Page added on September 18, 2016

THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S.

The Death of the Great Bakken Oil Field has begun and very few Americans understand the significance. Just a few years ago, the U.S. Energy Industry and Mainstream media were gloating that the United States was on its way to “Energy Independence.”

Unfortunately for most Americans, they believed the hype and are now back to driving BIG SUV’s and trucks that get lousy fuel mileage. And why not? Americans now think the price of gasoline will continue to decline because the U.S. oil industry is able to produce its “supposed” massive shale oil reserves for a fraction of the cost, due to the new wonders of technological improvement.

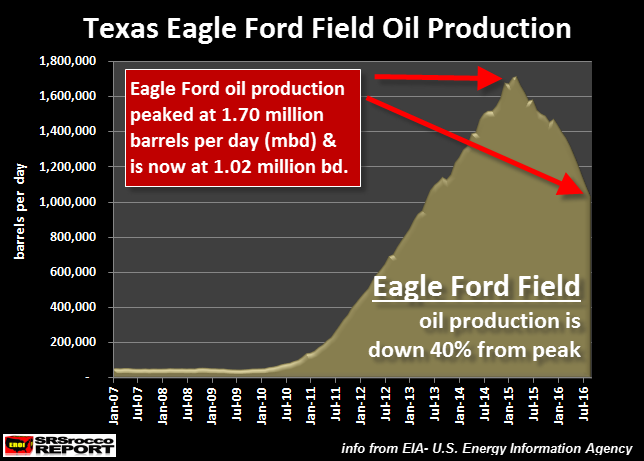

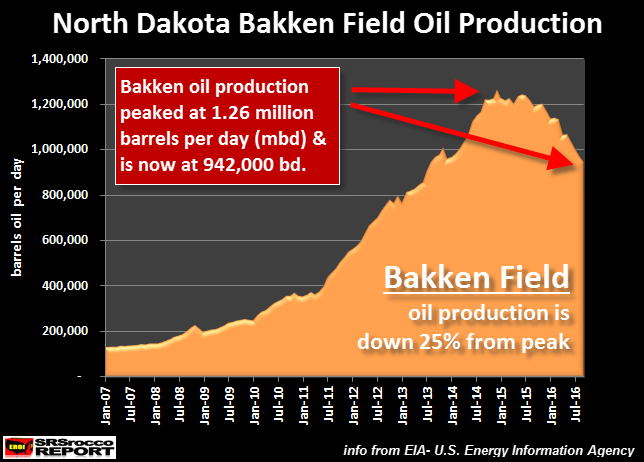

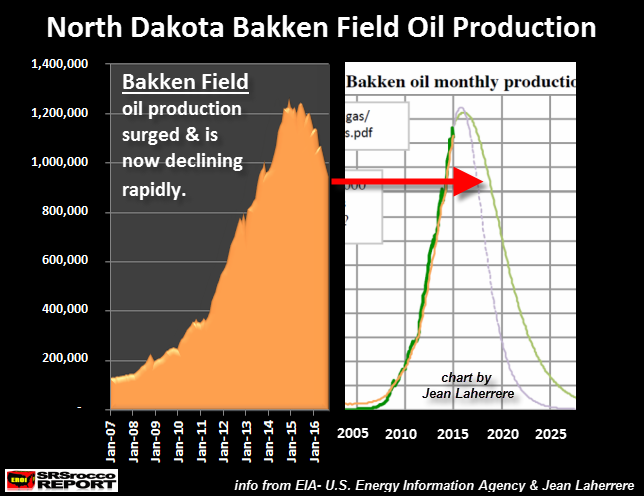

I actually hear this all the time when I travel and talk to family, friends and strangers. I gather they have no clue that the Great Bakken Oil Field is now down a stunning 25% from its peak in just a little more than a year and half ago:

The mighty Bakken oil field located in North Dakota reached peak production in December 2014 at 1.26 million barrels per day (mbd) and is now down to 942,000 bd. This decline is no surprise to me or to my readers who have been following my work for the past several years.

I wrote about the upcoming crash of the Bakken oil field in my article (click here to read article)– Published, NOV. 2013:

I ended the article with these sobering words:

There are only so many drilling locations available and once they run out, the Great Bakken Field will become a BUST as the high decline rates will push overall oil production down the very same way it came up.

Those who moved to the frigid state of North Dakota with Dollar signs in their eyes and images of sugar-plums dancing in their heads will realize firsthand the negative ramifications of all BOOM & BUST cycles.

Well, the Bust of North Dakota economy has arrived and according to the article, “The North Dakota Great Recession“:

Unfortunately by April 2015 it was clear that the oil markets were in a secular decline brought on by oversupply in the global energy markets fueled by a deep recession in China. As a result, companies started to lay off workers, and over the following months caused a massive exodus of people as jobs were eliminated. Nobody is exactly sure how many people have left the state, but some put estimates as high as 25,000.

The strongest real estate market continues to be Watford City with the weakest in Minot. However, even in Watford City the price of a three-bedroom rental home has come down from $2,500 in 2015 to a current price of $1,400. This represents a 44 percent decline of the rental price in the market.

Some folks believe the reason for the decline in oil production at the Bakken was due to low oil prices. While this was part of the reason, the Bakken was going to peak and decline in 2016-2017 regardless of the price. This was forecasted by peak oil analyst Jean Laherrere. I wrote about this in my article below (click here to read article)– Published, APRIL 2015:

I took Jean Laherrere’s chart and placed it next to the current actual Bakken oil field production:

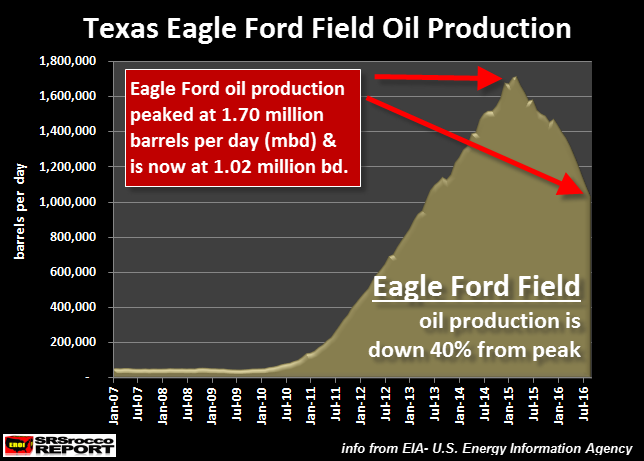

As we can see in the chart above, the rise and fall of Bakken oil production is very close to what Jean Laherrere forecasted several years ago (shown by the red arrow). According to Laherrere’s chart, the Bakken will be producing a lot less oil by 2020 and very little by 2025. This would also be true for the Eagle Ford Field in Texas.

According to the most recent EIA Drilling Productivity Report, the Eagle Ford Shale Oil Field in Texas will be producing an estimated 1,026,000 barrels of oil per day in September, down from a peak of 1,708,000 barrels per day in May 2015. Thus, Eagle Ford oil production is slated to be down a stunning 40% since its peak last year.

Do you folks see the writing on the wall here? The Bakken down 25% and the Eagle Ford down 40%. These are not subtle declines. This is much quicker than the U.S. Oil Industry or the Mainstream Media realize.

And… it’s much worse than that.

