by PeakOiler » Mon 13 Feb 2012, 21:53:20

by PeakOiler » Mon 13 Feb 2012, 21:53:20

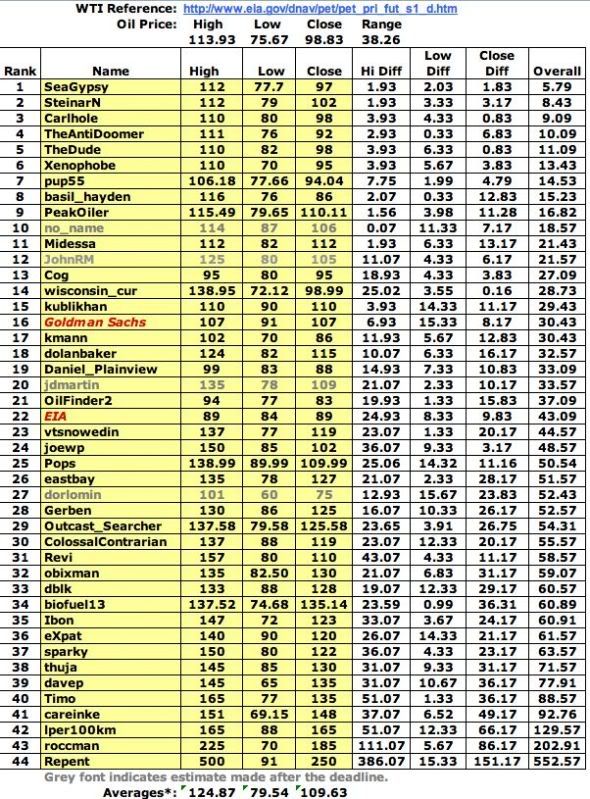

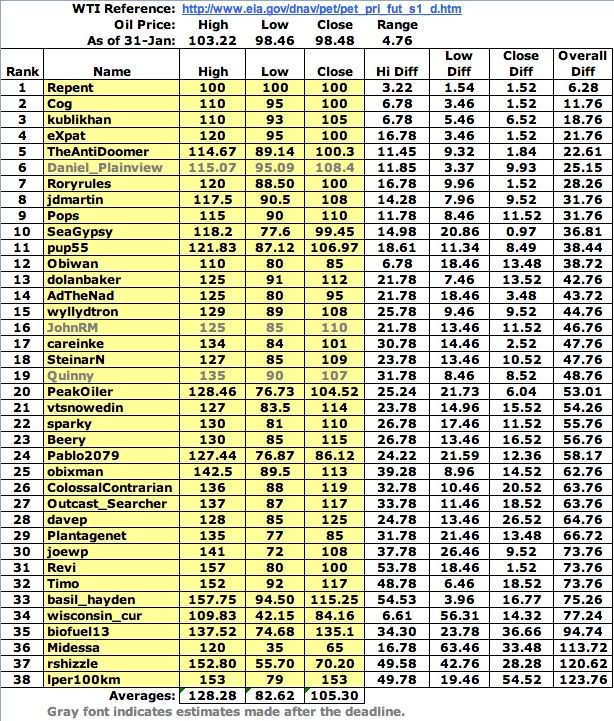

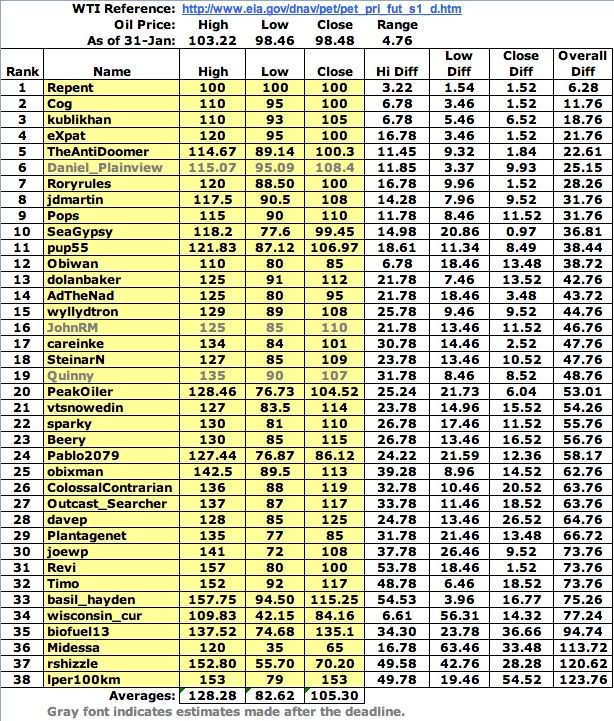

$this->bbcode_second_pass_quote('Beery1', 'T')he problem is, Repent owns everything from 97.5 to 105. As long as it stays in that band, he leads. As of now, the price is exactly back where it was at the beginning of the year - so he could retain the lead for another month or more.

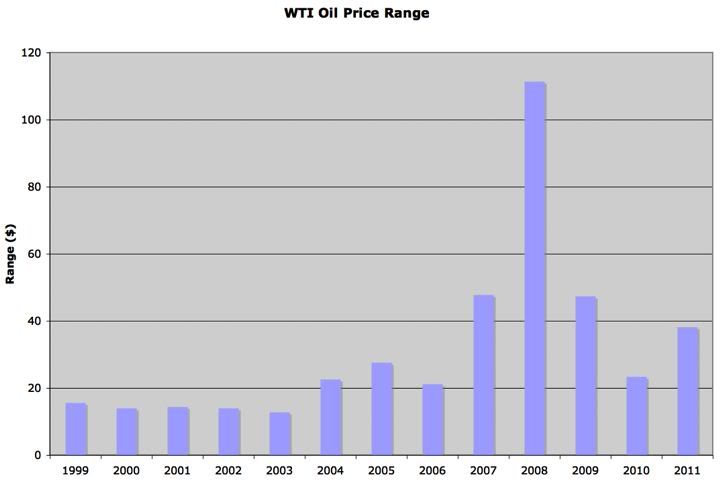

Repent will hold the lead for awhile longer, but consider this historical graph of the price range back to 1999 (the EIA data for WTI actually goes back to 1983):

The average price range from 1999 to 2100 was $31.58. OK, so 2008 was way out there. That's why this is an interesting game. It just appears that price volatility has been the trend over the last few years. That's one reason my guesses this year reflect a large range.

I wonder when and if the "fireworks" might appear around the racetrack and radically change the standings. ???

I wonder when and if the "fireworks" might appear around the racetrack and radically change the standings. ???