Page added on June 18, 2020

The Party Is Over For Shale And U.S. Energy Dominance

The party is over for shale and U.S. energy dominance.

It has nothing to do with the lack of shale profitability or other silly memes cited by people who don’t understand energy.

It’s because of low rig count.

The U.S. tight oil or shale rig count has fallen 69% this year from 539 in mid-March to 165 last week. Tight oil production will decline 50% by this time next year. As a result, U.S. oil production will fall from to less than 8 mmb/d by mid-2021.

What if the downward trend in rig count increases between now and then? No difference for the next year or so. That’s because of the lag between contracting a drilling rig and first production.

Leads and Lags

There are unavoidable leads and lags with oil price, adding or dropping rigs, and oil production.

-

Preliminary Data Suggests Low-Dose Radiation May Be Successful Treatment For Severe Covid-19

-

Oil Company Run By Forbes 30-Under-30 Winner Files For Chapter 11 Bankruptcy

-

How Working From Home Could Save 11 Billion Road Miles, Cut Emissions

It takes several months between an upward price signal and a signed contract for a drilling rig. It takes another 9-12 months from beginning to drill and first production for tight oil wells. With pad drilling, usually all wells on the pad must be drilled before bringing in a crew to frack the wells.

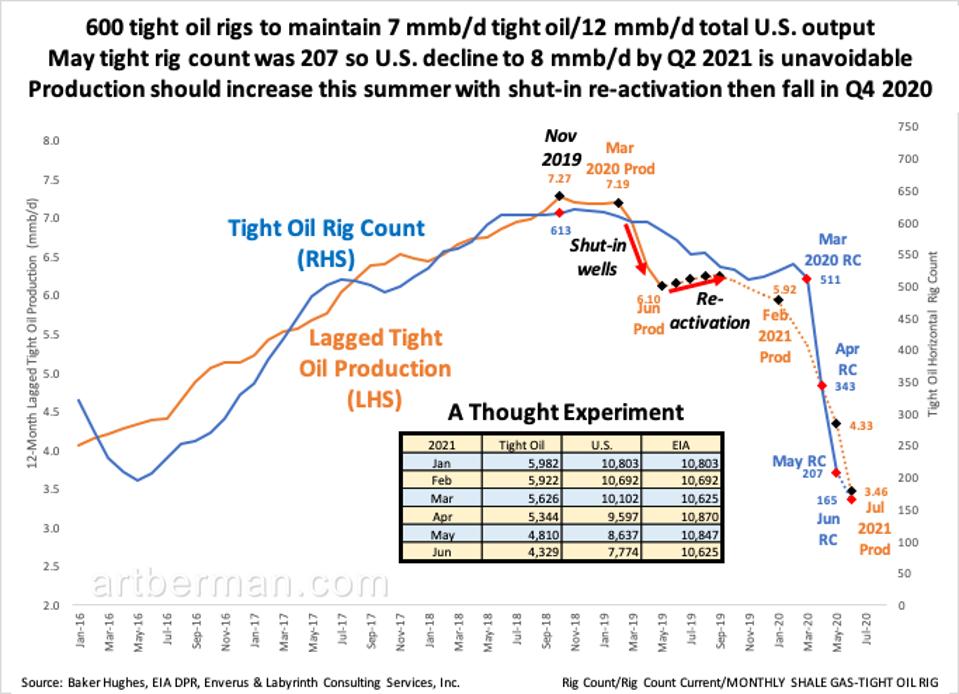

Tight oil production reached 7.28 mmb/d in November 2019 when the lagged rig count was 613 (Figure 1). That corresponded to 12.9 mmb/d of U.S. oil production—tight oil is about 55% of total output. Approximately 600 rigs are needed to maintain 7 mmb/d of tight oil and 12.5 mmb/d of U.S. production.

The horizontal rig count is now 165 so it is unavoidable that production will fall. The considerable lags and leads mean that production decline cannot be expected to reverse until well into 2021 assuming that rig counts start to increase immediately–which won’t happen.

Figure 1. 600 tight oil rigs to maintain 7 mmb/d tight oil/12 mmb/d total U.S. output. May tight rig … [+]

Baker Hughes, IEA DPR, Enverus and Labyrinth Consulting Services, Inc.

U.S. producers shut in most of their wells in May because oil prices had collapsed and storage had reached its limits. Tight oil production has fallen more than 1 mmb/d to 6.2 mmb/d and total U.S. output is around 11.2 mmb/d.

With the storage crisis now apparently averted and with higher oil prices, most tight oil wells are being re-activated. Production should increase until all shut-in wells are back on line and then, it will resume its decline.

