The US Economic Horror Show Continues

Re: The US Economic Horror Show Continues

This may have already been covered ad nauseum, but, is it possible for the US economy to collapse without taking the entire developed and developing world with it? With only about 5% of the world's population, the US uses approximately 25% of the world's resources. This means an enormous flow of resources constantly into the US, as well as an enormous flow of $ out, as well as resources in the form of exports. If the US economy truly collapses, so that virtually no money or resources are flowing out, and virtually none flowing in, can the rest of the world continue to function with 1/4 of the world's economic activity defunct?

- Ludi

Re: The US Economic Horror Show Continues

$this->bbcode_second_pass_quote('Ludi', ' ') If the US economy truly collapses, so that virtually no money or resources are flowing out, and virtually none flowing in, can the rest of the world continue to function with 1/4 of the world's economic activity defunct?

For the few years remaining before PO and peak resources crush all global economies, China/India/Brazil, etc., will have no problem picking up the slack in resource consumption once the US collapses.

An equally intriguing question is whether the US will wage a war before it collapses. Given the trillions invested in military infrastructure, the temptation would be exceedingly great to fight a major resource war as a final Hail Mary, perhaps with the hope of kicking the can down the road one last time. But, other than Iran, whom would the US attack? And, would such a conflict be isolated to Iran, or would it be global (i.e., WW III)?

-

Daniel_Plainview - Prognosticator

- Posts: 4220

- Joined: Tue 06 May 2008, 03:00:00

- Location: 7035 Hollis ... Near the Observatory ... Just down the way, tucked back in the small woods

Re: The US Economic Horror Show Continues

$this->bbcode_second_pass_quote('jdmartin', 'O')n a side note, is that a vampire in your signature?

Hi, JD ..... Good guess, but incorrect.

-

Daniel_Plainview - Prognosticator

- Posts: 4220

- Joined: Tue 06 May 2008, 03:00:00

- Location: 7035 Hollis ... Near the Observatory ... Just down the way, tucked back in the small woods

Re: The US Economic Horror Show Continues

America on a Burning Platform

$this->bbcode_second_pass_quote('', ' ') * The National Debt is $13.6 trillion today. Interest expense for fiscal 2010 totaled $414 billion. Based upon the current spending path and assuming that the Bush tax cuts are extended, the National Debt will exceed $20 trillion by 2015. A reasonable expectation of 5% interest rates would result in annual interest expense of $1 trillion. The entire budgeted outlays of the US government are $3.5 trillion today.

* Deficits exceeding $1 trillion per year are baked into the cake for the next decade. Non-Defense discretionary spending totals only $700 billion. Defense spending totals $900 billion. The remaining $1.9 trillion is on automatic pilot for Social Security, Medicare, Medicaid, and other entitlement programs. Politicians declaring they will freeze discretionary spending are treating you like fools. It will solve nothing.

* Debt as a percentage of GDP will exceed 125% of GDP by 2015. Rogoff & Reinhart in their book This Time is Different point out the dangers once debt surpasses 90% of GDP: The relationship between government debt and real GDP growth is weak for debt/GDP ratios below 90% of GDP. Above the threshold of 90%, median growth rates fall by 1%, and average growth falls considerably more. The chances of bad things happening to a country increase dramatically after the 90% level is surpassed.

* Japan began their 20 years of tears with a debt to GDP ratio of 52% and a National Savings rate of 15%. The Japanese people bought 90% of the debt that the government issued. Today, the debt to GDP ratio is 200% and the National Savings rate is 2%. The US entered this crisis with a debt to GDP ratio of 80% and a National Savings rate of 1%. We depend on foreigners to buy more than 50% of our new debt. We do not control our own destiny.

* A depreciating US dollar is already creating inflation in many assets. Gold, silver, oil, and agricultural commodities are increasing in price faster than the stock market. The policy of the US government and Federal Reserve of devaluing the currency is being matched by similar efforts in countries across the globe. The result is a flood of liquidity creating bubbles which will pop. The American middle class will be squeezed harder as their wages stagnate, while their food, energy, and costs at Wal-Mart go higher.

* TARP, the purchase of $1.5 trillion of Mortgage Backed Securities by the Federal Reserve, 0% interest rates, and accounting rule changes by the FASB have done nothing but paper over the fact that the biggest financial institutions in the US are insolvent. The assets on their books are worth 50% less than they are reporting. They are zombie banks. Their losses on residential real estate, commercial real estate and consumer credit continue to grow. The only beneficiaries of keeping zombie banks alive are the bankers who are receiving billions in compensation while the middle class dies a slow painful death.

