by AdamB » Wed 25 May 2016, 16:09:56

by AdamB » Wed 25 May 2016, 16:09:56

$this->bbcode_second_pass_quote('M_B_S', 'M')y answer is NO

The sheeple whant to believe but its all about physics.

You can allways print money but no oil=energy.

Fortunate indeed then that a recent Carnegie Mellon study pegs the amount of oil endowment at the 24 trillion barrel level, and we've used alittle more than 1.

Methinks Mr Rockman will have a career for as long as he wants one in the industry, and his children to.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB

- Volunteer

-

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

-

by AdamB » Wed 25 May 2016, 16:26:37

by AdamB » Wed 25 May 2016, 16:26:37

$this->bbcode_second_pass_quote('Revi', 'I')t seems like a lot of the high flyers have come up and came down spectacularly in recent years. Remember Matt Simmons? He was a little early with his predictions, but he managed to get the world out anyway.

Early? You mean like, Malthusian early? If we all wait a couple more centuries, maybe it'll happen? And word? Which word? The one that says you don't ask an accountant about oil stuff? See for yourself:

https://www.masterresource.org/peak-oil ... simmons-i/At the end even TOD was carving the guy up like a Christmas turkey.

http://www.theoildrum.com/node/6789$this->bbcode_second_pass_quote('revi', '

') I think we are going to see some things starting to happen very soon.

A common refrain for...more than a decade now? I'm betting that we will see some things very soon as well, like the glut continuing for a little longer as per the EIA, the availability of shale oil and particularly gas for the foreseeable future, as per the EIA, and peak demand as per the energy experts at UC Hastings, having learned about peak oil from poor references, I am now attempting to stick to people who know stuff, about stuff, rather than just asking anyone about topics they may have no knowledge in whatsoever.

Here is a real expert, to substantiate my point on peak demand.

http://www.eenews.net/stories/1060019207$this->bbcode_second_pass_quote('revi', '

') Twilight in the Desert was his book about Saudi oil, and it looks like they are in trouble nowadays. What goes up must come down, despite what AdamB thinks.

The Saudi's are in trouble for sure....because the US produced too much oil and gas and is now rewriting the economic global rulebook on price. Whooo Yahhh!

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

by AdamB » Wed 25 May 2016, 16:29:36

by AdamB » Wed 25 May 2016, 16:29:36

$this->bbcode_second_pass_quote('ROCKMAN', '&')quot;What goes up must come down, despite what AdamB thinks." And what goes down will eventually come back up. The POD, like rust, never sleeps. LOL

I like "the cure for high oil prices is high oil prices, and the cure for low oil prices is low oil prices" better.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB

- Volunteer

-

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

-

by AdamB » Tue 31 May 2016, 09:49:23

by AdamB » Tue 31 May 2016, 09:49:23

$this->bbcode_second_pass_quote('Revi', 'C')heck out the latest post by Ron Patterson. I think the danger has just begun:

http://peakoilbarrel.com/eia-world-crud ... roduction/I think the danger is in the deflationary nature of scary words. Peak oil was once considered a danger, and is now considered a period of high production and cheap price. Not quite the danger it once was certainly. And until Ron incorporates price effects in his analysis, and the possible effects of the shales around the world, he is ignoring the two basics that posters here knew about and called years ago. Recycling ideas without accounting for the reasons why the world never ended back then, and scary words suffered deflation, is just recycling ideas that didn't work before and have no expectation of being right this time.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB

- Volunteer

-

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

-

by Revi » Tue 31 May 2016, 10:37:03

by Revi » Tue 31 May 2016, 10:37:03

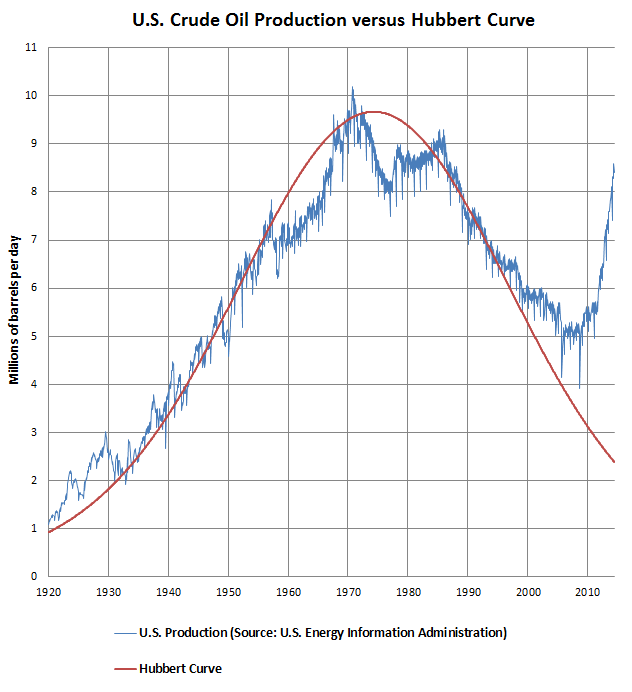

Thanks for your prompt response AdamB! I think it's an interesting bit of info from a guy who has been keeping an eye on what's going on. There's no doubt that the only places that are adding to oil supply right now are Iran and Russia. They can't keep the whole world from going over the peak, however. Check out the downslope from our fracked oil here in the US. I think we are going over the peak, but I could be wrong. We certainly haven't come up in oil production since last year. We'll have to see at the end of the year, but it looks like maybe we've hit that forbidden word.........PEAK OIL!!!!!!!!!!!

$this->bbcode_second_pass_quote('AdamB', '')$this->bbcode_second_pass_quote('Revi', 'C')heck out the latest post by Ron Patterson. I think the danger has just begun:

http://peakoilbarrel.com/eia-world-crud ... roduction/I think the danger is in the deflationary nature of scary words. Peak oil was once considered a danger, and is now considered a period of high production and cheap price. Not quite the danger it once was certainly. And until Ron incorporates price effects in his analysis, and the possible effects of the shales around the world, he is ignoring the two basics that posters here knew about and called years ago. Recycling ideas without accounting for the reasons why the world never ended back then, and scary words suffered deflation, is just recycling ideas that didn't work before and have no expectation of being right this time.

Deep in the mud and slime of things, even there, something sings.

by AdamB » Tue 31 May 2016, 10:53:04

by AdamB » Tue 31 May 2016, 10:53:04

$this->bbcode_second_pass_quote('Revi', 'T')here's no doubt that the only places that are adding to oil supply right now are Iran and Russia. They can't keep the whole world from going over the peak, however.

Here is the problem. The US has just demonstrated that "right now" isn't the issue, and a core flaw in always assuming that things only decline rather than combining the economics and geology to understand how the last peak oil becomes just another in the sine wave profile. Iraq has been adding production, and can do more. So can SA. So can Nigeria and Libya and the US already HAS added the largest oil fields across an entire hemisphere. So we can't just limit ourselves to what we can see today, we have to dig into all those other places where decline is not a requirement. Bell shaped curves don't work, and assuming they do is a slippery slope in a oil world defined by a sine wave production profile. Ron needs to leave the obsolete world of only decline, if only because he got caught out with TOD using such antiquated methods.

$this->bbcode_second_pass_quote('Revi', '

') Check out the downslope from our fracked oil here in the US.

Check out the upslope that oil caused first. Hard to find anyone who called that except Rockman and Mr Reserve...everyone else figured the US was in decline and that was that. Until what Rockman and Mr Reserve said would happen, did.

So now they are declining? Exactly as the POD says it should. And when prices return? How high will the next increase go? The EIA put that out recently in their AEO report, have you seen it? A return of price brings another US peak, just, using the shales, functioning exactly as Rockman and Mr reserve have already told us.

$this->bbcode_second_pass_quote('Revi', '

')I think we are going over the peak, but I could be wrong.

Over the peak again. With another one within a few years, according to the EIA.

$this->bbcode_second_pass_quote('Revi', '

')We certainly haven't come up in oil production since last year. We'll have to see at the end of the year, but it looks like maybe we've hit that forbidden word.........PEAK OIL!!!!!!!!!!!

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

by AdamB » Tue 31 May 2016, 13:14:31

by AdamB » Tue 31 May 2016, 13:14:31

$this->bbcode_second_pass_quote('ennui2', ' ')It won't be a Hirsch Report style transition but it's about as good as anyone would have hoped to see. And this doesn't even factor in benign behavioral change like telecommuting. I can see these things acting as a limiter on oil price rather than us proceeding straight to Mad Max and long-pork. I think all these things have a point of diminishing returns, but it could flatten out the shark-fin quite a bit.

