Latest Production Headlines

Covid to Keep More Oil Underground, Forcing Drillers to Change

Hundreds of billions of barrels of oil stranded by weak demand could accelerate companies’ pivot to cleaner energy, or threaten their long-term survival. BP Plc raised the possibility of stranded oil assets when it announced this month it would take the biggest writedown on the value of its business in a decade. But it wouldn’t […]

Are We Nearing Peak Oil Supply?

Are we now deep in the abyss? Up to our necks in it, if the oil price is any guide. Brent has now tested sub-U.S.$20 a barrel in this downturn and WTI sub-zero, albeit briefly and in somewhat freakish circumstances. Where are the signs of stress across the oil value chain? And what are the […]

Millions of Abandoned Oil and Gas Wells Pose Environmental, Health Risks

In May 2012, Hanson and Michael Rowe noticed an overpowering smell, like rotten eggs, seeping from an abandoned gas well on their land in Kentucky. The fumes made the retired couple feel nauseous, dizzy, and short of breath. Regulators responding to the leak couldn’t find an owner to fix it. J.D. Carty Resources LLC had […]

Why Are There ANY Rigs Running In the Permian Basin ?

Oil and natural gas wells make money or they don’t. They don’t start making money until they have paid back ALL costs associated with acquiring the lease to put that well on and ALL drilling and completions costs, including corporate overhead to run the business and, in the case of shale oil wells, the cost of financing. […]

US Oil Dominance Is Coming To An End

U.S.’ energy dominance agenda is dead as the country’s shale industry is looking at a steep production decline. The U.S. tight oil or shale rig count has fallen 69% this year from 539 in mid-March to 165 last week. U.S. oil import dependence is set to grow in the next couple of years. U.S. energy […]

Michael Lynch: World Oil Reserves Suddenly Downgraded By 292 Barrels! Yawn.

This week, Rystad Energy announced the eye-popping finding that the world’s estimate of oil supplies had suddenly shrunk by 292 billion barrels. Needless to say, the announcement caused eyes to pop, as did the headline’s statement heralding the early onset of “peak oil” demand. Hopefully, oil industry executives understand the nuances of the report, and […]

Russia’s Arctic ambition

Russia remains warm on Arctic projects Despite arduous operating conditions, Covid-19 further challenging the economics and the threat of further Western sanctions, growth in the region remains a core priority for the government The Arctic is the final frontier for Russian E&P. The territory holds an estimated 48bn bl of oil and 43tn m3 of […]

Recoverable oil loses 282bn barrels as COVID-19 hastens peak oil

The 2020 release of Rystad Energy’s annual global energy outlook reveals that the COVID-19 downturn will expedite peak oil demand, putting a lid on exploration efforts in remote offshore areas and as a result reducing the world’s recoverable oil by around 282 billion barrels. Global total expected remaining recoverable oil resources decrease to 1,903 billion […]

The Party Is Over For Shale And U.S. Energy Dominance

The party is over for shale and U.S. energy dominance. It has nothing to do with the lack of shale profitability or other silly memes cited by people who don’t understand energy. It’s because of low rig count. The U.S. tight oil or shale rig count has fallen 69% this year from 539 in mid-March […]

Is the Past the Key to the Present for Oil & Gas?

Punditry is a great thing. Especially when it involves forecasting major economic changes that are expected to take place over years instead of weeks. It allows anyone to be wrong as often as they are right. So, all pundits are wrong at least half the time. Especially when they venture into the massively unpredictable oil […]

Kurt Cobb: Peak World Oil Production?

We who have been suggesting that a peak in world oil production was nigh almost from the beginning of this century looked like we might be right when oil prices reached their all-time high in 2008. But since then, we have taken it on the chin for more than a decade as the U.S. shale […]

North Sea Oil Is Starting to Diminish

A glut of benchmark North Sea oil that’s been sitting on ocean-going tankers for weeks is starting to diminish. Millions of barrels of the region’s unwanted crude have been stashed on oil tankers since the coronavirus caused a demand collapse. But now the volumes are starting to shrink sharply, data compiled by Bloomberg show. Anchored […]

China Begins Consolidation Of $100+ Billion Oil & Gas Pipeline Industry

China has required the three biggest state-held oil corporations to transfer the management of half of their liquefied natural gas (LNG) terminals to the newly created state-controlled midstream firm, Caixin Global reported, citing industry insiders. The transfer of 10 LNG terminals owned by China National Petroleum Corporation (CNPC), Sinopec, and China National Offshore Oil Corporation […]

