Page added on September 8, 2016

Peak oil by any other name is still peak oil

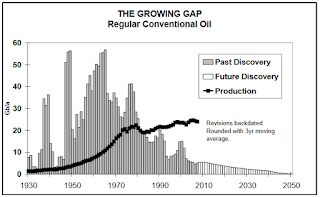

One of the most compelling charts I have ever seen is the “Growing Gap” chart that used to appear on the front page of every ASPO Newsletter. This is the one from the last ASPO Newsletter, written by Colin Campbell and published in April 2009.

Since then, more than seven years have passed, and peak oil has disappeared from the mainstream press headlines–almost. On August 29, Bloomberg published a story alerting to the fact that conventional oil discovery has reached a 70-year low. It published a very interesting chart, using data provided by Wood Mackenzie, the oil consulting firm, to show that fact. Unlike the ASPO chart, Bloomberg’s chart only goes back to 1947, the year before Ghawar was discovered.

I thought I would reproduce the “Growing Gap” chart using Wood Mackenzie’s data.

Neither Wood Mackenzie nor Bloomberg make public the data behind the chart, but I used a digitization program, WebPlotDigitizer, to extract data from the chart. The results are not perfect, of course, but give a good enough estimate. One must keep in mind that discovery data are not precise and may have a significant margin of error.

In order to obtain conventional oil production, I subtracted US tight oil production and Canadian tar sands production from the EIA’s global crude plus condensate number. I know I must also subtract the extra-heavy production from the Orinoco Belt, but it is hard to find data for it. In any case, this is a very good estimate. According to data gathered by Jean Laherrère, the Orinoco extra-heavy production is only around 1 Mb/d today.

The following chart shows the digitized Wood Mackenzie conventional discovery data and the production data described above. According to the data, since 1980, when the gap between production and discovery began to appear, humanity has extracted about 47 percent more conventional oil than it has discovered.

And the following chart shows a three-year moving average of discovery, to replicate the ASPO chart. Notice that discovered volumes are generally larger than Campbell’s data, but the drop since 2011 is more precipitous than he anticipated.

According to the Bloomberg story, this shortfall in discovery will be felt 10 years from now, when it begins to “hinder production.”

Peak oil by any other name is still peak oil.

Cassandra’s legacy by Diego Mantilla

44 Comments on "Peak oil by any other name is still peak oil"

ghung on Thu, 8th Sep 2016 10:54 am

“According to the Bloomberg story, this shortfall in discovery will be felt 10 years from now, when it begins to “hinder production.””

Ten years? May as well be a hundred to most folks. Meanwhile, they see stories like this:

Apache CEO Crashes Permian Party With ‘Giant Onion’ Oil Find

“….Apache on Wednesday said it has made an “immense” oil and natural-gas discovery in the southern reaches of the Permian, a region in West Texas where drillers have spent $40,000 an acre or more this year trying to amass assets. Apache spent about $1,300 an acre on average by focusing on land that others considered too geologically complex to drill economically, Christmann said in an interview in New York….

….Apache has estimated the region it calls the Alpine High contains at least 3 billion barrels of oil and 75 trillion cubic feet of gas, according to a company statement Wednesday. The land is mostly in Reeves County in the Delaware Basin, a section of the Permian that has been a hotbed of acquisition activity among oil explorers this year….”

Happy motoring!

Cloggie on Thu, 8th Sep 2016 11:23 am

Indeed, the problem is too much fuel, not depletion. The entire earth crust is one stinking tar ball. That is an amount for which there is not enough oxygen on the planet to burn it all.

Again, under the North-Sea there are coal reserves up to 1000 times the amount of fossil fuel burned globally up until today.

How are we going to tell this to shortonoil?

And how to the biosphere?

Peak oil, a story dead in the water for the duration of our life time.

On a positive note, the more we burn, the more we can expect rain forests, tropical rain forests that is, to show up in every corner of the planet, functioning as a partial buffer of CO2, the rest will be stored in the atmosphere.

Cloggie on Thu, 8th Sep 2016 11:33 am

So why were we so blind for this?

1. buying into the phrase “low hanging fruit”.

2. an aversion against technology.

These two lead us into a blind ally.

The reality is that professional fruit farmers use a ladder to pick the non-low hanging fruit. And in the realm of fossil fuel that ladder is technology.