U.S. oil production will probably be about 8 mmb/d by mid-2021 or more than 4 mmb/d less than peak November 2019 levels. EIA’s forecast (table in Figure 1) seems unreasonably optimistic but still suggests more than a 2 mmb/d decrease.

Energy Dominance and Green Paint

That’s bad for Trump’s Energy Dominance anthem but it’s even worse for U.S. balance of payments once demand recovers. We will have to import even more oil than we do today.

The idea of energy independence is ignorant at best and fraudulent at worst. The U.S. imported nearly 7 mmb/d of crude oil and condensate in 2019 and more than 9 mmb/d of crude oil and refined products. That’s almost as much as China—the world’s second largest economy—consumes.

What kind of a net exporter imports that much oil?

The U.S. is a net exporter in the same way that shale companies are making huge profits—accounting sleight-of-hand.

The U.S. imports other people’s crude oil, refines it and then, exports it. If a country imports unpainted cars, paints them green and then exports them, is it a net exporter of cars? No. It’s an exporter of green paint.

Killer Decline Rates Require Lots of Rigs

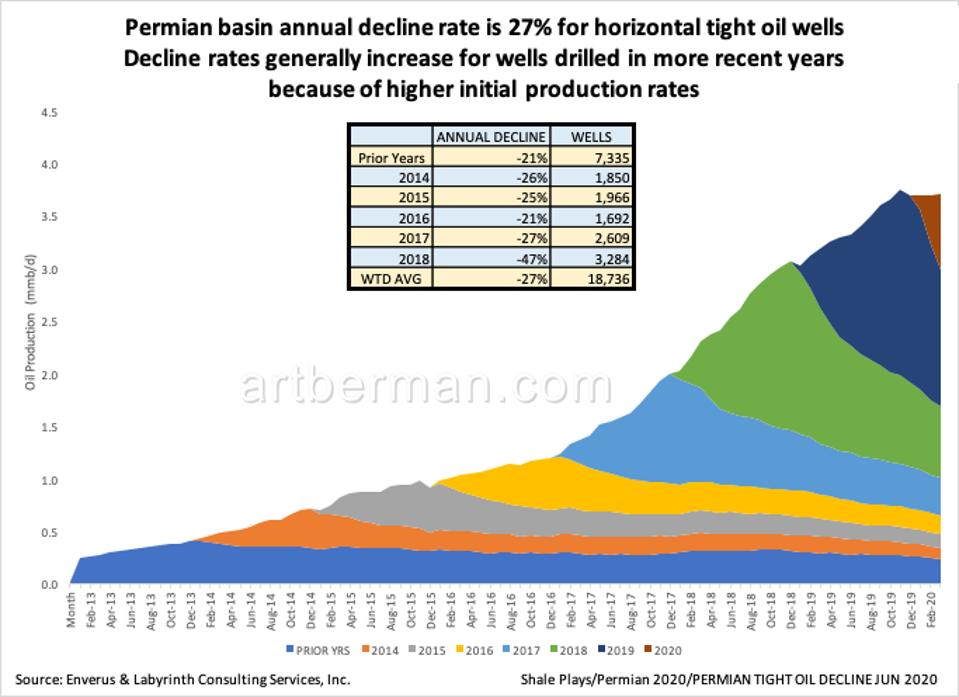

Lower U.S. crude and condensate production is unavoidable with rig counts where they are today. The unavoidable truth about U.S. shale plays is that decline rates are really high. Figure 2 shows Permian basin shale play decline rates by year of first production. The average of all years is 27% per year. More recently drilled wells decline at higher rates because of better drilling and completion technology. The problem is that they don’t have greater reserves—they just produce the reserves faster. That means higher decline rates.

Figure 2. Permian basin annual decline rate is 27% for horizontal tight oil wells Decline rates … [+]

Enverus and Labyrinth Consulting Services, Inc.

This is not a criticism of the plays or the companies. It’s just a fact.

And that’s why it’s critical to keep 500 or 600 rigs drilling all the time—to replace the 30% of output lost every year to depletion.

Production can be turned off and on as it was in May and June. Production cannot be increased without adding rigs and drilling new wells. Assuming there was infinite capital available to add rigs and drill wells, it would take several years to increase rig count to levels needed to maintain 2019 output levels.