Oversupply Is a Thing of the Past

Oversupply is a thing of the past as long as OPEC+ compliance stays strong and the oil demand recovery trajectory isn’t radically altered. That’s according to Rystad Energy, which made the comment in a statement sent to Rigzone on June 8. The company outlined that the last surplus month appears to have been May, when […]

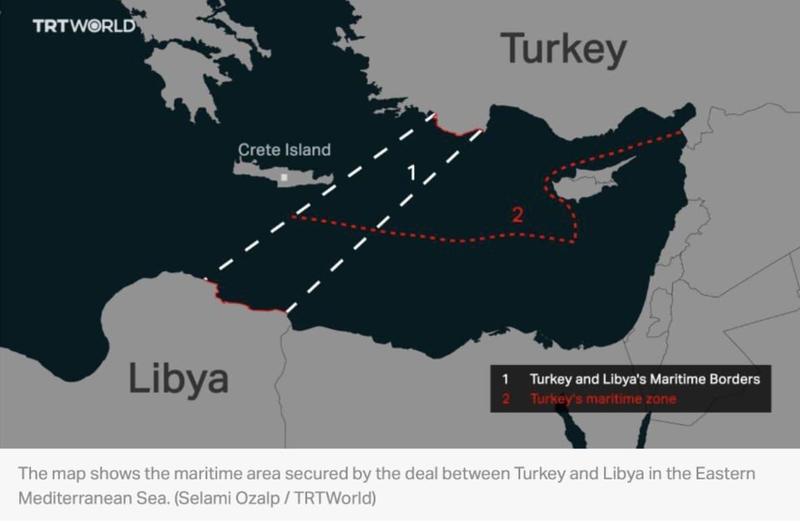

Mediterranean Oil Tensions Are Boiling Over

Under pressure in Libya – where it’s gone head-to-head with General Haftar in an ongoing battle to decide who gets to ultimately control the country’s oil revenues – and floundering in Syria, Turkey is once again upping the ante in the Mediterranean, this time preparing to issue new oil and gas exploration licenses in direct […]

Saudi Arabia Lays Down the Law to the Oil Market

Saudi Arabia called out the cheats at yesterday’s OPEC meeting — the countries that hadn’t fully reduced oil output in May as agreed — and extracted promises that they would compensate with even deeper reductions in the third quarter. Now the kingdom faces the group’s perennial problem of enforcing those promises. The meetings of the Organization of Petroleum Exporting Countries […]

Post-Pandemic Energy Might Not Change Much

When talking about the movement of oil prices, I often refer people to the movie “Trading Places,” and specifically to the scene where the elderly investment bankers are explaining the futures market to street hustler Eddie Murphy, and he says, “I get it. You guys are bookies.” One of the brothers turns to the other […]

US Oil Production Rebound Off The Lows

Shut-in oil production will start to return in June as producers receive better pricing. May production is likely to average somewhere around ~10 mb/d. Q3 2020 will see US oil production gradually decline as a lack of activity in Q2 will eat into existing production base. If our oil price projection pans out, US oil […]

Shutting Down Oil Wells, a Risky and Expensive Option

The temporary shutting in of wells is the one thing that oil companies are trying to avoid at all costs. That’s because restarting production is expensive and wells are not guaranteed to return to their flow rate. The doubts are so great that some experts wonder whether the current round of shut downs, far from […]

Oil Markets Could Soon Face A Devastating Supply Crunch

Concerted production cuts by OPEC+ and IOCs have largely been canceled out by a sharp fall in global oil demand from a record peak of >100 mbd to a recent low of 70 mbd, while WTI prices appear stuck in the mid-$30/barrel range. Given this backdrop, the last thing on the minds of investors probably […]

Oil Rallies With Producers Hiking Prices

Oil’s recovery from its historic crash last month is barreling ahead, with some OPEC producers displaying signs of confidence that the market is stabilizing. Nigeria and Algeria — both members of the Organization of Petroleum Exporting Countries — have lifted the official selling prices for their supply, a sign that they believe customers are willing […]

The stealth peak in world oil production

We who have been suggesting that a peak in world oil production was nigh almost from the beginning of this century looked like we might be right when oil prices reached their all-time high in 2008. But since then, we have taken it on the chin for more than a decade as the U.S. shale […]

Petro Questions and (Some) Answers

These are unusual times in oil and gasoline markets, but not really mysterious. Everyone has a role to play in the pandemic. My primary role – as my younger friends remind me – is to stay the hell home, and out of the hospital. Check. But the questions in my inbox lately suggest another role: […]

Is EIA Data Disguising A Disastrous Decline In US Shale?

