Rystad Energy, an independent oil and gas consulting services and business intelligence data firm in Oslo, Norway, has online, a wealth of information concerning upstream oil production projects and costs. Some of it is a bit dated but some of their charts date from late 2015.

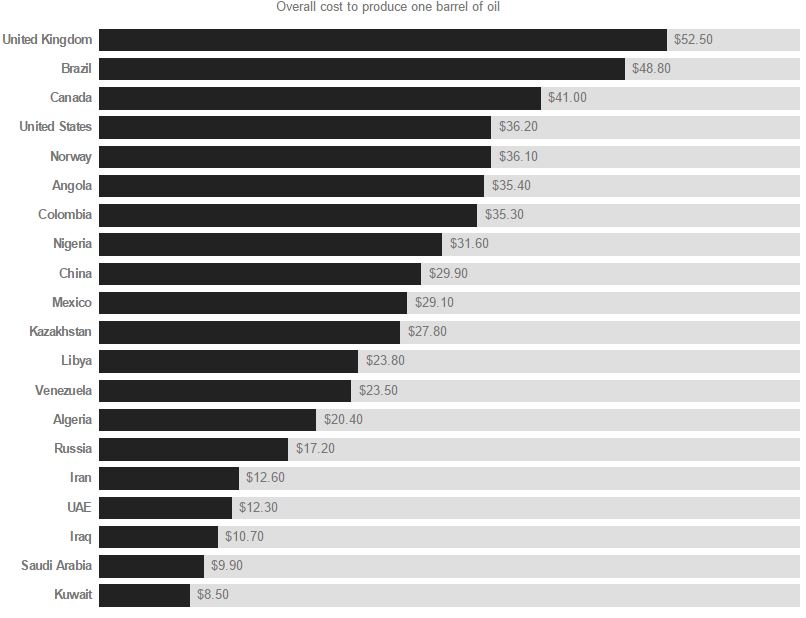

The two below Rystad charts were published by CNN Money on November 23, 2015.

This is overall or average cost, not marginal cost. It cost Canada $41 to produce a barrel of oil but only cost Russia $17.20. I guess that is why Canada is cutting back but Russia is not.

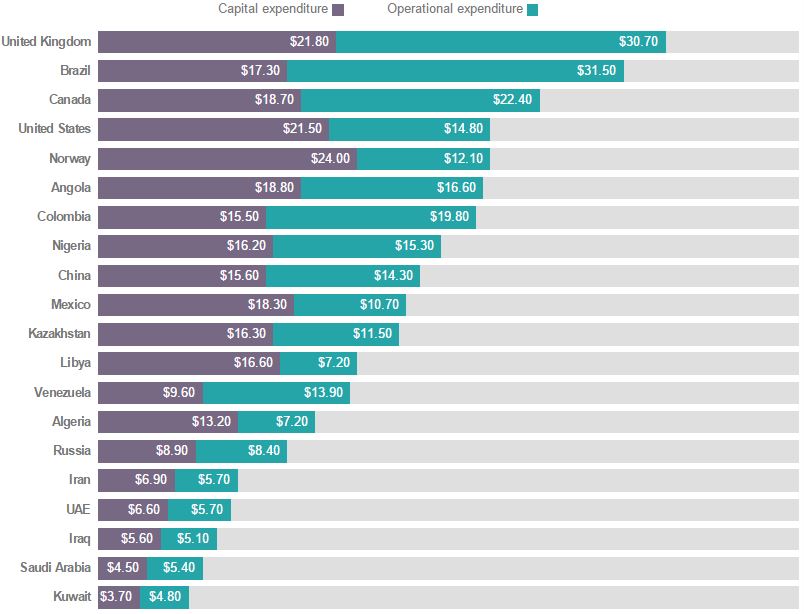

Here is the breakdown between capital expenditures and operational expenditures. Why would the United Kingdom’s operational expenditures be two and one half times those of Norway? After all, they are both drilling basically the same oil field.

Here is the breakdown between capital expenditures and operational expenditures. Why would the United Kingdom’s operational expenditures be two and one half times those of Norway? After all, they are both drilling basically the same oil field.

