THE 2012 PO.com Oil Price Challenge

Re: THE 2012 PO.com Oil Price Challenge

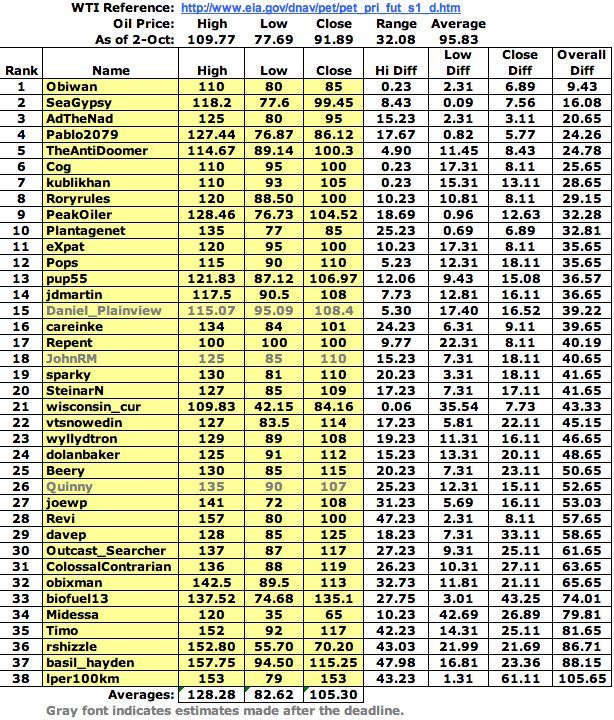

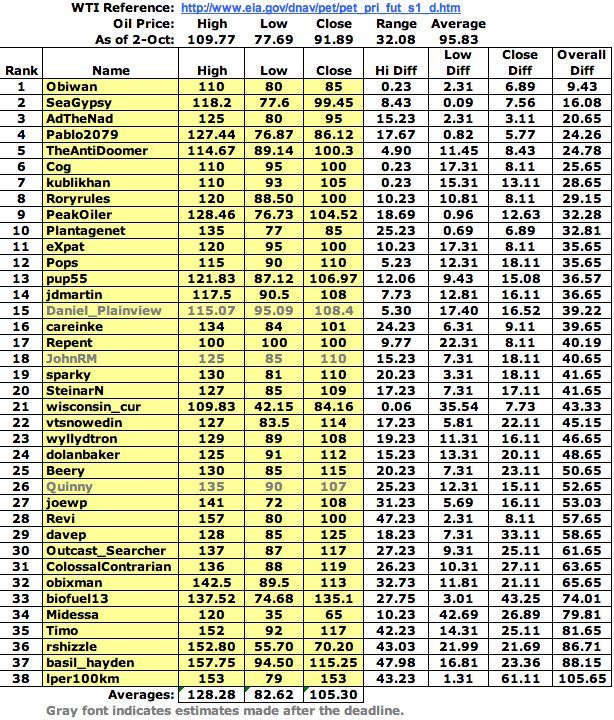

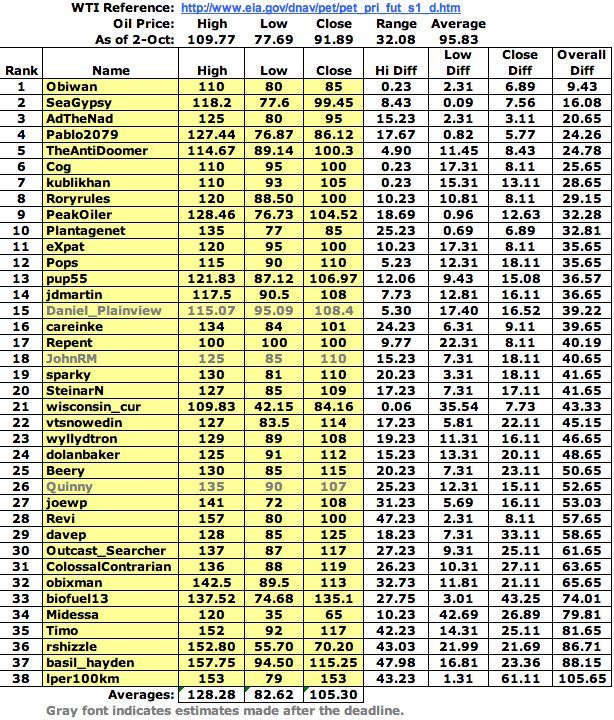

As of last Tuesday, Oct. 2:

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: THE 2012 PO.com Oil Price Challenge

Well, unless something crazy happens, I think we've hit the point of equilibrium for this year, anyway. I think Obiwan's got this one in the bag. I'm at 14, and I think that's my best finish yet so far. Maybe I'm actually learning something... :D

After fueling up their cars, Twyman says they bowed their heads and asked God for cheaper gas.There was no immediate answer, but he says other motorists joined in and the service station owner didn't run them off.

