by SumYunGai » Thu 15 Sep 2016, 21:01:40

by SumYunGai » Thu 15 Sep 2016, 21:01:40

$this->bbcode_second_pass_quote('AdamB', '')$this->bbcode_second_pass_quote('SumYunGai', '

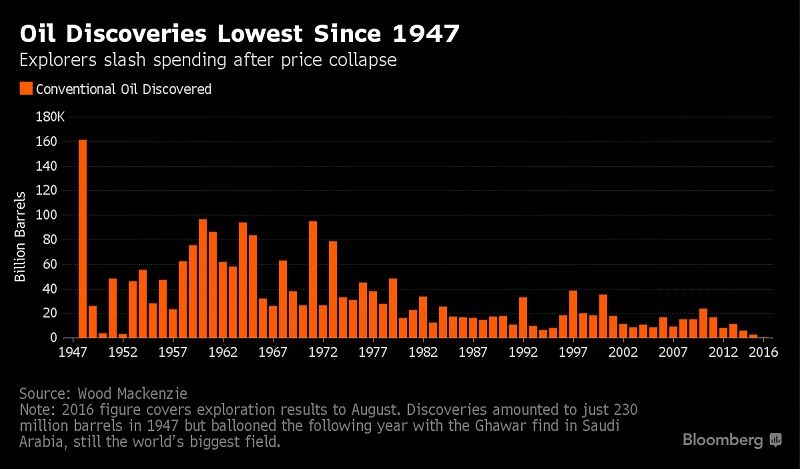

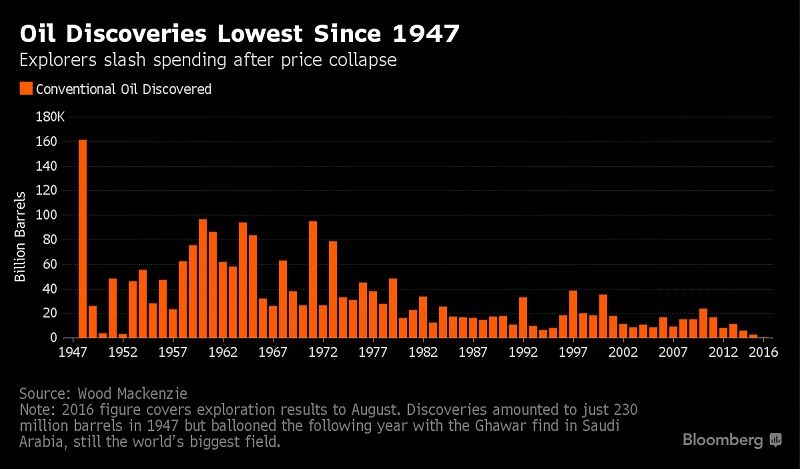

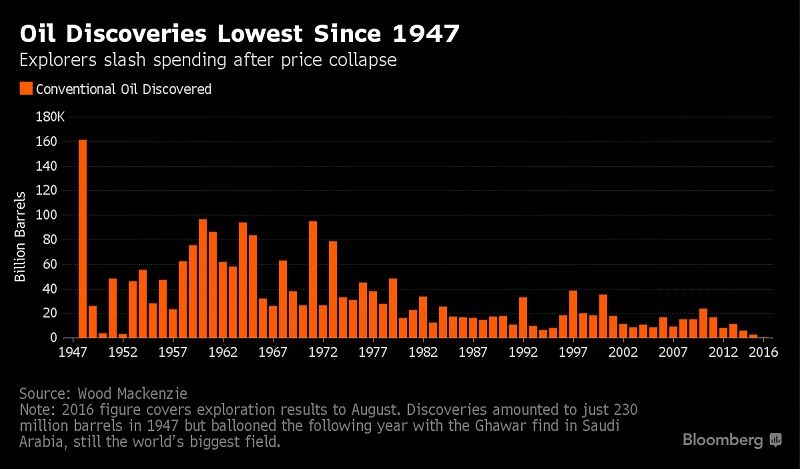

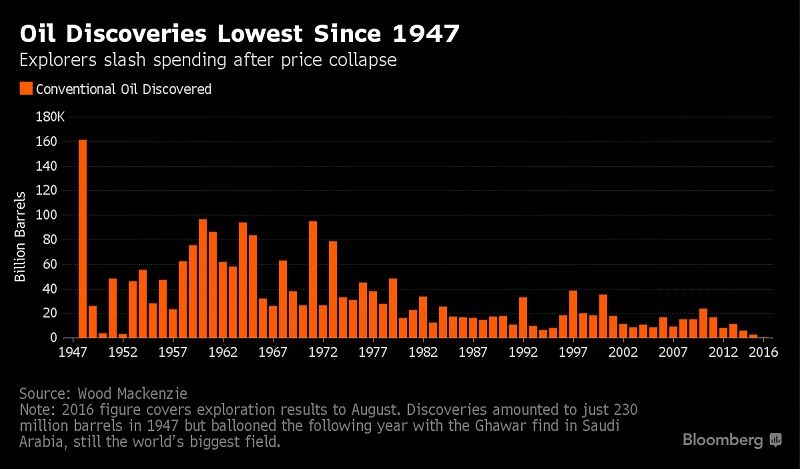

')What do you think of this chart, then?:

Does this trend look good to you?

If I define all the conventional oil as the easy oil, back when everything reached with a rotary drilling rig was unconventional, I can make one that looks even worse. Just as the hill group was forced to exclude data and cherry pick time frames to get their spurious relationship to work, and send out ignorant salesmen to pimp the report, this one needs to ignore certain types of oil as well.

You should know that this particular graphic, or a version of it, has been used to hide where most "new" oil was coming from since before the last peak oil scare. The geoscientists talk about it and study it, peak oiler amateurs design graphs to hide it. Don't take my word for it; first sentence in summary and conclusions. The document is near 20 years old now. Amateurs like whats his name, and 10 years ago in the peak oil crowd, can't even be bothered to learn this stuff.

http://pubs.usgs.gov/fs/fs-202-96/FS-202-96.html But the rate of reserve growth increase is also declining.

http://www.ogj.com/articles/print/volum ... rease.html$this->bbcode_second_pass_quote('', '[')b]

Regional reserves growth shows decline in annual rate of increaseResults analysis

Future reserve growth modeling will incorporate specific factors such as geological conditions and recovery technologies. As reserve growth models become more refined by regions representing different growth rates, the average rate of reserve growth will continue to decrease.