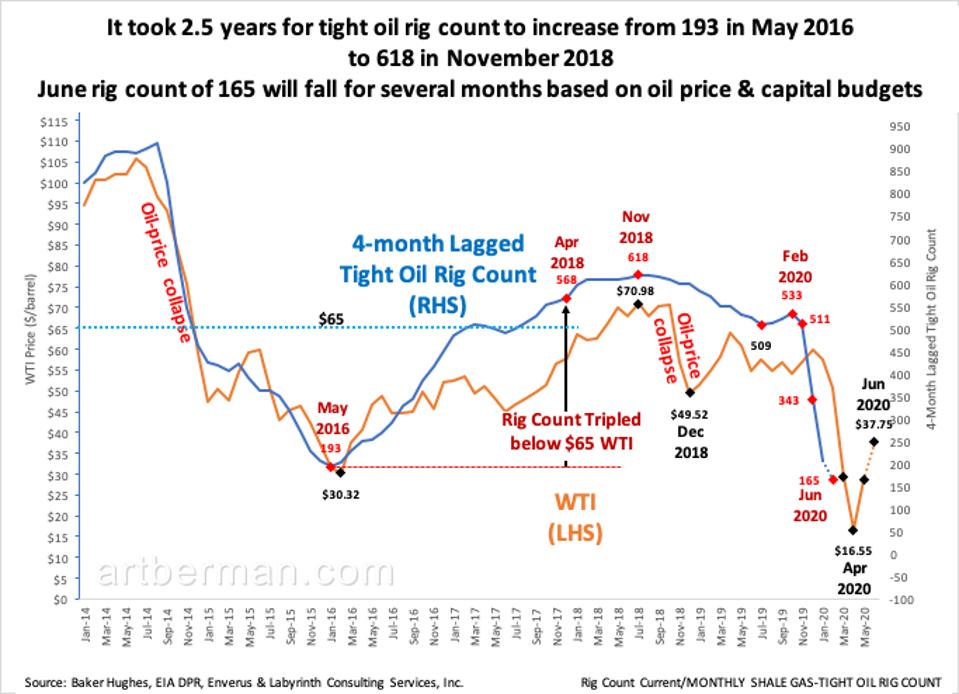

After the last oil-price collapse, it took 2.5 years for tight oil rig count to increase from 193 in May 2016 to 618 in November 2018 (Figure 3). The current June rig count of 165 will continue to fall for several months based on oil price & capital budgets.

Figure 3. It took 2.5 years for tight oil rig count to increase from 193 in May 2016 to 618 in … [+]

Baker Hughes, IEA DPR, Enverus and Labyrinth Consulting Services, Inc.

The U.S. is screwed when it comes to near- to medium-term oil production. It’s not because of Covid-19. U.S. rig count began to decline 15 months before anyone had heard of Covid-19. Even if the road to economic and oil-demand recovery is faster than I believe it will be, it will take a long time to get back to 12 or 13 million barrels per day of production.

Time to get real about the future for domestic oil supply, and its implications for the economy and for energy dominance.

19 Comments on "The Party Is Over For Shale And U.S. Energy Dominance"

Zeke Putnam on Thu, 18th Jun 2020 9:33 am

You mean I have to think of something besides Monday night football, going to the beach or going out for a beer. That’s asking a lot.

FamousDrScanlon on Thu, 18th Jun 2020 12:37 pm

Oh hell ya, shale was making money hand over fist. All the investors made a killing. Better than Bezo’s profits.

Just blame the Russians & Chinese when it’s time to explain the complete failure of ‘energy independence’ & ‘energy superpower’.

makati1 on Thu, 18th Jun 2020 5:09 pm

Some good things are coming from the new flu.

“The U.S. is screwed when it comes to near- to medium-term oil production.”

Also long term, but you gotta keep the oily suckers on the line with wishful thinking. There seems to be a lot of them in the stock market casino these days. All delusional. Ah well, a rude awakening is in their near future. It took 3 years for the stock market to drop 85% in the last depression, and a world war to regain its top.

Join the Void on Fri, 19th Jun 2020 1:17 pm

The U.S. is screwed – full stop. Party is over on the American Century.

zero juan on Fri, 19th Jun 2020 1:47 pm

Join the Void said The U.S. is screwed – full stop. Party is o…

Join the Void said Let us preay for near-term human extinction.

More Lunatic Davy (AKA The Widdle Pink Poodle) JuanP Derangement on Fri, 19th Jun 2020 3:19 pm

zero juan on Fri, 19th Jun 2020 1:47 pm

Famlin on Fri, 19th Jun 2020 4:09 pm

If more people choose to work from home even for just 1 day / week, oil consumption will fall drastically as the driving is curtailed.

Lower demand means lower oil prices and oil companies cannot continue to produce the same amount of oil at $40/barrel. Big Oil better keep a tight watch on their budgets.