So why is not the price of oil having a more dramatic effect on production? Well it is, it just takes a while. Here are some plans from about a year and a half ago, when the price of oil was much higher.

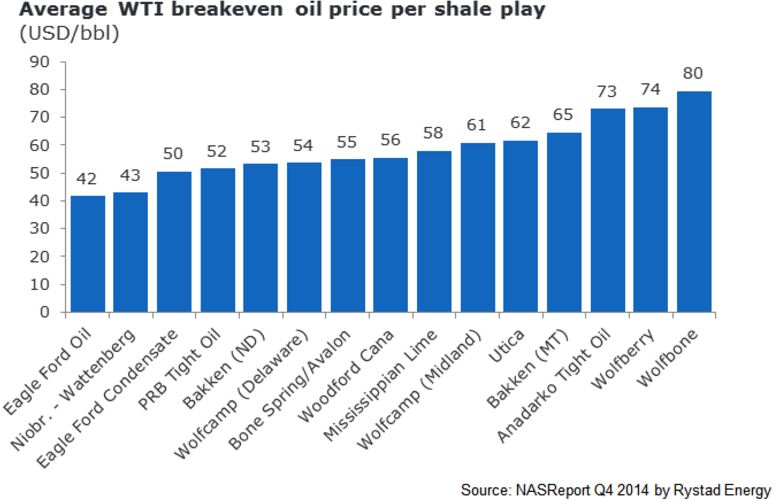

Rystad published the two below charts in their US Shale Newsletter in January 2015 but the data dates from the 4th quarter of 2014, just as the price of oil had started to drop.

At that time Bakken (ND) had a break even price of $53 while Eagle Ford oil had a break even price of $42 and Eagle ford condensate a break even price of $50.

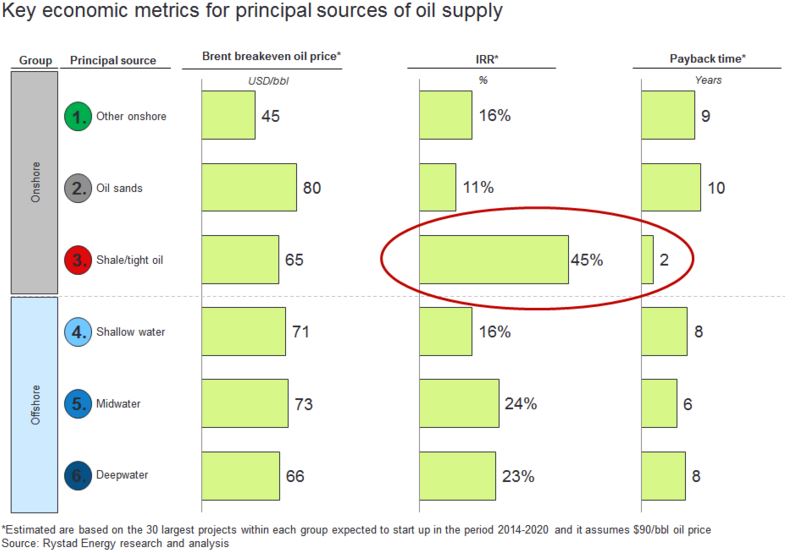

The below chart, from the same newsletter, assumes $90 a barrel oil.

Shale oil, at the time, had an average break even price of $65 a barrel, which would have given them a 45% internal rate of return and a payback time of only 2 years. It is amazing how much things have changed in just a little over a year.

But by October 2015 things had changed dramatically.

Exclusive: Offshore oil output to plunge as producers scrap field upgrades

Global offshore oil production in aging fields will fall by 10 percent next year as producers abandon field upgrades at the fastest rate in 30 years, in the first clear sign of output cuts outside the U.S. shale industry, exclusive data shows.

A drop in oil prices to half the level of a year ago has forced producers to slash spending and scrap mega projects that can take up to a decade to develop, but they are also taking less visible steps to cut investment in existing fields that will have an immediate impact on global supplies.

