When do we fall off the undulating plateau? Pt 2

Re: When do we fall off the undulating plateau?

I think the first reason why we will fall off the undulating plateau is the lack of investments made since the oil price crash of 2014.

Global economy is not really recovering, it is artificially helped by central banks which printed money for almost 10 years while technology companies (Amazon, Uber, Ebay, Air bn be...) basically act like parasites on real economy, creating virtual growth (stock) at the expense of jobs and production of goods.

So as a slow growing demand still exists, the need for oil gradually moves north, a bit like water getting hot for the frog cooked alive in the famous story we all know.

My pronostic is that we will wake up one day witnessing oil is now too expensive to have the time left to shift to renewable energies (which is by the way actually impossible without drastically change our non negociable way of life) or to invest in shale or whatever crappy fossil fuels left on this planet.

What will be more interesting is that as oil will get very expensive soon, central banks which already play a game with a credit rate pretty close to 0% won't have any bullet left in their barrel to shoot at inflation with.

My scenario :

1) oil is getting too expensive (+100$), economy slows down, "experts" don't get why

2) central banks low back their rate because the focus is not yet on oil prices, but on the worry about this slowing economy

3) energy and food inflation kicks in + jobs cut while dow jones getting higher

4) oil is getting more expensive (we fall off the plateau, so even with lower demand, oil offer still collapses)

5) dow jones getting higher faster and faster (bubble tech and real estate) BUT central banks become afraid about energy and food inflation : riots, political problems...

6) central banks lift their rate to calm down oil prices

7) which trigger a new collapse of real estate, this time far worse than 2008. In a terminal hurry, investors shift to oil and gold...

8 ) Oil prices skyrocket.

9) Central banks don't know what to do. Game Over.

We are heading right to hell. We are stucked in this plateau since 2008. 2008 was the first step of the global collapse of civilisation. The second step is described above. Enjoy.

Global economy is not really recovering, it is artificially helped by central banks which printed money for almost 10 years while technology companies (Amazon, Uber, Ebay, Air bn be...) basically act like parasites on real economy, creating virtual growth (stock) at the expense of jobs and production of goods.

So as a slow growing demand still exists, the need for oil gradually moves north, a bit like water getting hot for the frog cooked alive in the famous story we all know.

My pronostic is that we will wake up one day witnessing oil is now too expensive to have the time left to shift to renewable energies (which is by the way actually impossible without drastically change our non negociable way of life) or to invest in shale or whatever crappy fossil fuels left on this planet.

What will be more interesting is that as oil will get very expensive soon, central banks which already play a game with a credit rate pretty close to 0% won't have any bullet left in their barrel to shoot at inflation with.

My scenario :

1) oil is getting too expensive (+100$), economy slows down, "experts" don't get why

2) central banks low back their rate because the focus is not yet on oil prices, but on the worry about this slowing economy

3) energy and food inflation kicks in + jobs cut while dow jones getting higher

4) oil is getting more expensive (we fall off the plateau, so even with lower demand, oil offer still collapses)

5) dow jones getting higher faster and faster (bubble tech and real estate) BUT central banks become afraid about energy and food inflation : riots, political problems...

6) central banks lift their rate to calm down oil prices

7) which trigger a new collapse of real estate, this time far worse than 2008. In a terminal hurry, investors shift to oil and gold...

8 ) Oil prices skyrocket.

9) Central banks don't know what to do. Game Over.

We are heading right to hell. We are stucked in this plateau since 2008. 2008 was the first step of the global collapse of civilisation. The second step is described above. Enjoy.

-

Sys1 - Tar Sands

- Posts: 983

- Joined: Fri 25 Feb 2005, 04:00:00

Re: When do we fall off the undulating plateau?

$this->bbcode_second_pass_quote('Sys1', '

')1) oil is getting too expensive (+100$), economy slows down, "experts" don't get why

2) central banks low back their rate because the focus is not yet on oil prices, but on the worry about this slowing economy

3) energy and food inflation kicks in + jobs cut while dow jones getting higher

4) oil is getting more expensive (we fall off the plateau, so even with lower demand, oil offer still collapses)

5) dow jones getting higher faster and faster (bubble tech and real estate) BUT central banks become afraid about energy and food inflation : riots, political problems...