-

jdmartin - Heavy Crude

- Posts: 1272

- Joined: Thu 19 May 2005, 03:00:00

- Location: Merry Ol' USA

Re: THE 2012 PO.com Oil Price Challenge

Still a bit of a run to go and some strange movements going on. The last few weeks have seen divergence between the stock market (up/ flat) & oil prices (down); which is more than a bit un-usual. Especially with the noises in the middle east.

My thinking on this is that oil investors are becoming more savvy than run of the mill market folks. The stock markets seem largely hinged on Europe's mood of the week. Commodity prices seem more hooked up to whatever China & India are doing. Everyone is wondering when China's RE bubble will burst. How can a place with $10 a day wages can afford $200k units (millions and millions of them)?

My thinking on this is that oil investors are becoming more savvy than run of the mill market folks. The stock markets seem largely hinged on Europe's mood of the week. Commodity prices seem more hooked up to whatever China & India are doing. Everyone is wondering when China's RE bubble will burst. How can a place with $10 a day wages can afford $200k units (millions and millions of them)?

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: THE 2012 PO.com Oil Price Challenge

.

The OPEC basket price is under selling pressure for weeks

the Saudis seems to be try to keep it above 105$/bl

It's getting hard .......

they will have to cut production if they want the price to remain above 100$

The OPEC basket price is under selling pressure for weeks

the Saudis seems to be try to keep it above 105$/bl

It's getting hard .......

they will have to cut production if they want the price to remain above 100$

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: THE 2012 PO.com Oil Price Challenge

There are still many potential causes of a spike yet this year; any of the majors could fall prone to political unrest sufficient to disrupt production. A 5% shortfall could easily trigger a 10-15% spike. On the other hand, the trend is gradual down/ market destruction. Of course this is cyclical and next year could be (will be here) a whole new game!

I'm very ok with my 9c off low guess this year and doubt the trendline is heading hard south any time soon. No black swans, my close is looking pretty optimistic at present; we shall see how things go, still several of us in the running...

I'm very ok with my 9c off low guess this year and doubt the trendline is heading hard south any time soon. No black swans, my close is looking pretty optimistic at present; we shall see how things go, still several of us in the running...

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: THE 2012 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('SeaGypsy', ' ')Everyone is wondering when China's RE bubble will burst. How can a place with $10 a day wages can afford $200k units (millions and millions of them)?

This is a great question, SeaGypsy. I've given it some thought, as I'm pretty heavy into investing, and how Chindia does long term clearly affects things a LOT.

The short answer is -- MASSIVE SCALE. The vast majority of Chinese are still peasants.

A more detailed answer:

I THINK it is the vast scale of things is so awesome with China's population that 99.9% of us can't really wrap our minds around the implications without intense effort. (This includes me).

The middle class (a BIG one) is rising fairly rapidly in China. I presume it is THESE folks who make more like $100 a day, who are funding the RE market. The WELL OVER A BILLION still impoverished peasant class is still living in a slum, a shack, out in the street, or in some rural community doing farming (and very poor as they have no decent transpo infrastructure to get their goods to nonlocal markets).

From what I've seen on documentaries and read, there isn't much of a Chinese safety net for the poor. We in the US complain about income inequality -- but considering transfer payments from the government aren't counted as income in the official statistics -- our incomes are relatively equal (aside from the super-rich, say, .1%).

So, as long as their economy can crank along at (say) 6% or more growth, and that makes more middle class folks who demand your $200K units and can make the payments -- the game goes on.

Ironically, the larger the Chinese middle class grows (hundreds of millions in a decade?) the more the Chinese authorities NEED to keep things humming. Can you imagine a country-wide riot with HUNDREDS OF MILLIONS of angry demonstrors?! I can't, and I don't think any Chinese leader wants to.

So, as long as they have money to spend -- in my considered opinion, the beat is likely to go on. This could last what, decades?

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: THE 2012 PO.com Oil Price Challenge

I think that's about right OS, except for the $100 a day is combined income, couple making $50 each. $100 a day is way above middle wage in most of urban China & India.