There have been few signs of how cost cuts of around $180 billion will impact near-term production until now. They could erode the glut that has forced down prices, and help balance global production and demand by the middle of next year or earlier, Oslo-based oil consultancy Rystad Energy said.

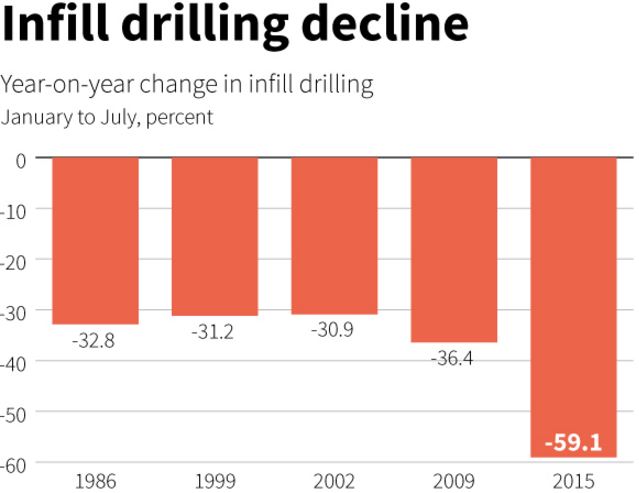

Data provided exclusively to Reuters by Rystad show a sharp decline in investment to upgrade mature offshore oil fields in order to arrest their natural decline, in what is known as infill drilling.(Graphic: link.reuters.com/xaz75w)

The above chart shows the decline in infill drilling due to previous drops in the price of oil. The data is from the Gulf of Mexico, Southeast Asia and Brazil. The decline in infill drilling in 2009 was the largest… until now. The first half of 2015 saw the largest decline in offshore infill drilling in history.

In three major offshore basins — the Gulf of Mexico, Southeast Asia and Brazil — infill drilling dropped by 60 percent between January and July this year compared with the same period last year, according to the Rystad Oil Market Trend Report, whose data is based on company data and regulatory filings.

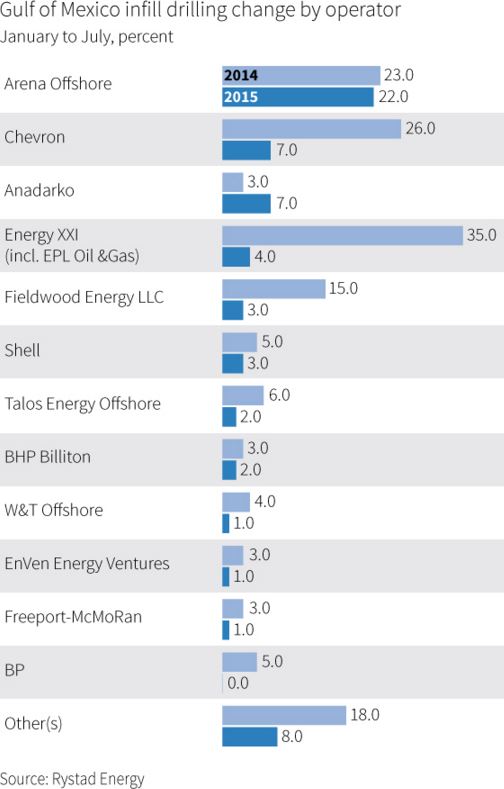

For example, according to the data, in the Gulf of Mexico, infill drilling on mature wells dropped from 149 wells between January and July 2014 to a total of 61 wells during the same period this year.

Based on this trend, Rystad Energy estimates that global offshore oil production in mature field will decline next year by 1.5 million barrels per day (bpd), or 10 percent, to 13.5 million bpd from 15 million bpd in 2015.

The above chart is change per operator, just in the GOM. And this was just in the first half of 2015 when the price of oil averaged about $56 a barrel. What is it now when the price of oil is over $20 a barrel lower?

Well, just since June Wood Mackenzie says the latest figures show that the amount of deferred capital spending on projects awaiting approval has almost doubled from $200bn to $380bn, with 2.9m barrels a day of liquids production now not due to come on stream until early in the next decade.