The U.S. Oil Industry Hasn’t Made a RED CENT Producing Shale

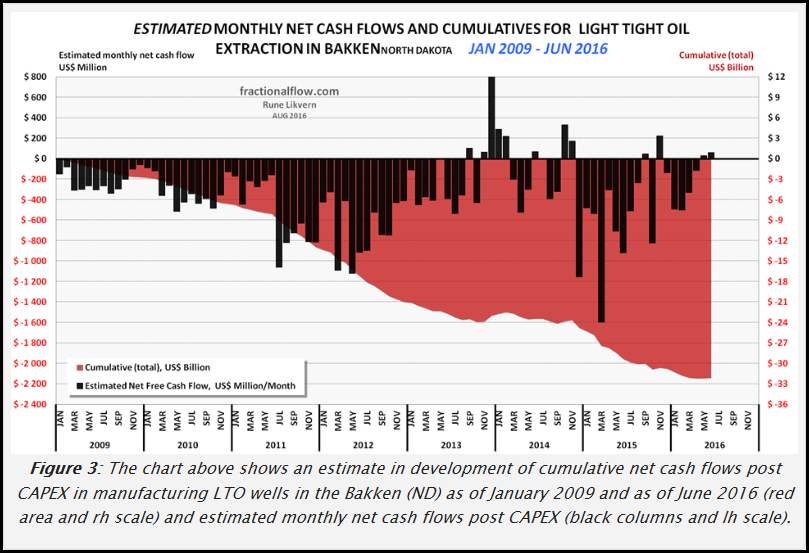

Rune Likvern of Fractional Flow has done a wonderful job providing data on the Bakken Shale Oil Field. Here is his excellent chart showing the cumulative FREE CASH FLOW from producing oil in the Bakken:

I will simply this chart by explaining that the BLACK BARS are estimates of the monthly Free Cash flow from producing oil in the Bakken since 2009, while the RED AREA is the cumulative negative free cash flow. As we can see there are very few black bars that are positive. Most are negative, heading lower.

Furthermore, the red area shows that the approximate negative free cash flow (deducting CAPEX- capital expenditures) is $32 billion. So, with all the effort and high oil prices from 2011-2014 (first half of 2014), the energy companies producing shale oil in the Bakken are in the hole for $32 billion. Well done…. hat’s off to the new wonderful fracking technology.

According to Rune Likvern in his article on the Bakken, he stated the following:

Just to retire estimated total debts (about $36 Billion, including costs for DUCs, SDWs, excluding hedges and income/loss of natural gas and NGLs) would require about 7 years with extraction and prices at Jun-16 levels.

Nominally to retire all debts (reach payout) would take an (average) future oil price close to $65/bo (WTI) for all the wells in operation as of end June – 16. This is without making any profit.

For the wells in production as per Jun-16, the total extraction of these will decline about 40% by Jun-17, and depletes their remaining reserves with about 20%. By assuming the operations remain cash flow neutral, total debt remains at $36 B in Jun-17.

As from Jul-17 this would now require an average oil price of about $73/bo (WTI) for these wells to nominally retire all debts (reach payout). Additional wells will add to what price is required to retire the total debt.

What Rune is stating here is that the $36 billion in total cumulative debt will occur by June 2017. Thus, it would take an average $65 a barrel to just pay back the debt in seven years. With the way things are going in the U.S. and world economies, I doubt we are going to see much higher oil prices.

Furthermore, the work by Louis Arnoux and the Hills Group suggest the price of oil will fall, not rise due to a Thermodynamic Collapse. More about this in an upcoming interview.

The United States Is In Big Trouble & Most Americans Have No Clue

As I have been documenting in previous articles (going back until 2013) the U.S. Shale Oil Industry was a house-of-cards. Readers who have been following my work, based on intelligent work of others, understood that Shale Oil is just another Ponzi Scheme in a long list of Ponzi Schemes.

From time to time, I look around different websites that publish my work and read some of the comments. I am surprised how many individuals still don’t believe in Peak Oil even though I explained the Falling EROI – Energy Returned On Investment quite clearly.

For some strange reason, some individuals cannot use deductive reasoning to destroy lousy conspiracy theories. Moreover, if they do believe in Peak Oil, then they think there is a wonderful “Silver-Bullet Energy Technology” that will save us all. I gather they believe this because the REALITY and IMPLICATIONS of Peak Oil are just too horrible, to say the least. So, holding onto HOPE that something will save us, just in the nick of time, is better than accepting the awful reality heading our way.

