Has the danger of Peak Oil passed?

Re: Has the danger of Peak Oil passed?

I think that we will be able to date peak oil in the rearview mirror. In maybe a couple of years we'll start to see it. then we'll see that we never came up to that amount of oil we produced in 2015, or whenever the peak was. Everything's clear in hindsight.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Has the danger of Peak Oil passed?

Revi - So true. Which emphasizes the point I keep boring some folks with: the date of global PO actually has little relevance in our daily lives.

LONG LIVE THE POD!!!

As if we have a f*cking choice. LOL

LONG LIVE THE POD!!!

As if we have a f*cking choice. LOL

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

$this->bbcode_second_pass_quote('pstarr', '

')Regardless I asked about the the missing $1 trillion dollars. In your opinion, did it have

a) nothing,

b) little,

c) or a trifle to do with our Great Recession?

')Regardless I asked about the the missing $1 trillion dollars. In your opinion, did it have

a) nothing,

b) little,

c) or a trifle to do with our Great Recession?

b) Maybe 25% or less. Note the oil speculation going on at the time. There was maybe a $20-30 premium tacked on due to speculation.

Of course, when you evoke the recession, you never even mention real-estate. Only peak-oil. It's that sin of omission I can't let pass without calling you on it. It's BS.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Has the danger of Peak Oil passed?

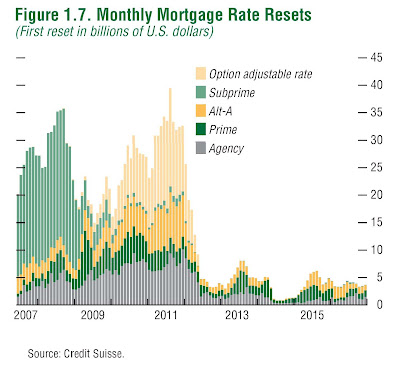

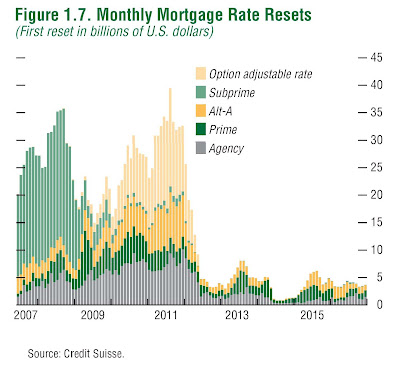

This is the only chart anyone needs to see to blame real-estate for the credit-crisis. I've used it many times and each time PStarr scoffs at it because he's mentally incapable of adding 2+2 on this simple logic. Clear peaker blinders.

The big spike up in people's monthly mortgage payments far outweighed the increased cost of commuting from the exurbs at $3.xx vs. $2.00 gas.

The big spike up in people's monthly mortgage payments far outweighed the increased cost of commuting from the exurbs at $3.xx vs. $2.00 gas.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Has the danger of Peak Oil passed?

$this->bbcode_second_pass_quote('pstarr', ' ')Current reserves from old fields are mostly unknowable as the old fields were mapped before modern 4-D seismic.

Current reserves are not required to be calculated using any seismic. And decades of performance, all the way back into the the old "unknowable" days, are great sources of information from which to do current reserves, with nary a seismic plot in sight.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

$this->bbcode_second_pass_quote('Revi', 'I') think that we will be able to date peak oil in the rearview mirror. In maybe a couple of years we'll start to see it. then we'll see that we never came up to that amount of oil we produced in 2015, or whenever the peak was. Everything's clear in hindsight.

That idea certainly worked for awhile in the US. But the real problem is, how many decades must we wait to figure out if it was the real deal? Using the US as an example, we have to wait more than 4 decades to make sure it doesn't happen all over again. So now we have to worry about the sine curve example of oil production coming back to haunt our grandchildren. Cycle 2, halfway through at this point. In 2050, maybe it'll be the oil shales doing the peak of cycle 3?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

PStarr's argument seems to revolve around the simple truth that oil is underground and we can't see it therefore we don't know how much is left. And since we can't, it's up to our individual biases to predict how much. Doomers = less. Cornies = more. That's really not a scientific argument. It's arguing for superstition or a crap-shoot.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Has the danger of Peak Oil passed?

$this->bbcode_second_pass_quote('pstarr', '

')How can current reserves from an old field be determined (modern reserves measure are a function both of production history and field geology).

a) the original production data is not accurate before SEC filings and,

b) the original field dimension were not mapped.

So You are wrong. And you need to drop the snarky images. They waste bandwidth and are visually actually an ad hom. Flagged?

')How can current reserves from an old field be determined (modern reserves measure are a function both of production history and field geology).

a) the original production data is not accurate before SEC filings and,

b) the original field dimension were not mapped.

So You are wrong. And you need to drop the snarky images. They waste bandwidth and are visually actually an ad hom. Flagged?

I stand by my original statement. The SEC requirements on reserve reporting date back to 1933.

First page, halfway down.

https://www.sec.gov/rules/final/2008/33-8995.pdf

3D seismic was a 60's event, you figure between 1933 and sometime after the 60's when 4D got invented no one was filing any reserve reports? 1/3 of the way down the page.

http://www.offshore-technology.com/feat ... d-4436910/

But even though you obviously aren't familiar with how reserves are done, I would like to ask Rockman if 4D seismic is how his billionaire oil boss estimates the future value of his fields or assets. How about it Rockman, does your rich boss call in Schlumberger every so often so he can reassess the value of his producing properties, it being apparently the way it can be done?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 11018

- Joined: Mon 28 Dec 2015, 17:10:26