6) central banks lift their rate to calm down oil prices

7) which trigger a new collapse of real estate, this time far worse than 2008. In a terminal hurry, investors shift to oil and gold...

8 ) Oil prices skyrocket.

9) Central banks don't know what to do. Game Over.

')1) oil is getting too expensive (+100$), economy slows down, "experts" don't get why

2) central banks low back their rate because the focus is not yet on oil prices, but on the worry about this slowing economy

3) energy and food inflation kicks in + jobs cut while dow jones getting higher

4) oil is getting more expensive (we fall off the plateau, so even with lower demand, oil offer still collapses)

5) dow jones getting higher faster and faster (bubble tech and real estate) BUT central banks become afraid about energy and food inflation : riots, political problems...

6) central banks lift their rate to calm down oil prices

7) which trigger a new collapse of real estate, this time far worse than 2008. In a terminal hurry, investors shift to oil and gold...

8 ) Oil prices skyrocket.

9) Central banks don't know what to do. Game Over.

This list contains ZERO adaptation. ZERO. EVs...don't exist. Telecommuting...doesn't exist. Drilling roaring back to life when oil becomes more expensive? Doesn't happen.

I just don't see how it can be that much of a shark-fin.

The undulating aspect will be when the more expensive oil starts to flow again at full clip. Only if you can make the case that all of that stuff is tapped out will it not, and I have yet to see a strong enough case for it.

We've got a buffer. Even if oil companies go bankrupt left and right, others will merely buy up the spoils and continue where they left off.

BOLD PREDICTIONS

-Billions are on the verge of starvation as the lockdown continues. (yoshua, 5/20/20)

HALL OF SHAME:

-Short welched on a bet and should be shunned.

-Frequent-flyers should not cry crocodile-tears over climate-change.

- asg70

- Permanently Banned

- Posts: 4289

- Joined: Sun 05 Feb 2017, 14:17:28

Re: When do we fall off the undulating plateau?

OK, time once again to be my pissy self. Before we can "fall off" an undulating plateau we have to be on an UP...which we aren't. Yes, global oil production has become somewhat static to a slight decline lately. But that's been artificial and not natural.

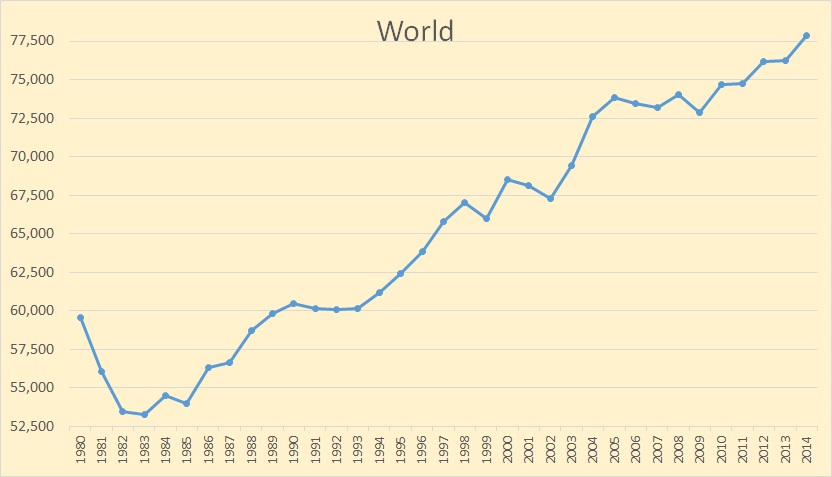

But even that is insignificant compared to the DECADES LONG trend of INCREASING GLOBAL OIL PRODUCTION. Am I the only one that pulls up production charts. There a variety out there and none show an UP:

