Page added on February 20, 2016

Saudi-Russian Deal Not A Quick Fix For The Oil Crisis

The recent deal struck between Russia, Saudi Arabia, Qatar and Venezuela to prop up oil prices by freezing production levels at January levels might have a psychological effect on oil markets, but it will not secure a major breakthrough from the current deadlock.

Oil exporters such as Venezuela and Nigeria have been calling for OPEC to cut production for almost a year now. The reason is obvious: persistent low prices are slowly killing-off the economies of many oil producers. Some of them – Saudi Arabia and the rich Gulf countries – can sustain themselves longer due to their fat hard currency reserves, but others cannot.

But what is the key reason behind the Saudi and Russian decision to bring the deal to the table? It could be two-fold.

On the one hand, both Riyadh and Moscow undoubtedly bear the heavy brunt of low oil prices, and the deal would be a subtle way to reverse the current trend without giving in too much. Another potential reason is the assessment that there is not much left to achieve in terms of market share or suffocating the high-cost producers.

At 10.2 and 10.8 million barrels per day respectively, Saudi and Russian production is already at its peak, which makes their spare capacities extremely thin, and questions their ability to raise production further without significant investment. In the current low price oil-glut environment, and with stretched fiscal capabilities of both countries, wasting valuable capital reserves on new projects that might additionally increase production capacities is highly unlikely.

Another issue is the deal’s high level of conditionality. Not only are the countries involved not committed to cut production, but they also require others to join in before the agreement takes effect.

15 Comments on "Saudi-Russian Deal Not A Quick Fix For The Oil Crisis"

peakyeast on Sat, 20th Feb 2016 5:37 pm

According to the comments I have read here on PO the price is still high on oil (wink wink, rocky).

If that is the case then all this is just whining caused by having to tighten the belt just a little bit.

Have they all become even more wasteful sissies or has the real inflation eaten away the purchasing power of those oil producing nations?

If I look at historic food prices – I dont know who to trust. Some graphs shows declining food prices, some shows increasing prices, the US-CPI shows almost stable prices (rising slightly after 2010 after crashing down a 2008-9 “mountain”).

I am functional idiot on these matters, but the US$ is almost twice its value (to the EURO) since a few years ago – which I would believe accounts for some of the price decrease?

Would someone help a hapless bewildered yeast cell?

Truth Has A Liberal Bias on Sat, 20th Feb 2016 6:22 pm

Both SA and Russia are maxed out. They are producing flat out. SA has no spare capacity. Qatar and Venezuela have both had flat production levels since 2011. The idea that they could raise production is stupid. The agreement between the four countries is not to freeze production at January levels, which would imply they plan on maintaining production at January levels, the agreement is that current and future production levels will not exceed January 2016 levels.

Plantagenet on Sat, 20th Feb 2016 8:03 pm

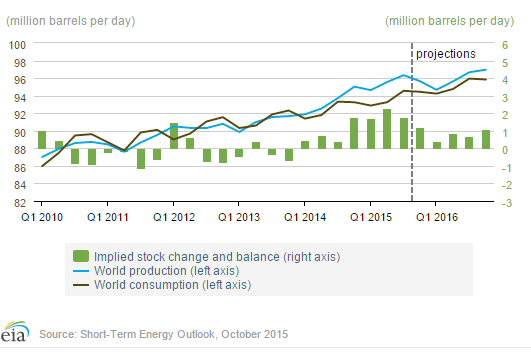

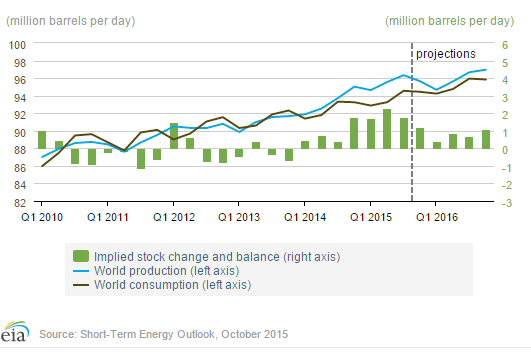

We’re in an oil glut. They only way to end the oil glut is have KSA, Russia etc. cut oil production or for global oil consumption to go up.