And the awful reality of Peak Oil will be felt more by Americans as their lifestyles have been highly elevated by the ability to extract wealth and resources from other countries through the issuing of massive amounts of paper Dollars and debt. Basically, they work, and we eat.

Unfortunately, the propping up of the U.S. market by the Fed and the domestic shale energy Ponzi scheme is running out of time. This is why it is imperative for investors to start moving out of Bonds, Stocks and Real Estate and into physical gold and silver to protect wealth.

For the wealthy investor or institution that believe a 5-10% allocation in physical gold is good insurance, you are sadly mistaken. While Donald Trump is receiving more support from Americans in his Presidential race, his campaign motto that he will “Make American Strong Again”, will never happen. The America we once knew is over. There just isn’t the available High EROI – Energy Returned On Investment energy supplies to allow us to continue the same lifestyle we enjoyed in the past.

So, now we have to transition to a different more local or regional way of living. This new living arrangement will be based on capital that is “STORED ECONOMIC ENERGY or WEALTH.” This can only come via the best sources such as physical gold and silver.

If individuals and countries have been acquiring physical gold and silver, they will be in better shape and will be able to enjoy more options than those who have been selling their gold and accumulating lots of debt and derivatives.

Lastly, if you haven’t checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

341 Comments on "THE DEATH OF THE BAKKEN FIELD HAS BEGUN: Big Trouble For The U.S."

Mike on Mon, 19th Sep 2016 11:32 am

Yes and No… The nature of the oil beast is also the supply-side economics that plague the U.S. because so many countries shut off the tap when there isn’t a peak demand. The ND story isn’t over yet, they have capped most of their wells because right now they have thwarted the supply-side monopoly of the opec nations and they were losing revenue and had to change their business practice. The oil in ND is more valuable than ever if not for a bargaining chip and should continue to pump, but have to compete with OPEC who can literally set their price high or low and off-set that with Chinese demand. We are simply taking advantage of China a little bit. Economics and Oil mix quite well (almost too well)…

curlyq3 on Mon, 19th Sep 2016 11:42 am

Howdy ghung … I wonder why the “Bot Masters” have decided this information at this point in time is worthy of their exploits? … this information has been discussed here since the beginning of the invasion of the Dakotas … you are right though, I need to start running for my life!

curlyq3

LOTSANERV on Mon, 19th Sep 2016 12:13 pm

The fields aren’t dead or “dying.” It’s expensive to extract that oil. Oil prices are low (Because people aren’t back to driving their old huge SUVs). Production is down because they’re cutting production. Simple economic decision. Alarmist propaganda is bad..mmkay.

imnotadoofus on Mon, 19th Sep 2016 12:37 pm

Yes, there is a rapid decline in the first two years after a well comes on line. But as Bakken production declines further, then imports will increase, as they are currently. That will then put upward pressure on Brent and WTI. As prices increase, perhaps to $60-75, closed wells will be restarted, more gradually perhaps, as many of the smaller e/p companies are long gone. So remaining experienced operators will survive and Bakken will also.

Penn Digger on Mon, 19th Sep 2016 12:38 pm

What a COMPLETE and Utter LIE. The peak is not even on the horizon since the wells have been turned down, not off.

Pretty pathetic attempt to attack American Oil and American Energy. With the lies you are so willing to tell, you must be working with Hillary Clinton.

michael briggs on Mon, 19th Sep 2016 12:55 pm

this article is like most journalism, illegal. 18 usc 1001 fraud. there is one reason and one reason only for the decline numbers. supply had to be dropped to compensate for the illegal move of opec 2.5 years ago of which they flooded they flooded the market to kill the frac production of the us. production was cut to stabilize the price.

why don’t you do an article on the illegality of the opec move. price manipulation to destroy domestic production.

we have enough domestic fields to be 100% self providing for the next 100 years, and that doesn’t include the new finds almost monthly.