As we speak, in Britain 29 licenses have been issued for drilling companies to access coal stored under the North-Sea. You pump water in and you get H2, CO (and CO2) back. this is not new technology, of course it is going to work. Britain as the next Saudi-Arabia, Russia and USA combined.

http://www.dailymail.co.uk/news/article-2593032/Coal-fuel-UK-centuries-Vast-deposits-totalling-23trillion-tonnes-North-Sea.html

https://drillordrop.com/2016/07/01/new-details-of-oil-and-gas-licence-commitments-extensions-and-relinquishments/

Fracking planet is next.

Cloggie on Thu, 8th Sep 2016 11:55 am

http://www.postcarbon.org/

Post carbon is good, hahahaha.

Ha.

http://www.cs.vu.nl/~frankh/dilbert/lowhangingfruit.gif

Apneaman on Thu, 8th Sep 2016 12:18 pm

Cloggie, the low hanging fruit analogy still applies. You would know this if you knew the difference in the cost of a conventional well vs a fracking operation and how much you get out of it. It’s not new technology. What was new was the mass deployment of it and that is what myself and others did nor think would happen – not the “technology”, since we knew it had existed and been proven. Also, after a period of time (experience) they get more extraction due to the learning curve. Again, you need to spend more of your internet time learning the basics instead of getting all excited and constantly throwing up confirmation bias industry PR release, links. Most of which it dosen’t look like you even read nor understand.

Your undersea coal hype reminds me of the methane clathrate hype and kerogen hype that keeps reappearing every 6 months to a year. When they get the production up and running, get back to us.

ghung on Thu, 8th Sep 2016 12:19 pm

The epic oil glut just got smaller — thanks to Hurricane Hermine

” U.S. crude oil stockpiles plummeted by an incredible 14.5 million barrels last week, the Energy Information Administration said on Thursday.

It’s the biggest decline in oil inventories since January 1999 — and the second largest on records going back to 1982.

The dramatic shift appears to be fueled by last week’s stormy weather along the East Coast. Imports into the critical Gulf Coast region declined by 760,000 barrels per day last week, the EIA said.

Production in the Gulf of Mexico was hampered by Hurricane Hermine, causing platforms to be evacuated. Output in that region dropped by 150,000 barrels per day of oil production, according to estimates from ClipperData. ….”

Cloggie on Thu, 8th Sep 2016 12:26 pm

“When they get the production up and running, get back to us.”

I will.

Apneaman, I absolutely feel your pain. You were looking forward to a career as “global enlightener of the internet masses” (your words) rather than selling car parts for a cloggie boss.

Thank God, there is still global warming, so not all hope is lost for you.

Hello on Thu, 8th Sep 2016 1:07 pm

>>> Thank God, there is still global warming

Yes, too bad it’s so slow. Not even the ocean rises at the promised rate.

rockman on Thu, 8th Sep 2016 1:33 pm

“Apache has estimated the region it calls the Alpine High contains at least 3 billion barrels of oil…” Which I hope folks bother to look at the chart to see that this ALLEDGED 3 billion bbl discovery fits right where the chart projected discoveries would be for today. And that this “huge” discovery is not much more then 10% of the discoveries made in 2000.

Every little bit helps and the ALLEDGED discovery by Apache certainly qualifies as “a little bit”. LOL.

Jerry McManus on Thu, 8th Sep 2016 1:38 pm

rockman tells it like it is.

rockman on Thu, 8th Sep 2016 1:47 pm

“It’s the biggest decline in oil inventories since January 1999 — and the second largest on records going back to 1982…The dramatic shift appears to be fueled by last week’s stormy weather along the East Coast.”

As pointed out in another post according to govt stats the lost offshore (the Gulf of Mexico and not from any f*cking storm along the east coast. LOL) oil production as a result of the storm represents at most 15% of the stockpile draw down. So they need offer a different explanation for the other 10 million bbls.

PracticalMaina on Thu, 8th Sep 2016 1:58 pm

Hello, rrrriiiiggghhttt, its getting back on track, no worries…… https://www.washingtonpost.com/news/energy-environment/wp/2016/07/19/greenland-lost-a-trillion-tons-of-ice-in-just-four-years/?utm_term=.e2421c5596d1

PracticalMaina on Thu, 8th Sep 2016 2:00 pm

I guess some volcanic ash had put a dent into heating in the previous decade, I do not have the article handy now, but I have no doubt in the power of feedback loops, especially when the heat is being concentrated in areas where the cold is all that is keeping greenhouse gases trapped underfoot…. 15 straight record temp months I believe…

Its been a dry one in my neck of the woods…

peakyeast on Thu, 8th Sep 2016 3:13 pm

I think I will buy some acres of land on Greenland.. It seems like its going to be very green again soon.

Cloggie on Thu, 8th Sep 2016 3:14 pm

Don’t forget to bring suntan lotion #50.

Cloggie on Thu, 8th Sep 2016 3:17 pm

…and of course an “integration course”. Greenland might have a Danish colony, the inhabitants are almost all Asian/Eskimo:

https://www.youtube.com/watch?v=DdWpppXPpSk

(Capital Nuuk, 17k)

peakyeast on Thu, 8th Sep 2016 3:20 pm

@Cloggie: Have you forgotten I am a Dane?

Its unavoidable knowing something about greenland. There are still close ties to Denmark.

peakyeast on Thu, 8th Sep 2016 3:24 pm

with a little luck I will find some of the lost Hydrogen bombs the americans carelessly dropped there when they thaw out. Then I can sell them to the highest bidder.

I am going to be rich Rich RICH … and green.

shortonoil on Thu, 8th Sep 2016 3:39 pm

“This really is a giant onion that is going to take us years and years to peel back and uncover,” Chief Executive Officer John Christmann told analysts at a Barclays conference on Wednesday.

http://www.businessinsider.com/apache-discovers-alpine-high-oil-field-in-texas-2016-9

Another shale find! Considering that there may still be over 30 billion barrels in the Bakken, that no one can extract at a profit, maybe another 3 billion that no one can extract at a profit is not much to get excited about? Unless you are a Wall Street investor with plenty of FED monopoly money to play with.

Same old hype, different day?

What will be really exciting is when they tell us that there is 3,000 billion barrels – on the moon!

Cloggie on Thu, 8th Sep 2016 4:09 pm

“Have you forgotten I am a Dane?

Its unavoidable knowing something about greenland. There are still close ties to Denmark.”

No, I am an “identitarian”, I always remember somebodies background. As I said, Greenland was/is a Danish colony, but you have to look really good to find real Danes in Greenland.

rockman on Thu, 8th Sep 2016 4:14 pm

Here you go P. From wiki. Rather dramatic given it was less the a 2F decrease:

“The year 1816 is known as the Year Without a Summer (also the Poverty Year, the Summer that Never Was, Year There Was No Summer, and Eighteen Hundred and Froze to Death), because of severe climate abnormalities that caused average global temperatures to decrease by 0.7–1.3 °F This resulted in major food shortages across the Northern Hemisphere.

Evidence suggests that the anomaly was predominantly a volcanic winter event caused by the massive 1815 eruption of Mount Tambora in the Dutch East Indies, the largest eruption in at least 1,300 years after the extreme weather events of 535–536. The Earth had already been in a centuries-long period of global cooling that started in the 14th century. Known today as the Little Ice Age, it had already caused considerable agricultural distress in Europe. The Little Ice Age’s existing cooling was aggravated by the eruption of Tambora, which occurred during its concluding decades.”

claman on Thu, 8th Sep 2016 4:54 pm

rockman , We don’t necessarily need peakoil to make an end to globalisation, a new Tambora could do it. Maybe Combined with a Carrington incident and some Saint Andreas, New Madrid or Cascade Mountain jolting.

Cloggie, Greenland democracy is not of the highest standards. But then again, it’s upp to them selves.

Apneaman on Thu, 8th Sep 2016 5:29 pm

claman, globalization along with industrial civilization is already doomed due to the consequence it has created. AGW jacked weather events are on the rise and will break so much infrastructure that it will be impossible to continue. Especially bad in the US where their infrastructure has been neglected since the Reagan era and is already in very poor condition. The AGW consequences are just getting started and are non linear. 1C so far and at least another 2C is baked in (probably more) and the humans are still burning everything they can get their hands on. Now storms are doing the same damage that hurricanes used to do.

Here is one early estimate (they always go up) from one no name storm.

Louisiana flood damage at least $8.7 billion, governor says

https://www.washingtonpost.com/national/louisiana-flood-damage-at-least-87-billion-governor-says/2016/09/03/f9223c7e-71ed-11e6-9781-49e591781754_story.html

I guess it’s a race – peak oil or AGW which one will end industrial civilization? Both are inevitable.

peripato on Thu, 8th Sep 2016 6:57 pm

We’re using a ton of money printing to disguise the peak. So far so good, those extra barrels of oil borrowed from the future sure are causing a lot of bubbles. And more money is poured in to keep insolvent producers from folding. Got make their nut, each and every year.

But guess what? Where still annihilating 30 bb’s per annum of this stuff, never to be replaced. When real production declines can no longer be masked by financial hijinks it won’t take much to derail the whole project.

Sissyfuss on Thu, 8th Sep 2016 7:05 pm

Klog, you’re getting more trollish with each revisionist tripish trope we endure from you. Plus it turns out you were a

cornucopian all along. No wonder Apester

finds you so annoying. Please stick with tales of a warm and fuzzy Hitler that nobody finds fascinating. Leave the environment to those of us who care about it.

Cloggie on Thu, 8th Sep 2016 7:21 pm

I am not a Cornucopian, but I can not deny that as far as fossil fuel is concerned “there is enough to fry us all”. I changed my mind from ASPO-2000 to this position in recent time.

I don’t see it as my task to write posts such that Apey is not offended.

Writing posts you don’t agree with is not trolling. This universe is not about you.

And where did you get the impression that I “don’t care about the environment?”. My standpoint is and has been since 1973 that the world needs to move away from fossil fuel and into renewables.

But I understand you very well… you are a resentful lefty. This is not your time…

https://www.youtube.com/watch?v=R_raXzIRgsA

Sissyfuss on Thu, 8th Sep 2016 10:04 pm

You don’t understand me at all, Clegg. I don’t ascribe to left or right, I look for reality as it presents itself. And no, this is not my time, it is no ones’ time. Collapse is closing in on all sides and comes closer everyday. I find you to be a bright and educated person,but you cling to the past,probably because the reality of collapse is insufferable to your long known comforts.

Meld on Fri, 9th Sep 2016 3:26 am

As far as I can see it we past peak oil at least economically in the mid 00s. Since then fracking companies have taken on huge debts that were printed by the US, loaned to the banks and then loaned to the oil companies to extract more oil. So basically fracking isn’t really economically viable. Now if the US can keep on printing money without anyone seeming to care and then loaning that money out to oil companies, then the real question is how long can this go on.

Basically everything rests on the USA keeping up the facade of economic growth to protect the dollar. Once the US begins to collapse the rest of the world will tumble after it in very short order. And when I mean collapse I mean open war on the streets, failing infrastructure and a leadership that less than 50% of the population respects. Sound familiar? This election could well be a turning point as no matter who gets elected there is going to be huge swathes of the population who are going to oppose (possibly violently) the result.

Cloggie on Fri, 9th Sep 2016 4:23 am

@Sissyfuss – interpretations or reinterpretations of the past are not insignificant academic exercises but have huge potential and define an entire era. Ask a German if interpretations of the past don’t matter for the present. These interpretations have the potential to destroy a nation spiritually.

Call me a cynic but not everything about collapse is negative. A collapse always means the collapse of the old order and old ways of doing things. Collapse also offers the opportunity of a new start. Germany for instance suffered a total collapse in 1945, yet ten years later they experienced the Wirtschaftswunder, the economic miracle. Likewise the collapse of the USSR in 1991 paved the way of a rebirth ten years later.

No, I am not living in the comfort of collapse denial. To a certain extent I even regret that the ASPO2000 story is not going to happen,,, or rather is not relevant anymore, with a big chance that BAU will continue much longer as originally anticipated by the peak oil crowd, of which I was a member.

Davy on Fri, 9th Sep 2016 5:41 am

China and the US together are keeping a new normal growth continuing. Europe is desperately attempting not to fall apart financial and politically. The rest of the world is just muddling along being wagged like a dog. There is a misconception on this “money printing”. It is repression and easing to combat deflation. In effect there is a desperate attempt to keep demand and economic velocity at a required level to maintain the status quo.

Real productivity is through application of capital and resources that yields real physical returns. We of course have this but we are increasingly having an adapted pseudo productivity of economic activity that is often malinvestment. In the old normal of price discovery, traditional rule of law, and generally accepted accounting practices malinvestment was discovered and adjusted through defaults and in a macro sense through recession. We have coopted recessions and are extending and repackaging bad debt. This eventually catches up and you have a situation of damaged demand. Once demand is damaged supply is damaged. When both supply and demand are damaged you then have a vicious circle of economic destructive change characterized by financial deflation, physical decline, and systematic dysfunction. Equally we have broad based depletion of quality resources especially peak oil and the dynamics that occur from the decline side of oil. Politically and socially you have irrational policy and actions. This also involves corruption of the checks and balance that maintain conflict of interest. Today we see the conflict of interest of the revolving door of political, industrial, and administrative structures. Once leadership is corrupted systems fail eventually. Corruption is not leadership.

