The 2011 PO.com Oil Price Challenge

Re: The 2011 PO.com Oil Price Challenge

If you want to know what not to pick, follow my picks over that last three years or so, I can't even get in the top 20!!!

- ColossalContrarian

- Heavy Crude

- Posts: 1374

- Joined: Tue 20 Jun 2006, 03:00:00

Re: The 2011 PO.com Oil Price Challenge

.

I'm about the same , no worries it's fun and it keep us our feet on the ground

I'm about the same , no worries it's fun and it keep us our feet on the ground

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('sparky', '.')

I'm about the same , no worries it's fun and it keep us our feet on the ground

I'm about the same , no worries it's fun and it keep us our feet on the ground

yep, some years get really exciting! Will 2011?

- ColossalContrarian

- Heavy Crude

- Posts: 1374

- Joined: Tue 20 Jun 2006, 03:00:00

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('dorlomin', 'T')oo late to enter? Id go for a high of 101. A low of 60 and a finishing of around 75.

On the low side but I would be guessing on a slow down on Q3 and Q4 and draining econmic confidence and a lot of volatility as bullish long positions on oil and other comodities get hurt.

On the low side but I would be guessing on a slow down on Q3 and Q4 and draining econmic confidence and a lot of volatility as bullish long positions on oil and other comodities get hurt.

I added you to the list. pup55 is the official laid back judge but I don't think he'd mind. You will get about 11/12th of the respect though.

Your at # 17.

I'll post another scorecard in a few weeks.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

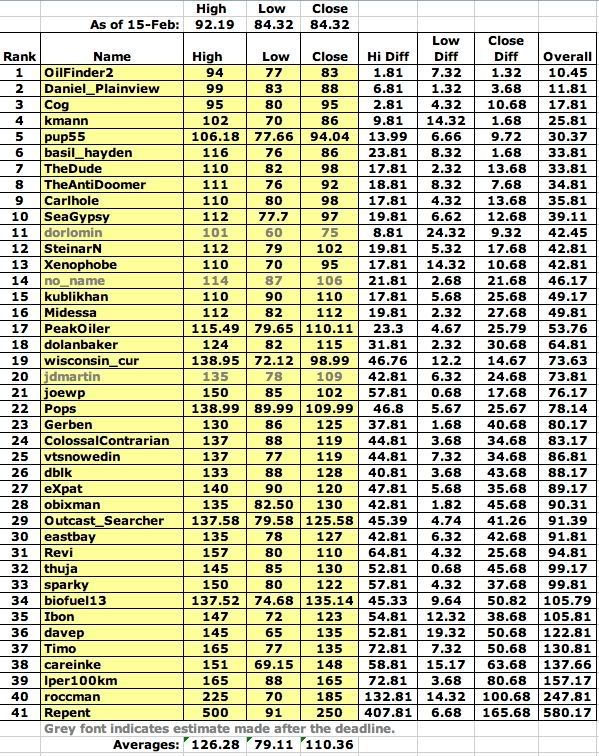

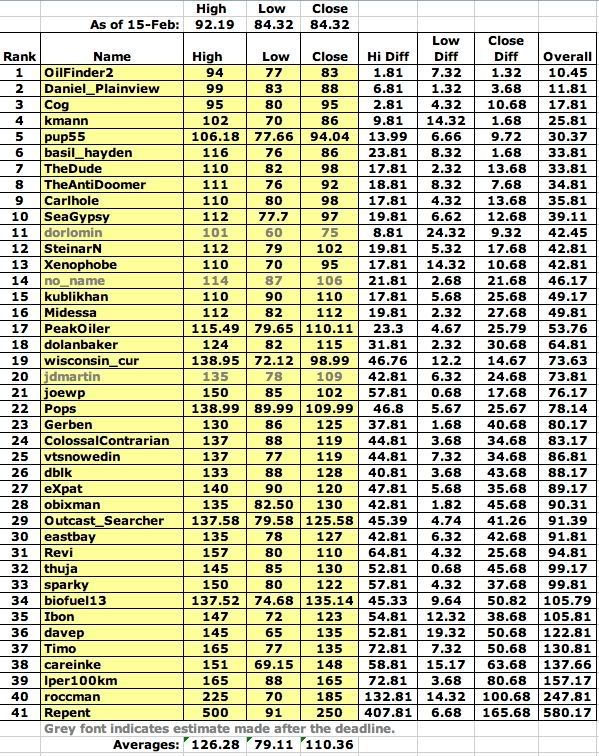

Since WTI set a new low in the last couple of days, there was a change in the rankings:

Daniel Plainview has held the #1 spot 87%, Cog 6.5%, and OilFinder2 6.5% of the days reported by the EIA so far this year.