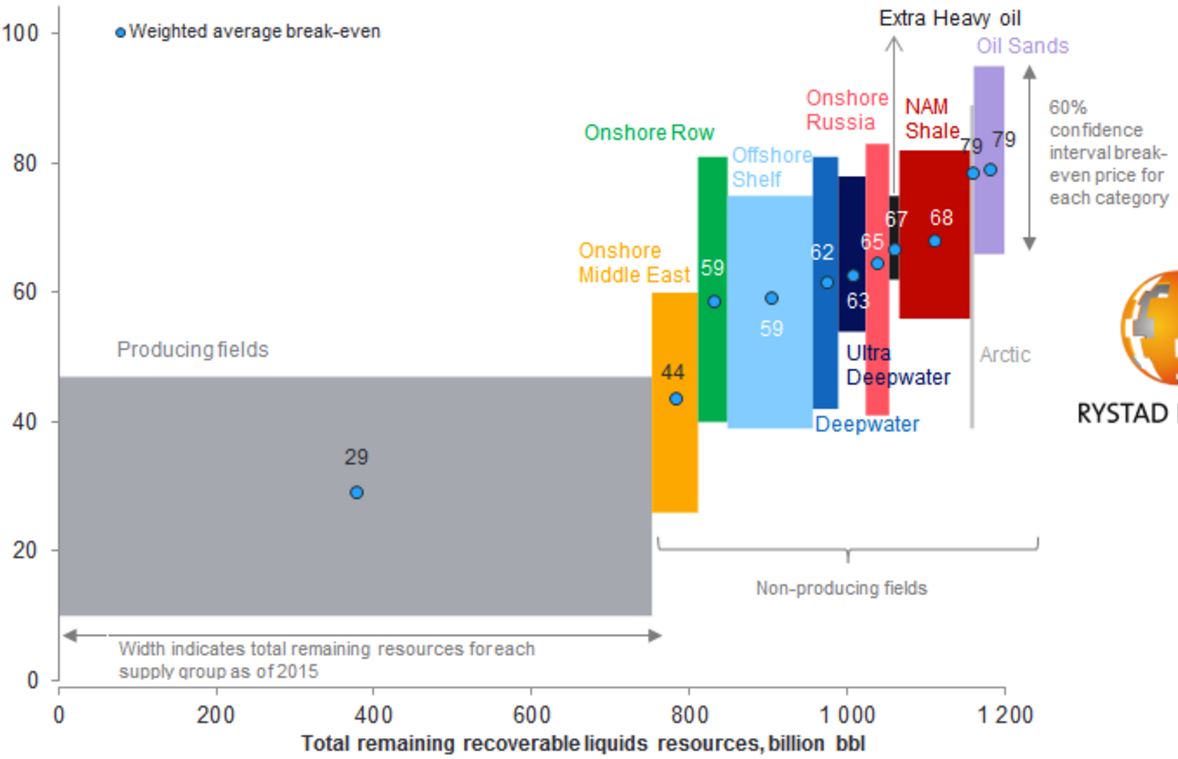

Global liquids cost curve (October 2015)

*The break-even price is the Brent oil price at which NPV equals zero using a real discount rate of 7.5%. Resources are split into two life cycle categories: producing and non-producing (under development and discoveries). the latter is further split into several supply segment groups. The curve is made up of more than 20,000 unique assets based on each asset’s break-even price and remaining liquids resources in 2015.

Source: Rystad Energy UCube September 2015

What the above chart tells me is that it now costs a lot more to produce a barrel than it once did. And… unless crude oil hits at least $60 a barrel soon a lot more projects will have to be cancelled. But… all that being said, I think it is now obvious that oil production will drop, rather dramatically, beginning sometime in 2016. And that drop will lead to a rise in the price of oil, at least to $60 a barrel and likely higher.

That is unless some black swan event happens. That could be a collapse in several economies of the world… or a collapse of the economy in one country, China. In other words, it is a given that production is going to decline. So if demand stays constant, or rises, then the price of oil will definitely rise. We know what is going to happen to supply. We have no idea what is going to happen to demand. But if BAU continues as normal, the price of oil is going up.

penury on Sun, 7th Feb 2016 4:49 pm

I am certain that this article contains much valuable information. However to me it reads like everyone should be bankrupt.

twocats on Sun, 7th Feb 2016 5:02 pm

here is what the IEA thinks for what its worth

https://www.iea.org/oilmarketreport/omrpublic/

they are showing demand having fallen in 4th qtr 2015, a quarter it generally increases (winter, etc). But they don’t think that trend lasts more than a couple quarters. Supply also fell, but not as much.

If we are talking about a 1.8 mbpd overhang. Well, Rystad is thinking that aging global offshore fields alone will have a 1.5 mbpd decrease in 2016. What do we assume Iran is going to add? 0.8 mbpd? So we are done to 1 million barrels a day supply above demand. But we’ve still got shale and oil sands to consider…

shortonoil on Sun, 7th Feb 2016 5:45 pm

Average Breakeven Price per Shale Play

Tracking 4,598 wells through 05/12 produced drilling cost per barrel of $55.74/ barrel. Production costs of $53? Sure, they must be pumping up $20 bills along with the oil.

It might be a good idea to treat this data with a little skepticism.

Boat on Sun, 7th Feb 2016 7:13 pm

Wow

Boat on Sun, 7th Feb 2016 7:17 pm

short,

But you and other doomers assured all of us that even when oil was at $100 it was all a ponzi scheme built on debt.

twocats on Sun, 7th Feb 2016 7:26 pm

And we’ve shown you list upon list of energy companies that have gone bankrupt with BILLIONS (over 15) in DEBT. Yes, my brain-dead friend, that is a ponzi scheme built on debt. And your idiotic response is…

rockman on Sun, 7th Feb 2016 7:32 pm

Unless someone presents the specific data to support any “break even” estimate none of those numbers are credible IMHO. Such as the utter BS that it cost $29/bbl to just produce the existing wells.

makati1 on Sun, 7th Feb 2016 7:38 pm

The last sentence is the qualifier.

“But if BAU continues as normal, the price of oil is going up.”

But BAU is NOT going to “continue as normal”.

Glad I did not waste my time reading another ad for suckers to keep/invest their money in oily paper.

mbnewtrain on Sun, 7th Feb 2016 8:22 pm

Rockman: The cost of production includes obligations to pay back shareholders/investors. I have made 3 investments in oil well projects and 2 of 3 have gone “belly up” or ceased to operate due to returns being much less than cost to drill/complete/operate the well. Hundreds of millions of dollars lost for us investors. That where $29/bbl gets us.

Plantagenet on Sun, 7th Feb 2016 8:45 pm

The oil glut continues and excess oil continues to go into storage.

Of course the oil glut will end eventually—-but we’re not there yet.

Cheers!

Boat on Sun, 7th Feb 2016 9:05 pm

Here is a bloomberg report on wells in Texas.

http://www.bloomberg.com/news/articles/2016-02-03/texas-toughness-in-oil-patch-shows-why-u-s-still-strong-at-30

This is why they are still drilling in areas. It has to do with making a profit.

GregT on Sun, 7th Feb 2016 9:41 pm

“This is why they are still drilling in areas. It has to do with making a profit.”

17 of those 26 plays are not turning a profit at $30/bbl Boat.

“Source: Bloomberg Intelligence”

LOL

twocats on Sun, 7th Feb 2016 11:09 pm

“Law firm Haynes and Boone LLP says 42 companies filed for bankruptcy as of Jan. 6.” [article]

The article had some balance. It’s not surprising that Bloomberg has a research / investigative team. Seems pretty legit.

“Such as the utter BS that it cost $29/bbl to just produce the existing wells.” [rockman]

I’m assuming you think that’s too high? It wasn’t clear to me.

shortonoil on Mon, 8th Feb 2016 7:24 am

Average Breakeven Price per Shale Play

“short,

But you and other doomers assured all of us that even when oil was at $100 it was all a ponzi scheme built on debt.”

