: 5064

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois