Page added on April 4, 2018

The Problem with EIA Shale Gas and Tight Oil Forecasts

Each year the U.S. Energy Information Administration (EIA) produces forecasts of U.S. oil and gas production in its Annual Energy Outlook (AEO), which is widely viewed as an authoritative assessment of what to expect for future U.S. oil and gas output (the EIA prefers the term “projection” to “forecast”). The EIA’s reference case is considered as the most likely scenario by industry, policy makers, and the media.

Considering that AEO reference case forecasts for shale gas and tight oil production in recent releases are remarkably optimistic when considered at the play-level in terms of well productivity, decline rates and prospective areas, I find this baffling and worrisome. It’s one thing for industry to paint a rosy picture of future production, but something altogether different when a government agency—tasked with providing the American public with objective information—does it.

AEO2018, for example, projects that shale gas production will be 130% higher in 2050 than in 2016, while tight oil production will grow by 74%, all at relatively low prices. This despite the fact that average production from individual wells falls 70–90% in the first three years and entire fields would decline 20-40% a year if new wells weren’t constantly drilled.

I recently assessed the EIA’s AEO2017 forecasts and assumptions for all major shale gas and tight oil plays using a proprietary commercial database of well production data—a database that the EIA itself uses for its own analysis. The study revealed that the EIA has overestimated the likely future production of shale gas and tight oil for most plays by a wide margin. This is a result of overestimating the size of the prospective area and hence the number of wells that can be drilled, and underestimating future declines in well productivity. These declines in productivity are due to well interference (as sweet spots become saturated with wells) and from drilling lower quality rock outside of the limited sweet spot areas. The EIA’s estimates are also much higher than those of the U.S. Geological Survey and the University of Texas Bureau of Economic Geology.

If the AEO2018 reference case projections are compared to the EIA’s most recent assumptions of proven reserves plus unproven resources, tight oil production would extract 96% of remaining tight oil and shale gas production would extract 77% of remaining shale gas by 2050, even though unproven resources (which are 86% of remaining potential) have not been demonstrated to be economically recoverable and are based on unrealistically large estimates of productive area for most plays. Furthermore, as the EIA projections assume that production will be at much higher levels in 2050 than today, they imply that there are vastly more additional resources to be recovered after 2050 than suggested by the EIA’s own estimates. Indeed, in several plays the EIA’s projections assume that more than 100% of its estimates of proven reserves plus unproven resources will be recovered before 2050. In essence, the EIA is banking on recovering resources that do not exist according to its current best estimates.

In the weeks following the release of AEO2018, the EIA published a report on the methodology behind its projections. Using the Eagle Ford play as an example, this report provided a reasonable overview of the evolution of shale plays—from discovery to full development to infill drilling of sweet spots and moving on to lower quality rock outside of sweet spots. This part of the report built on an assessment done by the same author in 2014. To my knowledge, the Eagle Ford play is the only county level assessment the EIA has ever published.

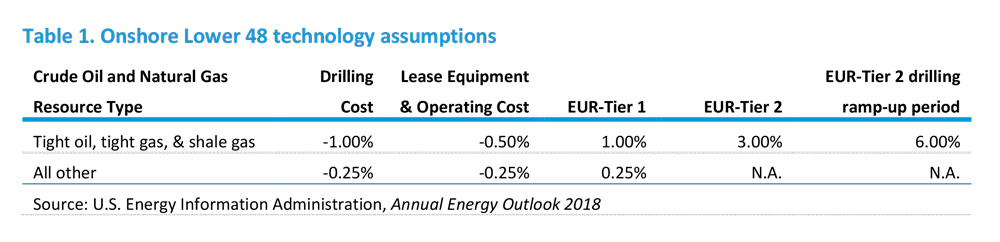

The report goes on, however, to dispel any confidence that the Eagle Ford example is actually how the EIA comes up with its projections. The EIA apparently assumes that the estimated ultimate recovery (EUR) of wells will continue to increase for the foreseeable future due to better technology, and that drilling and operating costs will decrease for the foreseeable future, given this table of assumptions of annual changes in costs and EURs from the report:

By overestimating prospective play areas and hence the number of available drilling locations, by assuming well EURs will continue to increase indefinitely, and by assuming drilling and operating costs will continue to fall, the EIA can come up with whatever forecast it wants. This is amply illustrated by the wild fluctuations from year to year in the EIA’s play-level forecasts pointed out in my study (the play-level forecasts are not published in the AEO—they are only provided if a special request is made to the EIA).