Daniel Plainview has held the #1 spot 87%, Cog 6.5%, and OilFinder2 6.5% of the days reported by the EIA so far this year.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

[quote]pup55 is the official laid back judge [/quoted}

I am much too laid back to worry about the 1/12th of the love and respect.

In the previous three years of the PO.com Oil price challenge, the late joiners have not tended to do much better than anyone else....

I am much too laid back to worry about the 1/12th of the love and respect.

In the previous three years of the PO.com Oil price challenge, the late joiners have not tended to do much better than anyone else....

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

Re: The 2011 PO.com Oil Price Challenge

I think we should switch from the price of WTI to Brent. Brent is taking off. It's something like $104 now. When will our humble brand of crude catch up? And why is WTI at such a discount when it used to be the premium stuff? Is it the syncrude from Canada diluting it? Whatever it is we're much more likely to see $157 in Brent. That's why I want to change the brand. Just kidding. I'll stick with my guesstimations. I have a better chance this year than last.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: The 2011 PO.com Oil Price Challenge

With the recent spike in oil prices, the EIA will report a new high price for WTI in the last week, and a new high close. I'll post a new scorecard in a day or so.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('Revi', 'I') think we should switch from the price of WTI to Brent. Brent is taking off. It's something like $104 now. When will our humble brand of crude catch up? And why is WTI at such a discount when it used to be the premium stuff? Is it the syncrude from Canada diluting it? Whatever it is we're much more likely to see $157 in Brent. That's why I want to change the brand. Just kidding. I'll stick with my guesstimations. I have a better chance this year than last.

My guesses work better with WTI at the moment, If brent hits 140 and the spread remains around 15 then I'm fine with that.

In real life it's going to be a pain!

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: The 2011 PO.com Oil Price Challenge

The original reason for using WTI is that the EIA prints out the daily prices in Excel form on their website....and so making it easier for Peakoiler, and I, when I feel like it, to do the standings....

Besides, at the end of the day, as soon as everybody recalibrates their guesses, it probably would not make too much difference, the winner of the love and respect would be unlikely to be bad predicting the brent price if they were good at predicting the WTI price....

I still think the more interesting contest would be to predict the gold-denominated oil price. We even tried to do something like that in 2008 by having a "euro dominated" oil price prediction....but there were only a couple of participants...

Simple is good.

Besides, at the end of the day, as soon as everybody recalibrates their guesses, it probably would not make too much difference, the winner of the love and respect would be unlikely to be bad predicting the brent price if they were good at predicting the WTI price....

I still think the more interesting contest would be to predict the gold-denominated oil price. We even tried to do something like that in 2008 by having a "euro dominated" oil price prediction....but there were only a couple of participants...

Simple is good.

-

pup55 - Light Sweet Crude

- Posts: 5249

- Joined: Wed 26 May 2004, 03:00:00

Re: The 2011 PO.com Oil Price Challenge

Yeah..besides, I'm about to make a run at first place. If we can get some good rioting going in Yemen, I'll be on my way

After fueling up their cars, Twyman says they bowed their heads and asked God for cheaper gas.There was no immediate answer, but he says other motorists joined in and the service station owner didn't run them off.

-

jdmartin - Heavy Crude

- Posts: 1272

- Joined: Thu 19 May 2005, 03:00:00

- Location: Merry Ol' USA

Re: The 2011 PO.com Oil Price Challenge

.

We could have a mention for the best on Brent yardstick

100% respect for that one

but the discrepancy should somewhat abate ,

VLCC oil can go anywhere and will follows the differential ,

it's only piped oil which is trapped in a market ,

the alternative is rail , which start to be interesting between the central states and California

the Canadians could explore the great lakes as an outlet

the abundance of natural gas is also a factor

We could have a mention for the best on Brent yardstick

100% respect for that one

but the discrepancy should somewhat abate ,

VLCC oil can go anywhere and will follows the differential ,

it's only piped oil which is trapped in a market ,

the alternative is rail , which start to be interesting between the central states and California

the Canadians could explore the great lakes as an outlet

the abundance of natural gas is also a factor

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: The 2011 PO.com Oil Price Challenge