* Cash For Clunkers, Home Buyer Tax Credit and energy efficiency credits did nothing but shift demand forward and cost the American taxpayer $25 billion. The estimated cost to the tax payer per incremental home sold was $100,000. Auto sales and home sales plunged as soon as the credits ran out. Home prices are falling and used car prices have soared due to less supply, hurting the poor.

* The borrowing of $800 billion from the Chinese to dole out to unions and political hacks all over the country has been a complete disaster. Unemployment has gone up by over 4 million since the stimulus was passed. Government spending has crowded out private spending. The economy hasn’t recovered because it was never allowed to bottom. Why look for a job when the government pays you for two years to watch Oprah in a house where you haven’t made a mortgage payment in 18 months?

* Consumers’ spending money they don’t have, saving less than 5% of their disposable income, and putting away nothing for their retirement is unsustainable. The average credit card debt per household is about $15,700. In 1968, consumers’ total credit debt was $8 billion (in current dollars). Now the total exceeds $880 billion. Americans currently owe $917 billion on revolving credit lines and $80 billion of it is past due, according to the latest Federal Reserve statistics.

* A scaling back of consumer spending to a sustainable 64% of GDP would reduce consumer spending by $500 billion per year. This would allow Americans to save and invest in the country. This is considered crazy talk in the Keynesian economic circles.

* The anticipation of QE2 has already made the dollar drop 10% and gold, silver and oil jump 10%. Ben Bernanke and the Federal Reserve are conducting an experiment on the American people. What they are doing today has never been attempted in human history. It boils down to whether the authorities can cure a disease brought on by too much debt by doubling and tripling the dosage of debt. If this experiment fails, the dollar collapse and possible hyperinflation would lead to anarchy. Ben is confident it might work. Are you?

* Social Security and Medicare have an unfunded liability exceeding $100 trillion. There is no money in a lockbox. Congress opened the lockbox and spent the money. Baby boomers are turning 50 years old at a rate of 10,000 per day. There is no possibility that the promises made to Americans by politicians can be honored. No politician of either party will tell the truth to the American public. A massive reduction in benefits or a massive increase in taxes would be required to deliver on this promise.

* The 2,000 page Obamacare bill that no one in Congress read was sold to the American people as a cost saving, care enhancing package of goodies. The reality is that [Obamacare] will increase the national debt by hundreds of billions, ration care, drive more doctors into retirement, strangle small business with onerous regulations and enrich the insurance companies and drug companies. The unintended consequences will be devastating.

* Total military expenditures for the entire world are $1.9 trillion annually. The US accounts for $900 billion of this expenditure. This is 7 times as much as the next largest spender – China.

* The wars of choice in the Middle East since 2001 have cost unborn generations of Americans $1.1 trillion so far, with a final cost likely reaching $3 trillion. Just like Donald Rumsfeld estimated. Over 5,700 Americans have lost their lives and another 39,000 have been wounded. The casualties in the countries that have been invaded number in the hundreds of thousands. Are we better off than we were on September 10, 2001?

* Defense spending in 2000 was $359 billion or 3.6% of GDP. Today it is $900 billion or 6.1% of GDP. Every dime of these expenditures is borrowed. Are we safer today?

* The Department of Energy was created in 1979 in order to create an energy policy that would reduce our dependence on foreign oil. The United States, which makes up 4% of the world’s population, consumes 25% of the world’s oil on a daily basis. In 1970 we imported 24% of our oil. Today we import 70% of our oil.

* Over 50% of our oil imports come from countries whose populations hate the US. Mexico, which accounts for 9% of our current oil supply, will become a net importer by 2015.

* The US has not built a new nuclear power plant or oil refinery since 1980.

* The existing energy infrastructure is rusting away. 80% to 90% of the system must be rebuilt. The cost of rebuilding the infrastructure will be $50 – $100 trillion. We have no blueprints, few supplies and fewer trained engineers and construction workers.

* Peak oil is a fact. World liquid oil production peaked at 86 million barrels per day in 2006. It has not reached that level since, even when prices soared to $145 per barrel. Demand will move relentlessly upward as China and India and the rest of the developing world march forward.