An example from AEO2018 is the Wolfcamp Play in the Permian Basin below. The EIA projects 148% more oil will be recovered in the AEO2018 projection than it projected in AEO2017, just one year earlier (22.1 billion barrels recovered by 2050 in AEO2018 compared to 8.9 billion barrels in AEO2017). This is 87% more oil than the total of Wolfcamp proven reserves plus unproven resources that the EIA estimated in 2017 (11.8 billion barrels).

How can this be? Most major shale plays have now been extensively drilled so the dimensions of the plays and location of sweet spots are well known. Over 400,000 wells have been drilled in the Permian Basin over many decades. Geology doesn’t change year to year and technology doesn’t improve at those rates over a single year (in fact average well productivity in 2017 declined in the Wolfcamp—see Figure 48).

Given an analysis of play fundamentals based on current drilling data, there is no credible basis for the highly to extremely optimistic forecasts offered by the EIA. Actual production is likely to be far less. Assuming the EIA forecasts are accurate in a long-term energy plan is likely to end very badly. And yet these forecasts are uncritically accepted by policy makers and the media, the consequences of which will be borne by all of us.

135 Comments on "The Problem with EIA Shale Gas and Tight Oil Forecasts"

Davy on Thu, 5th Apr 2018 6:14 pm

Your being childish greggie, stop it already.

Boat on Thu, 5th Apr 2018 6:45 pm

Clog

Much of the world lives in little tiny boxes stacked. You mass transit like cattle. You and mak win the energy game. Some of us like having a yard and trees of our own. Yes I get to drive to work but it’s not as nice open country.

Cloggie on Thu, 5th Apr 2018 7:08 pm

“Much of the world lives in little tiny boxes stacked. You mass transit like cattle. You and mak win the energy game. Some of us like having a yard and trees of our own. Yes I get to drive to work but it’s not as nice open country.”

Americans have indeed more m2 per capita living space, far bigger cars, although I don’t think mass transit is that much better as elsewhere.

But what may have been desirable in the sixties (“American Dream”)mcould become a nightmare, for Americans, in the near future. Because all that space still needs to be heated and these SUVs still need to be powered.

Now when I say that “peak oil is irrelevant” I’m mainly talking about Europe, the entity with the most serious renewable energy program and also the entity that needs up to 50% less energy than the US to generate the same wealth.

In Europe 90% of new energy production capacity is currently renewable. I’m confident that at least in Europe renewable energy penetration will happen fast enough to offset declining supply of conventional fossil fuel, without the need to resort to unconventional fossil fuel, available in sheer infinite quantities:

http://www.dailymail.co.uk/news/article-2593032/Coal-fuel-UK-centuries-Vast-deposits-totalling-23trillion-tonnes-North-Sea.html

I stopped worrying about the European energy situation years ago.

The US and China is a different story though.

GregT on Thu, 5th Apr 2018 7:22 pm

“You have played this game before”

Not Cloggie’s game Davy. That data came from the World Resources Institute.

http://www.wri.org

700 experts from over 50 countries around the world. The president’s credentials alone should get your attention, but as per usual, you would be the expert. 🙂

“Dr. Andrew Steer is the President and CEO of the World Resources Institute, a global research organization that works in more than 50 countries, with offices in the Brazil, China, Europe, India, Indonesia, Mexico and the United States.”

“Dr. Steer joined WRI from the World Bank, where he served as Special Envoy for Climate Change from 2010 – 2012. From 2007 to 2010, he served as Director General at the UK Department of International Development (DFID) in London.”

“Dr. Steer is a Global Agenda Trustee for the World Economic Forum, and is a member of the China Council for International Cooperation on Environment and Development (CCICED), the Leadership Council of the Sustainable Development Solutions Network, the Energy Transitions Commission, the Champions 12.3 Coalition to reduce food loss and waste, the Sustainable Advisory Groups of both IKEA and the Bank of America, and he serves on the Executive Board of the UN Secretary General’s Sustainable Energy For All Initiative.”

“Andrew was educated at St Andrews University, Scotland, the University of Pennsylvania, and Cambridge University. He has a PhD in economics.”

I’d be far more inclined to listen to experts, than I would be to listen to a supposed goat farmer from the Ozarks.

Davy on Thu, 5th Apr 2018 7:38 pm

“Western Europe needs half of the amount of energy the US or China need to generate a million buck:”

greggie, come on so you are saying this is presentation is legit? “generate a million buck” give me a reference that shows this reference, twinkle twinkle.

Davy on Thu, 5th Apr 2018 7:44 pm

“entity that needs up to 50% less energy than the US to generate the same wealth.”

Try this instead:

“GDP Per Unit of Energy Use”

https://tinyurl.com/ycf532bj

Cloggie on Thu, 5th Apr 2018 7:56 pm

“greggie, come on so you are saying this is presentation is legit? “generate a million buck” give me a reference that shows this reference, twinkle twinkle.”

Again, meathead too lazy to look things up himself. Zero intellectual curiosity, he is expecting the rest of the world to serve him:

https://en.wikipedia.org/wiki/List_of_countries_by_energy_intensity

…and “the rest of the world” does, provided it can make meatheat and his ignorance exposed yet again.

Davy on Thu, 5th Apr 2018 8:02 pm

“total energy consumption per unit GDP.”

Nederdummy,

How does this fit in dummy?

“generate a million buck”

Maybe nederdummy should use proper terms.

MASTERMIND on Thu, 5th Apr 2018 8:07 pm

Clogg

Europe’s Biggest Natural Gas Producer Is Running Out of Fuel

https://www.bloomberg.com/news/articles/2016-09-16/europe-s-biggest-natural-gas-producer-is-running-out-of-fuel

Looks like your country is almost out of gas…LOL Say goodbye to your economy! better get to that underground coal contraption the dailymail told you about! LOL

Cloggie on Thu, 5th Apr 2018 8:07 pm

Now that is a very weasel thing to do, meathead. No wonder you do not provide the full link to that graph, because you know very well you are lying through your teeth. Your graph is about the cost of energy in money terms…

https://en.wikipedia.org/wiki/Energy_intensity

…where I was talking about the amount of kWh’s required to generate a million buck.

Most likely you are just smart enough to understand the difference, but nevertheless intentionally insert the deceit. God are you a filthy POS. With history discussions it is the same… you very well understand my arguments but you chose to avoid them, just to make your club look good.

MASTERMIND on Thu, 5th Apr 2018 8:10 pm

Cloggie

How many times do I have to educate you? Coal cannot work without crude, crude cannot work without coal, natural gas cannot work without both oil and coal, Shale oil cannot work without any of those, and so on..

MASTERMIND on Thu, 5th Apr 2018 8:14 pm

Ignore the spin: Coal gasification is a stupid idea

https://www.newscientist.com/blogs/shortsharpscience/2009/05/however-you-spin-it-coal-gasif.html

Cloggie on Thu, 5th Apr 2018 8:17 pm

“Looks like your country is almost out of gas…LOL Say goodbye to your economy! better get to that underground coal contraption the dailymail told you about! LOL”

LOL all you like, millimind. But we have a replacement, namely the best part of the North Sea, that suffices as an energy province, for all the energy we’ll ever need and than some:

https://www.offshorewind.biz/2017/11/24/orsted-the-netherlands-might-become-one-of-the-largest-offshore-wind-markets-expertise-hub-video/

https://deepresource.wordpress.com/2017/07/07/contracts-signed-for-752-mw-offshore-wind-of-dutch-coast/

Holland has the potential to become a major hydrogen supplier for European energy markets:

https://deepresource.wordpress.com/2017/12/24/groene-waterstofeconomie-in-noord-nederland/

https://deepresource.wordpress.com/2017/05/16/the-enormous-energy-potential-of-the-north-sea/

Davy on Thu, 5th Apr 2018 8:18 pm

“kWh’s required to generate a million buck.”

Dummy, where is million bucks fit in all this. You are being sloppy and misrepresenting the analysis.

LIAR

“Your graph is about the cost of energy in money terms…”

Try this:

https://en.wikipedia.org/wiki/Energy_intensity

“Energy intensity is a measure of the energy efficiency of a nation’s economy. It is calculated as units of energy per unit of GDP. High energy intensities indicate a high price or cost of converting energy into GDP. Low energy intensity indicates a lower price or cost of converting energy into GDP. High energy intensity means high industrial output as portion of GDP. Countries with low energy intensity signifies labor intensive economy.”

makati1 on Thu, 5th Apr 2018 8:19 pm

Cloggie, Davy has nothing to back up his delusions. He hides behind tinyurls that he obviously never reads or, if he does, does not understand. Most goatherds in the 3rd world are smarter than he is, and more rational.

Davy on Thu, 5th Apr 2018 8:21 pm

“Holland has the potential to become a major hydrogen supplier for European energy markets:”

Potential doesn’t mean shit nederdummy. What is happening now? Nada!

GregT on Thu, 5th Apr 2018 8:21 pm

“How many times do I have to educate you? Coal cannot work without crude”

Coal worked just fine in China 3500 years ago without crude, fuelled the industrial revolution without crude, and fuelled modern industrialism for well over 100 years without crude. It also heated both of my parents’ homes when they were growing up. My father’s before they even had access to electricity or automobiles.

Davy on Thu, 5th Apr 2018 8:23 pm

Come on billy 3rd world say something or offer a reference. What a dumbass. OH, please fill me in more on the gold back petroyuan nonsense you where hyping earlier. No wonder you are a 1st semester college dropout.

Cloggie on Thu, 5th Apr 2018 8:24 pm

“Ignore the spin: Coal gasification is a stupid idea”

It is a stupid idea… unless it is used exclusively to achieve the renewable energy transition. But both my nothingness as well as the UK government are confident UCG won’t be necessary:

https://deepresource.wordpress.com/2017/01/02/uk-government-rejects-ucg/

The whole point why I bring up UCG is to silence those who claim there is not enough fossil fuel left to make the transition work. There IS enough.

Davy on Thu, 5th Apr 2018 8:27 pm

Coal gasification is uneconomic as a global solution to fossil fuel decline.

This is nonsense

“The whole point why I bring up UCG is to silence those who claim there is not enough fossil fuel left to make the transition work.”

There is not enough economy to make a transition possible. It can’t be afforded.

MASTERMIND on Thu, 5th Apr 2018 8:32 pm

Even illegal immigrants don’t want to come to America anymore. Illegal immigration has dropped 80 percent since 2000…

https://imgur.com/a/8wf3O

Cloggie on Thu, 5th Apr 2018 8:33 pm

“Potential doesn’t mean shit nederdummy. What is happening now? Nada!”

As usual you have no clue:

https://deepresource.wordpress.com/2017/08/09/first-climate-neutral-power-station-in-the-netherlands/

https://deepresource.wordpress.com/2017/08/09/prof-ad-van-wijk/

https://deepresource.wordpress.com/2017/08/17/interreg-north-sea-region-hytrec2/

https://deepresource.wordpress.com/2017/07/22/trucks-on-h2-generated-by-wind-turbines-in-the-netherlands/

As always meathead coquets with his lazy, easy doom, which enables our “white African” with his disgusting low ambition level merely consisting of goats and chickens to have to do exactly nothing.

MASTERMIND on Thu, 5th Apr 2018 8:35 pm

clogg

your country is going to become another failed state. the only reason it was wealthy was all that gas nature blessed you folks with. once its gone so goes the neighborhood! lol

Davy on Thu, 5th Apr 2018 8:35 pm

neder, today, how much hydrogen is the nederdummyland producing? Skip all the stupid deepresource personal goal seek references and show me the goods. Geeze you are one slimy MF.