E. Fudd on Mon, 19th Sep 2016 1:13 pm

Production is down because drilling is down. Drilling is down because the price of oil is down below the lifting cost. The price of oil is down because the Saudis and others have flooded the market with oil. The Saudis wanted to break the back of the American drillers/producers to reduce production. The Saudis are now buying up US oil/refining businesses. Do you think the Saudis acquiring American assets at bargain basement prices is just a coincidence? Drilling has been reduced in response to the prices of oil. The oil is still there. When the prices rise the drilling will expand. When will the price of oil rise? Only the Saudis can answer this question.

rockman on Mon, 19th Sep 2016 1:15 pm

Lots – So true: fields don’t “die”. The simply deplete to the point at which the are no longer economic to produce.

Oh, and another minor fact: the Bakken Field isn’t a f*cking field! LOL. It is a FORMATION in the Williston Basin. There are numerous FIELDS in the Williston BASIN that produces from the Bakken FORMATION. All one needs to do is pull up the Williston Basin map and see all the different FIELDS producing not only from the Bakken FORMATION as well as other productive FORMATIONS in the basin

Here’s a short except discussion production from a couple of FIELDS (Sanish and Parshall FIELDS) that produce from the Bakken FORMATION. BTW most of the Bakken FIELDS are seperate anticline structures resulting from draping over igneous basement highs:

“The North Dakota Department of Natural Resources estimated overall break-even to be just below US$40 per barrel. An analyst for Wood McKenzie said that the overall break-even price was US$62/barrel, but in high-productivity areas such as Sanish Field and Parshall Oil Field, the break-even price was US$38-US$40 per barrel.”

Apneaman on Mon, 19th Sep 2016 1:22 pm

I think it was worth it. How else can they make my Little Debbie’s snack cakes full of heavenly palm oily goodness?

100,000 deaths from Indonesia forest fires, study estimates

“The fires from July to October last year in southern Sumatra and the Indonesian part of Borneo were the worst since 1997 and exacerbated by El Nino dry conditions. About 2, 61,000 hectares of land burned. Some of the fires started accidently, but many were deliberately set by companies and villagers to clear land for plantations and agriculture.”

http://www.thehindu.com/sci-tech/energy-and-environment/100000-deaths-from-indonesia-forest-fires-study/article9123948.ece

Apneaman on Mon, 19th Sep 2016 1:28 pm

Macro-Economic Phlogiston

“For example, we now know that income and wealth inequality is much worse than it was during the Golden Age after World War II. And we now know that corporate CEOs made 949 times as much as the average American worker in 2014, not the previously reported 373 times as much. (More on this another time.)

We can observe that output growth (Gross Domestic Product, GDP) has slowed dramatically in recent decades, and especially in the last year. We can also observe that the weaker output growth becomes, the more devalued that variable becomes when the observer has a vested interest in making the economy look better than it actually seems to most workers. And we can almost certainly expect an October surprise after three straight quarters of anemic GDP growth.

(Note: I say that not because there is conspiracy to make the economy look better than it seems to most working Americans. I say that because human beings are fuck-ups, and that’s the most fucked up that could happen 11 days before the election. You know, an unfortunately but timely application of lipstick on the pig.)”

http://www.declineoftheempire.com/2016/09/macro-economic-phlogiston.html

Apneaman on Mon, 19th Sep 2016 1:30 pm

lipstick on the pig

Once again, the rosy view on U.S. economy wilts

“The final nail in the proverbial coffin may have come with a decline in retail sales and manufactured goods in August, reflecting persistent caution on the part of consumers and businesses.”

http://www.marketwatch.com/story/once-again-the-rosy-view-on-us-economy-wilts-2016-09-18

thing on Mon, 19th Sep 2016 1:51 pm

The problem here is you seem to be assuming the peak is due to technological limits and not economic limits. It is arguable that right now it is economic limits have caused the turn down. Now whether oil will ever get to $100 again making the Bakken accessible is doubtful I will agree (and whether investors will play risk again in). What is interesting is the rate of drop this bears out the expectations of the decline rate of fracked wells.

Sissyfuss on Mon, 19th Sep 2016 1:57 pm

Ap, is that you or is this”Invasion of the Oily Snatchers?

Jim Irgens on Mon, 19th Sep 2016 2:08 pm

The reason the Bakken production is going down is becasue there are only 27 rigs in North Dakota compared to over 200 in 2014. Start up the rigs and production will go up. Pretty simple to figure that out.

Apneaman on Mon, 19th Sep 2016 2:26 pm

Sissyfuss, dat me.

Apneaman on Mon, 19th Sep 2016 2:33 pm

Here’s a parallel to the Troll-Bot’s level of sophistication.

https://www.youtube.com/watch?v=rHXvMcLrLSY

rockman on Mon, 19th Sep 2016 2:45 pm

Thing – All true. But are you aware that all the tech that made the shales boom existed a decade early? Some tweaking for sure but the same infrastructure used to increase US production existed long before the boom. I mean the actual drill rigs, frac trucks and horizontal drilling equipment. The same hz tech that helped the Austin Chalk carbonate shale boom in the 90’s. It was used then to drill 5,000’+ laterals 20 years ago. But big deal: Maersk was drilling 30,000’+ laterals in the Persian Gulf before the US shale boom began.

So you’re correct: the cause of the boom was the higher oil price. But for folks that expect new tech (unlike the old tech that was utilized to make the shales boom) to save the day may have a very long wait…maybe forever. As pointed out hz drilling tech began developing over about 1/4 century ago (as was 3d seismic) and frac’ng a 1/2 century ago. The first Deep Water oil fields (more then 150 have been developed to date) in the GOM began producing over 30 years ago.

I continuously deal with the service companies…the service companies that have been the innovators and developers of new oil field tech for decades. And not one is talking about any new tech on the horizon that could come close to matching the impact of frac’ng, hz drilling, 3d seismic or Deep Water production.

And as you seem to imply no new tech could be used to develop future commercial oil fields if those fields don’t exist in the first place. Every oil trend ever developed eventually ran out of fields of significant size to develop…everyone. The Eagle Ford, Bakkin, Deep Water et al trends will eventually run out of significant reserves to develop regardless of how oil prices reached. Has happened in every very mature play that has ever been discovered…every one…no exceptions.

Scott on Mon, 19th Sep 2016 4:06 pm

That’s what happens when you don’t keep drilling to replace oil wells that are depleting.

Harry on Mon, 19th Sep 2016 7:40 pm

I don’t know what’s more pathetic, the manmade global warming stories or this krap. Production is down simply because the price of oil is down. Any idiot could figure that out.

makati1 on Mon, 19th Sep 2016 8:04 pm

You appear to be the idiot, Harry. Or another bot? Time for them to appear again, I guess. If so, I’ll be gone again.

Boat on Mon, 19th Sep 2016 9:32 pm

rock,

Do you disagree with the information in the link.

http://www.investors.com/news/boom-or-bust-u-s-oil-patch-finds-new-breakthroughs/

makati1 on Mon, 19th Sep 2016 9:34 pm

Boat, investors dot com is about keeping and/or recruiting new suckers for the industry. It is NOT an independent source for facts or anything real. I don’t need to read it to get the slant.

Boat on Mon, 19th Sep 2016 9:55 pm

Yes Mak,

You didn’t read it or hundreds of posts talking about oil tech as it evolves. Unlike you I will use any post from any where as a search input to see if it is bs or not.

makati1 on Mon, 19th Sep 2016 10:48 pm

Boat, using propaganda does NOT prove anything except your gullibility. You have to look at the real world as it is, not as some want it to be. You have to look at articles about and from all parts of the world. Not just the oily/capitalist industry.

Mark on Tue, 20th Sep 2016 12:03 am

PROPAGANDA , PROPAGANDA & MORE PROPAGANDA.