These numbers are obviously not generated from a P&L statement. These are not profit, and loss breakeven points. They are cash flow breakeven points resulting from bank EBITDA reports. These numbers are about loan eligibility, not about when these companies start making or losing money. The whole shale parade has had trouble differentiating between cash flow, and profit and loss from day one. Just like they have had problems differentiating between a thermodynamically balanced system and an ECON 101 farce. General credulity has been a larger asset for the shale industry than the Bakken, and Eagle Ford put together.

http://www.thehillsgroup.org/

Apneaman on Mon, 8th Feb 2016 7:38 am

Boat, you weren’t even on this board when oil was at $100, so stfu.

shortonoil on Mon, 8th Feb 2016 7:43 am

“short,

But you and other doomers assured all of us that even when oil was at $100 it was all a ponzi scheme built on debt.

We are reporting the output of a Model that is based on hard fundamental science, and which has the highest level of verification of any model ever presented to describe the petroleum depletion process. You apparently interpret that as “dommerism”. We would suggest that you crawl back into your bed, pull the covers over your head, and tell the whole story to your teddy bear.

http://www.thehillsgroup.org/

jjhman on Mon, 8th Feb 2016 12:01 pm

We seem to be caught in a maelstrom of confusion between anecdotal information, wishful thinking and hard data. Obviously there are oil companies that are still drilling and making money. Rockman seems to be in that catagory. However his success, or Chesapeak’s losses do not give, on their own, the full picture of what is the “average” breakeven price of oil on any given day. I end up discounting stories when the phrasing seems to indicate a bias. This article appears to be objective to me but the data they present is over four months old. That’s a long time in today’s environment.

I find myself tending to scan the articles, dismissing them when I see bias, and scan the comments with even more cynicism.

Reading some of you guys reminds me of the joke about the guy who went to the shrink to take some Rosarch tests. Evey picture the dr showed to the guy he responded with “naked girl” or “two people having sex” or some such. The dr finally tells the guy he is obsessed with sex. The patient tells the dr “Oh yeah? You’re the guy with all the dirty pictures”.

But eveyone thinks they are objective.

shortonoil on Mon, 8th Feb 2016 4:20 pm

“Law firm Haynes and Boone LLP says 42 companies filed for bankruptcy as of Jan. 6.” [article]”

Even though the Etp Model informs us that the shale industry was a dead man walking past 1.0 to 1.5 mb/d, proponents of classical economic analysis have still to produce reliable, and traditional estimates of its veracity. The most common evaluation tool used is probably the Debt/ EBITDA ratio. Historically past 8:1 the firm in question is probably going to go broke. Even though this simple, and extensively used parameter has been widely used in all most all other industries, it has been absent from the hundreds of articles that have been prepared on shale. The absences of its use leaves one wondering, “who is preparing these studies”?

twocats on Mon, 8th Feb 2016 4:37 pm

We seem to be caught in a maelstrom of confusion between anecdotal information, wishful thinking and hard data. Obviously there are oil companies that are still drilling and making money. Rockman seems to be in that catagory. However his success, or Chesapeak’s losses do not give, on their own, the full picture of what is the “average” breakeven price of oil on any given day. I end up discounting stories when the phrasing seems to indicate a bias. This article appears to be objective to me but the data they present is over four months old. That’s a long time in today’s environment. [jjhman]

CHK had revenues over $20 million ending 2014. Over $30 million in plant and equipment from 2012 – 2014. I’m not saying Rockman is irrelevant, but I know a lot of independent contractors (my expertise is construction, commercial and residential) that can basically make money if they just wake up and turn on the truck in the morning because they have so little that depreciates, their wives do the books, and they are the labor. You can’t run an entire oil industry on that model and no, for companies as big as CHK 4 months means very very little. It’s only relevant because of Wall Street and the bullshit they have to deal with there. Even the banks don’t care on that short of a time frame unless they are already watching covenants and credit lines etc (i.e. the situation has already been bad for a while).

Kenz300 on Tue, 9th Feb 2016 9:57 am

Electric cars powered by wind and solar are the future…..fossil fuel ICE cars and the fossil fuels they use are the past…………..

Think teen agers vs your grand father………………….

cell phones vs land lines…….