Currently we appear to be in the vicinity of the end of a new normal of adapted market capitalism and liberal democracy. Market capitalism has been adapted by policy and corrupted by decay and decline. The policy adaptations were a reaction to a near collapse. The corruption is creeping into the system by decline and decay. We have political and industrial leadership globally who are maintaining their wealth in the status quo by agreement and indirectly acquiescence of behavior that in the past would be considered “moral hazard”. We are well into moral hazard results but not yet into the collapse this always causes. In effect this moral hazard has become a “Ponzi”. It has become a Ponzi because normal productive markets are now repressed and adapted. We are maintaining the status quo then showing results that are not real. In effect we have unfunded liabilities and debt that is not productive. This unproductive debt is actually a liability because parties are showing this debt as an asset which it is not in the normal sense of the meaning of productive. This macro Ponzi takes current physical systematic returns from the public and returns them to investors as adapted returns. These adapted returns are higher than they should be. They are repackaged bad debt or investments returns that are inflated. Malinvestment and “make believe” growth is being maintained through wealth transfer. We are seeing private profit at the public expense. This is at different levels. We have savers penalized with negative rates but we also have more insidiously the decay and destruction of the systematic macro economy though malinvestment that should be penalized as deflating debt but instead is rewarded with a return. At the individual level bankruptcy is the equivalent. A bankrupt society will not feed itself. In effect our society is rewarding poor decisions and that cannot end well.

When you have too many people in a global ecosystem in decline and failure this can’t end well. When you have a climate destabilizing and a cascade of extinction this can’t end well. When you have limits to growth within systematic diminishing returns you do not have the momentum to overcome the inertia of decline, decay, and deflation that is occurring at multiple levels physical and abstract. Growth cannot continue with population and consumption. Once growth ends with a growth based system collapse must occur.

The conclusion here is not if we are facing collapse but when. Technology and efficiency are being employed at two levels to paper over this trend. We are believing with a social narrative that technology and efficiency will overcome these challenges. This creates a false confidence. Confidence is liquidity. So we have unrealistic behavior based upon a dysfunctional social narrative driving activity. Basically we are living a lie. We are malinvesting technology and efficiency in living arrangements that have no future per reality of our existential challenges. We are in denial these challenges are existential catch 22 predicaments. In effect we are digging a hole deeper and in reality this hole is our grave.

The heart of or better the “mother of all” predicaments is humanity. It is our attitudes and lifestyles that construct living arrangements with no future. It is a trap of population and consumption without balance and sustainability. This cannot last and will not because all systems cycle within the frequency of life and humans are no different it is just we think we are different and we build narratives that we are exceptional. In reality we are mammals with large brains that appear to have an evolutionary defect of civilization. Civilization is not conducive to an earth ecosystem. Civilization will end and with it something new that was old will return. We are going to return to the trees so to speak.

shortonoil on Fri, 9th Sep 2016 5:52 am

A recent article in the WSJ stated that China’s debt is now growing at a rate of 40% of its GDP per year. This shouldn’t take very long. Next stop, a Rembrandt for a loaf of bread.

makati1 on Fri, 9th Sep 2016 6:30 am

And the Wall Street Urinal is an unbiased rag? Perhaps they are correct, but they failed to compare it to the debt being run up in America by the governments, corporations and citizens. I have seen numbers up to $200T as the total obligations owed in America. That is 12+ times the US GDP and never will be repaid. More Imperial finger pointing signifying nothing.

Numbers mean nothing until the crash. Will China be any worse off then America? Nope. Nor will it be better off. When the crash happens, ALL countries will be in the same fast sinking boat. The Great Leveling will have taken ALL countries into 3rd or 4th world levels. Maybe even worse. We shall see.

oracle on Fri, 9th Sep 2016 7:05 am

3 billion barrels found in Permian? Since the world goes through 32 billion or so each year, and the US itself hogs a good share of that (7 billion per year), it’s clear that the Apache hype is merely aimed at getting bankers excited about “getting in on the ground floor of this opportunity”. Step right up!

Don Stewart on Fri, 9th Sep 2016 7:35 am

Shortonoil

Regarding the huge global debt, with the growth in debt in China being a poster child.

Can you estimate, based on remaining oil which can be produced at a profit, how much of the debt could possibly be repaid?

I realize this could be a very complex calculation. I’d settle for something pretty simple.

Thanks….Don Stewart

Boat on Fri, 9th Sep 2016 7:38 am

oracle,

Why is 3 billion barrels found in Permian hype. I buy gasoline with my sweat. Why do you call my gasoline going to work hogging it. Get a job and hog some to.

rockman on Fri, 9th Sep 2016 7:45 am

“…the Apache hype is merely aimed at getting bankers excited…”. Actually not so much the bankers. Especially these days: I doubt Apache is getting full book value of their proven reserves now. The target would first be the current shareholders. Specifically the ones with big positions like hedge funds. They can impact board decisions which can impact salaries and who keeps their jobs. The second targets would be potential future shareholders. Current shareholders (especially those that bought in after the collapse) will want to monitize any profits as soon as it makes sense.

Davy on Fri, 9th Sep 2016 7:57 am

Makati1, much of both Chinese and American debt and unfunded liabilities is owed internally by its respective citizens. They are both in the same predicament. You are just in an agenda delusion that is being destroyed daily by reality. LOL

Boat on Fri, 9th Sep 2016 8:10 am

Payment on debt is more important than the debt itself. For example the US debt is at an all time high but interest on the debt in 2015 was lower than most of the preceding 10 years.

https://www.treasurydirect.gov/govt/reports/ir/ir_expense.htm

rockman on Fri, 9th Sep 2016 8:14 am

And about “getting in on the ground floor”: since 2012 Apache’s stock has fallen almost 50%. In the last 2 days it has jumped 14% so the ” ground floor” may be gone. The hype does what it does but only last so long. It will take some serious increased production rates to hold on. BTW the stock has only regained to the price level

rockman on Fri, 9th Sep 2016 8:15 am

…the price level it was last June.

Don Stewart on Fri, 9th Sep 2016 8:39 am

Nicole Foss on Finance and Debt

https://www.theautomaticearth.com/2016/09/negative-interest-rates-and-the-war-on-cash-4/

You can click on the first 3 installments, if interested.

Regarding Boat’s claim that it is the payments on the debt that are important. Since the Central Banks have driven the world to negative interest rates, the whole idea of saving and loaning money no longer makes sense. Nor does buying life insurance or annuities or nursing home insurance and a raft of other financial products. The Bank of Japan has been muttering about the need to get 20 year bonds above zero so that corporations can have some reasonable prospect of paying pensions that they legally owe.

There is no free financial lunch in the absence of an actual growing economy. The ETP model casts grave doubts on the ‘growing economy’ part, and the Central Banks and governments and corporations and households have piled on debt to pretend that everything is OK. It’s not.

Don Stewart

ghung on Fri, 9th Sep 2016 10:21 am

Don; thanks for the link. I’ve sort of lost touch with TAE and Foss, but her message hasn’t changed much. The idea, and power-shift, of a cashless society isn’t new, but continues to manifest itself. Of course, the MSM is all-in on the scheme. I wonder what Foss would say to this guy. Anyway, it’s all about avoiding traps, which is getting harder these days.

Don Stewart on Fri, 9th Sep 2016 10:44 am

ghung

From Zero Hedge today:

‘Concerns about Japan’s possible ‘var shock’-inducing reverse twist policy has sparked selling across global sovereign bond markets. Both Japanese 10Y and German 10Y yields have surged to 0% overnight.’

The deal that it seems we will be offered is:

*You can’t have cash to store

*If you keep current assets, they will be taken from you a few percent per year

*If you want to preserve your assets, you must lock them up for 10 or 20 years in a bond which pays nothing except the principal.

And if you think there is any truth at all to the Hill’s Group scenario, locking up assets for 10 or 20 years is not very appealing. Yet, as Nicole says, buying hard assets now is buying at the top of the bubble.

They may have us trapped…Don Stewart

Boat on Fri, 9th Sep 2016 10:47 am

Don Stewart

“There is no free financial lunch in the absence of an actual growing economy.”

I agree with that. In fact when Bush and Gore ran I didn’t vote because both candidates chased the senior vote promising to fill the “doughnut hole”. I thought paying down the debt was more important. Today’s politicians are no different.

I don’t think we should worry about GDP growth. In fact if the US ended immigration population would slowly shrink. We should also quit giving out tax breaks for having children.