We've been transitioning in this way for better part of a decade now. When the sky was claimed to be falling a decade back, there weren't even EVs to transition to. Or windmills stretching to the horizon in Kansas and Texas. Back then peak oil itself was supposed to stop these transitions, and instead it not only created them, nurtured them and got them rolling in a major way, but the industry production response was so successful that they delivered glut prices and forced OPEC to respond in new ways to American production increases. A first in most of our lifetimes.

By the time we get toward around to someone making up yet another equation that only represents decline, while ignoring price responses, new technologies, industry innovation and just sheer volumes of resources in American shale formations, some portion of the population just won't care. Transition early and avoid the rush.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB

- Volunteer

-

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

-

by Tanada » Tue 31 May 2016, 13:16:06

by Tanada » Tue 31 May 2016, 13:16:06

$this->bbcode_second_pass_quote('ennui2', 'L')et's say fracking gives us one more hump on this cycle after prices rebound. It would be reasonable to say that the time between now and the tail-end of the second hump would be at least a few years. And by the time we get there, we're going to see some significant movement finally on things like EVs. Let's say by 2020-2021 oil price spikes back up to around $100 and stays there. Then there would be that much more of an impetus for people to buy EVs, just as manufacturing capability is scaling out in a way to provide them. This is a very different scenario from the spike in 2008. I just think when we're most likely to face the brunt of peak-oil that industry will be fairly well positioned to provide a transition. It won't be a Hirsch Report style transition but it's about as good as anyone would have hoped to see. And this doesn't even factor in benign behavioral change like telecommuting. I can see these things acting as a limiter on oil price rather than us proceeding straight to Mad Max and long-pork. I think all these things have a point of diminishing returns, but it could flatten out the shark-fin quite a bit.

Maybe, but prices are knocking on $50/bbl now so you would think if Fracking is going to be getting a second wind we would at least feel a little gust of breeze now. So far as I an tell things in terms of drilling and fracking are static or possibly still falling a bit. If Patterson is correct and all of the stability for the last 5 months has come from Iran ramping back up to full production as the rest of OPEC is declining. Naturally you have to take note of the fact that Venezuela, Nigeria and Libya are still a mess and their oil can all come back on line at some point in the future. Anyhow as the "fracking miracle" in the USA abates we will soon discover if there will be a recovery back to 2015 levels or not. The question then becomes, how soon will prices get back in that $111/bbl range needed to really encourage broad scale fracking to resume?

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

by AdamB » Tue 31 May 2016, 13:32:18

by AdamB » Tue 31 May 2016, 13:32:18

$this->bbcode_second_pass_quote('Tanada', '

')

Maybe, but prices are knocking on $50/bbl now so you would think if Fracking is going to be getting a second wind we would at least feel a little gust of breeze now.

Current EIA estimates put the recovery more in the 2 year time frame. Drilling rigs can be turned on pretty quickly, so there is no rush.

$this->bbcode_second_pass_quote('Tanada', '

')The question then becomes, how soon will prices get back in that $111/bbl range needed to really encourage broad scale fracking to resume?

The EIA puts the shale development oil recovery moving through to about 2020, looks like. Slide 44.

http://www.eia.gov/forecasts/aeo/er/pdf/0383er(2016).pdf

Corresponding to a price recovery of about $80/bbl. Slide 9.

Even more interesting in that presentation is the increased solar and renewables electrical power generation if the clean power plan rules go through, and how much longer lower crude prices stuck around than they just assumed last year. They are just fundamentally conservative in their outlook I guess, which would also explain why they underestimated the shale revolution during the initial rampup period.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

by Tanada » Tue 31 May 2016, 15:14:29

by Tanada » Tue 31 May 2016, 15:14:29

$this->bbcode_second_pass_quote('AdamB', '')$this->bbcode_second_pass_quote('Tanada', '

')

Maybe, but prices are knocking on $50/bbl now so you would think if Fracking is going to be getting a second wind we would at least feel a little gust of breeze now.

Current EIA estimates put the recovery more in the 2 year time frame. Drilling rigs can be turned on pretty quickly, so there is no rush.

$this->bbcode_second_pass_quote('Tanada', '

')The question then becomes, how soon will prices get back in that $111/bbl range needed to really encourage broad scale fracking to resume?

The EIA puts the shale development oil recovery moving through to about 2020, looks like. Slide 44.

http://www.eia.gov/forecasts/aeo/er/pdf/0383er(2016).pdf

Corresponding to a price recovery of about $80/bbl. Slide 9.