http://peakoilbarrel.com/wp-content/upl ... World1.jpg

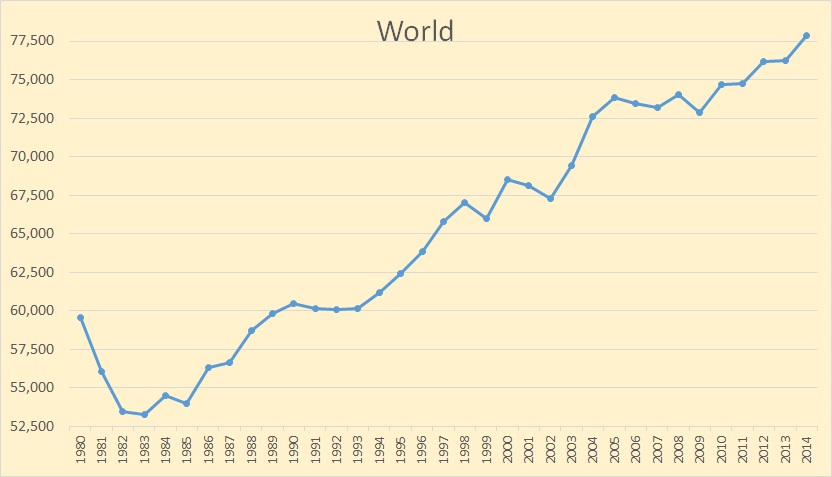

Next problem I have: so when we do reach a prolonged UP of global oil production define what a "fall off" !looks like. That terms implies a relatively rapid decline. But quantity it: 10%/yr, 20%/yr, 30%/yr, more? Compare to the US during pre-shale days:

https://en.m.wikipedia.org/wiki/Oil_dep ... _Curve.png

On an UP from 1968 to 1986. Then declined from 9 mm bopd to 5 mm bopd from 1986 to 2006: a 45% decline over 20 years. IOW significantly less the 10% per year. Does that qualify as "falling off"? I let everyone qualify it themselves. And do we expect global oil production to decline faster then what the US experienced? Slower? And why regardless of what you predict?

But even that is insignificant compared to the DECADES LONG trend of INCREASING GLOBAL OIL PRODUCTION. Am I the only one that pulls up production charts. There a variety out there and none show an UP:

http://peakoilbarrel.com/wp-content/upl ... World1.jpg

Next problem I have: so when we do reach a prolonged UP of global oil production define what a "fall off" !looks like. That terms implies a relatively rapid decline. But quantity it: 10%/yr, 20%/yr, 30%/yr, more? Compare to the US during pre-shale days:

https://en.m.wikipedia.org/wiki/Oil_dep ... _Curve.png

On an UP from 1968 to 1986. Then declined from 9 mm bopd to 5 mm bopd from 1986 to 2006: a 45% decline over 20 years. IOW significantly less the 10% per year. Does that qualify as "falling off"? I let everyone qualify it themselves. And do we expect global oil production to decline faster then what the US experienced? Slower? And why regardless of what you predict?

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: When do we fall off the undulating plateau?

I say the undulations will continue for 2-5 decades.

This will not be a comfortable period for anybody employed, unemployed, or retired - because as energy gets more expensive, so does everything else produced or transported with FF's. During this period, currency will inflate considerably, impoverishing those who try to exist on fixed incomes - soon to include me. Meanwhile, the 3rd World will starve.

The second half of the Peak Oil curve COULD last for another century of gradual power-down, if nobody panics, and nobody tries to take more than their share. It will last less than half as long as it could, because people are apes, acting as apes act.

https://www.youtube.com/watch?v=yLu9FaZTE-Y

This will not be a comfortable period for anybody employed, unemployed, or retired - because as energy gets more expensive, so does everything else produced or transported with FF's. During this period, currency will inflate considerably, impoverishing those who try to exist on fixed incomes - soon to include me. Meanwhile, the 3rd World will starve.

The second half of the Peak Oil curve COULD last for another century of gradual power-down, if nobody panics, and nobody tries to take more than their share. It will last less than half as long as it could, because people are apes, acting as apes act.

https://www.youtube.com/watch?v=yLu9FaZTE-Y

KaiserJeep 2.0, Neural Subnode 0010 0000 0001 0110 - 1001 0011 0011, Tertiary Adjunct to Unimatrix 0000 0000 0001

Resistance is Futile, YOU will be Assimilated.