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: THE 2012 PO.com Oil Price Challenge

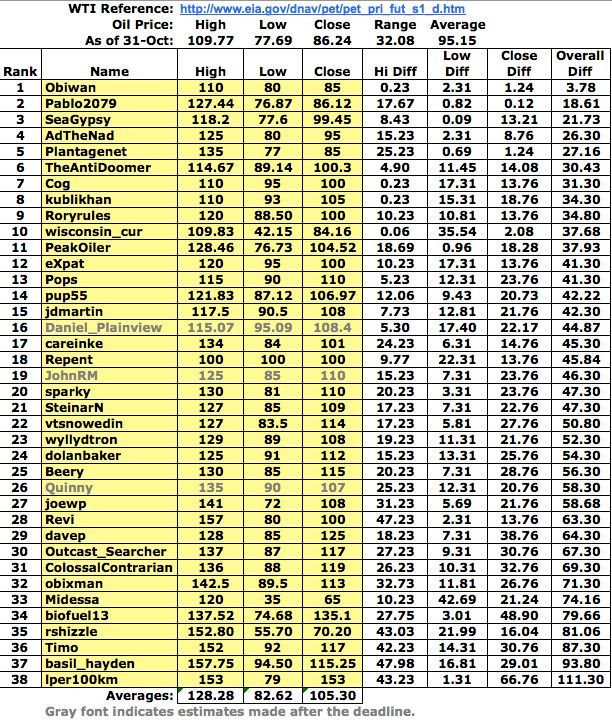

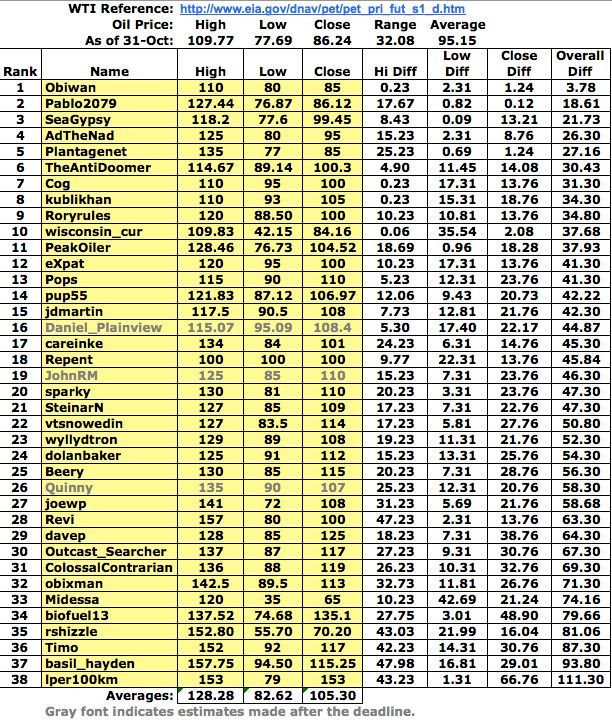

The latest scorecard:

I'll post another update around Dec. 1 and then the final one after the new year.

Who's going to do the 2013 Oil Price Challenge?

I'll post another update around Dec. 1 and then the final one after the new year.

Who's going to do the 2013 Oil Price Challenge?

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: THE 2012 PO.com Oil Price Challenge

I'm in for 2013 challenge. I think I'm getting better at this, which is scary!

After fueling up their cars, Twyman says they bowed their heads and asked God for cheaper gas.There was no immediate answer, but he says other motorists joined in and the service station owner didn't run them off.

-

jdmartin - Heavy Crude

- Posts: 1272

- Joined: Thu 19 May 2005, 03:00:00

- Location: Merry Ol' USA

Re: THE 2012 PO.com Oil Price Challenge

All I know is is that if I'd used my WTI guess in the Brent forecast I'd have done quite well.

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: THE 2012 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('PeakOiler', 'W')ho's going to do the 2013 Oil Price Challenge?

I'm done with WTI - I think I'll focus on Brent next year. Not that I'm any good at either one, but Brent seems more realistic.

"I'm gonna have to ask you boys to stop raping our doctor."

- Beery1

- Tar Sands

- Posts: 690

- Joined: Tue 17 Jan 2012, 21:31:15

Re: THE 2012 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('PeakOiler', '

')Who's going to do the 2013 Oil Price Challenge?

')Who's going to do the 2013 Oil Price Challenge?

Hey PeakOiler, do you mean who's going to tally or participate? We all really appreciate you keeping track of everything like pup55 used to do!

- ColossalContrarian

- Heavy Crude

- Posts: 1374

- Joined: Tue 20 Jun 2006, 03:00:00

Re: THE 2012 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('ColossalContrarian', '')$this->bbcode_second_pass_quote('PeakOiler', '

')Who's going to do the 2013 Oil Price Challenge?

')Who's going to do the 2013 Oil Price Challenge?

Hey PeakOiler, do you mean who's going to tally or participate? We all really appreciate you keeping track of everything like pup55 used to do!

Yes, I should have been clearer. I did mean: Who's going to keep track of the game next year? I don't plan on doing it.

Thanks, but it's time I hand the baton off to someone else.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas