Economics vs. ETP

Re: Economics vs. ETP

$this->bbcode_second_pass_quote('Yoshua', '[')img]http://www.usfunds.com/media/images/investor-alert/_2016/2016-09-23/COMM-Time-Major-Economies-Boost-Public-Infrastructure-Spending-09232016-LG.png[/img]

Yes, the question is where is the surplus nett energy to do this ? Where is the money to do this? The world is drowning in debt ,and you want more of it . Get real ^ The music is playing but the party is over ^ . Puerto Rico is not coming back and neither is Houston . Wake up .

- dirtyharry

- Lignite

- Posts: 226

- Joined: Fri 07 Apr 2017, 10:53:43

Re: Economics vs. ETP

$this->bbcode_second_pass_quote('', 'Y')es, the question is where is the surplus nett energy to do this ? Where is the money to do this? The world is drowning in debt ,and you want more of it . Get real ^ The music is playing but the party is over ^ . Puerto Rico is not coming back and neither is Houston . Wake up.

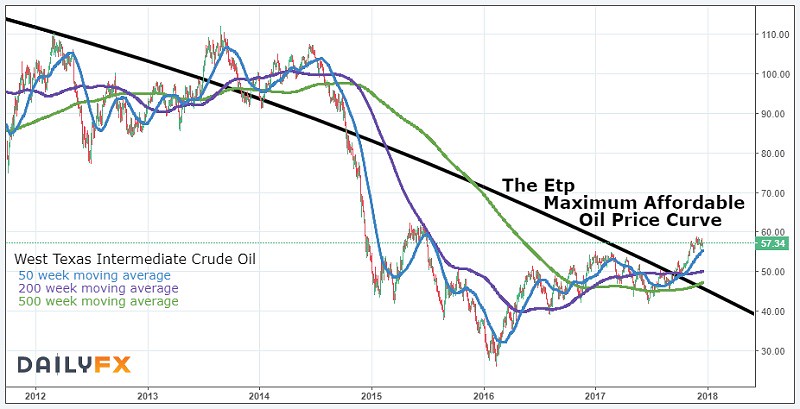

Historically, the price of oil is now very high. The total cost of crude as a percentage of GDP since 1960 has averaged 2.48%. It is presently 2.64%. According to the graph of Total Cost of Crude/ GDP is should now be 1.64%, or about $37/ barrel. The world has very few funds available for other investments beyond the cost of producing petroleum, and its products. The world has $250 trillion, or more in debt that must be serviced.

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: Economics vs. ETP

$this->bbcode_second_pass_quote('onlooker', '&')quot;The unnecessary bells and whistles ironically comes from economics. Put simply, we have an economic system measured in terms of money but dependent on energy and material resources. The first keeps growing through financial speculation while the latter becomes less available due to EROEI. The title thread implies that by creating more money we can reverse a downward trend in EROEI. That's not going to happen."

BRAVO!

As for being a Believer, well you all seem to easily believe the Mainstream authorities and Media. You also BELIEVE, the Etp is wrong as you are not able to interpret its more technical/mathematical formulations nor have you offered any disqualifying evidence beyond references again to the Mainstream communiques.

Then you try to convince us that Economics trumps physicis and biophysical conditions. Sorry it does not. Ultimately, economics is simply a way to measure what is happening related to resources and to allocate and distribute them in pre-planned ways. The Etp has tried to transcend this limited economic perspective and get at the status of the resource involved in this case OIL.

BRAVO!

As for being a Believer, well you all seem to easily believe the Mainstream authorities and Media. You also BELIEVE, the Etp is wrong as you are not able to interpret its more technical/mathematical formulations nor have you offered any disqualifying evidence beyond references again to the Mainstream communiques.

Then you try to convince us that Economics trumps physicis and biophysical conditions. Sorry it does not. Ultimately, economics is simply a way to measure what is happening related to resources and to allocate and distribute them in pre-planned ways. The Etp has tried to transcend this limited economic perspective and get at the status of the resource involved in this case OIL.

A major shortcoming of the ETP analysis is that it looks at only a single energy source- oil.

For an economy to operate it clearly needs energy, but to claim the economy will be "shorton energy", we would need to look at all energy sources, not just a single source of energy.

Oil is a very convenient form of energy relative to coal an natural gas and would be valuable even if it was only an energy carrier and only had an EROEI of 1. As long as other forms of energy (natural gas, coal, nuclear, wind and solar) have a combined EROEI that is high enough for the economy to function, the physics works out fine.

The economic system simply allocates the resources so that they are used as efficiently as possible to provide for the needs of the population again all of this run onthe basis of a market system with some measure of government regulation for externalities, public goods, and natural monopolies.

The system is far from perfect, we just have not found something better.

- dcoyne78

- Coal

- Posts: 476

- Joined: Thu 30 May 2013, 19:45:15

Re: Economics vs. ETP

$this->bbcode_second_pass_quote('shortonoil', '')$this->bbcode_second_pass_quote('', 'Y')es, the question is where is the surplus nett energy to do this ? Where is the money to do this? The world is drowning in debt ,and you want more of it . Get real ^ The music is playing but the party is over ^ . Puerto Rico is not coming back and neither is Houston . Wake up.

Historically, the price of oil is now very high. The total cost of crude as a percentage of GDP since 1960 has averaged 2.48%. It is presently 2.64%. According to the graph of Total Cost of Crude/ GDP is should now be 1.64%, or about $37/ barrel. The world has very few funds available for other investments beyond the cost of producing petroleum, and its products. The world has $250 trillion, or more in debt that must be serviced.

If we add up the total spent on C+C from 1960 to 2015 it is 40.69 trillion dollars (nominal dollars), the total nominal World GDP over the 1960-2015 period was 1408.97 trillion dollars.

So the average spending on crude was 40.69/1408.97=2.89%. In 2015 $1.54T was spent on crude and World GDP was $74.29T and 1.54/74.29=2.07%, so less expensive than the average from 1960 to 2015.

Price data from BP workbook at link below

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

World C+C from EIA (International Petroleum table 11.1b) link below

https://www.eia.gov/totalenergy/data/monthly/index.php

World debt has increased mostly due to increased debt in emerging economies as they have gained better access to financial markets as they have become more developed.

See Bank for International settlements statistics at link below.

https://www.bis.org/statistics/totcredit.htm?m=6%7C380%7C669

- dcoyne78

- Coal

- Posts: 476

- Joined: Thu 30 May 2013, 19:45:15

[/img]

[/img]