Warning: Messages timestamped before April 1, 2016, 06:00 PST were posted by the unmodified human KaiserJeep 1.0

Resistance is Futile, YOU will be Assimilated.

Warning: Messages timestamped before April 1, 2016, 06:00 PST were posted by the unmodified human KaiserJeep 1.0

- KaiserJeep

- Light Sweet Crude

- Posts: 6094

- Joined: Tue 06 Aug 2013, 17:16:32

- Location: Wisconsin's Dreamland

Re: When do we fall off the undulating plateau?

So Rockman is your prediction that total world production will keep rising for the foreseeable future?

The decline in the US production in the seventies was counter balanced by increases in other countries which were cheaper then continued efforts in the US. What happens when there are no more cheaper sites to exploit anywhere in the world? Even a five percent per year world decline would leave a lot of demand unmet and cause major changes in how we use oil. Burn it just to heat a building? not very likely.

The decline in the US production in the seventies was counter balanced by increases in other countries which were cheaper then continued efforts in the US. What happens when there are no more cheaper sites to exploit anywhere in the world? Even a five percent per year world decline would leave a lot of demand unmet and cause major changes in how we use oil. Burn it just to heat a building? not very likely.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: When do we fall off the undulating plateau?

$this->bbcode_second_pass_quote('ROCKMAN', 'O')K, time once again to be my pissy self. Before we can "fall off" an undulating plateau we have to be on an UP...which we aren't. Yes, global oil production has become somewhat static to a slight decline lately. But that's been artificial and not natural.

But even that is insignificant compared to the DECADES LONG trend of INCREASING GLOBAL OIL PRODUCTION. Am I the only one that pulls up production charts. There a variety out there and none show an UP:

Next problem I have: so when we do reach a prolonged UP of global oil production define what a "fall off" !looks like. That terms implies a relatively rapid decline. But quantity it: 10%/yr, 20%/yr, 30%/yr, more? Compare to the US during pre-shale days:

On an UP from 1968 to 1986. Then declined from 9 mm bopd to 5 mm bopd from 1986 to 2006: a 45% decline over 20 years. IOW significantly less the 10% per year. Does that qualify as "falling off"? I let everyone qualify it themselves. And do we expect global oil production to decline faster then what the US experienced? Slower? And why regardless of what you predict?

But even that is insignificant compared to the DECADES LONG trend of INCREASING GLOBAL OIL PRODUCTION. Am I the only one that pulls up production charts. There a variety out there and none show an UP:

Next problem I have: so when we do reach a prolonged UP of global oil production define what a "fall off" !looks like. That terms implies a relatively rapid decline. But quantity it: 10%/yr, 20%/yr, 30%/yr, more? Compare to the US during pre-shale days:

On an UP from 1968 to 1986. Then declined from 9 mm bopd to 5 mm bopd from 1986 to 2006: a 45% decline over 20 years. IOW significantly less the 10% per year. Does that qualify as "falling off"? I let everyone qualify it themselves. And do we expect global oil production to decline faster then what the US experienced? Slower? And why regardless of what you predict?

ROCKMAN back in the old days this thread was based around the graph Pops made, I am quoting the earliest version of that series I could find in the archives. The basic theory is simple, fracking picked up even as old oil fields were in decline at a steep rate in some cases, like the North Sea, but at a much slower decline rate in the Siberia and Alaska.

$this->bbcode_second_pass_quote('Pops', 'R')eal oil prices have never been this high for this long, ever.

And they've never been this much above the trend without producing substantial amounts of new oil production.

All we've gotten this time is a stripper well make work project in the US, otherwise production in the rest of the world has been flat for 7 years.

Looks like a plateau to me...

Great charts at crudeoilpeak

http://crudeoilpeak.info/excluding-the- ... an-in-2005

.

$this->bbcode_second_pass_quote('Alfred Tennyson', 'W')e are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

- Tanada

- Site Admin

- Posts: 17094

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA