THE Saudi Arabian Oil Co. (ARAMCO) pt 3

Re: Saudi Arabia cuts output, says market oversupplied

$this->bbcode_second_pass_quote('sparky', 'I')t could be also straightforward , they did release more oil than their quota , there is no point cheesing off their friends and it might be a sweet gesture to Iran too

production increase would then happen in batches

a couple of months on , a couple of months off

production increase would then happen in batches

a couple of months on , a couple of months off

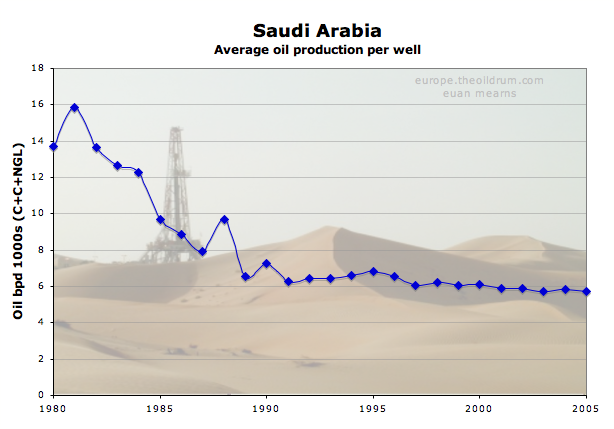

At 8 million barrels a day now, they've cut back to their minimum historical benchmark since 1990:

This is a pretty big cut here.. 9.12% of their total production. The oil minister says April will be about the same. With everything going on in the middle east, seems like an odd time to cut production. Maybe Ghawar is tapping out?

Anyhow this news certainly won't help rising oil / gas prices. So what are we looking at by summer, $5 gas, $5.50?

-

Sixstrings - Fusion

- Posts: 15160

- Joined: Tue 08 Jul 2008, 03:00:00

Re: Saudi Arabia cuts output, says market oversupplied

Off topic text deleted.

Last edited by Ferretlover on Tue 19 Apr 2011, 15:24:12, edited 1 time in total.

Reason: Off topic text deleted.

Reason: Off topic text deleted.

- Pretorian

- Light Sweet Crude

- Posts: 4685

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Somewhere there

Re: Saudi Arabia cuts output, says market oversupplied

Off topic text deleted.

Last edited by Ferretlover on Tue 19 Apr 2011, 15:24:49, edited 1 time in total.

Reason: Off topic text deleted.

Reason: Off topic text deleted.

-

dsula - Tar Sands

- Posts: 982

- Joined: Wed 13 Jun 2007, 03:00:00

Re: Saudi Arabia cuts output, says market oversupplied

Text deleted

Well, Haiti was in your backyard for decades. Now you get to have them in your lounge.

http://www.socialismtoday.org/82/haiti.html

Well, Haiti was in your backyard for decades. Now you get to have them in your lounge.

http://www.socialismtoday.org/82/haiti.html

Last edited by Ferretlover on Tue 19 Apr 2011, 15:25:53, edited 1 time in total.

Reason: Off topic text deleted.

Reason: Off topic text deleted.

- americandream

- Permanently Banned

- Posts: 8650

- Joined: Mon 18 Oct 2004, 03:00:00

Re: Saudi Arabia cuts output, says market oversupplied

I smell smoke. And my canary is acting very unusual. Anyone else?

Obama, the FUBAR presidency gets scraped off the boot

-

Fishman - Intermediate Crude

- Posts: 2137

- Joined: Thu 11 Aug 2005, 03:00:00

- Location: Carolina de Norte

Re: Saudi Arabia cuts output, says market oversupplied

.

My canary is alive but it smell funny

My canary is alive but it smell funny

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: Saudi Arabia cuts output, says market oversupplied

$this->bbcode_second_pass_quote('', 'F')ull supplies at Cushing no longer matter to GLOBAL markets as they used to. There is a reason why we now see the spread between Brent and WTI. Screaming and thumping the table about full inventory at Cushing is nothing more than a misunderstanding of the nature of the current oil trading environment.

The US is still almost at a tie with China in terms of largest consumer. If you look at the current spread between Brent and WTI it started in January of this year. I don't think it is coincidental that corresponds to the start of the Egypt riots which was followed of course by similar events in Yemen and Libya. There are all sorts of other issues that come into play with regards to the spread including the unusually large number of refineries undergoing maintanence (as Pup pointed out), the fact that Brent is becoming scarcer in comparison to WTI (Brent represents about 2% of global production but is the referential unit for >60% of all oil transactions) and possibly the increasing contango in the US.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Saudi Arabia cuts output, says market oversupplied

$this->bbcode_second_pass_quote('AirlinePilot', 'F')ull supplies at Cushing no longer matter to GLOBAL markets as they used to. There is a reason why we now see the spread between Brent and WTI. Screaming and thumping the table about full inventory at Cushing is nothing more than a misunderstanding of the nature of the current oil trading environment.

I'm pretty sure the main reason for the spread is the tar sands and Bakken are both landlocked except for expensive truck and rail transport. Once the construction of pipelines to the coasts are complete (next year sometime I think) expect the spread to disappear - actually, expect the discounted WTI to rise to the world market price and our little vacation to be over.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Saudi Arabia cuts output, says market oversupplied

Text deleted.

Last edited by Ferretlover on Tue 19 Apr 2011, 15:22:27, edited 1 time in total.

Reason: Off topic post deleted.

Reason: Off topic post deleted.

- Pretorian

- Light Sweet Crude

- Posts: 4685

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Somewhere there

Re: Saudi Arabia cuts output, says market oversupplied

Goodbye. I won't be a part of a community that talks about people in such a vicious way.

From the secure heights

- Puchica

- Peat

- Posts: 64

- Joined: Wed 02 Feb 2011, 08:35:51

Re: Saudi Arabia cuts output, says market oversupplied

$this->bbcode_second_pass_quote('Puchica', 'G')oodbye. I won't be a part of a community that talks about people in such a vicious way.

Sorry to see you go but divide and rule capitalism breeds ignorance. Ignorance is essential to the art of selling these Ad hom deletedthe junk they don't need. So in essence, they are hardly to blame for being bred stupid. And stupidity comes in many forms on this planet. So you might want to reconsider.

Last edited by Ferretlover on Tue 19 Apr 2011, 15:27:43, edited 1 time in total.

Reason: Ad hom deleted.

Reason: Ad hom deleted.

- americandream

- Permanently Banned

- Posts: 8650

- Joined: Mon 18 Oct 2004, 03:00:00