MASTERMIND on Thu, 5th Apr 2018 8:36 pm

Clogg

Why do you block all the comments on your blog? why so insecure? LOL

Cloggie on Thu, 5th Apr 2018 8:39 pm

“Even illegal immigrants don’t want to come to America anymore. Illegal immigration has dropped 80 percent since 2000…

https://imgur.com/a/8wf3O”

Most come legally and still come in large numbers, turning the US into an impotent third world country.

That roaring laughter you hear in the distance, that’s from Europeans, Russians and Chinese. The entity formerly known as “#1” is committing geopolitical suicide.

https://www.amazon.com/Suicide-Superpower-Will-America-Survive/dp/125000411X/ref=sr_1_1

Your choice. Just keep on shouting “racism” and “natzi”. This is an order.lol

Davy on Thu, 5th Apr 2018 8:43 pm

Will Germany Still Belong To Germans In The Near-Future?

https://tinyurl.com/ybpfj5ft

Via GEFIRA,

“The speed with which the German population is shrinking seems to be even too much for the statisticians of Destatis, the official German bureau of statistics, who posit that by 2060, with a zero level of net immigration, the German population will have declined to 60,2 million. However, our research team has found out that this number is far too optimistic: in 40 years Germany will have a population of 52,6 million people, a considerable 34% drop from the current 81 million inhabitants, and by the end of the century the native German population, the indigenous people without a migration background, will have shrunk even further and be approaching 21,6 million. The explanation that Destatis has mailed us is tantamount to admitting that their projections are unrealistic. If the German elites succeed in maintaining their population at 80 million, in 2060 the majority of naturalized Germans will have no historical relation to the nation’s ancestors who were once proud subjects of the Holy Roman Empire. Moreover, they will stand in the same relation to Albert Schweitzer, Johann Sebastian Bach, Karl Benz and Friedrich Nietzsche as Recep Tayyip Erdoğan stands to the Byzantine emperors. The excessive numbers of migrants will have altered the German nation forever.”

Cloggie on Thu, 5th Apr 2018 8:45 pm

“Potential doesn’t mean shit“

Meathead does not believe in his potential. To be fair to him, I do not believe in his potential either.

PS. a good school system knows about the potential of a child by the age of 8, that is decades before the adult will become productive.

Oilfields same story.

Only those without potential do not believe in potential.

Here: an oak tree:

https://goo.gl/images/bzs9MZ

*** potential ***

Cloggie on Thu, 5th Apr 2018 8:58 pm

Meathead again with his Dutch neo-nazi link, pretending to know how Germany will look like in 2060. Merkel will be gone in 4 years and populism will probably have taken over, like everywhere else. Islam is not going to take over Europe without a fight. Besides, the coming right-wing Italian government will seal off the Mediterranean, problem solved. It is only a matter of time until somebody orders shoot-to-kill policies. I hope Trump turns “the caravan” into “filet Americain”. You only have to do it once. Every year thousands of Africans drown in the Mediterranean. It is far more humanitarian to shoot a few dozen in order to deter these unwanted invaders from trying in the first place. We are not going to take in tens of millions, so hardness is required. Let them go to the raycism crying fools in the Ozarks.

makati1 on Thu, 5th Apr 2018 8:59 pm

Delusional Davy:

“China Moves to Destroy US Dollar As They Launch the Gold-backed Petro-Yuan”

http://www.theeventchronicle.com/finanace/china-moves-to-destroy-us-dollar-as-they-launch-the-gold-backed-petro-yuan-2/#

“China has grand ambitions to dethrone the dollar. It may make a powerful move this year”

https://www.cnbc.com/2017/10/24/petro-yuan-china-wants-to-dethrone-dollar-rmb-denominated-oil-contracts.html

“Gold-Backed, Yuan-Denominated Oil Futures Could Dethrone US Petrodollar”

https://schiffgold.com/key-gold-news/gold-backed-yuan-denominated-oil-futures-dethrone-us-petrodollar/

“Petro Dollar Checkmate – Gold Backed Yuan For Oil” (2017)

https://modernsurvivalblog.com/current-events-economics-politics/petro-dollar-checkmate/

“China Moves to Destroy US Petrodollar with Introduction of Gold-Backed ‘Petro-Yuan’” (2017)

http://thefreethoughtproject.com/chinas-petro-yuan-petrodollar/

Sorry. No references from Faux News. They only publish propaganda, not fact. lol

Cloggie on Thu, 5th Apr 2018 9:02 pm

“Why do you block all the comments on your blog? why so insecure? LOL”

I’m not going to waste my precious time moderating comments from fools like you. I’m a broadcaster of a message, a propagandist, if you will.