Indadman on Tue, 20th Sep 2016 10:11 am

This article was interesting until it segued into another “buy precious metals” pitch. If everything really goes to hell, gold and silver will have no more value than paper dollars. Corn, wheat, and water will have value.

Kenz300 on Tue, 20th Sep 2016 11:05 am

I thought Canada tar sands were the highest cost producers.

How do they stay in business at these prices?

Just more competition for the frackers.

Robert Spoley on Tue, 20th Sep 2016 2:40 pm

The price of oil and gas will always go up and down as will the cost of acreage and drilling and extraction. Reserves are not going up and never will. The discovery of new reserves continues to decline and always will. These facts do not change the fact that reserves will always decline. The arguments above are a function of dollar efficiency in finding and extracting those reserves. If the “play” currently in favor only has minor reserves, it may only be profitable for a short time as the prices must be high to initiate the “play”. Once those reserves have been significantly reduced by production, the remaining reserves may never be profitable regardless of the price. None of the shale “plays” have significant reserves now and never did. Only the rapid production of those reserves at very high prices made it appear that way. Payout should be about 5 to 7% of the time for the life of the individual well (play/field). This is a function of reserves vs. production rates. Say hello to dollar efficiency vs. barrels of oil produced over a significant time period.

Ryan Gibson on Wed, 21st Sep 2016 2:56 pm

I had to double-check to confirm I wasn’t reading Paul Erhlich. Been hearing this chicken little for decades. We’re not running out of oil for well over 200 years. Only rate-limiting factor is gov regulatory.

banjo on Thu, 22nd Sep 2016 4:33 am

Just take a look at the world. Wars everywhere, Ukraine, Yemen, Syria, Lybia, Iraq, Afghanistan. Civil unrest in the USA. Brexit. We are drilling the dregs in Tar Sands and Shales. Interest rates are at 0% something like 20 Trillion in government bonds is negative. Unemployment in OECD countries is double digit. There is simply not enough energy to keep 7 billion people pampered with shopping malls and iPhones. Good luck.

Kenz300 on Fri, 23rd Sep 2016 6:58 am

The oil companies and the auto companies need to get their collective heads out of the sand and realize that the world is changing with or without them.

Climate Change is real….. it will impact all of us…

It is time to move away from fossil fuels and embrace alternative energy sources like wind, solar, wave energy, geothermal and second generation biofuels made from algae, cellulose and waste. They need to change their business models and move from being OIL companies to ENERGY companies. The auto industry needs to move from just building compliance vehicles to embracing electric vehicles and start putting development and advertising behind them..

The world is moving to embrace alternative energy sources…….. the fossil fuel companies can transform themselves into “energy” companies or they can die a slow death.

As Climate Change impacts more people there will be a bigger backlash against fossil fuels.

Apneaman on Fri, 23rd Sep 2016 8:44 am

Kenz300, your fearless libtard leader, queen bee Hillary only cares about climate change as much as it affects her polling results. She just makes the required amount of talking points and empty promises needed to string retards like you along. Nothing will change.

Clinton pulled climate from speeches after Sanders endorsement

Transcripts show the Democrat presidential candidate referred to climate change directly in less than half as many speeches after her left-wing rival conceded defeat

http://www.climatechangenews.com/2016/09/20/clinton-softened-climate-talk-after-sanders-endorsement/

ghung on Fri, 23rd Sep 2016 8:57 am

“Clinton pulled climate from speeches after Sanders endorsement…”

Talking about climate change makes people uncomfortable. Creating cognitive dissonance won’t get anyone elected; only addressing short-term issues that are considered “solvable without pain”, or making folks angry about the other side’s position helps her numbers.

Everyone who cares knows that climate change is their fault, and responding will require a change in behavior. Not a good way to get elected. Ask Bernie.