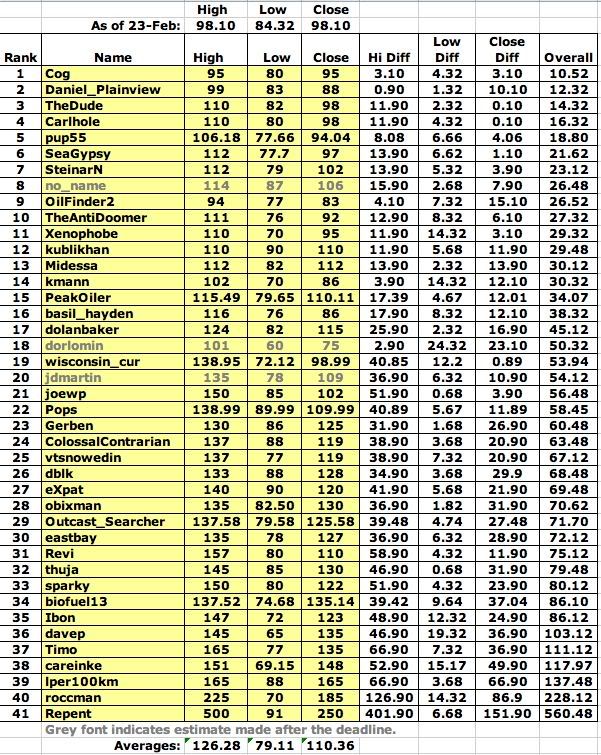

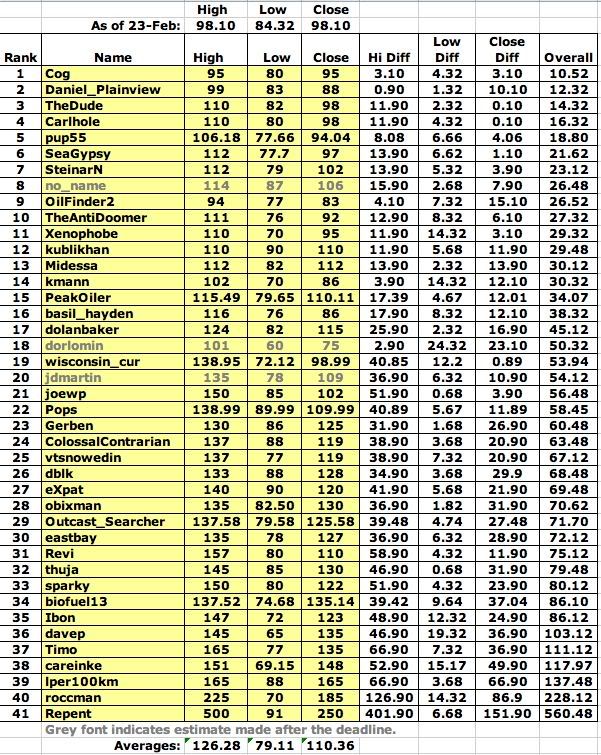

Here's the latest:

I think WTI was even higher on the 24th, but we'll have to wait another week to see what the EIA reports.

I think WTI was even higher on the 24th, but we'll have to wait another week to see what the EIA reports.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: The 2011 PO.com Oil Price Challenge

This is looking better for me. I'm up from 12th to 7th place on the last scorecard. If we only could have a bit more rioting in a few Opec countries before it calms down a bit.....

-

SteinarN - Master Prognosticator

- Posts: 278

- Joined: Thu 20 Sep 2007, 03:00:00

- Location: Norway

Re: The 2011 PO.com Oil Price Challenge

Careful what you wish for Steinar! There are rumors that Saudi may have a Facebook revolution starting on March 20th.

I am going to stick with my $157 and see what happens.

The way things are going, I may be moving up in the ranks soon enough.

I am going to stick with my $157 and see what happens.

The way things are going, I may be moving up in the ranks soon enough.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: The 2011 PO.com Oil Price Challenge

$this->bbcode_second_pass_quote('Revi', 'C')areful what you wish for Steinar! There are rumors that Saudi may have a Facebook revolution starting on March 20th.

I am going to stick with my $157 and see what happens.

The way things are going, I may be moving up in the ranks soon enough.

I am going to stick with my $157 and see what happens.

The way things are going, I may be moving up in the ranks soon enough.

Publically announced "surprises" tend not to work! The house of Saud is apparantly buying peace at the moment, with their wealth they can continue paying the "danegeld" for a good many years.

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

The serious dislocation between WTI and everything else means we really should find a better benchmark. Or hand out honorary prizes. Or use a median at the close. Or?

The serious dislocation between WTI and everything else means we really should find a better benchmark. Or hand out honorary prizes. Or use a median at the close. Or?