MASTERMIND on Thu, 5th Apr 2018 9:19 pm

Illegal immigrants don’t even want to come to America anymore. Illegal immigration has dropped 80 percent since 2000…

https://imgur.com/a/8wf3O

GregT on Thu, 5th Apr 2018 9:33 pm

“Will Germany Still Belong To Germans In The Near-Future?”

https://www.zerohedge.com/news/2018-03-27/will-germany-still-belong-germans-near-future?

Good one Davy. Another Russian disinformation link from Zerohedge.

GregT on Thu, 5th Apr 2018 9:46 pm

“nederdummyland”

So now the entire country of the Netherlands is up for personal attack.

I’ll bet you’re a real scream at cocktail parties Davy.

Boat on Thu, 5th Apr 2018 9:50 pm

Mm

Bullshyt, how about those college kids doing those paid for propaganda studies staying in the states when their Visa expires. Peer review that punk.

Boat on Thu, 5th Apr 2018 9:56 pm

Mak,

Stack those yaun 4″ high, tape them to the bottom of the average P mans shoes and they will approach normal heighth.

Boat on Thu, 5th Apr 2018 10:02 pm

Sorry clog, 2009 is to old for energy intensity stats. 2017 is fresh but ageing.

Anonymouse1 on Thu, 5th Apr 2018 10:39 pm

Did the funding at your retard school get cut again boatwetard? You seem to have a lot more time on your hands these days.

makati1 on Thu, 5th Apr 2018 10:48 pm

Boat:

Winston Churchill 5’7″

Napoleon Bonaparte 5’6″

Mahatma Gandhi 5’4″

James Madison 5’4″

Andrew Carnegie 5’2″

Yuri Gagarin 5’2″

Tom Cruise 5’7″

Pablo Picasso 5’4″

Ludwig van Beethoven 5’3″

Genghis Khan 5’1″

Aristotle 5’5″

Steven Spielberg 5’7″

Alexander the Great 5’6″

George Lucas 5’7″

Isaac Newton 5’6″

BTW: Average Chinese male height is 5’6″. Filipinos is 5’5″. The Russians are taller than Americans. lol WIKI

makati1 on Thu, 5th Apr 2018 10:51 pm

BTW Boat… “Whatever South Korean women are eating, pass it around!

The country is having a massive growth spurt. And it doesn’t look like it’s slowing down anytime soon.

Women in South Korea have gained 8 inches in height, on average, in the past century — a jump bigger than any other population in the world, researchers reported Tuesday.

For men, Iranians are the big winners, gaining 6.5 inches in the past hundred years.

In contrast, Americans are falling behind. Back in 1914, the U.S. had the third tallest men and fourth tallest women in the world. Now it’s in the middle of the pack, ranking around 40th for both men and women.”

https://www.npr.org/sections/goatsandsoda/2016/07/27/487391773/americans-are-shrinking-while-chinese-and-koreans-sprout-up

Do you need 6 inches of faux dollars taped to your feet to look Genghis Kahn in the eye? LOL

MASTERMIND on Thu, 5th Apr 2018 11:24 pm

Boat

Those numbers come from the border patrol department! The chart is from the Associated Press. You have been duped by right wing scaremongers and fake news! LOL

MASTERMIND on Thu, 5th Apr 2018 11:30 pm

Boat- you are being replaced! LOL Per UN!

UN Population Division Immigration Replacement Plan for US, Europe, and Japan.

https://imgur.com/a/6Vr7P

Cloggie on Fri, 6th Apr 2018 12:02 am

Your buddy neder days Europe is the world’s economic powerhouse.