Apneaman on Fri, 23rd Sep 2016 9:20 am

ghung, there will be no intentional changes that matter and lest not from the Hillary creature. If there was no multi billion dollar denial industry the humans might have slowed down a little and bought a few decades more, but that’s about it.

Caring does not really factor into it all that much. Yesterday you linked to the newest Mobus piece in which he basically says what I’ve been saying……… only gentler.

“It was inevitable that the carbon-based fuels would be burned, the energy released as heat radiating to space. We humans are merely the agents of its release. However, that inevitability does not mean it had to be done as fast as possible.”

http://questioneverything.typepad.com/question_everything/2016/09/an-autumnal-equinox-and-a-new-human-society-.html

It’s all one big smoke & mirrors show folks.

Hillary Clinton’s Connections to the Oil and Gas Industry

Hillary Clinton’s campaign and the Super PAC supporting her have received more than $6.9 million from the fossil fuel industry.

http://www.greenpeace.org/usa/campaign-updates/hillary-clintons-connection-oil-gas-industry/

Smoke & mirrors

FALSE HOPE: THE CORE STRATEGY OF 350

http://www.wrongkindofgreen.org/2016/04/27/false-hope-the-core-strategy-of-350/

Davy on Fri, 23rd Sep 2016 9:27 am

“Cognitive dissonance won’t get you elected” so true. It appears today as was the case in Rome you give the masses what they want and hope yours are a majority. That becomes a tightrope of finding common issues that appeal to a broad field of voters. Those topics run out quickly so then you turn to good ole attack points. There is never enough attack points so a candidate is always safe going that route. Destroy character and present issues as good and bad. Sometimes even go as far as hinting at evil and death. Are we talking about the election or this board?

onlooker on Fri, 23rd Sep 2016 9:36 am

“If there was no multi billion dollar denial industry the humans might have slowed down a little and bought a few decades more, but that’s about it. ”

Yep that was like a blank check allowing worldwide civilization to continue onward full throttle, no critical mass of people attempting to slow things down. And even with full disclosure, one wonders if humans would REALLY have attempted slowing down or changing path

Robert Spoley on Fri, 23rd Sep 2016 12:45 pm

A lot of interesting comments, all of which seem to reflect on only one principle, and that is SELF DISCIPLINE or the lack thereof. With more self discipline, stability in almost every topic addressed above, recedes to stability. These topics include 1)prices; 2)production rates; 3) population; 4)climate change; 5)pollution of all kinds;6)all manner of resources; 7)politics and regulations; 8)agriculture; 9)jobs and a host of other topics. Seems to me that self discipline is the one “thing” this planet is in short supply of. And it’s getting worse.

ghung on Fri, 23rd Sep 2016 12:55 pm

That self-interest trumps self-discipline is pretty universal. People employ self-discipline only when they perceive it’s to their benefit.

onlooker on Fri, 23rd Sep 2016 1:15 pm

Also, from my perspective self discipline is not a natural innate state of people. Much more keen to pleasure self fulfillment, instant gratification etc. Rather self discipline is an acquired nurtured trait of some who chose this route or have been early on steered in that direction. I see no steering in that direction in western societies. Quite the opposite.

Davy on Fri, 23rd Sep 2016 2:23 pm

We have a whole economic sectors dedicated to self-interest and the letting go of self-discipline. They tell us it is good for us to have balance. You know, work hard and play hard. The results are destructive on us individually and collectively. These industries are now part of the economic landscape. They are listed on the stock exchanges. Good luck with changing that. Self-discipline at all levels is required of anyone in the struggle for survival we just found ways to disperse risk but in the process put everything at risk. Welcome to modernism!

Dan on Mon, 26th Sep 2016 9:18 am

The Bakken has always been a Ponzi-scheme. The oil and gas companies have to keep sucking in investors because the only way to keep production up is to drill well after well after well, since production drops off dramatically for a well within two years. Because of decreased production (primarily due to low oil prices) the Ponzi-scheme is unraveling as profits aren’t able to keep up with what’s owed to investors.