When to draw your social security?

Re: When to draw your social security?

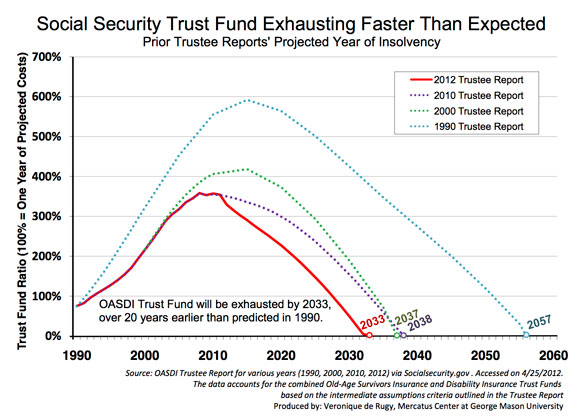

actually I'm not all that concerned with the trust fund, tweaking it here and there should keep it going fine.

I'm much more worried about privatizing both SocSec and Medicare

I'm much more worried about privatizing both SocSec and Medicare

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: When to draw your social security?

$this->bbcode_second_pass_quote('Pops', 'a')ctually I'm not all that concerned with the trust fund, tweaking it here and there should keep it going fine.

I'm much more worried about privatizing both SocSec and Medicare

I'm much more worried about privatizing both SocSec and Medicare

I don't think anyone is proposing privatizing either one for those of us that are already of receiving age. No time to build up an account balance and all that. I'm more concerned with what they are doing or rather not doing about long term nursing home care and reverse mortgages.

There are two groups of predators out there just waiting for you and yours to get sick or feeble minded enough to fall into their clutches.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: When to draw your social security?

yeah I'm likely on the cusp at 59

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: When to draw your social security?

If I recall correctly they were looking back to age 55 to make the change to a private system. Over 55 and you were good to go. Below that and you are sort of phased into a new system.

I'm doubtful any change will be made to all of this. The younger workers have to keep contributing to it to pay the existing claimants. I don't see how to change that without immediately bankrupting the system.

I'm doubtful any change will be made to all of this. The younger workers have to keep contributing to it to pay the existing claimants. I don't see how to change that without immediately bankrupting the system.

-

Cog - Fusion

- Posts: 13416

- Joined: Sat 17 May 2008, 03:00:00

- Location: Northern Kekistan

Re: When to draw your social security?

A good run of antibiotic resistant drug will wipe out many old times. That would help.

Ss is a big deal. I made a pretty good salary and draw near the max. It's like having over a million in the bank drawing interest.

Ss is a big deal. I made a pretty good salary and draw near the max. It's like having over a million in the bank drawing interest.

-

Newfie - Forum Moderator

- Posts: 18651

- Joined: Thu 15 Nov 2007, 04:00:00

- Location: Between Canada and Carribean

Re: When to draw your social security?

$this->bbcode_second_pass_quote('Newfie', 'A') good run of antibiotic resistant drugdisease will wipe out many old timers. That would help.

vtsnowedin auto correct

$this->bbcode_second_pass_quote('', '

')Ss is a big deal. I made a pretty good salary and draw near the max. It's like having over a million in the bank drawing interest.

Yes a very good deal.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: When to draw your social security?

$this->bbcode_second_pass_quote('vtsnowedin', '')$this->bbcode_second_pass_quote('Shaved Monkey', 'I')ts a different system in Australia.

You have a private superannuation your employer put 9% in and you put what ever you want in at 15% tax in

All that is 0% tax out.

You can start getting it at about 60 depending on when you were born but can draw it earlier if you need it for some reason.(unemployment illness emergency etc.)

Then your government pension kicks in at 65 or upto 67 depending on when you were born.(conservatives want to make it upto 70 but hopefully it wont pass the senate)

You can get both so you never run out of money worst case you will have just the government one

Which my dad is on nearly $400 AUD a week for a single or its $300 a week for each couple.

He saves money on his.

My wifes sister has private and government

She gets about $750 a week and goes on 2 cruises a year.

She was a secretary and had about $180 g in super on retirement

Plus everyone gets free medical and cheap drugs

My wife and I will have both private and government

So much love for socialism its much greater than what Trump is visualising

How financially sound are the trust funds for those systems? And how is overall Australian government debt?You have a private superannuation your employer put 9% in and you put what ever you want in at 15% tax in

All that is 0% tax out.

You can start getting it at about 60 depending on when you were born but can draw it earlier if you need it for some reason.(unemployment illness emergency etc.)

Then your government pension kicks in at 65 or upto 67 depending on when you were born.(conservatives want to make it upto 70 but hopefully it wont pass the senate)

You can get both so you never run out of money worst case you will have just the government one

Which my dad is on nearly $400 AUD a week for a single or its $300 a week for each couple.

He saves money on his.

My wifes sister has private and government

She gets about $750 a week and goes on 2 cruises a year.

She was a secretary and had about $180 g in super on retirement

Plus everyone gets free medical and cheap drugs

My wife and I will have both private and government

So much love for socialism its much greater than what Trump is visualising

Trust funds are in the biggest Super funds in Australia

There's lots of rules of what they can and cant do, but yes they lose money in massive down turns and interest rates are low.

It all comes back to simplifying my life in preparation for retirement.

My overheads are very low, solar hot water and electricity,efficient appliances,rain water for drinking,no heating , no cooling, lots of home grown fruit and veg,no need for too much clothes,only a few hundred dollars of petrol (gas) a year.

If TSHTF I can crank up harder.

If it doesnt even better.

All I can do is hope for good health and fun times.

Ready to turn Zombies into WWOOFers

-

Shaved Monkey - Intermediate Crude

- Posts: 2578

- Joined: Wed 30 Mar 2011, 01:43:28