Since Russia, KSA, etc. can’t come to an agreement to cut oil production, the oil glut will end when global oil consumption grows to the point that it surpasses global oil production.

Cheers!

JuanP on Sat, 20th Feb 2016 10:29 pm

No deal! https://www.rt.com/business/333064-oil-freeze-mechanism-iran/

rockman on Sun, 21st Feb 2016 5:53 am

peaky – Exactly. There’s no “oil crisis” so there’s nothing to fix. there is certainly a lot of companies that are having a cash flow/debt servicing crisis. And some oil exporting govts with a developing budget crisis. But that’s their problem. Oil is priced exactly where it should be…where the market put it.LOL.

geopressure on Sun, 21st Feb 2016 9:19 am

I wish I could post pictures/charts on here so that I can point out how/why the oil market has been heavily manipulated since about March of 2014…

Can anyone advise me as to how I can post an image here? or a link to an image?

geopressure on Sun, 21st Feb 2016 9:31 am

Here’s why the Oil Market is as manipulated as a market can possibly be:

Cut/Paste the following into the address bar:

http://tinypic.com/r/243na1k/9

ghung on Sun, 21st Feb 2016 10:36 am

From geopressure’s link:

“Record losses posted by all the oil-trading funds confirms that the SPR was used to create a fake oil glut & the EIA stopped telling the truth…”

“The SPR is empty….”

“US commercial storage is empty….”

Cue the Twilight Zone jingle.

dissident on Sun, 21st Feb 2016 11:50 am

The use of the term “glut” to describe the current oil market is a lie. Lack of global demand is not equivalent to glut. The term “glut” has an implicit association with production excess due to its historic use during market flooding by OPEC. Without qualifying the fact that there is no production flood today, the use of the word “glut” becomes a lie.

geopressure on Sun, 21st Feb 2016 12:04 pm

How do you suppose that the new supply that flooded the market in 2014 managed to evade Analysts???

If you say from Shale Oil, that would be incorrect, as analysts have no problems predicting future supply from this shale oil.

If you say Saudi Arabia, that would be incorrect, they were not significantly increasing until early 2015.

It was not from decreased demand either, demand was all-time record highs in 2014…

where else could ~2 Million BOPD have come from that was somehow missed by ALL analysts???

—

You say “cue the Twilight Zone Jingle” only because you have been completely mislead by the Media…

—

Everything I propose has all been done before, so it should not seem that radical… It was first executed very successfully in 1986…

geopressure on Sun, 21st Feb 2016 12:08 pm

Dissident; Of Course the glut is a lie… It is not possible for 2 Million BOPD to just spring into existence…

The glut occurred when oil was pumped out of the SPR, into Commercial Storage, but not subtracted from the EIA’s Reported SPR Volume…

—

The media does not tell the truth with regards to foreign policy or crude oil…

Davy on Sun, 21st Feb 2016 12:12 pm

Those who discount the effects of demand destruction on the slowing of the rate of growth in oil demand are goal seeking a positive message. It is very evident aggregate demand has dropped after a bubble was inflated by central bank activity. Oil was part of that bubble and now is suffering the effects of demand deflation. Demand is not enough now for the supply that was brought on during that commodity bubble period that ended months ago.

geopressure on Sun, 21st Feb 2016 2:13 pm

Davy; you might find this interesting:

http://tinypic.com/r/243na1k/9

all that extra supply you refer to… it never existed…

—

You are right about demand destruction though, Obama is purposefully destroying demand as we speak… But China is besting him… They are shutting production in to cancel out all of the demand that he destroys…

peakyeast on Sun, 21st Feb 2016 2:21 pm

@geopressure: I believe that you have to resign yourself to using links here at the news discussions.

If you want to show pictures you must create a new topic and post it there.

Hope this helps.

But the links you posted works fine !

PracticalMaina on Mon, 22nd Feb 2016 10:37 am

PeakYeast, the price for anything that is not raised with anything that can taint it is at an all time high. If you want some GMO soy been, artificially flavored, hevily processed and preserved made in a lab in New Jersey no real nutrient bullshit, the price is relatively stable. Until oil goes back up, then it is gonna reach new heights right in time for a drought, and the painful realization Monsanto doesnt benefit farmers or hungry people.