* The US Military has concluded in a report put out a few months ago that by 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD. A severe energy crunch is inevitable without a massive expansion of production and refining capacity. While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds.

$this->bbcode_second_pass_quote('', ' ') * The National Debt is $13.6 trillion today. Interest expense for fiscal 2010 totaled $414 billion. Based upon the current spending path and assuming that the Bush tax cuts are extended, the National Debt will exceed $20 trillion by 2015. A reasonable expectation of 5% interest rates would result in annual interest expense of $1 trillion. The entire budgeted outlays of the US government are $3.5 trillion today.

* Deficits exceeding $1 trillion per year are baked into the cake for the next decade. Non-Defense discretionary spending totals only $700 billion. Defense spending totals $900 billion. The remaining $1.9 trillion is on automatic pilot for Social Security, Medicare, Medicaid, and other entitlement programs. Politicians declaring they will freeze discretionary spending are treating you like fools. It will solve nothing.

* Debt as a percentage of GDP will exceed 125% of GDP by 2015. Rogoff & Reinhart in their book This Time is Different point out the dangers once debt surpasses 90% of GDP: The relationship between government debt and real GDP growth is weak for debt/GDP ratios below 90% of GDP. Above the threshold of 90%, median growth rates fall by 1%, and average growth falls considerably more. The chances of bad things happening to a country increase dramatically after the 90% level is surpassed.

* Japan began their 20 years of tears with a debt to GDP ratio of 52% and a National Savings rate of 15%. The Japanese people bought 90% of the debt that the government issued. Today, the debt to GDP ratio is 200% and the National Savings rate is 2%. The US entered this crisis with a debt to GDP ratio of 80% and a National Savings rate of 1%. We depend on foreigners to buy more than 50% of our new debt. We do not control our own destiny.

* A depreciating US dollar is already creating inflation in many assets. Gold, silver, oil, and agricultural commodities are increasing in price faster than the stock market. The policy of the US government and Federal Reserve of devaluing the currency is being matched by similar efforts in countries across the globe. The result is a flood of liquidity creating bubbles which will pop. The American middle class will be squeezed harder as their wages stagnate, while their food, energy, and costs at Wal-Mart go higher.

* TARP, the purchase of $1.5 trillion of Mortgage Backed Securities by the Federal Reserve, 0% interest rates, and accounting rule changes by the FASB have done nothing but paper over the fact that the biggest financial institutions in the US are insolvent. The assets on their books are worth 50% less than they are reporting. They are zombie banks. Their losses on residential real estate, commercial real estate and consumer credit continue to grow. The only beneficiaries of keeping zombie banks alive are the bankers who are receiving billions in compensation while the middle class dies a slow painful death.

* Cash For Clunkers, Home Buyer Tax Credit and energy efficiency credits did nothing but shift demand forward and cost the American taxpayer $25 billion. The estimated cost to the tax payer per incremental home sold was $100,000. Auto sales and home sales plunged as soon as the credits ran out. Home prices are falling and used car prices have soared due to less supply, hurting the poor.

* The borrowing of $800 billion from the Chinese to dole out to unions and political hacks all over the country has been a complete disaster. Unemployment has gone up by over 4 million since the stimulus was passed. Government spending has crowded out private spending. The economy hasn’t recovered because it was never allowed to bottom. Why look for a job when the government pays you for two years to watch Oprah in a house where you haven’t made a mortgage payment in 18 months?

* Consumers’ spending money they don’t have, saving less than 5% of their disposable income, and putting away nothing for their retirement is unsustainable. The average credit card debt per household is about $15,700. In 1968, consumers’ total credit debt was $8 billion (in current dollars). Now the total exceeds $880 billion. Americans currently owe $917 billion on revolving credit lines and $80 billion of it is past due, according to the latest Federal Reserve statistics.

* A scaling back of consumer spending to a sustainable 64% of GDP would reduce consumer spending by $500 billion per year. This would allow Americans to save and invest in the country. This is considered crazy talk in the Keynesian economic circles.

* The anticipation of QE2 has already made the dollar drop 10% and gold, silver and oil jump 10%. Ben Bernanke and the Federal Reserve are conducting an experiment on the American people. What they are doing today has never been attempted in human history. It boils down to whether the authorities can cure a disease brought on by too much debt by doubling and tripling the dosage of debt. If this experiment fails, the dollar collapse and possible hyperinflation would lead to anarchy. Ben is confident it might work. Are you?

* Social Security and Medicare have an unfunded liability exceeding $100 trillion. There is no money in a lockbox. Congress opened the lockbox and spent the money. Baby boomers are turning 50 years old at a rate of 10,000 per day. There is no possibility that the promises made to Americans by politicians can be honored. No politician of either party will tell the truth to the American public. A massive reduction in benefits or a massive increase in taxes would be required to deliver on this promise.

* The 2,000 page Obamacare bill that no one in Congress read was sold to the American people as a cost saving, care enhancing package of goodies. The reality is that [Obamacare] will increase the national debt by hundreds of billions, ration care, drive more doctors into retirement, strangle small business with onerous regulations and enrich the insurance companies and drug companies. The unintended consequences will be devastating.

* Total military expenditures for the entire world are $1.9 trillion annually. The US accounts for $900 billion of this expenditure. This is 7 times as much as the next largest spender – China.

* The wars of choice in the Middle East since 2001 have cost unborn generations of Americans $1.1 trillion so far, with a final cost likely reaching $3 trillion. Just like Donald Rumsfeld estimated. Over 5,700 Americans have lost their lives and another 39,000 have been wounded. The casualties in the countries that have been invaded number in the hundreds of thousands. Are we better off than we were on September 10, 2001?

* Defense spending in 2000 was $359 billion or 3.6% of GDP. Today it is $900 billion or 6.1% of GDP. Every dime of these expenditures is borrowed. Are we safer today?

* The Department of Energy was created in 1979 in order to create an energy policy that would reduce our dependence on foreign oil. The United States, which makes up 4% of the world’s population, consumes 25% of the world’s oil on a daily basis. In 1970 we imported 24% of our oil. Today we import 70% of our oil.

* Over 50% of our oil imports come from countries whose populations hate the US. Mexico, which accounts for 9% of our current oil supply, will become a net importer by 2015.

* The US has not built a new nuclear power plant or oil refinery since 1980.

* The existing energy infrastructure is rusting away. 80% to 90% of the system must be rebuilt. The cost of rebuilding the infrastructure will be $50 – $100 trillion. We have no blueprints, few supplies and fewer trained engineers and construction workers.

* Peak oil is a fact. World liquid oil production peaked at 86 million barrels per day in 2006. It has not reached that level since, even when prices soared to $145 per barrel. Demand will move relentlessly upward as China and India and the rest of the developing world march forward.

* The US Military has concluded in a report put out a few months ago that by 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD. A severe energy crunch is inevitable without a massive expansion of production and refining capacity. While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds.

-

Daniel_Plainview - Prognosticator

- Posts: 4220

- Joined: Tue 06 May 2008, 03:00:00

- Location: 7035 Hollis ... Near the Observatory ... Just down the way, tucked back in the small woods

Re: The US Economic Horror Show Continues

Well that last post will require that I change my shorts.