I didn’t say it like that. I would say that Europe is the economic powerhouse of high-end products. The US is still #1 in standard software. In output there is not much difference between the three economic blocks US, EU, China.

MASTERMIND on Fri, 6th Apr 2018 12:06 am

Illegal immigrants barely even want to come to America anymore. Illegal immigration has dropped 80 percent since 2000. That is more than a fivefold decrease in less than 20 years.

https://imgur.com/a/8wf3O

https://www.scribd.com/document/375672329/CBP-Border-Security-Report-Fiscal-Year-2017

MASTERMIND on Fri, 6th Apr 2018 12:45 am

China ‘not afraid’ of trade war with Trump

https://www.ft.com/content/11416168-3948-11e8-8b98-2f31af407cc8

Michael Moore predicted this would happen last year.

Michael Moore predicts Trump-driven economic crash and advises not to invest in stock market

https://www.marketwatch.com/story/michael-moore-predicts-trump-driven-economic-crash-and-advises-not-to-invest-in-stock-market-2017-08-11

GregT on Fri, 6th Apr 2018 1:41 am

A little piece of advice MM. Get yourself a real job, and pay off your debt. This is likely going to drag on for much longer than you think that it will.

MASTERMIND on Fri, 6th Apr 2018 2:41 am

Greg

No offense but you are a tin foil hat doomsday prepper…So I don’t need any advice from someone like you…lol

Davy on Fri, 6th Apr 2018 4:44 am

“Good one Davy. Another Russian disinformation link from Zerohedge.”

Grow up greggie and be an adult. Is this disinformation too: LOL

https://tinyurl.com/ybpfj5ft

Davy on Fri, 6th Apr 2018 4:45 am

“Get yourself a real job”

Hypocrite

Davy on Fri, 6th Apr 2018 5:04 am

We don’t call him Billy 3rd world for nothing! Billy, your references are empty please show where any of them say the petroyuan is backed by gold. The petroyuan is not backed by gold and likely never will be. You are allowing your agenda to lead you to the world of make believe. Big hint the prick did not prick me on the subject because he know he would look stupid like you do now.

“The Gold-Backed-Oil-Yuan Futures Contract Myth”

https://tinyurl.com/y7fme7gu

“All the rumours and analyses on gold, oil and yuan that are making rounds now in the blogosphere are based on the Nikkei article. But the Nikkei article itself contains zero official sources. Basically, the whole story has been invented by Damon Evans.”

“Specifications of the contract can be read here. In all official sources, though, there is no mention of gold. Officially this contract is not “convertible into gold”.”

https://tinyurl.com/y8zj3gv4

“Quickly “the story” by Nikkei transformed through the blogosphere where analysts suggested the gold in SGE vaults would back the yuan. The problem with this theory is that gold in SGE vaults (i) isn’t owned by the Chinese government and (ii) isn’t allowed to be exported from the Chinese domestic market (not very convenient for foreign oil producers). Then analysts suggested the gold in vaults of the Shanghai International Gold Exchange (SGEI) would do the job. But SGEI gold (i) isn’t owned by the Chinese government either and (ii) can only have been sourced in the international gold market, paid for with US dollars. So much for the oil-gold trade circumventing US dollars as presented by Nikkei.”

“1.As shown above, China hasn’t announced anything but an oil-yuan futures contract. Gold has nothing to do with it. 2. Yuan can technically be spent on gold at the SGE, but gold in the Chinese domestic market (SGE system) is not allowed to be exported. Gold from the SGEI is allowed to be exported but is bought in the international market via yuan with US dollars.3.Foreign enterprises, like oil producers, cannot hedge gold on the Shanghai Futures Exchange. The SHFE is not open for international customers. There’s only a spot deferred product listed on the SGE, which is comparable to a futures contract, through which foreign enterprises can hedge gold in yuan. But why would oil producers buy gold and subsequently hedge the metal in yuan. Their end position would be merely exposure to the price of yuan. Why then not buy a yuan denominated bond with an interest rate? Or hold gold without the hedge?”