When do we fall off the undulating plateau? Pt 2

Re: When do we fall off the undulating plateau?

$this->bbcode_second_pass_quote('ROCKMAN', 'D')ave - By all means: "I am a river to my people." LOL.Points if you know the movie I stole that line from. The greatest movie ever made IMHO.

In my world, Google is a thing. Such quotes aren't exactly hard to find, generally.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: When do we fall off the undulating plateau?

And for folks too lazy to Google: Lawrence of Arabia. Anthony Quinn's character after being accused of skimming from his tribe.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: When do we fall off the undulating plateau?

ROCKMAN,

Lawrence of Arabia? Very entertaining, indeed; don't know about great, though. Now, for great:

Anthony Quinn in Zorba the Greek, playing opposite a very young Alan Bates.

Lawrence of Arabia? Very entertaining, indeed; don't know about great, though. Now, for great:

Anthony Quinn in Zorba the Greek, playing opposite a very young Alan Bates.

- Synapsid

- Tar Sands

- Posts: 780

- Joined: Tue 06 Aug 2013, 21:21:50

Re: When do we fall off the undulating plateau?

pstarr - Yes: just like the line from another of my favorite movies as the character reflects on the death of his father: "Grief...it's a process". IOW it's not just an emotion by a dynamic that changes over time. Just like our feelings about PO: good days and bad days. But in the end we're still just as dead as his old man. LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: When do we fall off the undulating plateau?

Rockman, just because Shell has suspended their efforts with $50.00/bbl oil does not mean nobody will dust those plans off again if oil sustains $125.00/bbl for a year or so.

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: When do we fall off the undulating plateau?

We might have oil go back up in price again, but it won't get enough going to create another peak. By that time we will have dropped 13% off of the legacy fields, which will put us behind the eight ball enough so that another pile of condensates won't put us back over the peak. That's my 2 cents worth, anyway...

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: When do we fall off the undulating plateau?

$this->bbcode_second_pass_quote('Revi', 'W')e might have oil go back up in price again,

it can't, its only worth $10/bbl

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: When do we fall off the undulating plateau?

The catch with high oil prices needed to support more exploration is that the former also leads to economic crisis.

-

ralfy - Light Sweet Crude

- Posts: 5651

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: When do we fall off the undulating plateau?

ralfy - And thus the notorious/unimportant POD lives on. LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: When do we fall off the undulating plateau?

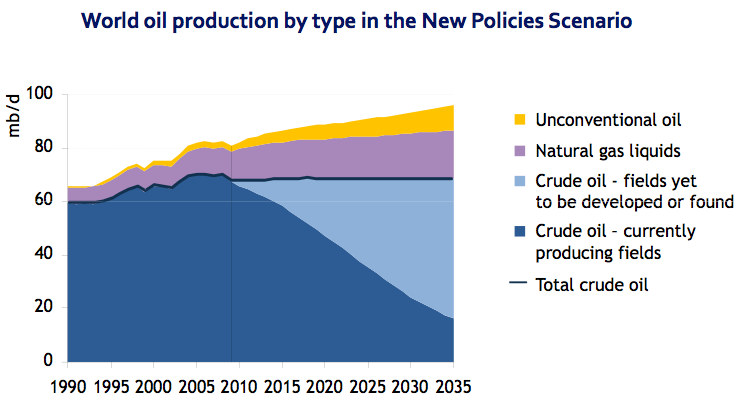

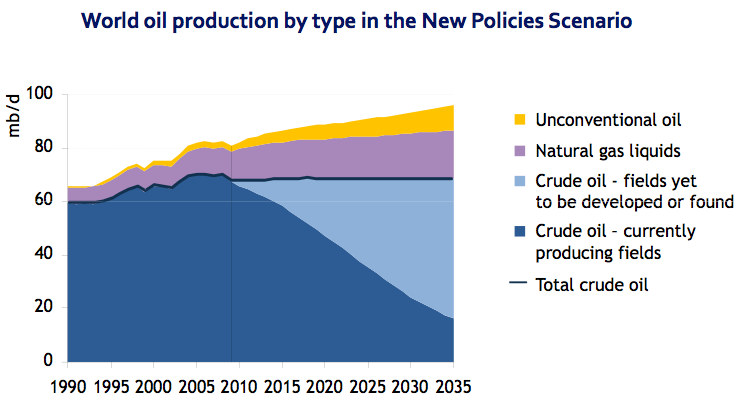

I'm sure y'all remember this good old goody...

"The Arctic" and the super-deep, pre-salt Lula (owned by now junk-bond rated Petrobras) were probably imagined to be a good portion of that pretty blue undiscovered/undeveloped area.

Which isn't to say those will never produce, merely that the deep blue slope illustrates that declines in existing fields are a certainty and new discoveries and new production must always fight to offset.

"The Arctic" and the super-deep, pre-salt Lula (owned by now junk-bond rated Petrobras) were probably imagined to be a good portion of that pretty blue undiscovered/undeveloped area.

Which isn't to say those will never produce, merely that the deep blue slope illustrates that declines in existing fields are a certainty and new discoveries and new production must always fight to offset.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: When do we fall off the undulating plateau?

It would be nice if they updated the chart through 2014 with real data, that perfect yellow should be imperfect real world blue.

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4705

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: When do we fall off the undulating plateau?

We went up a lot higher than that graph showed, thanks to enhanced recovery. All that is done now, so the downslope will be steeper as well.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: When do we fall off the undulating plateau?

Ten years ago, when I bought a house in a rural village, we were arguing if Peak Oil would be in 2008 or even as late as 2012. At that time some of the more moderate people were expecting an 'undulating plateau'. Meanwhile the Cornucopias were expecting some form of technology to save the day.

As it turned out the Energy Fairy did pull a large fracking plum out of where the sun has not shone for millions of years (I don't go with the young oil theories).

Looking back it does seem that we have for some years now been on a undulating plateau that has been slowly rising.

I am not sure if on the supply side the Energy Fairy has any more plums to pull out. However, on the demand side, with China's growth rate slowing and its import of commodities dropping, with the EU back in deflation, and the US in a weak recovery (too weak to raise interest rates last time the Feds met), I expect that dampened demand might lead to the inability to use more oil and so prolong a demand-driven plateau.

My guess is that until the the economy implodes we might continue on a plateau for some years, with it possibly drifting down a little (as it has been slowly rising for the last few years).

As it turned out the Energy Fairy did pull a large fracking plum out of where the sun has not shone for millions of years (I don't go with the young oil theories).

Looking back it does seem that we have for some years now been on a undulating plateau that has been slowly rising.

I am not sure if on the supply side the Energy Fairy has any more plums to pull out. However, on the demand side, with China's growth rate slowing and its import of commodities dropping, with the EU back in deflation, and the US in a weak recovery (too weak to raise interest rates last time the Feds met), I expect that dampened demand might lead to the inability to use more oil and so prolong a demand-driven plateau.

My guess is that until the the economy implodes we might continue on a plateau for some years, with it possibly drifting down a little (as it has been slowly rising for the last few years).

- EdwinSm

- Tar Sands

- Posts: 601

- Joined: Thu 07 Jun 2012, 04:23:59

Re: When do we fall off the undulating plateau?

$this->bbcode_second_pass_quote('Subjectivist', 'I')t would be nice if they updated the chart through 2014 with real data, that perfect yellow should be imperfect real world blue.

Seconded. I would like to see this updated.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld