I might fair pretty well this year if this guest post from ZeroHedge works out. Gotta love the Apocalyptic Christian group predictions though

http://www.zerohedge.com/article/guest-post-who-how-and-why-140-oil-and-5-gas

http://www.zerohedge.com/article/guest-post-who-how-and-why-140-oil-and-5-gas$this->bbcode_second_pass_quote('', '[')b]Who, How and Why: $140 Oil and $5 Gas

According to a loosely-organized apocalyptic Christian movement, May 21, 2011 will be the "end of days." On or about that same date, the price of oil in the United States will begin to climb to $4 a gallon, according to two savants of the oil industry.

The former is highly unlikely but the latter is very probable.

The escalation in the price of oil is predicted by the legendary oil man T. Boone Pickens, known for his financial acuity as well as his oil expertise, and John Hofmeister, who retired as president of Shell Oil Company, to sound the alarm about the rate of U.S. consumption of oil.

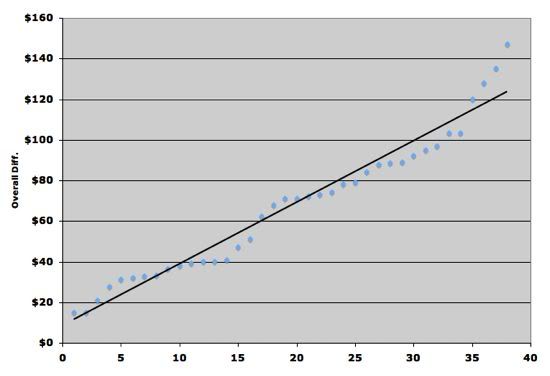

In an interview with a trade publication, Hofmeister predicted that oil would rise to $4 a gallon this year and to $5 a gallon in the election year 2012. Separately, Pickens—who has been leaning on Congress to enact an energy policy that would switch large trucks and other commercial vehicles from imported oil to domestic natural gas—predicts that oil currently selling for just over $90 a barrel will go to $120 a barrel, with a concomitant price per gallon of $4 or more.

)

)