Commercial Real Estate Collapse, Why hasn't it Happened Yet

30 posts

• Page 1 of 2 • 1, 2

Commercial Real Estate Collapse, Why hasn't it Happened Yet

What ever happen to the supposed commercial real estate that was to colapse and cause a 2nd wave of bank failures, is it still going to happen or has this been fixed, we still have a lot of vacant commercial here in Vegas but seems to be not a problem like the resident real estate bubble, did all the bailouts keep this at bay, anyone know whats going on here.

-

timmac - Permanently Banned

- Posts: 1901

- Joined: Thu 27 Mar 2008, 03:00:00

- Location: Las Vegas

Re: Commercial Real Estate Collapse, Why hasn't it Happened Yet

It's happening, albeit slowly.

Over the next couple years as these loans come due many of them will blow up and take down some banks.

Implications of John Hancock Tower Auction Grim for Commercial Real Estate

$this->bbcode_second_pass_quote('', 'S')uppose you bought an office building five years ago with 20% down, for an 80% loan-to-value ratio. You have not missed a payment, the building’s value has been stable, your amortization has paid down the loan balance by four percent of the building’s original value. A new loan will have a 76% loan-to-value ratio.

Here’s the problem: nobody will make a commercial mortgage loan with a 76% loan-to-value ratio today. You haven’t missed a mortgage payment, your building is fully leased, you’ve been working down your principal, but the lenders are all scared. Bank regulators are scared. Secondary markets are scared. So you have to pony up additional cash to bring the loan-to-value ratio down to at least 70%, and maybe even 65 or 60%.

What if you don’t have the cash sitting around to do that? You have a maturity default. Your problem is that credit standards tightened faster than you were paying off your loan.

Over the next couple years as these loans come due many of them will blow up and take down some banks.

Implications of John Hancock Tower Auction Grim for Commercial Real Estate

$this->bbcode_second_pass_quote('', 'S')uppose you bought an office building five years ago with 20% down, for an 80% loan-to-value ratio. You have not missed a payment, the building’s value has been stable, your amortization has paid down the loan balance by four percent of the building’s original value. A new loan will have a 76% loan-to-value ratio.

Here’s the problem: nobody will make a commercial mortgage loan with a 76% loan-to-value ratio today. You haven’t missed a mortgage payment, your building is fully leased, you’ve been working down your principal, but the lenders are all scared. Bank regulators are scared. Secondary markets are scared. So you have to pony up additional cash to bring the loan-to-value ratio down to at least 70%, and maybe even 65 or 60%.

What if you don’t have the cash sitting around to do that? You have a maturity default. Your problem is that credit standards tightened faster than you were paying off your loan.

"www.peakoil.com is the Myspace of the Apocalypse."

- Tyler_JC

- Expert

- Posts: 5438

- Joined: Sat 25 Sep 2004, 03:00:00

- Location: Boston, MA

Re: Commercial Real Estate Collapse, Why hasn't it Happened Yet

The numbers are ugly and getting uglier, but I don't think you can expect a fast crash like we got with residential mortgages. Banks are willing to cut deals for commercial borrowers that ordinary people would never get.

"The problems of today will not be solved by the same thinking that produced the problems in the first place." - Albert Einstein

-

Leanan - News Editor

- Posts: 4582

- Joined: Thu 20 May 2004, 03:00:00

Re: Commercial Real Estate Collapse, Why hasn't it Happened Yet

$this->bbcode_second_pass_quote('Leanan', 'T')he numbers are ugly and getting uglier, but I don't think you can expect a fast crash like we got with residential mortgages. Banks are willing to cut deals for commercial borrowers that ordinary people would never get.

Maybe they are forced to cut deals, since we are all tap out for any more large bailouts and such, I think somthing is happening quietly in back offices of these large banks because even the main stream media does not seem to talk much about the commercial real estate but still talking about the resident real estate that tanked over a year ago, here in Vegas on the outskirts of town where the newest developments were built the commercial buildings are 90% vacant and in the inner city it almost 25-35% vacant but it seems as if things are still ok because there is even commercial construction going on as we speak, and no its not old money deals made before the collapse some are even breaking ground today, who's loaning the money ??.

-

timmac - Permanently Banned

- Posts: 1901

- Joined: Thu 27 Mar 2008, 03:00:00

- Location: Las Vegas

Re: Commercial Real Estate Collapse, Why hasn't it Happened Yet

it's happening, although some of the buys CRE companies made were so STUPID, losing those buildings hardly seems like a collapse (e.g. Morgan Stanley's purchase of a huge amount of office space in San Francisco in 2007 ).

my brother worked for Morgan Stanley CRE for about 15 years. worked his way to be a mid-level Vice President. CRE was his life.

until they let him go - this last month.

my brother worked for Morgan Stanley CRE for about 15 years. worked his way to be a mid-level Vice President. CRE was his life.

until they let him go - this last month.

http://www.LASIK-Flap.com/ ~ Health Warning about LASIK Eye Surgery

-

pedalling_faster - Permanently Banned

- Posts: 1399

- Joined: Sat 10 Dec 2005, 04:00:00

Re: Commercial Real Estate Collapse, Why hasn't it Happened Yet

I am seeing more and more vacancies in strip malls everyday. These small businesses just aren't going to make it much longer. I have a feeling many are barely hanging on.

-

Armageddon - Light Sweet Crude

- Posts: 7450

- Joined: Wed 13 Apr 2005, 03:00:00

- Location: St.Louis, Mo

Re: Commercial Real Estate Collapse, Why hasn't it Happened Yet

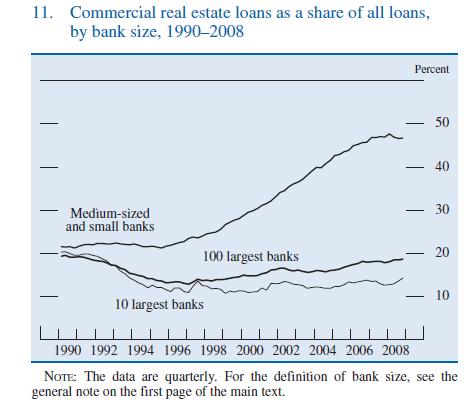

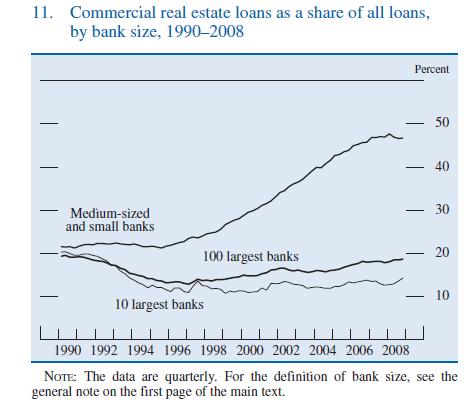

CRE loans were typically made with much larger down payments than home mortgages.

No one was getting a no money down loan for an office park.

You need 20%+ to get a CRE loan. That's why we haven't seen the kinds of defaults and writedowns yet. There is still enough of an equity cushion that when a bank repossess a bankrupt office park, it can resell it for close to the remaining terms of the mortgage.

The same cannot be said for the "liar loans" that made the subprime mortgage crisis so bad.

There's also the problem of concentration. The Big Banks don't own as large a share of the commercial real estate market as the local/regional banks.

No one was getting a no money down loan for an office park.

You need 20%+ to get a CRE loan. That's why we haven't seen the kinds of defaults and writedowns yet. There is still enough of an equity cushion that when a bank repossess a bankrupt office park, it can resell it for close to the remaining terms of the mortgage.

The same cannot be said for the "liar loans" that made the subprime mortgage crisis so bad.

There's also the problem of concentration. The Big Banks don't own as large a share of the commercial real estate market as the local/regional banks.

"www.peakoil.com is the Myspace of the Apocalypse."

- Tyler_JC

- Expert

- Posts: 5438

- Joined: Sat 25 Sep 2004, 03:00:00

- Location: Boston, MA

Re: Commercial Real Estate Collapse, Why hasn't it Happened Yet

$this->bbcode_second_pass_quote('Armageddon', 'I') am seeing more and more vacancies in strip malls everyday. These small businesses just aren't going to make it much longer. I have a feeling many are barely hanging on.

i saw an article about 80% of small businesses being in a situation where 2010 is a make-or-break year.

i.e., either they have to improve sales, or they will close because they can't bankroll a small business that is losing money any more.

i wish the guy had elaborated & i had kept the URL.

anyway, yes, many & possibly most, are barely hanging on.

One of the implications of Peak Oil is that energy costs rice and make many activities that were previously profitable, un-profitable, so they cease - and the economic activity is not immediately replaced.

and crime rises accordingly.

http://www.LASIK-Flap.com/ ~ Health Warning about LASIK Eye Surgery

-

pedalling_faster - Permanently Banned

- Posts: 1399

- Joined: Sat 10 Dec 2005, 04:00:00

Re: Commercial Real Estate Collapse, Why hasn't it Happened Yet

$this->bbcode_second_pass_quote('pedalling_faster', '

')

One of the implications of Peak Oil is that energy costs rice and make many activities that were previously profitable, un-profitable, so they cease - and the economic activity is not immediately replaced.

and crime rises accordingly.

')

One of the implications of Peak Oil is that energy costs rice and make many activities that were previously profitable, un-profitable, so they cease - and the economic activity is not immediately replaced.

and crime rises accordingly.

And yet crime is actually going down

$this->bbcode_second_pass_quote('', 'T')he year 2009 was a grim one for many Americans, but there was one pleasant surprise amid all the drear: Citizens, though ground down and nerve-racked by the recession, still somehow resisted the urge to rob and kill one another, and they resisted in impressive numbers. Across the country, FBI data show that crime last year fell to lows unseen since the 1960s - part of a long trend that has seen crime fall steeply in the United States since the mid-1990s.

At the same time, however, another change has taken place: a steady rise in the percentage of Americans who believe crime is getting worse. The vast majority of Americans - nearly three-quarters of the population - thought crime got worse in the United States in 2009, according to Gallup’s annual crime attitudes poll. That, too, is part of a running trend. As crime rates have dropped for the past decade, the public belief in worsening crime has steadily grown. The more lawful the country gets, the more lawless we imagine it to be.

We think crime is getting worse. We're wrong. I'm okay with that.

"www.peakoil.com is the Myspace of the Apocalypse."

- Tyler_JC

- Expert

- Posts: 5438

- Joined: Sat 25 Sep 2004, 03:00:00

- Location: Boston, MA