"Where is the man who has so much as to be out of danger?" -Thomas Huxley

-

Duende - Coal

- Posts: 418

- Joined: Sat 27 Nov 2004, 04:00:00

- Location: The District

Re: The US Economic Horror Show Continues

iDepression 2.0

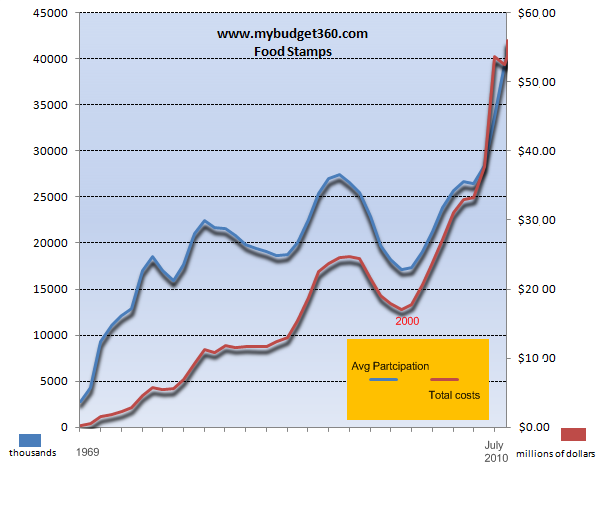

$this->bbcode_second_pass_quote('', '.').. Using the method of measuring unemployment used during the Great Depression and reproduced by http://www.shadowstats.com, the real unemployment rate is a depression-like 22.5%. The peak unemployment rate during the Great Depression was 25%. There is no doubt that we are in the midst of 2nd Great Depression, but where are the bread lines and the lines of unemployed winding around the corner? No need. This is the electronic Great Depression – iDepression 2.0. Your 99 weeks of unemployment and food stamps are direct deposited into your bank account so that you don’t have to leave the comfort of your McMansion that you haven’t made a mortgage payment on in the last 14 months. There were no credit cards in 1933. Without a job or a house, you needed to move to where there might be a job. Hence the mass migration from the Midwest to California – ala The Grapes of Wrath. Today, a neighbor in a matching McMansion down the street, with the perfectly manicured lawn, could be unemployed for three years and no one would ever know. They could sustain themselves on unemployment payments, food stamps, and credit cards. Welcome to the iDepression 2.0.

Dude, Where’s My Job?

Every politician in the U.S. is running for election on a platform of “creating” new good paying jobs for Americans. Only one problem. Politicians don’t create jobs. Businesses create jobs. When politicians and the Federal Reserve get involved in the job market, bad things happen. The excessively low interest rates put in place by the Federal Reserve created a housing bubble that led to the “creation” of 1 million new construction jobs between 2002 and 2006. Of course, the bubble burst has led to the loss of 2 million construction jobs since 2007. What the myopic pundits on CNBC don’t realize, because they aren’t programmed to think, is that the Greenspan Housing Bubble “created” millions of other jobs that had no chance of being sustained. ... The reality is that Greenspan, Bernanke, and the rest of the Federal Reserve Governors “created” millions of jobs that were not sustainable. Their policies distorted an already tenuous economic model, dependent upon consumer spending, no savings, and delusions of home wealth. The chart below paints the picture of sorrow. The key points are:

* The number of employed Americans has declined by 7.4 million since 2007.

* Goods producing jobs have declined by 19% since 2007, while service jobs have only declined by 2.8%.

* Luckily, Government jobs have actually increased since 2007.

* The population of the US has increased by 10.8 million since 2007.

* The working age population has increased by 6.5 million since 2007, while the work force has only increased by 1 million.

* Only 58.5% of the working age population in the U.S. is currently employed versus 64.4% in 2000, a lower level than in 1978.

... The truth is that the country should still have 64.4% of the working age population employed today as we did 10 years ago. That means we should have 153.5 million employed Americans today. Instead, we have 130.2 million employed Americans. That is a 23.3 million job deficit and the Obama administration crows when we add 50,000 new jobs in a month. Welcome to iDepression 2.0.

No Way Out

The United States of America is a hollowed out shell of the great industrial machine that dominated the world after World War II. The BLS data unequivocally proves this is so. The chart below compares American jobs in 1970 versus today. The storyline about good paying manufacturing jobs being shipped overseas is absolutely true. The population of the United States in 1970 was 203 million. Today, the population of 310 million is 53% higher. During this same time frame manufacturing jobs have declined from 17.8 million to 11.7 million, a 34% decrease. The corporate oligarchs that run this country will tell you this is due to efficiency. The truth is that these jobs were shipped to China in order to enrich the oligarch CEOs and their MBA efficiency “experts”. The key disturbing facts from this data are as follows:

* Goods producing jobs as a percentage of all jobs have declined from 31.2% in 1970 to 13.8% today.

* Lawyers, accountants, financial advisors and other paper pushing professions made up 12.4% of jobs in 1970 versus 18.7% of all jobs today.

* Obese Americans love to go out to restaurants and be served. Hospitality employees now make up 10.1% of the workforce versus 6.7% in 1970.

* Obese, vain, stupid Americans have also benefitted the Health Services and Education industries as the number of nurses, proctologists, teachers, school administrators and Beverly Hills TV surgeons has surged from 6.4% of the workforce to 15.1%. You’d think we would be healthier and smarter with these figures. We’re not.

[In 1970, manufacturing represented 25.1% of the workforce; today that figure is 9.0% ]...Unless American union workers are willing to work for $7 per hour with no benefits, the manufacturing jobs are not coming back from China. The corporate oligarchs and their bought off cronies in Congress sold the country down the river over the last 40 years. ...

$this->bbcode_second_pass_quote('', '.').. Using the method of measuring unemployment used during the Great Depression and reproduced by http://www.shadowstats.com, the real unemployment rate is a depression-like 22.5%. The peak unemployment rate during the Great Depression was 25%. There is no doubt that we are in the midst of 2nd Great Depression, but where are the bread lines and the lines of unemployed winding around the corner? No need. This is the electronic Great Depression – iDepression 2.0. Your 99 weeks of unemployment and food stamps are direct deposited into your bank account so that you don’t have to leave the comfort of your McMansion that you haven’t made a mortgage payment on in the last 14 months. There were no credit cards in 1933. Without a job or a house, you needed to move to where there might be a job. Hence the mass migration from the Midwest to California – ala The Grapes of Wrath. Today, a neighbor in a matching McMansion down the street, with the perfectly manicured lawn, could be unemployed for three years and no one would ever know. They could sustain themselves on unemployment payments, food stamps, and credit cards. Welcome to the iDepression 2.0.

Dude, Where’s My Job?

Every politician in the U.S. is running for election on a platform of “creating” new good paying jobs for Americans. Only one problem. Politicians don’t create jobs. Businesses create jobs. When politicians and the Federal Reserve get involved in the job market, bad things happen. The excessively low interest rates put in place by the Federal Reserve created a housing bubble that led to the “creation” of 1 million new construction jobs between 2002 and 2006. Of course, the bubble burst has led to the loss of 2 million construction jobs since 2007. What the myopic pundits on CNBC don’t realize, because they aren’t programmed to think, is that the Greenspan Housing Bubble “created” millions of other jobs that had no chance of being sustained. ... The reality is that Greenspan, Bernanke, and the rest of the Federal Reserve Governors “created” millions of jobs that were not sustainable. Their policies distorted an already tenuous economic model, dependent upon consumer spending, no savings, and delusions of home wealth. The chart below paints the picture of sorrow. The key points are:

* The number of employed Americans has declined by 7.4 million since 2007.

* Goods producing jobs have declined by 19% since 2007, while service jobs have only declined by 2.8%.

* Luckily, Government jobs have actually increased since 2007.

* The population of the US has increased by 10.8 million since 2007.

* The working age population has increased by 6.5 million since 2007, while the work force has only increased by 1 million.

* Only 58.5% of the working age population in the U.S. is currently employed versus 64.4% in 2000, a lower level than in 1978.

... The truth is that the country should still have 64.4% of the working age population employed today as we did 10 years ago. That means we should have 153.5 million employed Americans today. Instead, we have 130.2 million employed Americans. That is a 23.3 million job deficit and the Obama administration crows when we add 50,000 new jobs in a month. Welcome to iDepression 2.0.

No Way Out

The United States of America is a hollowed out shell of the great industrial machine that dominated the world after World War II. The BLS data unequivocally proves this is so. The chart below compares American jobs in 1970 versus today. The storyline about good paying manufacturing jobs being shipped overseas is absolutely true. The population of the United States in 1970 was 203 million. Today, the population of 310 million is 53% higher. During this same time frame manufacturing jobs have declined from 17.8 million to 11.7 million, a 34% decrease. The corporate oligarchs that run this country will tell you this is due to efficiency. The truth is that these jobs were shipped to China in order to enrich the oligarch CEOs and their MBA efficiency “experts”. The key disturbing facts from this data are as follows:

* Goods producing jobs as a percentage of all jobs have declined from 31.2% in 1970 to 13.8% today.

* Lawyers, accountants, financial advisors and other paper pushing professions made up 12.4% of jobs in 1970 versus 18.7% of all jobs today.

* Obese Americans love to go out to restaurants and be served. Hospitality employees now make up 10.1% of the workforce versus 6.7% in 1970.

* Obese, vain, stupid Americans have also benefitted the Health Services and Education industries as the number of nurses, proctologists, teachers, school administrators and Beverly Hills TV surgeons has surged from 6.4% of the workforce to 15.1%. You’d think we would be healthier and smarter with these figures. We’re not.

[In 1970, manufacturing represented 25.1% of the workforce; today that figure is 9.0% ]...Unless American union workers are willing to work for $7 per hour with no benefits, the manufacturing jobs are not coming back from China. The corporate oligarchs and their bought off cronies in Congress sold the country down the river over the last 40 years. ...

-

Daniel_Plainview - Prognosticator

- Posts: 4220

- Joined: Tue 06 May 2008, 03:00:00

- Location: 7035 Hollis ... Near the Observatory ... Just down the way, tucked back in the small woods