The Trump administration claims that the U.S. is “transitioning to greatness,” and that energy companies are going to see “massive gains.” U.S. Secretary of Energy Dan Brouillette says there is “stability” in the oil market, and that economic activity will “explode” on the other side of the pandemic. Thanks to the leadership of President @realDonaldTrump, […]

Kunstler interview Art Berman

Art Berman is an independent oil geologist and industry analyst. We go deep on the recent extreme price crash in the oil markets, the current situation and destiny of shale oil, and the implications of all this for the economy in general. Art lives in Houston. He blogs at https://www.artberman.com/blog/ The theme music for the […]

Crashing oil demand drives a 17 MMbpd global output cut in Q2

Consulting firm IHS Markit expects oil demand in the second quarter of 2020 to be 22 MMbpd less than a year ago. This collapse in demand combined with low oil prices, storage constraints and government ordered cuts are driving what is an extraordinary level of liquids production cuts and shut-ins around the world. “The Great […]

Oil flows spell deep depression

Energy is not just one commodity among many in the economy; it is the commodity. Without energy, nothing gets done. And, oil is not just one form of energy in the energy commodity complex; it is the energy source upon which our modern way of life depends. In fact, it is the main energy source […]

Permian Drillers Slash Output Themselves

On the same day OPEC-style oil quotas in Texas were pronounced dead on arrival, shale drillers disclosed more supply cuts in response to the crude market collapse. Diamondback Energy Inc. and Centennial Resource Development Inc. on Monday became the latest Permian Basin shale explorers to say they were curbing output. A pandemic-fueled crash in oil […]

Saudi Arabia aiming to dominate oil’s sunset years

Do you remember peak oil? It was the theory, very popular a few years ago, that the world would soon exhaust all easily accessible reserves of oil. We were heading, the analysts assured us, for an energy crunch. Crude prices would climb ever higher, as would demand for the stuff, and eventually we would run […]

The world is running out of space to keep oil. Where will it go?

At beginning of this year, oil in the United States was selling for around $60 a barrel. Now you can barely get rid of the stuff; at $12 a barrel on April 29, a latte-sized cup of crude would cost less than five cents. Last week, oil futures prices went below zero for the first […]

Oil News Categories

Recent Board Topics

Archive

LATEST NEWS HEADLINES

- Why the IEA is Wrong About Peak Oil Demand

- Did we inadvertently speed global warming?

- Venezuela’s Oil Monopoly Eases

- Why Germany is Choosing Natural Gas Over Nuclear Power

- U.S. coal-fired electricity generation decreased in 2022 and 2023

- America Cracks Down on Methane Emissions from Oil and Gas Facilities

- Meet America’s Newest Oil Trader Extraordinaire: Joe Biden

- Is It Time To Refill America’s Strategic Petroleum Reserve?

- Oil prices set to end year 10% lower as demand concerns snap winning streak

- What’s Driving America’s New Oil and Gas Boom?

- China’s peak oil demand bombshell eviscerates Danielle Smith’s energy strategy

Member Comments

- said leather Exclusive Harley-Davidson Collections...

- said bjj gi Discover the pinnacle of Brazilian Jiu Jits...

- said Pokud hledáte spolehlivý zdroj pro nákup kokainu o...

- said The UK’s North Sea oil boom is fading. Remem...

- said corrections

- said We’re all lovers of supremacist muzzies here

- said The game is a spiritual successor to Wordle — diff...

- said It is worrying to see the global food crisis worse...

- said https://comprarcarnetdeconducira.com

- said http://kupprawojazdyb.com

- said Thought-provoking article! It’s refreshing t...

- said Dear Sir/Ma, We are a trusted financial consulting...

- said Melon Playground is fun because creativity is what...

- said We’re all lovers of supremacist muzzies here

- said Europe is under pressure from Putin’s strate...

- said This isnt just a card game. It’s a worldwide...

- said 666gt6

- said 1. Forecast uncertainty is huge Long-term predicti...

- said The discussion on scarcity usually focuses on ener...

- said happy world supremacist muzzies bag day

PO Real Time

Fetch Tweets: You currently have access to a subset of X API V2 endpoints and limited v1.1 endpoints (e.g. media post, oauth) only. If you need access to this endpoint, you may need a different access level. You can learn more here: https://developer.x.com/en/portal/product Code: 453