In addition, the rate of decrease will be more obvious for natural gas, suggesting reserve growth is lower for regions outside the US. Reserve volumes and the rate of increase in recent years may not provide the same stable growth as in earlier years.

With new discoveries almost non existent, reserves are just being drained that much faster. Running on reserve growth is like running on fumes. Face it, the oil industry is going out of business.

by rockdoc123 » Fri 16 Sep 2016, 11:37:05

by rockdoc123 » Fri 16 Sep 2016, 11:37:05

$this->bbcode_second_pass_quote('', 'I') said nothing about extra heavy oil. Rock, do you have a reading comprehension issue?

here is exactly what you said:

$this->bbcode_second_pass_quote('', 'T')he tar sands were last big thing. Sad. Green River oil shale (not to be confused with tight-shale oil) and

Orinoco superheavy will never be produced.

I certainly don't have a reading comprehension issue but you obviously have a writing comprehension issue.

by ennui2 » Fri 16 Sep 2016, 12:33:22

by ennui2 » Fri 16 Sep 2016, 12:33:22

$this->bbcode_second_pass_quote('rockdoc123', '')$this->bbcode_second_pass_quote('', 'I') said nothing about extra heavy oil. Rock, do you have a reading comprehension issue?

here is exactly what you said:

$this->bbcode_second_pass_quote('', 'T')he tar sands were last big thing. Sad. Green River oil shale (not to be confused with tight-shale oil) and

Orinoco superheavy will never be produced.

I certainly don't have a reading comprehension issue but you obviously have a writing comprehension issue.

This exchange is eerily similar to one from a while back.

He starts out making a sweeping universal statement

"the world is in recession because of demand-dearth. Nobody can afford oil even at current prices!"Then we trot out all the data showing demand growing and especially strong economic numbers out of the US.

Then he says "I'm not talking about the US!"

Well,

of course he was, because he was making a sweeping statement about

the whole world. The US is a huge part of global GDP. So he has to keep narrowing down and qualifying his original hyperbolic statement while simultaneously denying that he ever meant anything quite so broad. We're, I guess, supposed to just know that there are imaginary asterisks next to them.

Doomers are notorious for making these sorts of sweeping statements. StarvingLion is sort of the last stop along that train, where everything's a ponzi scheme, period. End of discussion. Do not pass go. There's really nowhere to take an argument with someone who sees the world in such childlike simplicity. There's no dialogue, only dueling monologues.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

by ennui2 » Fri 16 Sep 2016, 14:25:06

by ennui2 » Fri 16 Sep 2016, 14:25:06

Oh, and btw, hot of the presses.

http://www.businessinsider.com/baker-hu ... picks=true$this->bbcode_second_pass_quote('', '

')The oil-rig count has climbed in 11 out of the last 12 weeks, the longest streak since early 2014, before the oil crash.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2

- Permanently Banned

-

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

-

by AdamB » Sat 17 Sep 2016, 18:12:06

by AdamB » Sat 17 Sep 2016, 18:12:06

$this->bbcode_second_pass_quote('rockdoc123', '

')You have no history in the oil industry and certainly no apparent knowledge yet you feel perfectly fine in making bold sweeping statements that have no basis in fact and are usually contradicted by data readily available to anyone. You remind me of the crazies we used to always see in Hyde Park corner who would get up and rant about subjects they knew nothing about but it didn’t stop them from having strong opinions that they were convinced were correct regardless of all the evidence to the contrary.

You've been here for a decade and are just figuring this out NOW?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB

- Volunteer

-

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

-

by AdamB » Sat 17 Sep 2016, 18:22:13

by AdamB » Sat 17 Sep 2016, 18:22:13

$this->bbcode_second_pass_quote('SumYunGai', '')$this->bbcode_second_pass_quote('AdamB', '

')

http://pubs.usgs.gov/fs/fs-202-96/FS-202-96.htmlBut the rate of reserve growth increase is also declining.

http://www.ogj.com/articles/print/volum ... rease.html You didn't even see the numbers discussed in your reference did you? LARGER than the USGS estimates of same..and you want to pretend this means LESS?

Why how interesting, you must be the salesman pimping the Etp, he wouldn''t have known that a past estimate in the 500 billion barrel range, was smaller than what is claimed in your reference, in the 600 billion barrel range.

Tell me where you live, and I'll find a remedial math class at the local community college, and we'll get you schooled up and winning math-lete challenges with 2nd graders in no time!

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

by SumYunGai » Sat 17 Sep 2016, 19:38:17

by SumYunGai » Sat 17 Sep 2016, 19:38:17

$this->bbcode_second_pass_quote('AdamB', '')$this->bbcode_second_pass_quote('SumYunGai', '')$this->bbcode_second_pass_quote('AdamB', '

')

http://pubs.usgs.gov/fs/fs-202-96/FS-202-96.htmlBut the rate of reserve growth increase is also declining.

http://www.ogj.com/articles/print/volum ... rease.html You didn't even see the numbers discussed in your reference did you? LARGER than the USGS estimates of same..and you want to pretend this means LESS?

Why how interesting, you must be the salesman pimping the Etp, he wouldn''t have known that a past estimate in the 500 billion barrel range, was smaller than what is claimed in your reference, in the 600 billion barrel range.

Tell me where you live, and I'll find a remedial math class at the local community college, and we'll get you schooled up and winning math-lete challenges with 2nd graders in no time!

Ouch. Your own link from the USGS states the following:

$this->bbcode_second_pass_quote('', '[')b]Summary and Conclusions

Reserve growth is a major component--perhaps THE major component--of remaining United States natural-gas resources. Historical data (figs. 1, 2) support this premise, as do estimates of technically recoverable and of economically recoverable gas resources remaining in the United States (figs. 3, 4).

Yet, as Attanasi and Root (1994) emphasized when they referred to "the enigma of oil and gas field growth,"

reserve growth is poorly understood. Projections of future reserve growth in the United States carry large uncertainty. Much work remains to be done on the phenomenon of reserve growth, which is arguably the most significant research problem in the field of hydrocarbon resource assessment.