Even more interesting in that presentation is the increased solar and renewables electrical power generation if the clean power plan rules go through, and how much longer lower crude prices stuck around than they just assumed last year. They are just fundamentally conservative in their outlook I guess, which would also explain why they underestimated the shale revolution during the initial rampup period.

First off EIA is all over the map if you want to speculate on their long term accuracy. Back in 2005 they thought we would never get over $50/bbl and that production would grow basically forever as much as needed to always meet demand.

Second point, starting in August 2011 and lasting through November 2014 the price was at or above $80/bbl and stayed in the price band of $80-93 with a few peaks up to almost $96/bbl all of which were very brief.

Third point, we know that many if not most of the Fracking oil companies that formed or greatly expanded operations in all the different plays during the 2009-2015 period were losing money on their physical production even at those $80-96 selling prices during the 2011-2014 period, and when prices declined staring in November 2014 the bleeding of cash turned from bad to horrific.

So IMO, and I know it is just my opinion, someone or a group of someones at EIA is projecting that if prices just get back into the $80-96 band where they spent over three years during the fracking boom everything will just reset to the way it was and everything will be sunshine and lollipops all over again. Sorry, but the real world does not even remotely work that way. The Fracking bubble is still deflating even though prices have recovered to be at 63 percent of the $80-96 price band. Some, maybe even half depending on whom you believe, fracked LTO wells make a profit at this price point. However nowhere near half as many wells are being drilled and completed today. May 31 2016, as were being drilled and completed in 2014. You can chalk that up to any cause that suits you. To me it screams that the oil drilling and completion funding model that was in place from 2009-2014 has ceased to function. IOW nobody is throwing fistfuls of cash at fracking companies today like they were two years ago.

EIA is making several assumptions, first that as soon as the price passes $60/bbl the slope of the increase will be considerably reduced. From February through May 2016 the price has been trending upward at an averaged rate around $0.90/bbl/week. That is happening right now despite all the proclamations that storage is almost full, that Iran is going to flood the market or pick whatever price downward pressure news you want. Is it possible that when we hit $50/bbl or $60/bbl the upward price pressure will dissipate and the price will stabilize? Sure. Is it likely? Well that is a much more complicated and difficult question to answer. Also they are assuming that as soon as the price hits somewhere around $65/bbl drilling and completions will pick up the pace until new production balances depletion.

If they turn out to be correct then their scenario becomes a realistic possibility, but everything has to go just the way they want it too. The economy can not stumble, no new major wars can break out, the economy can not grow too fast and world oil supplies outside the fracking industry can not decline to rapidly. That is a fairly long list of requirements that are all questionable that have to be met for their IMO overly optimistic projection to come true. Step back and remember these are the same people who thought the Shale fracking boom would continue full speed up through 2020-2023 at which time drilling locations would be the major controlling factor in USA oil production.

by AdamB » Tue 31 May 2016, 16:16:56

by AdamB » Tue 31 May 2016, 16:16:56

$this->bbcode_second_pass_quote('Tanada', '

')First off EIA is all over the map if you want to speculate on their long term accuracy.

But we are talking about short term accuracy here, not long term. And predicting the future is hard, certainly, and if you noticed in that presentation there were certainly some caveats.

$this->bbcode_second_pass_quote('Tanada', '

') Back in 2005 they thought we would never get over $50/bbl and that production would grow basically forever as much as needed to always meet demand.

Back in 2006 they got the global world oil production right about spot on, and didn't fall for peak oil along the way, unlike many others. This alone, and the expertise it took not to jump on that bankwagon, gives them a leg up on any organization that fell for it.

And it turns out that increasing oil production to meet demand is exactly what happened, and is still happening today.

$this->bbcode_second_pass_quote('Tanada', '

')Second point, starting in August 2011 and lasting through November 2014 the price was at or above $80/bbl and stayed in the price band of $80-93 with a few peaks up to almost $96/bbl all of which were very brief.

And this was the point of those shale fields exploding into a black swan for OPEC. So this is good, because it didn't require $110/bbl. And the peak was brief because price clobbered the rig count, just as Rockman and the POD would predict. Did predict.

$this->bbcode_second_pass_quote('Tanada', '

')Third point, we know that many if not most of the Fracking oil companies that formed or greatly expanded operations in all the different plays during the 2009-2015 period were losing money on their physical production even at those $80-96 selling prices during the 2011-2014 period, and when prices declined staring in November 2014 the bleeding of cash turned from bad to horrific.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"