Duncan Idaho on Fri, 19th Jun 2020 4:42 pm

“The idea of U.S. energy independence is ignorant at best and fraudulent at worst. The U.S. imported nearly 7 mmb/d of crude oil and condensate in 2019 and more than 9 mmb/d of crude oil and refined products. That’s almost as much as China—the world’s second largest economy—consumes.”

joe on Fri, 19th Jun 2020 5:26 pm

No Famlin lower demand means HIGHER prices. As less volume means higher cost per shipment. With millions of greedy arabs on government handouts Arabian oil is becoming less and less profitable to ship to the US. Recently Saudi Arabia put up massive taxes on its own people to gather back some of its lavish social programme.

https://www.seattletimes.com/business/half-the-saudi-population-receiving-welfare-in-new-system/

In the end oil will fail because its being used to feed more and more mouths, not just a few tribal camel warriors.

Its utility is high but its suffered diminishing marginal returns over the decades…..

joe on Fri, 19th Jun 2020 5:36 pm

For example ‘Opec plus’ is working hard to drive up prices while oil demand dropped massively this year.

JuanP on Fri, 19th Jun 2020 6:10 pm

“The U.S. imported nearly 7 mmb/d of crude oil and condensate in 2019 and more than 9 mmb/d of crude oil and refined products.”

Duncan, you are so anti-American. The US is slightly net positive but you know that would screw up your bad boy attitude.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MTTNTUS2&f=M

JuanP on Fri, 19th Jun 2020 6:15 pm

“If more people choose to work from home even for just 1 day / week, oil consumption will fall drastically as the driving is curtailed.”

Or more people could be like me and not work at all. My family takes care of me, no worries.

Davy on Fri, 19th Jun 2020 6:27 pm

“If more people choose to work from home even for just 1 day / week, oil consumption will fall drastically as the driving is curtailed.”

Or more of you dumbasses could be like me and sock post on PO.com and not work at all. My goats and donkey takes care of me, no worries.

FamousDrScanlon on Fri, 19th Jun 2020 8:20 pm

Chesapeake Energy Was Once the Second Biggest Natural Gas Company in the Nation. Now It’s Nearly Bankrupt.

The once-mighty energy company is now a shell of its former self.

https://www.fool.com/investing/2020/06/17/chesapeake-energy-was-once-the-second-biggest-natu.aspx

Drill Baby Drill —> Die Baby Die

zero juan on Fri, 19th Jun 2020 8:27 pm

another stupid juanpee personality. Why does the dumb fuck just be himself? Mental illness obviously

FamousDrScanlon on Fri, 19th Jun 2020 8:20 pm

Davy on Fri, 19th Jun 2020 10:09 pm

Complaining about someone else using socks must sound REAL STUPID coming from me right?

Davy on Sat, 20th Jun 2020 5:15 am

JuanP on Fri, 19th Jun 2020 10:09 pm

“Complaining about someone else using socks must sound REAL STUPID coming from me right?”

juanPee, you can play your stupid game that trashed the board. I will ignore it. You fuck with me and I will make you pay. You want to censor me so instead you will be censored. No problem or worries, in fact it is fun to fuck with a lunatic back when I have justification. If you enjoy it too quit whining pussy and take your punishment. For me it proves I am above you. You are a skumbag from the gutter who goes after me because I trigger you.

Davy on Sat, 20th Jun 2020 6:57 am

The one and only thing that keeps me going, besides my time with the goats, is the knowledge that one day Immigration will catch up to you, and deport your illegal ass back to Guadalajara. Until that glorious day comes, and its coming soon, I will be here, 24 hours a day, to nooter your sock lunacy.

That’s a promise.

Davy on Sat, 20th Jun 2020 7:15 am

JuanP on Sat, 20th Jun 2020 6:57 am

“The one and only thing that keeps me going, besides my time with the goats, is the knowledge that one day Immigration will catch up to you, and deport your illegal ass back to Guadalajara. Until that glorious day comes, and its coming soon, I will be here, 24 hours a day, to nooter your sock lunacy. That’s a promise.”

JuanPee, I have you just where I want you. I expose all your stupidity. Your above ID theft is turned back on you. LMFAO. It is stale and old after 3 years of taking over this form with bad behavior. The stalking with ID theft started around 3 years ago in an obsessed stalking illness directed at me. You were doing it before that and doing the socks too but it was not a domination of whole pages with your stupid mindless low IQ zero juan shit. Your socks are on the moderated side too but I can’t do much about that. I moderate all your comments on that side by bringing them over here. You are a fucking failure lunatic and a great source of enjoyment for me.