what underlies oil pricing?

Re: what underlies oil pricing?

Occam's Razor tells me fracking is working and margins ARE high enough to make it worthwhile even at these prices. Sure, there are pundits who say this is some overarching ploy to punish Russia or banksters are shorting themselves for some sort of ponzi scheme. This may be true, but there's no way to really tell once and for all until later. But in the meantime, society seems to run better with $60 oil than $100 oil, despite the damage to the environment, so I'm not going to look a gift horse in the mouth.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: what underlies oil pricing?

Don't know if this has been posted already, but it claims that the price has been buoyed by QE.

http://wolfstreet.com/2014/12/21/did-th ... ing-chart/

http://wolfstreet.com/2014/12/21/did-th ... ing-chart/

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: what underlies oil pricing?

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: what underlies oil pricing?

$this->bbcode_second_pass_quote('dolanbaker', 'D')on't know if this has been posted already, but it claims that the price has been buoyed by QE.

Yeah, but purchases of treasuries and MBS were at 85 billion a month and were gradually brought down by 10 billion a month during which time oil actually went up before making a fast face plant.

Seems much more likely an over correction of demand/supply price dynamics. Pretty typical in the oil biz with prices since 1998 ranging from around 10 bucks to 147 or so.

- Byron Walter

- Wood

- Posts: 25

- Joined: Thu 04 Jul 2013, 13:02:16

Re: what underlies oil pricing?

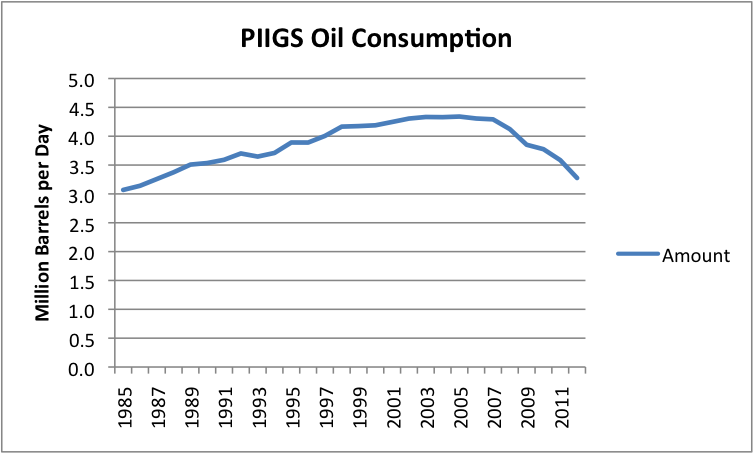

"But in the meantime, society seems to run better with $60 oil than $100 oil, despite the damage to the environment, so I'm not going to look a gift horse in the mouth." As you said, time will tell. No one has a clue how the world's economies will respond to $60/bbl oil because there's no clear picture yet of the ultimate effect of $90+/bbl and all the QE influence. If one uses oil consumption as a rough metric of economic vitality: how much did oil falling from $98/bbl in 2008 to $58/bbl in 2009 boost the global economy? It didn't: oil consumption of $58/bbl oil was a bit less then the consumption of $98/bbl oil.

By December 2015 we'll likely have the answer. In fact, by July we should have a pretty good hint. Especially if we back out any increase in Chinese consumption. China consumption which actually increased in 2009 making the decline in the rest of the world that year appear even more severe.

By December 2015 we'll likely have the answer. In fact, by July we should have a pretty good hint. Especially if we back out any increase in Chinese consumption. China consumption which actually increased in 2009 making the decline in the rest of the world that year appear even more severe.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: what underlies oil pricing?

$this->bbcode_second_pass_quote('Numbersman', 'T')he main premise is that due to increasing costs to extract, ship, and refine oil, the useable energy in a barrel of oil is falling. Therefore, the price should be falling in proportion to the useable energy.

This makes no sense. If energy is becoming scarcer, whatever the reason, why on earth would it become cheaper?

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: what underlies oil pricing?

$this->bbcode_second_pass_quote('Pops', '')$this->bbcode_second_pass_quote('Numbersman', 'T')he main premise is that due to increasing costs to extract, ship, and refine oil, the useable energy in a barrel of oil is falling. Therefore, the price should be falling in proportion to the useable energy.

This makes no sense. If energy is becoming scarcer, whatever the reason, why on earth would it become cheaper?

Because this is the same energy that powers the economic system. As its ability to power it is strangled due to increasing extraction, production and refining costs (it is really the energy investment to obtain energy), we cannot afford to pay for higher prices.

The Price of oil is not determined by extraction, production and refining costs. What ultimately determines the Price of oil is the ability of the end-consumer to pay for it. And this capability is determined by the net-energy that flows into the economic system, which is getting scarcer as time passes by.

As you see, this is a self-reinforcing loop. Some years ago this was not a problem. Oil was cheap and the costs to extract, proccess and distribute it were also really low. The system was disturbed by the increase in the Price of oil due to rising costs. This destroyed the demand as the end consumer had to cut the energy consumption. Now this downward spiral is going to destroy a good amount of the supply, as it is more than evident that we cannot pay a 100 USD barrel of oil (Who is going to pay for it? The guys who are on foodstamps, or the ones who saw how their wages were reduced, or maybe the ones who have to pay off their debts or the 25% unemployed in Spain or Greece?).

The cause of the economic crisis in 2008 was that less net-energy was entering the system, and the consequence is that we cannot pay again for a 145 USD barrel of oil. And even less money. I compare this situation with a financial tsunami, as the financial system will realize that debts will not ever be repaid. We are right now in the phase when the sea is receding...

- Observerbrb

- Coal

- Posts: 408

- Joined: Mon 08 Dec 2014, 15:24:48